Navigating the world of electric vehicles (EVs) can be exciting, but it's also important to understand the financial incentives available to make the switch more accessible. Many governments and organizations offer financial assistance in the form of credits or rebates to encourage the adoption of electric vehicles. If you're considering making the leap to an EV, understanding whether you qualify for these credits is a crucial step. This guide will help you explore the criteria for EV credit eligibility, ensuring you can make an informed decision about your next vehicle purchase.

What You'll Learn

- Income Limits: Determine if your income meets the criteria for EV tax credits

- Vehicle Type: Understand which EVs qualify for the credit

- Purchase vs. Lease: Explore the differences in EV credit eligibility for buying or leasing

- Resale and Trade-In: Learn how a previous vehicle affects your EV credit qualification

- State and Local Incentives: Discover additional EV incentives beyond the federal credit

Income Limits: Determine if your income meets the criteria for EV tax credits

To determine if you qualify for the electric vehicle (EV) tax credits, it's crucial to understand the income limits set by the government. These limits are designed to ensure that the financial assistance is directed towards those who truly need it, particularly those with lower incomes. Here's a step-by-step guide to help you assess your eligibility:

- Familiarize Yourself with the Income Thresholds: The income limits for EV tax credits vary depending on your filing status and the type of EV you purchase. For instance, as of 2023, the Internal Revenue Service (IRS) sets the following income thresholds: For single filers, the modified adjusted gross income (MAGI) cannot exceed $150,000. For married couples filing jointly, the MAGI should not surpass $300,000. These limits are adjusted annually, so it's essential to check the latest IRS guidelines.

- Calculate Your Modified Adjusted Gross Income (MAGI): MAGI is a specific type of income used by the IRS to determine tax credit eligibility. It includes your adjusted gross income (AGI) and certain adjustments. To calculate MAGI, you'll need to review your tax returns and consider any deductions or adjustments you've made. This step is crucial as it directly impacts your eligibility for the EV tax credit.

- Understand the Impact of Filing Status: Your filing status, such as single, married filing jointly, head of household, or married filing separately, plays a significant role in determining income limits. Each filing status has its own set of income thresholds. For example, married couples filing jointly often have higher income limits compared to single filers. Understanding your filing status is essential to accurately assess your eligibility.

- Research State-Specific Incentives: In addition to federal tax credits, some states offer their own incentives for EV purchases. These state programs may have different income limits and eligibility criteria. Research your state's EV incentive programs to see if you qualify for additional benefits. State-specific incentives can further enhance your financial savings when purchasing an electric vehicle.

- Consult Professional Advice: If you're unsure about your income eligibility or the complex tax credit rules, consider seeking advice from a tax professional or financial advisor. They can provide personalized guidance based on your unique financial situation and help you navigate the intricacies of EV tax credits.

Remember, the EV tax credits are designed to promote the adoption of electric vehicles and reduce environmental impact. By understanding the income limits and requirements, you can make an informed decision about your eligibility and potentially take advantage of these valuable financial incentives.

Boosting Electric Vehicle Performance: Tips for Efficiency and Range

You may want to see also

Vehicle Type: Understand which EVs qualify for the credit

When considering the eligibility for the electric vehicle (EV) tax credit, it's crucial to understand the specific vehicle types that qualify. The credit is designed to incentivize the purchase of EVs, but not all electric vehicles are created equal in terms of their tax benefits. Here's a breakdown of the key points to consider:

All-Electric Vehicles: The most straightforward category for the EV tax credit is all-electric vehicles. These cars are powered solely by electric motors and do not have a gasoline or diesel engine. Examples include fully electric cars like the Tesla Model 3, Nissan Leaf, or Chevrolet Bolt. These vehicles are typically zero-emission, meaning they produce no direct exhaust emissions, which is a significant factor in their qualification.

Plug-in Hybrid Vehicles: Plug-in hybrids (PHEVs) are another type of vehicle that can qualify for the credit. These cars combine a traditional internal combustion engine with an electric motor and a rechargeable battery. PHEVs can be driven in electric mode for short distances before switching to a hybrid mode, where both the electric motor and the gasoline engine are used. Vehicles like the Toyota Prius Prime or the Hyundai Ioniq Plug-in Hybrid fall into this category. The key requirement here is that the vehicle must have a plug-in capability, allowing for charging from an external power source.

Range-Extended EVs: These vehicles are similar to PHEVs but are designed to be primarily electric vehicles with a smaller internal combustion engine that only kicks in to extend the range when the battery is low. Examples include the BMW i3 Range Extender and the Fisker EMotion. The range-extended feature is crucial for qualification, as it ensures the vehicle can travel a significant distance on electric power before the backup engine engages.

It's important to note that the EV tax credit often has specific mileage and price limits. The vehicle's base price, including destination charges, must not exceed a certain threshold, and the vehicle's annual mileage must meet certain criteria. These factors further refine the list of eligible EVs, ensuring that the credit is directed towards vehicles that are both environmentally friendly and accessible to a wide range of consumers. Understanding these vehicle categories and their specific requirements is essential for determining your eligibility for the electric vehicle tax credit.

Unraveling Tesla's Electric Mystery: Fact or Fiction?

You may want to see also

Purchase vs. Lease: Explore the differences in EV credit eligibility for buying or leasing

When considering the purchase or lease of an electric vehicle (EV), understanding the differences in credit eligibility can significantly impact your financial decision. Here's an exploration of the key distinctions between buying and leasing an EV in the context of government incentives and credit programs.

Purchase Eligibility:

- When you buy an EV, you typically qualify for various incentives and credits offered by governments to promote the adoption of electric vehicles. These incentives can include federal tax credits, state-specific rebates, and local incentives.

- The eligibility criteria for purchase credits often focus on the vehicle's price, battery capacity, and the buyer's residency and income. For instance, the federal tax credit for EVs generally applies to vehicles with a base price below a certain threshold and a battery range above a minimum requirement.

- Researching and understanding the specific purchase requirements in your region is essential, as these criteria can vary widely.

Lease Eligibility:

- Leasing an EV presents a different set of considerations. Lease programs often target specific vehicle models and may have unique eligibility rules.

- Lease incentives can include reduced lease payments, cashback offers, or additional benefits like free charging station access. However, these incentives are usually tied to the leasing company's policies and the vehicle's lease terms.

- Lease eligibility might also consider factors such as the lease duration, mileage limits, and the lessee's creditworthiness. Some lease programs may require a higher credit score or a more substantial down payment compared to purchase options.

Key Differences:

- The primary distinction lies in the ownership structure. When you purchase an EV, you gain full ownership, which may make you eligible for a broader range of incentives. In contrast, leasing provides temporary use of the vehicle, often with different incentive structures.

- Purchase credits are generally more straightforward and directly benefit the buyer. Lease incentives, on the other hand, can be more complex and may require specific lease agreements to unlock the full benefits.

- Additionally, the resale value and environmental impact of the vehicle can vary between purchase and lease options, influencing the overall cost-effectiveness and sustainability of the choice.

Understanding these differences is crucial for making an informed decision. Researching and comparing the specific EV credit programs in your area will help you determine the most suitable financing option, whether it's purchasing or leasing an electric vehicle.

Disney's Electric Conveyance Vehicles: A Smooth Ride Through the Magic

You may want to see also

Resale and Trade-In: Learn how a previous vehicle affects your EV credit qualification

When considering the purchase of an electric vehicle (EV), understanding the impact of your previous vehicle's resale or trade-in value is crucial. This is especially important as many governments and automotive manufacturers offer incentives and tax credits to promote EV adoption. These incentives can significantly reduce the overall cost of your new EV, making it more affordable and attractive.

The resale or trade-in value of your current vehicle can directly influence your eligibility for these EV credits. Here's how:

- Trade-In Value: If you decide to trade in your old car when purchasing an EV, the dealer will consider the vehicle's condition, age, and market demand. A higher trade-in value can contribute to a lower overall price for your new EV, making it more financially viable. This is particularly beneficial if you're aiming to maximize the incentive amount you can receive.

- Resale Strategy: Selling your previous vehicle privately or through a dealership can also impact your EV credit qualification. Some EV incentives are designed to encourage the disposal of older, less efficient vehicles. If you can prove that you've sold or traded in a vehicle that meets specific environmental criteria, you may be eligible for additional benefits. This strategy not only helps the environment by removing less fuel-efficient cars from the road but also potentially increases your EV credit.

It's essential to research the specific requirements and guidelines set by your local government or the EV manufacturer you're interested in. These guidelines often provide detailed information on the types of vehicles eligible for trade-ins or resales that qualify for incentives. For instance, some programs might prioritize vehicles that are at least a certain age or have low mileage, ensuring they are no longer in high demand on the used car market.

Additionally, keeping records of your previous vehicle's maintenance history and service records can be advantageous. A well-maintained vehicle, regardless of its age, may command a higher trade-in value and could also indicate a responsible ownership history, which might be considered favorably by EV credit providers.

In summary, the resale or trade-in of your previous vehicle is a strategic aspect of qualifying for EV credits. It not only influences the financial aspect of your new purchase but also contributes to a more sustainable and environmentally conscious approach to vehicle ownership. Understanding these factors can help you make informed decisions and potentially secure the incentives you're entitled to.

Unveiling the Risks: Navigating Challenges in Electric Vehicle Ownership

You may want to see also

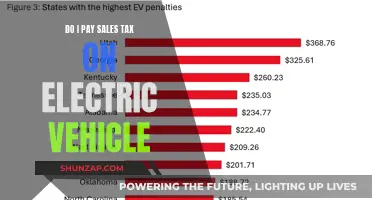

State and Local Incentives: Discover additional EV incentives beyond the federal credit

When it comes to purchasing an electric vehicle (EV), the federal tax credit is a well-known incentive, but it's just the tip of the iceberg. Many states and local governments also offer their own incentives to encourage EV adoption and promote sustainable transportation. These state and local programs can provide significant savings and make the transition to electric mobility even more attractive. Here's a breakdown of what you need to know about these additional incentives:

State-Specific Tax Credits and Rebates: Each state has its own unique set of incentives, often tailored to local needs and priorities. For instance, California, a leader in EV adoption, offers the Clean Vehicle Rebate Project, which provides rebates of up to $7,000 for new electric cars and $2,500 for used EVs. This program is designed to reduce air pollution and promote the use of cleaner vehicles. Similarly, New York offers the NY EV Charge Incentive Program, providing rebates of up to $2,000 for electric vehicles. These state-specific incentives can significantly reduce the overall cost of purchasing an EV, making it more accessible to a wider range of consumers.

Local Government Incentives: In addition to state-level programs, many cities and counties offer their own incentives. These can include cash rebates, low-interest loans, or even grants to help EV buyers cover a portion of the vehicle's cost. For example, some cities provide free or discounted parking for EVs, making it more convenient and cost-effective to own an electric car. Local incentives often target specific communities or demographics, ensuring that the benefits reach those who need them most.

Low-Emission Vehicle (LEV) Programs: Some states have implemented LEV programs, which are designed to reduce greenhouse gas emissions and improve air quality. These programs often include a combination of incentives, such as tax credits, rebates, and even access to carpool lanes. For instance, the LEV II program in California offers various incentives, including a $2,000 rebate for new EVs and a $1,500 rebate for used ones. These programs are particularly beneficial for those living in areas with strict emission standards or who are looking to contribute to environmental conservation.

Clean Energy Credits: In some regions, incentives are tied to the use of renewable energy sources. For EV owners, this can mean additional benefits. For example, certain states offer credits or rebates for installing home charging stations powered by solar energy. This not only encourages the use of clean energy but also provides an extra layer of savings for EV owners who invest in sustainable charging solutions.

Research and Compare: To take full advantage of these state and local incentives, it's crucial to research and compare the offerings in your specific area. Many governments provide detailed information on their websites, outlining the eligibility criteria and application processes. By understanding the specific incentives available, you can make an informed decision and potentially save a significant amount on your EV purchase.

Beyond Lithium: Exploring Electric Vehicle Battery Diversity

You may want to see also

Frequently asked questions

The eligibility criteria for EV tax credits vary depending on the country and region. In the United States, for instance, the Internal Revenue Service (IRS) offers a credit for electric vehicles, but it has specific rules. You need to check if your vehicle meets the requirements, such as being new, purchased for personal use, and meeting certain emissions standards. Additionally, there might be income limits and other factors to consider, so it's best to review the IRS guidelines or consult a tax professional.

Yes, income limits often play a significant role in EV credit eligibility. For example, in the US, the credit amount is reduced for individuals with adjusted gross income (AGI) above a certain threshold. For the 2023 tax year, if your AGI exceeds $150,000 ($200,000 for married filing jointly), the credit is phased out. These limits may vary by jurisdiction, so it's essential to check the specific rules applicable to your region.

In some cases, yes, but the process might be different. Leasing an EV can still make you eligible for certain credits, but the rules may vary. You may need to consider factors like the lease term, the vehicle's usage, and the specific tax regulations in your area. It's advisable to consult a tax advisor or review the relevant tax laws to understand your options.

Used EV purchases or private sales can still qualify for the credit, but the process might be more complex. You'll need to provide documentation proving the vehicle's value and its compliance with the eligibility criteria. The tax authorities may require additional proof of ownership and vehicle specifications. It's recommended to seek professional advice to ensure you meet all the necessary requirements.

Yes, vehicle specifications are crucial. The EV must meet certain criteria, such as being new, having a qualified battery electric range, and adhering to specific performance and safety standards. These requirements can vary by jurisdiction, so it's essential to check the guidelines provided by your local tax authorities or relevant government agencies.