The federal government has implemented several legislative measures to promote the adoption of electric vehicles (EVs) and reduce the environmental impact of transportation. One significant piece of legislation that has extended subsidies for electric vehicles is the Inflation Reduction Act (IRA) of 2022. This comprehensive law, signed into effect by President Joe Biden, includes a range of incentives and tax credits aimed at accelerating the transition to clean energy technologies, including EVs. The IRA provides substantial financial support for EV buyers, manufacturers, and charging infrastructure, making it a pivotal moment in the history of electric mobility.

What You'll Learn

- EV Tax Credits: Tax credits for EV purchases, incentivizing buyers

- Infrastructure Funding: Allocating funds for charging stations and EV infrastructure

- Research & Development: Supporting R&D for EV technology advancements

- Manufacturing Incentives: Tax breaks for EV manufacturing and job creation

- Environmental Standards: Setting emissions standards to encourage EV adoption

EV Tax Credits: Tax credits for EV purchases, incentivizing buyers

The federal government has implemented various tax incentives to promote the adoption of electric vehicles (EVs) and reduce the environmental impact of the transportation sector. One of the most significant measures is the EV tax credit, which provides financial benefits to buyers of electric cars, trucks, and motorcycles. This credit is designed to encourage individuals to make the switch from traditional gasoline vehicles to more environmentally friendly alternatives.

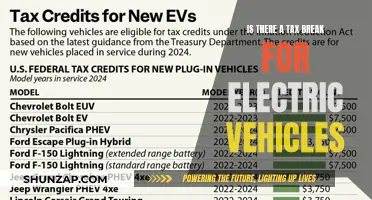

Under the Internal Revenue Code, the EV tax credit is available to individuals who purchase or lease certain qualified electric vehicles. The credit amount varies depending on the vehicle's battery capacity and the manufacturer's sales volume. For new EVs, the credit can range from $2,500 to $7,500, while used EVs purchased from dealers or through a qualified dealer network are eligible for a credit of up to $4,000. This credit is a direct financial incentive, reducing the overall cost of ownership for EV buyers.

To qualify for the EV tax credit, buyers must ensure that the vehicle meets specific criteria. The vehicle should have a battery-powered electric motor as its main source of power and be capable of being recharged from an external source. Additionally, the vehicle must be new and not used, and it should be purchased or leased from a dealer or manufacturer that participates in the EV tax credit program. The credit is also subject to a sales volume cap, ensuring that the incentive is distributed across a wide range of EV models and manufacturers.

The EV tax credit has been a successful initiative, significantly impacting the EV market. It has encouraged consumers to invest in electric vehicles, leading to increased sales and a wider range of EV models available. This legislation has also fostered innovation in the automotive industry, as manufacturers strive to meet the growing demand for electric cars and trucks. As a result, the tax credit has played a crucial role in accelerating the transition to a more sustainable transportation system.

Furthermore, the EV tax credit extends beyond individual buyers, as it also benefits businesses and fleets. Commercial entities can claim the credit for purchasing or leasing qualified EVs for business use. This aspect of the legislation encourages companies to adopt electric vehicles, reducing their carbon footprint and long-term operating costs. The credit's availability to businesses further strengthens the case for EV adoption, making it an attractive option for various industries.

Unlock EV Savings: Your Guide to Electric Vehicle Tax Credits

You may want to see also

Infrastructure Funding: Allocating funds for charging stations and EV infrastructure

The federal government has played a crucial role in promoting the adoption of electric vehicles (EVs) through various legislative measures, including the allocation of funds for charging infrastructure. One significant piece of legislation that has extended subsidies and incentives for EVs is the Infrastructure Investment and Jobs Act (IIJA), enacted in 2021. This act provides substantial funding for the development of a robust EV charging network across the United States.

The IIJA allocates a substantial portion of its budget to establish a national network of EV charging stations, ensuring that drivers have convenient access to charging facilities. The funding is directed towards states and territories, empowering them to design and implement their own charging infrastructure plans. This approach allows for a more localized and tailored approach to EV charging, considering the unique needs and demographics of each region. By providing financial assistance, the federal government aims to accelerate the deployment of charging stations, making EVs more accessible and practical for the general public.

States and territories are required to develop comprehensive plans outlining their strategies for allocating the received funds. These plans should include the identification of priority areas for charging station installation, such as highways, urban centers, and public parking facilities. The funding can be utilized to construct new charging stations, upgrade existing ones, and implement innovative technologies to improve charging efficiency and convenience. Additionally, the IIJA encourages the development of fast-charging stations, which are essential for long-distance travel and reducing charging times.

The allocation of funds for charging infrastructure is a strategic move to address the range anxiety associated with EVs. By ensuring a well-distributed network of charging stations, the federal government aims to alleviate concerns about running out of battery power during EV ownership. This, in turn, can boost consumer confidence and encourage a faster transition to electric mobility. Furthermore, the IIJA's focus on infrastructure funding extends beyond charging stations, encompassing other aspects of EV adoption, such as battery recycling and second-life battery applications.

In summary, the Infrastructure Investment and Jobs Act serves as a pivotal federal legislation in extending subsidies and support for electric vehicles. By allocating funds for charging stations and EV infrastructure, the act facilitates the creation of a comprehensive charging network, making EVs more accessible and practical for American drivers. This legislative effort is a significant step towards a sustainable transportation future, reducing environmental impact and promoting the widespread adoption of electric vehicles.

Electric Vehicle ETFs: Investing in the Future of Green Transportation

You may want to see also

Research & Development: Supporting R&D for EV technology advancements

The federal government has played a crucial role in promoting the adoption and advancement of electric vehicles (EVs) through various legislative measures, one of which is the extension of subsidies for EV technology research and development. This support is aimed at fostering innovation, reducing environmental impact, and enhancing energy security. Here's an overview of the research and development (R&D) initiatives related to EV technology advancements:

Legislative Framework: The extension of subsidies for EV-related R&D is primarily facilitated through legislation such as the Inflation Reduction Act (IRA) in the United States. This act, enacted in 2022, includes significant provisions to boost EV infrastructure and technology. It offers tax credits and incentives for EV manufacturers and researchers, encouraging the development of advanced EV batteries, charging systems, and related technologies. The IRA's focus on R&D subsidies is a strategic move to accelerate the transition to a more sustainable transportation sector.

Research Priorities: The R&D initiatives in the EV sector encompass several key areas. Firstly, improving battery technology is a primary goal, aiming to increase energy density, enhance charging speed, and extend battery lifespan. Researchers and companies are exploring solid-state batteries, lithium-ion advancements, and new materials to achieve these objectives. Secondly, developing efficient and reliable charging infrastructure is essential. This includes fast-charging stations, wireless charging technologies, and smart grid integration to support the growing EV fleet.

Government Support and Partnerships: Federal agencies and departments collaborate with research institutions, universities, and private companies to drive EV technology advancements. These partnerships facilitate knowledge exchange, funding opportunities, and shared resources. For instance, the Department of Energy (DOE) in the US has launched various programs, such as the Vehicle Technologies Office, to support R&D in EV batteries, electric motors, and vehicle systems. The DOE's initiatives provide grants and resources to accelerate innovation and bring cutting-edge technologies to market.

Impact and Benefits: The R&D support for EV technology has far-reaching implications. It contributes to the development of more efficient, affordable, and environmentally friendly vehicles. Improved battery technology leads to longer driving ranges, reduced charging times, and lower costs, making EVs more accessible to a broader market. Additionally, advancements in charging infrastructure enable a seamless transition to electric mobility, addressing range anxiety and supporting the widespread adoption of EVs.

Global Collaboration and Innovation: The EV R&D efforts are not limited to individual countries but are part of a global collaboration. International partnerships and knowledge-sharing initiatives accelerate technological progress. Countries and regions with strong EV markets and infrastructure are investing in R&D to maintain their competitive edge. This global cooperation fosters innovation, leading to the development of standardized technologies and best practices, which can further accelerate the EV revolution worldwide.

Wyoming's EV Ban: Fact or Fiction?

You may want to see also

Manufacturing Incentives: Tax breaks for EV manufacturing and job creation

The federal government has implemented various incentives to encourage the growth of the electric vehicle (EV) industry and promote sustainable transportation. One significant aspect of these incentives is the provision of tax breaks for EV manufacturing and job creation, which has played a crucial role in extending subsidies for electric vehicles.

Manufacturing incentives are designed to attract and support EV manufacturers in the United States, fostering a competitive and sustainable automotive sector. These incentives often take the form of tax credits or deductions, offering financial benefits to companies that invest in EV production facilities, research and development, and job creation. By providing tax relief, the government aims to reduce the financial burden on manufacturers, making it more attractive to establish or expand EV assembly plants within the country. This, in turn, creates a positive ripple effect, stimulating economic growth and potentially reducing the reliance on imported vehicles.

The tax breaks can be particularly advantageous for companies in the early stages of EV manufacturing, helping them overcome initial financial challenges and encouraging long-term investments. For instance, a tax credit for EV manufacturing might be offered for each vehicle produced, with a specific cap on the total credit amount. This incentive structure encourages manufacturers to increase production, as the credit directly translates to financial savings. Additionally, tax breaks for job creation can be applied to new hires in EV-related roles, including assembly workers, engineers, and researchers, fostering a skilled workforce in the emerging green energy sector.

These incentives are often part of broader legislation aimed at reducing greenhouse gas emissions and promoting energy independence. By encouraging the production and adoption of electric vehicles, the government aims to reduce the carbon footprint of the transportation sector. Tax breaks for EV manufacturing and job creation contribute to this goal by making it more financially viable for companies to enter the market and create a sustainable business model.

In summary, tax breaks for EV manufacturing and job creation are a critical component of federal legislation aimed at extending subsidies for electric vehicles. These incentives provide financial support to manufacturers, stimulate economic growth, and foster a skilled workforce in the EV industry. As the world shifts towards more sustainable transportation, such incentives play a vital role in shaping a greener and more environmentally conscious future.

Debunking Myths: Do EVs Still Pollute?

You may want to see also

Environmental Standards: Setting emissions standards to encourage EV adoption

The federal government has implemented various environmental standards and regulations to promote the adoption of electric vehicles (EVs) and reduce greenhouse gas emissions. One crucial aspect of this strategy is setting emissions standards, which play a pivotal role in encouraging EV adoption. These standards are designed to ensure that vehicles, including EVs, meet specific environmental criteria, thereby reducing their environmental impact.

Emissions standards are typically set by regulatory bodies, such as the Environmental Protection Agency (EPA) in the United States. These standards define the maximum allowable levels of pollutants and emissions that vehicles can produce. For EVs, the focus is often on zero-emission or low-emission technologies, ensuring that these vehicles do not contribute to air pollution. By setting stringent emissions limits, governments aim to accelerate the transition to cleaner transportation options.

The process of setting emissions standards involves rigorous testing and evaluation of vehicle performance. This includes assessing the vehicle's fuel efficiency, emissions output, and overall environmental impact. For EVs, the evaluation often centers on their battery efficiency, charging infrastructure, and the source of electricity used for charging. The goal is to ensure that EVs meet or exceed the defined environmental standards, making them a viable and sustainable transportation choice.

Incentivizing EV adoption is another critical aspect of environmental standards. Governments often provide subsidies, tax benefits, or grants to encourage consumers to purchase and use electric vehicles. These incentives can significantly reduce the upfront cost of EVs, making them more accessible to a wider range of consumers. Additionally, offering subsidies for charging infrastructure development can further promote EV adoption by addressing range anxiety and ensuring convenient charging options.

Environmental standards and incentives work in tandem to create a supportive ecosystem for EV adoption. By setting clear emissions targets and providing financial support, governments can effectively drive the market towards cleaner transportation alternatives. This approach not only benefits the environment by reducing emissions but also fosters innovation in the automotive industry, leading to the development of more efficient and sustainable vehicle technologies.

The Future is Electric: Unlocking the Potential of EVs

You may want to see also

Frequently asked questions

The legislation in question is the Inflation Reduction Act (IRA), signed into law in 2022. This act includes significant provisions to incentivize the adoption of electric vehicles and promote a cleaner energy economy.

The IRA offers several incentives, including a tax credit for EV purchases. This credit can be up to $7,500 per vehicle, depending on the manufacturer and the type of EV. The act also provides tax credits for the production of electric vehicles and their critical minerals, aiming to boost domestic manufacturing and reduce the environmental impact of the automotive industry.

Yes, the subsidies come with certain conditions. For instance, the vehicle's final assembly must occur in North America, and the manufacturer must meet specific labor and environmental standards. Additionally, the IRA includes a phase-out of the tax credit for certain high-income earners and a cap on the number of vehicles per household that can qualify for the subsidy.