California is a leader in the electric vehicle (EV) market, with a strong focus on reducing greenhouse gas emissions and promoting sustainable transportation. One of the key incentives to encourage EV adoption is the availability of an electric vehicle credit. This credit is a financial benefit designed to make electric cars more affordable for consumers. The credit can significantly reduce the upfront cost of purchasing an EV, making it an attractive option for those looking to go green. Understanding the specifics of this credit is essential for anyone considering an electric vehicle purchase in California, as it can provide valuable savings and make the transition to electric mobility more accessible.

| Characteristics | Values |

|---|---|

| Electric Vehicle Credit in California | Yes, California offers an electric vehicle (EV) credit program. |

| Program Name | California Competes Tax Credit for Electric Vehicles |

| Eligibility | Available to individuals and businesses purchasing or leasing new electric vehicles. |

| Credit Amount | Up to $2,500 per vehicle, depending on the vehicle's price and battery capacity. |

| Income Limit | The credit is generally available to all income levels, but there are some restrictions for high-income earners. |

| Vehicle Types | Includes plug-in hybrid electric vehicles (PHEVs) and all-electric vehicles (BEVs). |

| Manufacturer and Model | Applies to most electric vehicles, including those from domestic and international manufacturers. |

| Credit Duration | The credit is available for vehicles purchased or leased on or after January 1, 2023, and before January 1, 2025. |

| Application Process | Claimable through the California Franchise Tax Board (FTB) when filing state income tax returns. |

| Additional Benefits | May be combined with other incentives, such as the federal tax credit for electric vehicles. |

| Changes in 2023 | The credit amount was increased to $2,500 per vehicle in the 2023 tax year. |

What You'll Learn

Eligibility: Who qualifies for the EV credit in California?

California offers a valuable incentive for residents interested in purchasing electric vehicles (EVs) through its EV credit program. This credit is designed to encourage the adoption of clean energy vehicles and reduce the state's carbon footprint. To qualify for this credit, individuals must meet specific criteria set by the California Air Resources Board (CARB).

Firstly, the vehicle must be new and purchased from an authorized dealer in California. This ensures that the credit is directed towards the local market and supports local businesses. The vehicle should also be new to the state, meaning it hasn't been previously registered in California. This rule is in place to promote the purchase of EVs that will remain in the state, contributing to the overall environmental benefits.

Eligible buyers include California residents, which can be individuals or businesses. This broad eligibility ensures that both personal and commercial EV purchases are incentivized. For individuals, the vehicle must be used primarily for personal transportation, and the buyer must be the registered owner of the vehicle. This ensures that the credit is awarded to the end-user, who will directly benefit from the environmental impact of the EV.

Businesses, on the other hand, can claim the credit for the purchase of EVs used for commercial purposes. This includes fleet vehicles, taxis, and other vehicles used for business operations. The key requirement here is that the business must be registered and operating within California. This aspect of the program aims to support businesses in their transition to cleaner transportation options while also promoting economic growth.

Additionally, the EV credit program has specific vehicle requirements. The vehicle must be powered by a battery or fuel cell, and it should meet the CARB's zero-emission vehicle (ZEV) requirements. This ensures that the credit is applied to vehicles that provide the maximum environmental benefit. The ZEV requirements outline the minimum standards for vehicle performance, efficiency, and emissions, ensuring that the credit is awarded to the most environmentally friendly EVs.

Uncover the Top Stocks in the Electric Vehicle Revolution

You may want to see also

Amount: How much is the credit?

California offers a significant incentive for residents and businesses to adopt electric vehicles (EVs) through its Electric Vehicle (EV) Incentive Program. This program provides a financial credit to encourage the purchase or lease of new electric vehicles, aiming to reduce greenhouse gas emissions and promote cleaner transportation options. The credit amount varies depending on the type of vehicle and the applicant's income.

For new electric vehicles, the credit can range from $2,500 to $7,500, depending on the vehicle's price and the applicant's income. Vehicles priced below $50,000 generally qualify for the full $7,500 credit, while those priced between $50,000 and $60,000 are eligible for a reduced credit of $5,000. Vehicles priced above $60,000 do not qualify for the EV incentive. It's important to note that the credit is not a fixed amount but rather a percentage of the vehicle's price, ensuring that lower-priced EVs receive a larger credit relative to their cost.

In addition to the base credit, California also offers a $1,500 credit for the installation of a home charging station. This credit is available to both individuals and businesses and is designed to encourage the adoption of home charging infrastructure, which is essential for EV owners. The combined credit for a new electric vehicle and a home charging station can be substantial, making the purchase of an EV more affordable and attractive to consumers.

The EV incentive program in California is designed to be a one-time credit, and the amount is directly applied to the purchase or lease price of the vehicle. This ensures that the credit is a genuine financial benefit to the buyer or lessee, encouraging a faster transition to electric vehicles. It's worth mentioning that the program has income limits, with a maximum household income of $100,000 for individuals and $150,000 for joint filers to be eligible for the full credit amount.

Understanding the credit amount and its eligibility criteria is crucial for anyone considering purchasing an electric vehicle in California. The state's incentive program provides a substantial financial benefit, making EVs more accessible and affordable to residents and businesses. By offering these credits, California aims to accelerate the adoption of electric vehicles and contribute to its environmental goals.

Mastering the EV Service Permit: A Step-by-Step Guide to Application Success

You may want to see also

Vehicle Types: Which EVs are eligible?

California's electric vehicle (EV) credit program is designed to incentivize the adoption of zero-emission vehicles and promote a cleaner environment. The state offers various credits and incentives for EV buyers, which can significantly reduce the overall cost of purchasing an electric car. When considering eligibility, it's important to understand that the specific requirements may vary depending on the type of EV and its intended use.

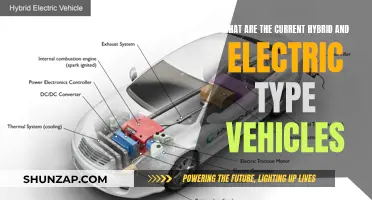

Eligible vehicle types under California's EV credit program generally include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Battery electric cars are fully powered by an electric motor and rechargeable batteries, with no internal combustion engine. These vehicles produce zero tailpipe emissions and are a popular choice for environmentally conscious consumers. Plug-in hybrid electric vehicles, on the other hand, combine a traditional internal combustion engine with an electric motor and rechargeable batteries. They offer the flexibility of both electric and gasoline power, making them suitable for longer trips or areas with limited charging infrastructure.

To be eligible for the EV credit, the vehicle must also meet certain criteria regarding its manufacturing and sales. California has specific guidelines for the production and assembly of EVs to ensure they are manufactured in compliance with environmental standards. Additionally, the vehicle must be purchased new and registered as a personal or commercial vehicle in California. Used EVs may not qualify for the credit, as the program aims to encourage the purchase of new, zero-emission vehicles.

It's worth noting that the EV credit program may have different eligibility rules for commercial and fleet vehicles. Commercial entities, such as taxi services or car rental companies, may be eligible for credits on a larger scale, encouraging the adoption of EVs in the transportation sector. Fleet vehicles, which are used for business purposes, may also qualify for special incentives to reduce the overall cost of ownership.

Understanding the specific vehicle types and criteria that qualify for California's EV credit is essential for potential buyers. By promoting the use of battery electric and plug-in hybrid vehicles, the state aims to reduce greenhouse gas emissions and improve air quality. This incentive program not only benefits individual consumers but also contributes to a more sustainable and environmentally friendly transportation system in California.

Solar-Powered Revolution: Electric Vehicles with Solar Roofs

You may want to see also

Income Limits: Are there income restrictions for the credit?

California offers a valuable incentive for residents looking to go green: the Electric Vehicle (EV) Credit. This credit is a financial reward for purchasing or leasing a new electric vehicle, aiming to promote the adoption of cleaner transportation options. However, it's essential to understand that this credit is not universally available; it comes with specific criteria, including income limits, which are designed to ensure the benefit reaches those who need it most.

The income restrictions for the EV credit in California are set to support lower- to middle-income families. The state's guidelines typically cap the eligible income at a certain percentage of the Area Median Income (AMI). For instance, as of 2023, the AMI for a family of four in California is approximately $100,000. Households earning below this threshold may qualify for the full credit amount, which can vary depending on the vehicle's price and other factors. It's crucial to note that these income limits are adjusted annually, reflecting the state's commitment to ensuring the credit's accessibility over time.

To determine your eligibility, you can start by checking your household income against the latest AMI figures. Various online resources and government websites provide these details, allowing you to assess your potential qualification. Additionally, consulting with a financial advisor or tax professional can offer personalized guidance, ensuring you understand the specific income requirements and how they apply to your unique circumstances.

It's worth mentioning that the EV credit is just one of the many incentives available in California to encourage the use of electric vehicles. Other benefits may include tax exemptions, reduced registration fees, and access to carpool lanes. Understanding these various incentives can further enhance the financial benefits of going electric.

In summary, while the Electric Vehicle Credit in California is a valuable incentive, it is not available to everyone. Income limits are a critical factor in determining eligibility, ensuring that the credit supports those who may need it most. By understanding these income restrictions and exploring other available incentives, residents can make informed decisions about their transportation choices, potentially saving money and contributing to a more sustainable future.

EV Battery End-of-Life: Recycling, Disposal, and Second Life Potential

You may want to see also

Application Process: How to apply for the EV credit

The application process for the California Electric Vehicle (EV) Credit is designed to be straightforward, but it requires careful preparation and attention to detail. Here's a step-by-step guide to help you navigate the process:

- Determine Your Eligibility: Before applying, ensure you meet the eligibility criteria. The EV credit is available to individuals and businesses purchasing or leasing new electric vehicles in California. You must be a resident of the state or have a valid California address for the vehicle. Additionally, the vehicle must be new and meet specific emission standards. Check the California Air Resources Board (CARB) website for the most up-to-date information on eligible vehicle models.

- Gather Required Documents: Collect all the necessary documents to support your application. This typically includes proof of identity (e.g., driver's license, passport), proof of residency, and vehicle purchase or lease agreement. For businesses, you may need additional documentation, such as a business license and a detailed vehicle purchase or lease contract.

- Complete the Application Form: Obtain the EV credit application form from the CARB website or your local county tax collector's office. Fill it out accurately and completely. Provide all the required information, including vehicle details, purchase or lease date, and your contact information. Double-check your application to ensure there are no errors or missing fields.

- Submit the Application: You have two options for submitting your application. You can either mail it to the California Air Resources Board or submit it online through their website. If mailing, use the address provided on the application form. If submitting online, follow the instructions on the CARB website to upload all required documents and complete the electronic submission process.

- Wait for Processing and Approval: After submitting your application, allow sufficient time for processing. The CARB typically takes several weeks to review and approve applications. You will receive a notification once your application is approved, and you will be issued the EV credit. Keep a record of your application submission date and any reference numbers for future correspondence.

- Claim the Credit: With your EV credit approved, you can now claim it when purchasing or leasing your electric vehicle. Present the credit certificate or notification to the dealership or leasing company during the purchase process. They will apply the credit to the vehicle's price, reducing the overall cost. Ensure you keep a copy of the credit certificate for your records.

Remember, staying organized and providing all the required information accurately is crucial to a smooth application process. Keep yourself updated with the latest guidelines and deadlines by regularly checking the CARB website for any changes or additional requirements.

Exploring the Range of Electric Conveyance Vehicle Sizes

You may want to see also

Frequently asked questions

The California EV Credit, also known as the Clean Vehicle Rebate Project, is a state-funded program designed to incentivize the purchase or lease of new electric vehicles (EVs) in California. This credit provides financial assistance to eligible residents, helping to reduce the upfront cost of EVs and promote the adoption of cleaner transportation options.

The credit amount varies depending on the type of EV and its battery capacity. For plug-in hybrid electric vehicles (PHEVs), the credit ranges from $1,500 to $4,500. All-electric vehicles (BEVs) are eligible for a credit of up to $7,000. The credit is based on the vehicle's battery capacity, with higher credits for vehicles with larger batteries.

California residents who purchase or lease a new EV are eligible for the credit. The vehicle must be new and purchased from an authorized dealer or leased from a participating leasing company. Additionally, the buyer or lessee must meet specific income requirements to ensure the credit supports lower-income households in their transition to electric vehicles.

The application process typically involves submitting a completed application form, providing proof of residency and income, and supplying documentation related to the EV purchase or lease. The California Air Resources Board (CARB) manages the EV credit program and provides detailed instructions and guidelines on their website. Applicants can also reach out to CARB for assistance and to ensure their application is submitted correctly.