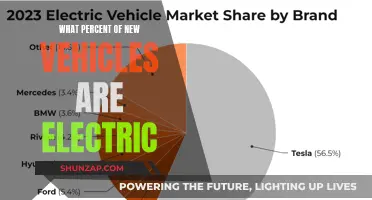

Electric vehicles (EVs) have gained significant traction in recent years, and many companies are considering the switch from traditional internal combustion engine (ICE) vehicles to EVs. The financial implications of this transition are a key consideration for businesses. This paragraph will explore the cost-effectiveness of electric vehicles for companies, examining the initial investment, operational expenses, and long-term savings. It will also discuss the potential benefits of reduced fuel and maintenance costs, as well as the impact of government incentives and subsidies on the overall affordability of EVs for businesses.

What You'll Learn

- Total Cost of Ownership (TCO): Compare long-term costs of EVs vs. traditional vehicles

- Fuel Savings: Highlight reduced fuel expenses for electric fleets

- Maintenance Costs: Discuss lower maintenance needs for electric motors

- Tax Incentives: Explore government incentives for EV adoption

- Depreciation Rates: Analyze faster depreciation of EVs compared to conventional cars

Total Cost of Ownership (TCO): Compare long-term costs of EVs vs. traditional vehicles

The concept of Total Cost of Ownership (TCO) is a comprehensive approach to evaluating the financial implications of an asset over its entire lifecycle. When comparing electric vehicles (EVs) to traditional internal combustion engine (ICE) vehicles, TCO analysis becomes a powerful tool for businesses to understand the long-term cost advantages of EVs. This analysis considers various factors, including purchase price, fuel and energy costs, maintenance and repair expenses, and even the environmental impact of the vehicles.

In the context of long-term costs, EVs often emerge as a more economical choice for companies. Firstly, the initial purchase price of EVs has been decreasing as technology advances and production scales up. While still potentially higher than their ICE counterparts, the total cost of ownership for EVs can be significantly lower over time. This is primarily due to the simpler mechanical systems in EVs, which generally require fewer parts and less frequent maintenance compared to ICE vehicles. As a result, companies can expect reduced expenses on labor and parts for EV maintenance and repairs.

Energy costs play a pivotal role in the TCO comparison. EVs are powered by electricity, which, in many regions, is often cheaper than gasoline or diesel. Over the lifetime of a vehicle, the savings on fuel can be substantial. For instance, a company operating a fleet of EVs might save thousands of dollars annually on fuel compared to a similar fleet of ICE vehicles, especially considering the rising costs of fossil fuels. Additionally, the efficiency of EVs, which can convert over 77% of battery energy to power the vehicle, is significantly higher than that of ICE vehicles, further reducing energy expenses.

Maintenance and repair costs are another critical aspect of TCO. EVs have fewer moving parts, leading to less frequent and less complex maintenance requirements. This simplicity translates to lower maintenance costs and reduced downtime for companies. Traditional vehicles, with their intricate engines and numerous components, often incur higher maintenance expenses and may require more frequent repairs, impacting productivity and financial resources.

Furthermore, the environmental impact of vehicles is increasingly becoming a factor in TCO calculations. Companies are under growing pressure to reduce their carbon footprint and adopt sustainable practices. EVs produce zero tailpipe emissions, contributing to a cleaner environment and potentially attracting incentives or subsidies from governments and organizations. While the initial purchase price of EVs might be a consideration, the long-term environmental benefits can offset these costs, making EVs an attractive option for companies aiming to minimize their environmental impact.

In summary, a comprehensive TCO analysis reveals that EVs offer significant long-term cost advantages over traditional vehicles. From reduced fuel and energy expenses to lower maintenance costs and environmental benefits, companies can make a compelling case for transitioning to electric fleets. As technology continues to advance and infrastructure for EVs improves, the financial and environmental benefits of electric vehicles are likely to become even more pronounced, solidifying their position as a cost-effective and sustainable choice for businesses.

Green Machines: Unveiling the Environmental Impact of Electric Vehicles

You may want to see also

Fuel Savings: Highlight reduced fuel expenses for electric fleets

Electric vehicles (EVs) are revolutionizing the way companies approach transportation, and one of the most compelling advantages for businesses adopting electric fleets is the significant reduction in fuel costs. The traditional reliance on gasoline or diesel engines for commercial vehicles is becoming increasingly expensive, especially with the ever-fluctuating fuel prices. Electric fleets, on the other hand, offer a more stable and cost-effective solution.

When it comes to fuel savings, electric fleets can provide substantial financial benefits to companies. Firstly, EVs have zero direct fuel costs. Once charged, the electricity required to power these vehicles is generally much cheaper than the price of gasoline or diesel. This is a direct and immediate saving for companies, as they no longer need to purchase fuel for their fleets. Over time, this can result in substantial savings, especially for businesses with large commercial vehicle fleets.

The efficiency of electric motors also plays a crucial role in reducing fuel expenses. Electric engines are inherently more efficient than their internal combustion counterparts, converting a higher percentage of energy into actual power. This means that electric fleets can travel further on a single charge, reducing the frequency of refuels and, consequently, the overall fuel expenditure. Moreover, the instant torque of electric motors allows for quicker acceleration, which can improve fleet productivity and reduce unnecessary idling, further contributing to fuel savings.

In addition to the direct cost savings, companies can also benefit from the environmental advantages of electric fleets. Many regions offer incentives and tax benefits for businesses adopting eco-friendly transportation methods. These financial incentives can further reduce the overall cost of ownership for electric vehicles, making them an even more attractive option for companies. By embracing electric fleets, businesses can not only save money but also contribute to a more sustainable and environmentally friendly future.

Implementing electric fleets also allows companies to future-proof their operations. As the world moves towards more sustainable practices, electric vehicles align with global trends and consumer preferences. Businesses that invest in electric fleets can stay ahead of the curve, potentially attracting environmentally conscious customers and employees. This strategic move not only benefits the company's bottom line but also enhances its reputation and market position.

Unlock Massachusetts EV Tax Savings: A Comprehensive Guide

You may want to see also

Maintenance Costs: Discuss lower maintenance needs for electric motors

Electric vehicles (EVs) are gaining popularity in the transportation sector, and for companies, the financial implications of this shift are significant. One of the key advantages of electric motors over traditional internal combustion engines is their lower maintenance requirements, which can lead to substantial cost savings for businesses.

The maintenance of electric motors is generally more straightforward and less frequent compared to their gasoline or diesel counterparts. Electric motors have fewer moving parts, which means there is less wear and tear, and consequently, fewer components that can break down or require servicing. For instance, electric vehicles do not have complex transmissions or exhaust systems, which are common sources of maintenance issues in conventional cars. This simplicity in design translates to reduced maintenance costs for companies, as they spend less on labor, parts, and repairs.

Over time, the savings can be substantial. Electric motors often have longer lifespans and require less frequent servicing, which means companies can save on regular maintenance checks and oil changes. Additionally, the absence of oil changes eliminates the need for specialized equipment and the associated costs, further reducing maintenance expenses. This is particularly beneficial for fleet operators, who can optimize their vehicle maintenance schedules and allocate resources more efficiently.

Furthermore, the lower maintenance needs of electric motors contribute to the overall reliability and efficiency of electric vehicles. With fewer components prone to failure, companies can expect higher uptime for their fleets, ensuring consistent performance and reducing the risk of unexpected breakdowns. This reliability can enhance the overall operational efficiency of a business, especially in industries where vehicle downtime can lead to significant losses.

In summary, the lower maintenance costs associated with electric motors are a compelling reason for companies to consider electric vehicles as a cost-effective transportation solution. The reduced frequency of maintenance tasks and the simplicity of electric motor design result in significant financial benefits, making electric vehicles an attractive option for businesses looking to optimize their maintenance budgets and improve overall operational efficiency.

Cadillac's Electric Revolution: The Future of Luxury EVs

You may want to see also

Tax Incentives: Explore government incentives for EV adoption

The adoption of electric vehicles (EVs) by companies can lead to significant cost savings and financial benefits, making it an increasingly attractive option for businesses. One of the key advantages is the availability of tax incentives and subsidies offered by governments worldwide to encourage the transition to electric mobility. These incentives play a crucial role in reducing the upfront costs of EV adoption and can have a substantial impact on a company's bottom line.

Many countries and regions have implemented various tax benefits to promote the use of electric cars. For instance, governments may offer tax credits or deductions for businesses purchasing EVs. These incentives can directly reduce the overall cost of the vehicle, making it more affordable for companies. For example, in the United States, the Internal Revenue Code provides a tax credit for businesses that acquire qualified plug-in electric vehicles. This credit can be substantial, often covering a significant portion of the vehicle's price, especially for zero-emission vehicles. Similarly, in the European Union, member states have been granted the flexibility to design their own national or regional schemes, offering tax advantages to businesses investing in EVs.

In addition to direct vehicle cost reductions, governments also provide tax benefits for EV charging infrastructure. Installing charging stations is essential for companies operating EV fleets, and governments recognize the importance of supporting this aspect. Tax incentives can be offered for the purchase and installation of charging equipment, making it more financially viable for businesses to set up the necessary infrastructure. This is particularly beneficial for companies with large fleets, as it enables them to manage their charging needs efficiently while potentially reducing long-term energy costs.

Furthermore, some regions offer tax breaks or refunds for the lease or rental of EVs, which can be advantageous for companies with short-term or flexible vehicle needs. This approach allows businesses to test the waters with electric vehicles without a significant upfront investment. By providing tax relief for leasing, governments aim to encourage companies to explore the benefits of EVs without the commitment of full ownership.

Understanding and utilizing these tax incentives can be a strategic move for companies aiming to reduce operational costs and contribute to environmental sustainability. It is essential for businesses to research and stay updated on the specific tax benefits available in their respective countries or regions, as these incentives can vary and may be subject to change. By taking advantage of these financial incentives, companies can make informed decisions about EV adoption, ensuring long-term cost savings and a positive environmental impact.

Green Revolution: Unveiling the Environmental Impact of Electric Vehicles

You may want to see also

Depreciation Rates: Analyze faster depreciation of EVs compared to conventional cars

The concept of depreciation is a critical factor in assessing the long-term cost-effectiveness of electric vehicles (EVs) for companies. When comparing EVs to conventional internal combustion engine (ICE) vehicles, one notable aspect is the depreciation rate, which can significantly impact the overall financial health of a business.

EVs have historically experienced faster depreciation compared to their conventional counterparts. This phenomenon can be attributed to several factors. Firstly, the technology behind EVs is relatively newer, and as a result, the market for used EVs is still developing. This limited market for pre-owned EVs often leads to lower residual values, especially for older models, which in turn accelerates depreciation. Secondly, the rapid advancements in EV technology mean that newer models are constantly being released, offering improved performance, features, and efficiency. This constant evolution can make older EV models less desirable, further contributing to faster depreciation.

The faster depreciation of EVs is a double-edged sword. On one hand, it can make EVs more affordable for companies in the short term, as the initial purchase price is often lower compared to conventional cars. This is particularly true for businesses that operate in fleets, where the total cost of ownership (TCO) over the vehicle's lifetime is a crucial consideration. However, the faster depreciation also means that companies may need to replace EVs more frequently, potentially increasing maintenance and replacement costs.

To mitigate the impact of faster depreciation, companies can consider several strategies. One approach is to lease EVs instead of purchasing them outright. Leasing allows businesses to avoid the initial high depreciation hit, as the lease payments are typically based on the vehicle's residual value at the end of the lease term. This can provide a more stable and predictable cost structure. Additionally, companies can explore the option of purchasing used EVs, which may have already undergone the initial rapid depreciation phase, thus reducing the overall cost.

In conclusion, the faster depreciation of EVs compared to conventional cars is a significant consideration for companies evaluating their vehicle fleets. While it presents short-term cost advantages, it also introduces potential long-term financial challenges. By understanding these depreciation patterns and implementing appropriate strategies, businesses can make informed decisions to optimize their EV investments and overall fleet management.

Tax Benefits: Deducting EV Purchase Costs

You may want to see also

Frequently asked questions

Electric vehicles can significantly reduce operational costs for companies. EVs have lower fuel and maintenance expenses compared to traditional gasoline or diesel vehicles. The cost of electricity to power EVs is generally cheaper than the price of fossil fuels, leading to substantial savings over time. Additionally, EVs have fewer moving parts, resulting in reduced maintenance needs and lower repair costs.

Yes, many governments and local authorities offer incentives to encourage the adoption of electric vehicles. These incentives can include tax credits, rebates, or grants. For instance, in the United States, the Internal Revenue Code provides a credit for qualified plug-in electric vehicle purchases, which can be beneficial for businesses. Such financial support can help offset the initial investment in EVs, making them more affordable and attractive to companies.

While electric vehicles do require regular charging, modern charging infrastructure and efficient battery technology have addressed this concern. Companies can implement charging stations at their facilities or take advantage of public charging networks. Rapid charging options are becoming more common, allowing for quicker replenishment of battery power. With proper planning and infrastructure, businesses can ensure that their electric vehicle fleet remains operational and ready for use without significant disruptions.

Electric vehicles produce fewer greenhouse gas emissions and have a lower carbon footprint compared to conventional vehicles. By adopting EVs, companies can contribute to reducing air pollution and combating climate change. This is especially relevant for businesses aiming to enhance their sustainability and corporate social responsibility. Additionally, the environmental benefits can lead to positive public perception and potential cost savings in the long term.

Absolutely. Electric vehicles can be a powerful marketing tool for companies, especially those focused on sustainability and innovation. Many consumers are increasingly conscious of environmental issues and prefer brands that align with their values. By showcasing an electric vehicle fleet, companies can attract environmentally-minded customers and employees. Moreover, efficient and reliable EVs can enhance customer satisfaction, leading to increased loyalty and positive word-of-mouth.