Considering the benefits of electric vehicles (EVs) is a smart move, and one of the most attractive incentives is the Texas EV Tax Credit. This credit can significantly reduce the cost of purchasing an EV, making it an even more appealing choice for environmentally conscious drivers. However, understanding whether you qualify for this credit is crucial. The Texas EV Tax Credit is available to residents who purchase or lease a new electric vehicle, but there are specific requirements and limitations to consider. This paragraph will guide you through the key factors that determine your eligibility, ensuring you can make an informed decision about your EV purchase.

What You'll Learn

- Income Limits: Determine if your income falls within the qualifying range for the EV tax credit

- Vehicle Cost: Check the price of the EV to ensure it meets the federal cap

- Residency: Verify your state of residence is eligible for the credit

- Manufacturer Requirements: Understand the specific criteria set by EV manufacturers

- Tax Filing Status: Review how your tax filing status impacts eligibility

Income Limits: Determine if your income falls within the qualifying range for the EV tax credit

To determine if you qualify for the Electric Vehicle (EV) tax credit in Texas, one of the key factors to consider is your income. The EV tax credit is designed to incentivize the purchase of electric vehicles and promote environmental sustainability. However, there are income limits set by the state to ensure that the credit benefits those who may need it most.

The income limits for the EV tax credit in Texas are based on the federal poverty guidelines, which are adjusted annually. As of the latest update, the qualifying income range for the EV tax credit is set at below 150% of the federal poverty level. This means that your income must be at or below a certain threshold to be eligible for the credit. For example, if the federal poverty level for a family of four is $25,000, then the qualifying income limit for the EV tax credit would be $37,500 or less.

To find out if your income falls within this range, you can start by calculating your household income. This includes the income of all members of your household who are claimed as dependents on your tax return. It's important to note that income from certain sources, such as social security benefits or retirement income, may be exempt or partially exempt from the income limits.

Once you have determined your household income, you can compare it to the qualifying range. If your income is below the set limit, you may be eligible for the EV tax credit. This credit can significantly reduce the cost of purchasing an electric vehicle, making it more affordable for those with lower incomes. It's a great incentive for individuals and families who want to go green but may have financial constraints.

It is recommended to consult the official Texas government resources or seek professional tax advice to ensure you have the most up-to-date and accurate information regarding income limits and the EV tax credit eligibility criteria. Understanding these requirements will help you make an informed decision about your EV purchase and take advantage of the available financial incentives.

Top EV Exporter to India: Unveiling the Global Leader

You may want to see also

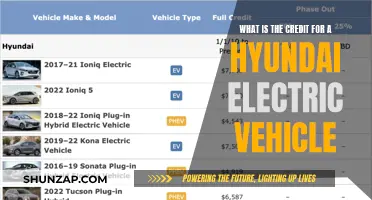

Vehicle Cost: Check the price of the EV to ensure it meets the federal cap

When considering the purchase of an electric vehicle (EV) and exploring the possibility of a tax credit, one crucial aspect to verify is the cost of the EV itself. The federal government has set a cap on the price of eligible EVs to ensure accessibility and promote a wide range of options for consumers. This cap is an important consideration as it directly impacts your qualification for the tax credit.

To determine if you qualify, start by researching the price range of the specific EV model(s) you are interested in. Many EV manufacturers provide detailed information on their websites, including the base price of their vehicles. It is essential to consider the standard or 'base' model, as additional features and packages can increase the overall cost. Look for the manufacturer's suggested retail price (MSRP) or the 'starting at' price, which often represents the lowest cost of the vehicle.

The federal cap for EV tax credits is typically set at a certain amount, and this value may vary over time. As of my knowledge cutoff in June 2024, the cap is set at $80,000 for new vehicles and $85,000 for used vehicles (with certain adjustments for vehicle age). This means that the EV's price, including any applicable fees and taxes, should not exceed this threshold to be eligible for the tax credit. It's important to note that this cap is a general guideline, and specific rules and regulations may apply, so always refer to the latest information provided by the IRS or relevant tax authorities.

Additionally, some states and local governments may have their own EV incentives and price limits, so it's beneficial to check the guidelines in your region as well. These additional requirements can further refine your understanding of eligible vehicle costs. By verifying the price of the EV against the federal cap, you can ensure that your potential purchase aligns with the tax credit program's criteria, providing you with valuable financial savings.

Remember, the tax credit is designed to encourage the adoption of EVs and make them more affordable for consumers. By carefully reviewing the vehicle's cost and comparing it to the federal cap, you can make an informed decision and potentially take advantage of this beneficial incentive.

Unveiling the Green Revolution: Electric Vehicles' Environmental Impact

You may want to see also

Residency: Verify your state of residence is eligible for the credit

To determine your eligibility for the electric vehicle tax credit, it's crucial to verify your state of residence. The credit is typically available to residents of specific states, and the availability can vary based on regional policies and incentives. Here's a step-by-step guide to help you verify your eligibility:

- Check State-Specific Requirements: Each state has its own set of rules and regulations regarding the electric vehicle tax credit. Start by researching your state's official government websites or dedicated environmental/energy portals. These sources will provide the most accurate and up-to-date information. Look for sections or pages specifically related to electric vehicle incentives, tax credits, or clean energy initiatives.

- Identify Eligible States: Not all states offer the same level of support for electric vehicle purchases. Some states provide a direct tax credit, while others offer rebates or grants. Identify the states that are currently participating in the program. You can often find this information by searching for "electric vehicle tax credit eligible states" or similar keywords. Make a list of the states where you are eligible to claim the credit.

- Verify Residency: Residency requirements may vary between states. Some states may require proof of residency for a certain period, such as a year or more. Check if your state has specific documentation or forms that need to be filled out to establish residency. This could include providing proof of address, such as a utility bill or lease agreement, and potentially a social security number or driver's license.

- Stay Informed: Tax credit policies can change over time due to legislative updates or budget reallocations. Therefore, it's essential to stay informed about any changes in your state's program. Regularly check for updates on official government websites or subscribe to newsletters from relevant environmental organizations in your state. This ensures that you have the most current information regarding residency requirements and credit availability.

Remember, the electric vehicle tax credit is a valuable incentive to promote sustainable transportation. By verifying your state's eligibility and residency requirements, you can take the necessary steps to maximize your savings when purchasing an electric vehicle.

Electric Vehicles: Cheaper to Run Than You Think

You may want to see also

Manufacturer Requirements: Understand the specific criteria set by EV manufacturers

When considering the eligibility for electric vehicle (EV) tax credits, it's crucial to delve into the specific requirements set by EV manufacturers. These criteria can vary widely, and understanding them is essential for maximizing your chances of qualifying for these incentives. Here's a breakdown of what you need to know:

Vehicle Model and Production Year: Each EV manufacturer has a list of eligible vehicle models that qualify for the tax credit. This list often includes specific makes and models from their current or previous years of production. For instance, Tesla, a prominent EV manufacturer, has a dedicated page on its website outlining the eligible models and their respective production years. It's imperative to check this information for the specific manufacturer you're interested in.

Battery Capacity and Range: Many EV tax credits are tied to the vehicle's battery capacity and the range it can achieve on a single charge. Manufacturers often provide detailed specifications for their vehicles, including battery size and estimated range. For example, the Tesla Model 3, a popular sedan, offers different battery options with varying ranges, and the tax credit amount may depend on the chosen battery capacity.

Assembly and Manufacturing Location: Some tax credits have geographic restrictions, requiring the vehicle to be assembled and manufactured in specific regions. This criterion ensures local economic benefits and job creation. For instance, the United States has implemented tax credits for EVs produced and assembled in North America. Understanding the manufacturing location requirements is vital, especially if you're considering vehicles from international brands.

Compliance with Environmental Standards: EV manufacturers often have their own environmental standards and certifications that their vehicles must meet. These standards may include emissions, safety, and performance criteria. For example, the California Air Resources Board (CARB) has established strict emissions standards for EVs, and manufacturers must ensure their vehicles comply with these regulations to be eligible for certain tax credits.

Dealer and Purchase Requirements: In addition to vehicle specifications, manufacturers might have specific dealer and purchase requirements. This could include purchasing the vehicle from an authorized dealership or meeting certain sales conditions. These requirements are designed to ensure a consistent and controlled sales process, providing customers with a reliable and authorized source for their EV purchases.

By thoroughly researching and understanding these manufacturer-specific criteria, you can navigate the EV tax credit application process with confidence. It's a detailed process, but one that can result in significant financial savings when purchasing an electric vehicle.

Green Revolution: Unveiling the Environmental Impact of Electric Vehicles

You may want to see also

Tax Filing Status: Review how your tax filing status impacts eligibility

Understanding your tax filing status is crucial when determining your eligibility for the electric vehicle (EV) tax credit. This credit is designed to incentivize the purchase of electric cars and promote environmental sustainability. The Internal Revenue Service (IRS) has specific criteria that applicants must meet, and your tax filing status plays a significant role in this process.

For individuals, your tax filing status is typically determined by whether you are single, married filing jointly, married filing separately, or head of household. Each status has its own set of rules and benefits. For instance, if you are single, you may have a different income threshold for claiming the credit compared to someone who is married filing jointly. The IRS provides detailed guidelines on their website, outlining the maximum income limits for each filing status. These limits are adjusted annually and are based on the previous year's inflation rates. It's essential to check the IRS website for the most up-to-date information, as these limits may change from year to year.

Married individuals have two options for filing taxes: jointly or separately. Filing jointly means combining your income, deductions, and credits with your spouse. This can often result in a higher overall income, which may impact your eligibility for the EV tax credit. On the other hand, married filing separately allows each spouse to file individually, which can be advantageous if one spouse's income is significantly lower, potentially increasing the chances of qualifying for the credit. However, it's important to note that there are specific rules and limitations for each filing status, and consulting a tax professional is recommended to ensure compliance with the IRS regulations.

Head of household filers, which includes individuals who are unmarried but support a qualifying child or dependent, may also be eligible for the EV tax credit. The IRS has specific criteria for determining head of household status, and meeting these requirements can provide an opportunity to claim the credit. It's important to understand the definitions and criteria set by the IRS to ensure you qualify for this filing status.

In summary, your tax filing status is a critical factor in determining your eligibility for the electric vehicle tax credit. The IRS provides clear guidelines for each filing status, and understanding these rules is essential to ensure you meet the income and eligibility requirements. Whether you are single, married, or head of household, being aware of these nuances will help you navigate the process and potentially qualify for this valuable tax incentive.

Unveiling the Green Myth: Do EVs Still Pollute?

You may want to see also

Frequently asked questions

To qualify for the electric vehicle tax credit, you must be a resident of Texas and purchase or lease a new electric vehicle from a dealership or manufacturer that participates in the program. The vehicle must be primarily used for personal transportation and meet specific emission standards.

There is no specific income limit set for the electric vehicle tax credit in Texas. However, the credit amount is generally limited to the amount of state sales tax paid on the vehicle purchase. The sales tax credit is available to all Texas residents, regardless of income.

No, the electric vehicle tax credit is non-transferable and is tied to the vehicle purchase or lease. If you don't qualify, the credit cannot be transferred to another individual. The credit is designed to incentivize the purchase of electric vehicles and is typically claimed by the vehicle owner or lessee.