Electric vehicles (EVs) have gained significant popularity in recent years, and many drivers are considering making the switch from traditional gasoline or diesel cars. One important aspect to consider when owning an EV is the road tax obligation. Unlike conventional vehicles, EVs are generally exempt from road tax, which is a fee levied on vehicle owners to help fund road infrastructure and maintenance. This exemption is due to the environmental benefits of EVs, as they produce zero tailpipe emissions. However, it's essential for EV owners to understand the specific regulations and requirements in their region, as some areas may have different rules regarding road tax for electric cars. This paragraph aims to explore the topic of whether electric vehicles are subject to road tax and provide insights into the varying policies across different regions.

Do Electric Vehicles Pay Road Tax?

| Characteristics | Values |

|---|---|

| Country | United Kingdom |

| Electric Vehicle (EV) Type | All-electric (zero-emission) cars |

| Road Tax Exemption | Yes, all-electric cars are exempt from paying road tax in the UK. |

| Reason for Exemption | To encourage the adoption of low-emission vehicles and reduce environmental impact. |

| Alternative Fuel Vehicles | Hybrid and plug-in hybrid cars may be exempt or pay a reduced rate, depending on their CO2 emissions. |

| Emission Standards | Vehicles must meet the Euro 6 or higher emission standards to be exempt from road tax. |

| Registration Date | Road tax is typically paid annually, and the exemption applies from the registration date. |

| Other Benefits | EVs are also exempt from the London Congestion Charge and may have access to bus lanes in some cities. |

| Note | This information is subject to change, and specific regulations may vary by region. Always check the latest government guidelines for accurate details. |

What You'll Learn

- Eligibility: Electric vehicles (EVs) are exempt from road tax in many countries

- Registration: EVs are typically registered with a low or zero road tax rate

- Environmental Benefits: EVs often qualify for tax incentives and reduced road tax

- Exemptions: Some regions offer tax breaks for EVs to promote sustainability

- Compliance: Ensure your EV meets tax regulations to avoid penalties

Eligibility: Electric vehicles (EVs) are exempt from road tax in many countries

Electric vehicles (EVs) have gained significant popularity in recent years, and many governments around the world have recognized the environmental benefits of these cars. As a result, several countries have implemented policies to encourage the adoption of EVs, and one of the most common incentives is the exemption from road tax. This financial benefit is a significant advantage for EV owners, as it can save them a considerable amount of money over the lifetime of their vehicle.

The eligibility for this tax exemption varies depending on the country and region. In many European countries, such as Norway, Sweden, and Germany, EVs are entirely exempt from road tax. This means that EV owners do not have to pay any additional fees or taxes when registering their vehicles, making it an attractive option for those looking to reduce their environmental impact and save money. For example, in Norway, the world's leading country in EV adoption, the government has implemented a zero-emission vehicle (ZEV) mandate, which requires a certain percentage of new car sales to be zero-emission vehicles. This has led to a rapid increase in EV sales and a corresponding reduction in road tax revenue, but the government has chosen to reinvest these savings back into the EV infrastructure and incentives.

In the United States, the situation is a bit more complex. While some states offer exemptions or reduced road tax rates for EVs, others do not. For instance, California, a leader in EV adoption, has implemented a zero-emission vehicle (ZEV) program, which requires a certain percentage of new car sales to be EVs. As a result, EV owners in California may be eligible for a reduced registration fee, which is essentially a form of road tax exemption. However, in states like New York, road tax for EVs is the same as for conventional vehicles, with no special exemptions.

The eligibility criteria for EV road tax exemptions often include factors such as the vehicle's emissions, its age, and its intended use. For example, some countries may exempt only zero-emission vehicles, while others may have a threshold for vehicle age, exempting older EVs that were among the first to enter the market. Additionally, certain regions might offer exemptions for specific vehicle types, such as hybrid or plug-in hybrid EVs, which can also contribute to reduced emissions.

It is essential for EV owners and prospective buyers to research the specific regulations in their country or region to understand their eligibility for road tax exemptions. Many governments provide official websites or resources outlining these policies, ensuring that EV owners can take full advantage of the financial benefits associated with owning an electric vehicle.

Unlock EV Tax Savings: A Guide to Qualification

You may want to see also

Registration: EVs are typically registered with a low or zero road tax rate

Electric vehicles (EVs) have gained significant popularity in recent years, and many countries are now offering incentives to encourage their adoption. One of the most common questions regarding EVs is whether they are exempt from paying road tax. The answer to this question varies depending on the country and region, but in many places, EVs are indeed registered with a low or zero road tax rate.

In the United Kingdom, for example, electric cars are currently exempt from paying road tax, which is a significant advantage for EV owners. This exemption was introduced to promote the use of low-emission vehicles and reduce the environmental impact of road transport. The UK government has also implemented a system where EVs are registered with a 'zero-rate' band, meaning they are not subject to the standard road tax rates. This system ensures that EV owners can benefit from the tax exemption without any additional paperwork or complex processes.

Similarly, in the United States, the rules regarding road tax for EVs vary by state. Some states, like California, have implemented a zero-emission vehicle (ZEV) program, which provides exemptions from both registration fees and annual road taxes for EVs. These programs aim to accelerate the transition to zero-emission transportation and reduce air pollution. Other states may offer partial exemptions or reduced rates, making EV ownership more affordable and accessible.

The registration process for EVs with low or zero road tax rates is often straightforward. When registering an EV, drivers typically provide the necessary documentation, including proof of ownership and vehicle specifications. The registration authority then applies the appropriate tax rate, which is usually much lower than that of conventional vehicles. This process ensures that EV owners can legally operate their vehicles on public roads while enjoying the tax benefits.

It is important to note that the specific regulations and tax rates for EVs can change over time as governments update their policies to support sustainable transportation. Therefore, it is advisable for EV owners to stay informed about the latest road tax laws in their respective regions. By taking advantage of these tax incentives, EV owners can contribute to a greener future while also enjoying the financial benefits of reduced road tax.

Mastering Electrical Connections: A Guide to Disconnecting Vehicle Connectors

You may want to see also

Environmental Benefits: EVs often qualify for tax incentives and reduced road tax

The environmental advantages of electric vehicles (EVs) are well-documented, and one of the financial incentives that contribute to their widespread adoption is the reduced or waived road tax. Many countries and regions have implemented policies to encourage the use of electric cars, recognizing their potential to significantly lower carbon emissions and improve air quality.

In the United Kingdom, for instance, electric vehicles are exempt from paying road tax, which is a substantial annual fee typically based on the vehicle's engine size and age. This exemption is a direct incentive for drivers to choose EVs over conventional gasoline or diesel cars. By eliminating the need to pay road tax, governments aim to make EVs more affordable and attractive to consumers, thereby promoting a shift towards cleaner transportation.

Similarly, in the United States, several states offer tax credits and rebates for EV purchases. These financial incentives can significantly reduce the upfront cost of buying an electric car, making it more accessible to a broader range of consumers. For example, California's Clean Vehicle Rebate Project provides rebates of up to $7,000 for the purchase or lease of new electric vehicles, further enhancing the financial appeal of EVs.

The environmental benefits of these tax incentives are twofold. Firstly, by making EVs more affordable, governments encourage a faster transition to electric mobility, which directly contributes to reduced greenhouse gas emissions and a smaller carbon footprint. Secondly, the reduced road tax often leads to lower overall vehicle operating costs, making EVs more economically viable in the long term. This, in turn, can further accelerate the adoption of electric vehicles, as drivers are more inclined to choose environmentally friendly options when they are financially advantageous.

In summary, the environmental advantages of electric vehicles are closely tied to the financial incentives they receive, including reduced or waived road tax. These policies not only make EVs more affordable but also actively promote their use, leading to a more sustainable and environmentally friendly transportation system. As the world seeks to combat climate change and improve air quality, such incentives play a crucial role in encouraging the widespread adoption of electric vehicles.

Electric Vehicles: Unveiling the True Environmental Impact vs. Diesel

You may want to see also

Exemptions: Some regions offer tax breaks for EVs to promote sustainability

In many countries, governments have implemented various incentives to encourage the adoption of electric vehicles (EVs) and reduce the environmental impact of traditional combustion engines. One such incentive is the provision of tax breaks or exemptions for EV owners, which can significantly reduce the overall cost of ownership. These exemptions are designed to promote sustainability and accelerate the transition to a greener transportation ecosystem.

For instance, in the United Kingdom, electric car owners are exempt from paying road tax, which is a significant financial benefit. This exemption was introduced to encourage the use of low-emission vehicles and reduce the country's carbon footprint. Similarly, in the United States, some states offer reduced or waived road taxes for EVs, providing an additional incentive for consumers to make the switch. These tax breaks can amount to substantial savings, especially over the long term, making EVs more affordable and attractive to potential buyers.

The idea behind these exemptions is to make EVs more accessible and competitive in the market. By reducing the financial burden associated with vehicle ownership, governments aim to stimulate demand and create a positive feedback loop. As more people opt for EVs, the overall environmental impact can be significantly reduced, leading to improved air quality and a more sustainable future. This strategy not only benefits the environment but also supports the growth of the EV industry, fostering innovation and creating new job opportunities.

Furthermore, these tax breaks often extend beyond just road tax. Some regions offer additional incentives, such as reduced registration fees, lower insurance premiums, or even subsidies for home charging infrastructure. These comprehensive measures ensure that EV owners can fully realize the benefits of their purchase and contribute to a cleaner, more sustainable transportation network. As a result, many EV owners experience a sense of financial relief and increased satisfaction with their eco-friendly choice.

In summary, the concept of tax breaks for EVs is a powerful tool in promoting sustainability and environmental consciousness. By offering exemptions from various taxes, governments can encourage the widespread adoption of electric vehicles, leading to a more sustainable and environmentally friendly future. This approach not only benefits individual EV owners but also contributes to a global effort to combat climate change and reduce the carbon emissions associated with traditional transportation methods.

The Elusive Electric Hybrid: Unlocking the Mystery of Scarcity

You may want to see also

Compliance: Ensure your EV meets tax regulations to avoid penalties

Electric vehicles (EVs) have gained significant popularity due to their environmental benefits and technological advancements. However, when it comes to owning an EV, there are certain legal obligations that owners must be aware of, particularly regarding road tax. Understanding the tax regulations for EVs is crucial to ensure compliance and avoid any penalties.

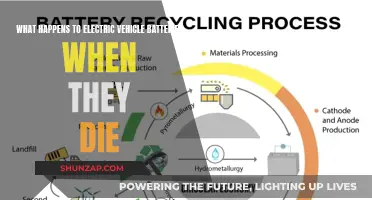

In many countries, road tax, also known as vehicle tax or road fund license, is a mandatory fee levied on vehicle owners. The primary purpose of this tax is to fund road infrastructure and maintenance. Traditionally, road tax has been associated with conventional internal combustion engine (ICE) vehicles. However, with the rise of EVs, governments have had to adapt their tax policies to accommodate this new technology.

The good news is that EVs often qualify for tax exemptions or reduced rates compared to their ICE counterparts. This is because EVs produce zero tailpipe emissions, contributing to a cleaner environment. As a result, many countries offer incentives to encourage the adoption of electric mobility. For instance, in some regions, EV owners are exempt from paying road tax entirely, while others may provide a significant discount. These tax benefits can be substantial, especially over the long term, making EVs an economically attractive choice.

To ensure compliance, EV owners should familiarize themselves with the specific tax regulations in their respective regions. This includes checking the official government websites or contacting local tax authorities to obtain accurate and up-to-date information. Typically, EV owners will need to provide proof of vehicle ownership, such as the registration documents, and may need to pay the road tax annually or at specific intervals. Failure to pay the required tax can result in penalties, including fines and potential legal consequences.

Additionally, it is essential to keep all relevant documentation related to your EV's tax compliance. This includes tax exemption certificates, if applicable, and any correspondence with tax authorities. Proper record-keeping ensures that you can provide evidence of your compliance during tax inspections or audits, which can help prevent any unnecessary issues. Staying informed and proactive about tax regulations will not only ensure you meet your legal obligations but also allow you to take full advantage of the financial benefits associated with owning an electric vehicle.

Powerful Electric Vehicles: Unlocking the 4x4 Potential

You may want to see also

Frequently asked questions

Yes, electric vehicles (EVs) are subject to road tax, just like conventional gasoline or diesel cars. The road tax system is designed to fund road infrastructure and maintenance, and EVs are included in this system.

The tax for EVs is typically calculated based on the vehicle's CO2 emissions, which is a measure of its environmental impact. Some countries or regions may have specific tax bands or rates for electric cars, often with lower or zero tax rates to encourage EV adoption.

In some cases, yes. Many governments offer exemptions or reduced tax rates for electric cars to promote sustainable transportation. These incentives can vary by region, so it's essential to check local regulations and consult with tax authorities.

Yes, EV owners might have different payment methods or options. Some regions allow for online payments or provide tax discs specifically for electric cars. It's advisable to review the official guidelines provided by the tax authorities in your area.

The frequency of road tax payments can vary. In some cases, it may be an annual or biennial payment, while in others, it could be a one-time fee when the vehicle is registered. Again, local tax laws will dictate the specific requirements for EV owners.