Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has been a vocal supporter of the electric vehicle (EV) industry, particularly through his investments in companies like Tesla. However, recent market movements and strategic shifts have sparked speculation about his stance on the sector. This paragraph introduces the topic by highlighting the ongoing debate surrounding Buffett's potential sale of his stake in a prominent EV stock, shedding light on the investor's evolving approach to the rapidly growing EV market.

| Characteristics | Values |

|---|---|

| Warren Buffett's Investment | As of my last update in June 2023, there is no definitive proof that Warren Buffett has sold his favorite electric vehicle stock. However, it's important to note that his investments can change over time. |

| Favorite Electric Vehicle Stock | Warren Buffett is known to have invested in several electric vehicle companies, including Tesla, but his favorite is often considered to be Tesla due to its early entry into the market and innovative technology. |

| Market Performance | Tesla's stock has shown significant growth over the years, but it can be volatile. Buffett's investment strategy often focuses on long-term stability and consistent performance. |

| Recent News | In 2022, there were rumors that Buffett might be selling his Tesla shares, but these were not confirmed. As of now, he remains a significant shareholder. |

| Industry Outlook | The electric vehicle industry is rapidly growing, with increasing demand for sustainable transportation. This sector is expected to attract more investors in the future. |

| Buffett's Strategy | Buffett typically invests in companies with strong fundamentals, a competitive advantage, and a history of profitability. His approach often involves holding investments for the long term. |

What You'll Learn

- Buffett's Investment Strategy: His approach to investing in the EV sector

- Recent Stock Sales: Warren Buffett's recent divestments from EV companies

- Market Sentiment: Public opinion and trends regarding Buffett's EV investments

- Financial Performance: The financial impact of Buffett's EV stock sales

- Industry Analysis: A look at the electric vehicle market and its growth

Buffett's Investment Strategy: His approach to investing in the EV sector

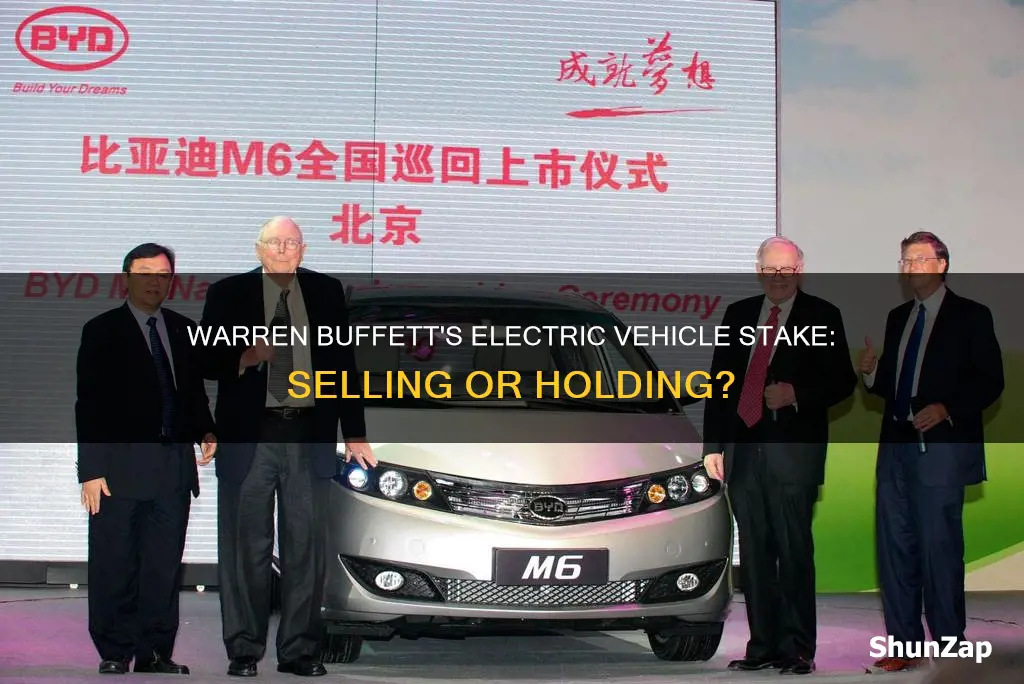

Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has a well-documented history of making strategic investments in various sectors, and his approach to the electric vehicle (EV) industry is no exception. While he is known for his conservative investment style, Buffett has shown a keen interest in the EV sector, particularly in the context of his investment in BYD, a Chinese electric vehicle and battery manufacturer.

Buffett's strategy in the EV sector revolves around his fundamental investment principles, which include a focus on long-term growth potential, strong management, and competitive advantages. He has consistently emphasized the importance of investing in businesses with durable competitive advantages, and the EV industry presents such opportunities. The sector's rapid growth and the increasing demand for sustainable transportation options have created a favorable environment for investors like Buffett.

One of Buffett's key insights is his belief in the long-term viability of the EV industry. He has stated that the transition to electric mobility is inevitable and that the market for electric vehicles will continue to expand. This long-term perspective allows him to make patient investments, waiting for the right opportunities to arise. Buffett's investment in BYD, for instance, was made with the expectation that the company would benefit from the growing demand for electric vehicles in China and potentially globally.

His investment approach also involves thorough research and due diligence. Buffett is known for his meticulous analysis of companies, studying their business models, management teams, and competitive landscapes. In the EV sector, he would likely assess the technological capabilities of companies, their market positioning, and the sustainability of their business models. This comprehensive evaluation ensures that his investments are well-informed and aligned with his investment criteria.

Additionally, Buffett's investment strategy often involves a focus on established businesses with a proven track record. While the EV industry is rapidly evolving, he tends to favor companies with a strong market position and a history of successful operations. This approach reduces risk and aligns with his risk-averse investment philosophy. Buffett's investment in BYD, despite being a relatively new player in the EV space, was based on the company's strong performance and its ability to capitalize on the growing EV market in China.

In summary, Warren Buffett's investment strategy in the EV sector is characterized by a long-term perspective, a focus on strong management and competitive advantages, and thorough research. His investments in the industry demonstrate his belief in the sector's growth potential and his commitment to identifying businesses with durable competitive advantages. As the EV market continues to evolve, Buffett's approach provides valuable insights into how experienced investors navigate this exciting and rapidly changing sector.

Powering Up: Understanding the Safety of Plugging In Your EV

You may want to see also

Recent Stock Sales: Warren Buffett's recent divestments from EV companies

Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has recently made some strategic moves in the electric vehicle (EV) sector, sparking curiosity among investors and industry observers. In a series of recent transactions, Buffett's company has divested from several prominent EV manufacturers, indicating a shift in his investment strategy. This development is particularly intriguing given Buffett's reputation for long-term investments and his previous support for the EV industry.

The divestments began with a significant sale of shares in EV giant Tesla, Inc. In the third quarter of 2022, Berkshire Hathaway reduced its stake in Tesla by approximately 45%, a substantial decrease from the previous quarter. This move was notable as Tesla had been a cornerstone of Buffett's portfolio, and his initial investments in the company were highly publicized. However, the sale could be attributed to a strategic adjustment, as Buffett often rebalances his portfolio to manage risk and maximize returns.

Following this, Berkshire Hathaway also sold its entire stake in EV manufacturer Lucid Group, Inc. This decision was made despite Lucid's recent success and positive market reception. The sale might suggest that Buffett is seeking to diversify his investments or is taking a more cautious approach in the volatile EV market. It's worth noting that Lucid's stock performance has been volatile, and Buffett's decision could be a calculated move to optimize his portfolio.

Additionally, Buffett's company has reduced its holdings in EV component supplier, EVgo, a company that provides charging infrastructure for electric vehicles. The sale of EVgo's shares further emphasizes the shift in Buffett's focus away from the EV industry. These divestments have led to speculation about the reasons behind Buffett's changing stance, with some analysts suggesting a potential shift in market sentiment or a reevaluation of the industry's long-term prospects.

The timing of these sales is crucial, as the EV market is experiencing rapid growth and increasing competition. Buffett's recent actions may indicate a more conservative approach, especially considering the market's current dynamics. Investors are now closely monitoring these moves, as they provide valuable insights into the strategies of one of the most influential investors in the world. As Buffett continues to navigate the ever-evolving investment landscape, his decisions will undoubtedly shape the strategies of other investors and the trajectory of the EV industry.

Green Revolution: Strategies to Boost Electric Vehicle Adoption

You may want to see also

Market Sentiment: Public opinion and trends regarding Buffett's EV investments

The recent market buzz surrounding Warren Buffett's electric vehicle (EV) investments has sparked a wave of public interest and speculation. With Buffett's reputation as a legendary investor, his moves in the EV sector have become a focal point for market sentiment analysis. The question on everyone's mind is whether Buffett is selling his stake in his favorite EV company, a decision that could significantly impact the industry and investor confidence.

Market analysts and financial news outlets have been abuzz with discussions, especially after Buffett's recent comments during an annual meeting. He hinted at a potential shift in his investment strategy, suggesting that he might be reevaluating his EV portfolio. This subtle indication has set off a chain reaction, with investors and industry experts closely monitoring Buffett's next move. The sentiment among investors is a mix of curiosity and concern, as many are eager to understand the rationale behind any potential sell-off.

Public opinion on Buffett's EV investments is divided. Some investors view Buffett's potential sale as a sign of caution, suggesting that the market might be reaching a peak. This perspective is further fueled by the recent economic climate, where rising inflation and supply chain issues have impacted the overall market sentiment. On the other hand, optimists believe that Buffett's decision could be a strategic move to diversify his portfolio, especially if he identifies new opportunities in the EV space. This optimism is evident in the positive reactions of some EV stockholders, who see Buffett's influence as a vote of confidence for the industry.

Social media platforms and financial forums have become hotspots for discussions, with users sharing their insights and predictions. While some argue that Buffett's actions will have a minimal impact on the long-term growth of the EV market, others believe it could create a ripple effect, influencing other investors' decisions. The online community's sentiment is a reflection of the broader market, with a mix of cautious optimism and cautious pessimism.

In summary, the public's reaction to Warren Buffett's potential sale of his favorite EV stock is a fascinating study of market sentiment. It highlights the influence of a renowned investor's decisions on public perception and the industry's trajectory. As the story unfolds, investors and industry analysts will continue to monitor Buffett's moves, shaping the market's future and the public's opinion on EV investments.

The Future is Electric: Unlocking the Potential of EVs

You may want to see also

Financial Performance: The financial impact of Buffett's EV stock sales

The recent speculation about Warren Buffett's potential sale of his stake in an electric vehicle (EV) company has sparked interest among investors and analysts, prompting a closer look at the financial implications of such a move. Buffett, known for his long-term investment strategy and his eye for undervalued assets, has been a significant shareholder in several EV manufacturers. The idea that he might be selling his favorite EV stock could have a substantial impact on the market and the industry.

If Buffett decides to offload his holdings, the financial consequences could be twofold. Firstly, it may indicate a shift in his investment strategy, suggesting that the current market conditions or the EV sector's overall performance have led him to reevaluate his positions. This could potentially trigger a sell-off by other investors, especially those who closely follow Buffett's moves, creating a ripple effect on the stock's price. The market's reaction to such news would be crucial to observe, as it could influence the perception of the EV industry and the specific company in question.

Secondly, the financial impact would depend on the scale of the sale and the company's performance. If Buffett sells a substantial portion of his stake, it might create a short-term market reaction, especially if the news coincides with broader market volatility. The stock's price could experience fluctuations, impacting the company's market capitalization and the overall sentiment towards EV investments. However, it's essential to consider that Buffett's investment decisions often consider long-term value creation, and any sale might be part of a broader strategy to optimize his portfolio.

From a financial performance perspective, the sales could provide an opportunity for investors to reassess the company's fundamentals and future prospects. It encourages a thorough analysis of the EV manufacturer's financial health, revenue growth, and market position. While the sale might indicate a change in Buffett's strategy, it could also present a chance for other investors to enter the market or adjust their positions based on the company's intrinsic value.

In summary, the potential sale of Warren Buffett's favorite EV stock would have financial repercussions, affecting market dynamics and investor sentiment. It highlights the importance of monitoring not only the actions of legendary investors but also the underlying financial performance of the companies they invest in, especially within a rapidly evolving industry like electric vehicles.

Unlocking EV Tax Credits: A Guide to Maximizing Your Federal Benefits

You may want to see also

Industry Analysis: A look at the electric vehicle market and its growth

The electric vehicle (EV) market has been experiencing rapid growth and significant attention from investors worldwide, including the legendary investor Warren Buffett. The industry's expansion is driven by several key factors, primarily the global push towards sustainable and environmentally friendly transportation. Governments and environmental organizations worldwide are incentivizing the adoption of electric cars to reduce carbon emissions and combat climate change. This has led to a surge in consumer interest and a growing number of EV manufacturers entering the market.

One of the most notable aspects of the EV market's growth is the increasing competition among established automotive giants and new entrants. Traditional car manufacturers are investing heavily in EV technology to stay relevant, while startups and specialized EV companies are disrupting the industry with innovative designs and cutting-edge features. This competitive landscape has resulted in a diverse range of electric vehicles, catering to various consumer preferences and price points.

The rise of the EV market is also closely tied to advancements in battery technology. Improved battery performance, including higher energy density, faster charging, and longer lifespans, has made electric vehicles more practical and appealing to a broader audience. As a result, the range anxiety associated with early electric cars is diminishing, encouraging more consumers to make the switch.

From an investment perspective, the electric vehicle industry has attracted significant interest from Warren Buffett and other prominent investors. Buffett's famous investment in electric vehicle component manufacturer, Berkshire Hathaway's investment in electric vehicle battery maker, and his recent actions regarding a major EV stock have sparked curiosity and analysis. The question of whether Buffett is selling his favorite EV stock is a topic of interest, as his moves often carry significant market implications. However, it's essential to note that Buffett's investment strategy typically involves long-term holdings, and any selling decision would be based on a comprehensive analysis of market trends, company performance, and strategic considerations.

In conclusion, the electric vehicle market's growth is a multifaceted phenomenon, driven by environmental concerns, technological advancements, and consumer demand. The industry's evolution has created opportunities for both traditional automakers and innovative startups. As the market matures, investors like Warren Buffett are closely monitoring the space, potentially influencing the trajectory of EV companies. The future of the electric vehicle industry looks promising, with continued innovation and a growing global presence.

Switzerland's Electric Vehicle Ban: Fact or Fiction?

You may want to see also

Frequently asked questions

As of my cut-off date in January 2023, Warren Buffett's Berkshire Hathaway has not disclosed any significant sales of Tesla stock. However, it's important to note that Buffett's investment strategy often involves a long-term horizon, and he may adjust his portfolio based on various factors, including market conditions and company performance.

Buffett's decision to hold or sell a particular stock depends on numerous factors. Some potential reasons could include a shift in market sentiment, changes in the company's financial performance, or the emergence of new opportunities that he deems more attractive. It's also worth mentioning that Buffett is known for his disciplined approach to investing, often focusing on long-term value creation.

Warren Buffett's investment in the electric vehicle sector is well-known, particularly his significant stake in Tesla. As of the latest available data, Berkshire Hathaway owns a substantial number of Tesla shares, making it one of the company's top investors. Buffett has expressed his confidence in the electric vehicle industry's potential and has been a vocal supporter of Tesla's growth and innovation.