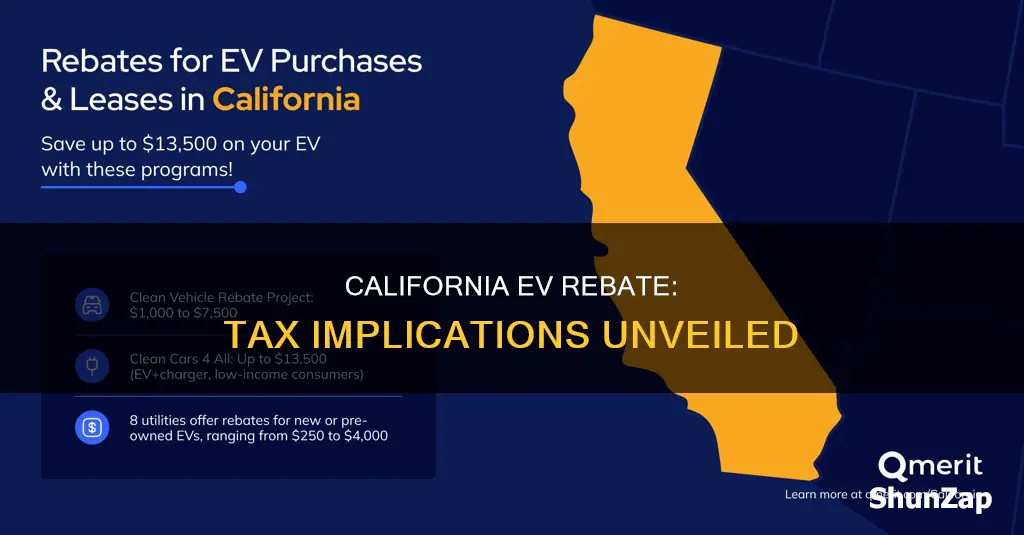

The California electric vehicle (EV) rebate program offers financial incentives to promote the adoption of clean energy vehicles. However, understanding the tax implications of these rebates is crucial for EV buyers. This paragraph will explore the question of whether the California electric vehicle rebate is taxable, shedding light on the potential tax consequences for recipients and the importance of considering these factors when making the decision to purchase an EV.

| Characteristics | Values |

|---|---|

| Tax Status | The California Electric Vehicle (EV) Rebate is generally not taxable. It is a state-funded incentive program designed to promote the adoption of electric vehicles and reduce greenhouse gas emissions. |

| Rebate Amount | Varies based on the vehicle's price, battery capacity, and other factors. The rebate can range from $1,500 to $7,500 for new EVs and $2,500 to $5,000 for used EVs. |

| Eligibility | Open to California residents who purchase or lease a new or used electric vehicle. The vehicle must be new to the state and meet specific emissions standards. |

| Application Process | Applicants typically submit a rebate application form along with supporting documents, such as the vehicle's title and sales documents, to the California Air Resources Board (CARB). |

| Timing | Rebates are usually processed and issued within a few months of the application submission. |

| Tax Implications | Since the rebate is a form of financial assistance, it may be considered taxable income by the Internal Revenue Service (IRS) for federal tax purposes. However, the California Franchise Tax Board (FTB) has ruled that the EV rebate is not taxable at the state level. |

| Recent Changes | The EV rebate program has undergone changes, including adjustments to rebate amounts and eligibility criteria. It is advisable to check the latest information on the CARB website. |

What You'll Learn

- Eligibility Criteria: Who qualifies for the rebate and what vehicles are eligible

- Rebate Amount: How much is the rebate and how is it calculated

- Tax Implications: Are there any tax consequences for receiving the rebate

- Sales Tax: How does the rebate affect the vehicle's sales tax

- Income Limits: Are there income limits for receiving the rebate

Eligibility Criteria: Who qualifies for the rebate and what vehicles are eligible?

The California Electric Vehicle (EV) Rebate Program is designed to incentivize the adoption of electric vehicles and reduce the state's carbon footprint. To qualify for the rebate, individuals and businesses must meet specific criteria, and the vehicle itself must also adhere to certain standards. Here are the key eligibility criteria:

Individuals and Residents:

- California residents are eligible to apply for the rebate. This includes individuals who are permanent residents of the state and have a valid California driver's license or identification card.

- The rebate is available to both new and existing vehicle owners. If you are purchasing a new EV, you must be a resident at the time of purchase. For used EV purchases, residency at the time of transfer is required.

Vehicles:

- The rebate is applicable to new and used electric vehicles, including plug-in hybrid electric vehicles (PHEVs). These vehicles must be purchased or leased from an authorized California dealer or retailer.

- Eligible vehicles are those that meet the California Air Resources Board (CARB) standards for zero-emission vehicles (ZEVs). This includes battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs). PHEVs must have a minimum all-electric range of 100 miles to qualify.

- The vehicle's model year must be 2014 or newer for new purchases and 2010 or newer for used purchases. This ensures that the technology and performance meet modern standards.

Income and Sales Tax:

- There are income-based requirements for the rebate. Households with an annual income of $100,000 or less are eligible for the full rebate amount. For those with incomes above $100,000, the rebate decreases proportionally based on income.

- The rebate is not taxable as income, but it may be subject to sales tax in some jurisdictions. It is recommended to check local tax laws to understand any potential tax implications.

Additional Considerations:

- Businesses and fleets are also eligible for the rebate, but they must meet specific criteria, such as operating in California and having a certain number of vehicles in their fleet.

- The rebate amount varies depending on the vehicle's price and the applicant's income. Higher-priced vehicles and lower-income applicants may receive a larger rebate.

Understanding these eligibility criteria is essential for anyone considering purchasing an electric vehicle in California. It ensures that the rebate program benefits those who meet the state's environmental and economic goals.

Electric Vehicle Express Lanes: Free or Fee-Based?

You may want to see also

Rebate Amount: How much is the rebate and how is it calculated?

The California Electric Vehicle (EV) Rebate Program offers financial incentives to residents purchasing new electric vehicles, aiming to promote cleaner transportation and reduce greenhouse gas emissions. The rebate amount varies depending on the vehicle's battery capacity and the type of EV. For new electric cars, the rebate is calculated based on the vehicle's battery capacity, with a maximum rebate of $7,000 for vehicles with a battery capacity of 150 miles or more. Vehicles with a battery capacity between 100 and 149 miles are eligible for a rebate of up to $5,000. The rebate amount is directly proportional to the vehicle's battery capacity, ensuring that higher-capacity EVs receive a more substantial incentive.

The calculation of the rebate is straightforward. It is based on a per-mile rate, with the specific amount varying depending on the vehicle's range. For instance, the $7,000 maximum rebate is available for vehicles with a battery capacity of 150 miles or more, which equates to a per-mile rate of approximately $46.67. This rate is applied to the vehicle's battery capacity to determine the rebate amount. The per-mile rate is designed to encourage the purchase of more efficient and environmentally friendly vehicles, as those with higher battery capacities and longer ranges are eligible for the highest rebates.

It's important to note that the rebate amount is not a flat fee but rather a percentage of the vehicle's price. The rebate percentage varies based on the vehicle's battery capacity and the type of EV. For example, the rebate for a new electric car with a battery capacity of 150 miles or more is typically around 25% of the vehicle's price, up to the maximum rebate amount. This structure ensures that the incentive is more substantial for higher-priced vehicles, making electric cars more affordable for California residents.

Additionally, the rebate program may have specific guidelines and limitations. Some vehicles, such as those with a battery capacity below 100 miles, may be eligible for a lower rebate amount or even a different incentive structure. It is crucial for potential EV buyers to review the latest program guidelines and consult with authorized dealers to understand the exact rebate amount they can expect based on their vehicle choice.

In summary, the California EV Rebate Program provides significant financial incentives for electric vehicle purchases, with rebate amounts varying based on battery capacity and vehicle type. The rebate calculation is a per-mile rate applied to the vehicle's battery capacity, ensuring a higher incentive for more efficient EVs. Understanding these rebate amounts and calculations is essential for California residents considering the purchase of an electric vehicle to maximize their savings.

Diagnosing Electrical Shorts: A Guide for Vehicle Owners

You may want to see also

Tax Implications: Are there any tax consequences for receiving the rebate?

The California Electric Vehicle (EV) Rebate Program offers financial incentives to encourage the adoption of electric vehicles, which can have significant tax implications for recipients. Understanding these implications is crucial for EV buyers to ensure compliance with tax laws and avoid any unintended consequences.

When an individual or entity receives the California EV rebate, it is generally considered taxable income. The rebate amount is a form of financial assistance, and in the eyes of the Internal Revenue Service (IRS), it is treated as income. This means that the recipient must report the rebate as income on their tax return for the year it was received. Failure to report this income could result in penalties and interest charges.

The taxability of the rebate is important because it can affect the overall tax liability of the recipient. The rebate amount will likely increase the recipient's taxable income, which may lead to a higher tax bracket and, consequently, a higher tax rate. This can have a direct impact on the individual's or entity's overall tax burden. For example, if the rebate pushes the recipient's income into a higher tax bracket, they may owe more in federal and state taxes for that year.

Additionally, the tax consequences can vary depending on the recipient's tax situation. If the recipient is a business, the rebate might be considered a business income and taxed accordingly. For individuals, the rebate could be subject to different tax rates based on their filing status and overall income. It is essential to consult tax professionals to understand how the rebate fits into the recipient's overall tax strategy.

In summary, receiving the California EV rebate can have tax implications, primarily concerning taxable income and potential changes in tax liability. EV buyers should be aware of these consequences and consider consulting tax experts to ensure proper reporting and compliance with tax regulations. Staying informed about the tax treatment of financial incentives is crucial to avoid any legal issues and make informed financial decisions.

California's Electric Revolution: A Green Future in Sight?

You may want to see also

Sales Tax: How does the rebate affect the vehicle's sales tax?

The California Electric Vehicle (EV) Rebate Program offers financial incentives to encourage the adoption of electric cars, which can significantly impact the sales tax calculation for these vehicles. When purchasing an EV, the rebate amount is subtracted from the vehicle's final price, which directly affects the sales tax. In California, sales tax is typically calculated as a percentage of the vehicle's purchase price. If the rebate reduces the purchase price, the sales tax will also be lower, resulting in a lower tax liability for the buyer. This is a crucial consideration for EV buyers, as it can lead to substantial savings.

For instance, let's consider a hypothetical scenario. Suppose a California resident buys an EV with a sticker price of $40,000. The state's EV rebate could be $5,000, reducing the final price to $35,000. The sales tax would then be calculated based on this lower price, potentially saving the buyer several hundred dollars in sales tax. This example highlights how the rebate directly influences the tax amount, making EVs more affordable for consumers.

It's important to note that the rebate amount and its impact on sales tax may vary depending on the specific EV model and the buyer's residency status. California residents are eligible for the full rebate, but non-residents might receive a partial rebate or none at all. This distinction can further affect the sales tax calculation, as the final price and, consequently, the tax amount will differ for different buyer categories.

Additionally, the timing of the rebate application is essential. Some EV manufacturers and dealerships might not immediately apply the rebate to the vehicle's price, which could lead to incorrect sales tax calculations. Buyers should ensure that the rebate is properly accounted for to avoid potential disputes with tax authorities.

In summary, the California EV rebate program has a direct impact on the sales tax liability of EV buyers. The rebate reduces the purchase price, which in turn lowers the sales tax amount. Understanding this relationship is crucial for EV purchasers to maximize their savings and ensure compliance with tax regulations.

Mastering EV Repairs: Tips for Troubleshooting and Fixing Electric Vehicles

You may want to see also

Income Limits: Are there income limits for receiving the rebate?

The California Electric Vehicle (EV) Rebate Program offers financial incentives to residents for purchasing or leasing new electric vehicles, aiming to promote cleaner transportation options. However, it's important to understand the eligibility criteria, particularly regarding income limits, to ensure you meet the requirements for this benefit.

For the EV rebate, there are specific income thresholds that applicants must meet. The California Air Resources Board (CARB) sets these limits to ensure the program's resources are distributed to those who need it most. As of the latest updates, the income limits for the EV rebate are determined based on the household's annual income. For a household of one, the maximum income limit is set at $75,000. For households of two, the limit increases to $100,000. For larger families, the limit is $125,000 for three people and $150,000 for four or more individuals. These figures are adjusted annually, so it's essential to check the current year's guidelines to ensure accuracy.

It's worth noting that these income limits are designed to target lower- to middle-income households, as the primary goal of the rebate program is to encourage EV adoption among those who may benefit the most from the financial assistance. Applicants must provide proof of income and residency to verify their eligibility.

If your household income exceeds these limits, you may still be eligible for other incentives or programs offered by the state or local governments. Additionally, some cities within California have their own EV incentive programs with different income requirements, so it's advisable to explore these options as well.

Understanding the income limits is crucial for those seeking the California EV rebate, as it ensures a fair distribution of the financial assistance. By meeting these criteria, individuals can take advantage of the program's benefits and contribute to a more sustainable future.

Unveiling the Electric Vehicle Community: Strategies to Identify Owners

You may want to see also

Frequently asked questions

The California EV rebate, also known as the Clean Vehicle Rebate Project, is a state-funded program that provides financial incentives to residents for purchasing or leasing new electric vehicles. The rebate amount is generally not taxable as income for the recipient. However, it's important to note that the rebate is considered a form of government assistance and may have specific tax implications.

The rebate is offered as a direct payment to the vehicle dealer or manufacturer, which then reduces the purchase price for the buyer. The amount varies depending on the vehicle type, model, and the state's current funding levels.

Yes, there are certain eligibility criteria and restrictions. The vehicle must be new and purchased or leased in California. Additionally, there are income limits and vehicle mileage requirements that must be met.

If you sell the vehicle before the lease term ends, you may still be eligible for the rebate, but there are specific conditions and procedures to follow. It's best to consult with the California Air Resources Board (CARB) or a tax professional for guidance in such cases.

If you sell the vehicle for more than its original purchase price, you may need to repay the rebate amount to the state. The California EV rebate program has guidelines to ensure fair usage and prevent potential fraud.