In the United States, a unique tax system applies to owners of hybrid and electric vehicles, with several states implementing specific regulations. This paragraph aims to shed light on the states that levy taxes on these environmentally friendly vehicles, providing an overview of the tax implications for their owners. Understanding these tax policies is essential for vehicle owners to manage their finances effectively and stay compliant with state laws.

What You'll Learn

- Tax Incentives: States offer tax breaks for electric vehicle owners

- Registration Fees: Additional charges for registering hybrid/electric vehicles

- Sales Tax Exemption: Some states exempt EV buyers from sales tax

- Property Tax Benefits: Reduced property taxes for electric vehicle owners

- Income Tax Deductions: Tax deductions for hybrid/electric vehicle expenses

Tax Incentives: States offer tax breaks for electric vehicle owners

The adoption of electric vehicles (EVs) has been gaining momentum, and several states have recognized the importance of incentivizing their ownership to promote environmental sustainability. These tax incentives are designed to encourage residents to make the switch from traditional gasoline-powered cars to greener alternatives. Here's an overview of how these incentives work and which states are offering them:

State-Specific Tax Benefits:

- California: This state has been at the forefront of EV adoption and offers a range of incentives. One notable benefit is the California Clean Air Vehicle (CAV) Decal, which exempts EV owners from the state's annual vehicle registration fee. Additionally, California provides a partial rebate on state personal income tax for EV purchases, making it an attractive option for residents.

- New York: The Empire State provides a significant tax credit for EV purchases. The New York State Energy Research and Development Authority (NYSERDA) offers a rebate of up to $2,000 for the purchase or lease of new electric vehicles. This incentive is particularly beneficial for those looking to acquire an EV, as it directly reduces the upfront cost.

- Washington: Residents of the Evergreen State can take advantage of a tax credit for EV purchases. The Washington State Department of Revenue offers a credit of up to $5,000, which can be claimed on state income tax returns. This credit significantly reduces the financial burden associated with buying an electric vehicle.

- Oregon: Oregon's Department of Revenue provides a tax credit for EV purchases, with a maximum credit amount of $2,000. This incentive is available to Oregon residents who buy or lease new electric vehicles, making it an attractive option for those seeking to reduce their tax liability while contributing to a greener environment.

These tax incentives are a strategic move by state governments to accelerate the transition to electric mobility. By offering financial benefits, states aim to make EVs more affordable and appealing to consumers. As a result, EV ownership becomes more accessible, and the environmental impact of reduced carbon emissions is positively influenced.

It is important to note that the availability and specifics of these tax incentives may vary, and interested individuals should consult their state's official revenue or environmental protection agencies for the most accurate and up-to-date information. Additionally, some states might offer other forms of incentives, such as reduced registration fees, toll exemptions, or special parking privileges, further enhancing the benefits of owning an electric vehicle.

The Future of EVs: Banning or Boosting?

You may want to see also

Registration Fees: Additional charges for registering hybrid/electric vehicles

In the United States, the registration and taxation of hybrid and electric vehicles can vary significantly from state to state. While some states offer incentives and reduced registration fees for these environmentally friendly vehicles, others impose additional charges, often referred to as 'hybrid/electric vehicle surcharges'. These surcharges are typically applied on top of the standard registration fees, and they can vary in amount and purpose.

For instance, in California, one of the leading states in promoting electric vehicles, the Department of Motor Vehicles (DMV) imposes an additional fee for zero-emission vehicles. This fee is designed to help fund the state's clean air programs and infrastructure for electric vehicles. The surcharge is typically a fixed amount, and it applies to all new and used electric and hybrid vehicles registered in California. The revenue generated from these surcharges is then directed towards various environmental initiatives.

New York is another state with a unique approach to taxing hybrid and electric vehicles. Here, the state imposes a 'Clean Vehicle Incentive Program' surcharge, which is a percentage-based fee on the vehicle's value. This surcharge is intended to encourage the adoption of cleaner vehicles and is applied in addition to the standard registration fees. The funds collected are used to support the development of charging infrastructure and other clean transportation initiatives.

On the other hand, some states offer exemptions or reduced registration fees for hybrid and electric vehicles. For example, in Washington state, the Department of Licensing provides an exemption from the standard registration fee for zero-emission vehicles, which includes both hybrids and electric cars. This incentive aims to promote the use of cleaner transportation options and reduce the environmental impact of traditional vehicles.

Understanding the specific registration fees and surcharges in your state is crucial for hybrid and electric vehicle owners. These fees can impact the overall cost of vehicle ownership and may vary based on factors such as vehicle type, age, and environmental performance. It is recommended to consult your state's DMV or relevant government agency to obtain the most accurate and up-to-date information regarding registration fees and any applicable surcharges for hybrid or electric vehicles.

Electric Vehicles: The Rapid Overtake in the Automotive Industry

You may want to see also

Sales Tax Exemption: Some states exempt EV buyers from sales tax

In the United States, the adoption of electric vehicles (EVs) and hybrid cars has been steadily rising, driven by environmental concerns and technological advancements. However, the financial implications of owning these vehicles can vary significantly from state to state, particularly regarding sales tax. Some states offer sales tax exemptions for EV buyers, which can result in substantial savings for consumers. This financial incentive is a significant factor in encouraging the adoption of environmentally friendly vehicles.

Several states have implemented sales tax exemptions for electric and hybrid vehicle purchases, recognizing the potential environmental benefits of these cars. For instance, California, one of the most progressive states in promoting green technology, offers a sales tax exemption for zero-emission vehicles. This exemption applies to the purchase of new electric vehicles, and it can amount to a significant reduction in the overall cost of the vehicle. Similarly, states like New York, New Jersey, and Massachusetts have also introduced similar tax breaks, making these vehicles more affordable for residents.

The sales tax exemption for EV buyers is a strategic move by state governments to promote sustainable transportation. By reducing the financial burden, these states aim to make electric and hybrid vehicles more accessible to a broader population. This strategy not only benefits individual buyers by providing financial relief but also contributes to a larger environmental goal. As a result, more people are likely to consider purchasing these vehicles, leading to a potential increase in the number of EVs on the road.

It is essential for prospective EV buyers to research their state's specific tax laws and regulations. Some states may have additional requirements or restrictions for claiming the exemption, such as residency or income limits. For example, in certain states, the exemption might only apply to vehicles purchased within the state's borders or to those who meet specific income thresholds. Therefore, understanding these details is crucial to ensure that buyers can take full advantage of the sales tax exemption.

In summary, the sales tax exemption for electric and hybrid vehicle buyers is a significant incentive offered by several US states. This financial benefit not only makes these vehicles more affordable but also encourages a shift towards sustainable transportation. Prospective buyers should be aware of their state's specific policies to maximize their savings and contribute to a greener future.

Unraveling the Mystery: Essential vs. Optional Electrical Gear in Vehicles

You may want to see also

Property Tax Benefits: Reduced property taxes for electric vehicle owners

The concept of taxing electric vehicle (EV) owners is a topic of interest for many states, and it often revolves around the idea of incentivizing or discouraging the adoption of these environmentally friendly vehicles. While some states offer incentives and rebates to promote EV ownership, others have implemented a different approach by taxing EV owners, either directly or indirectly. This practice is often associated with the concept of 'property tax benefits' for EV owners, which can vary significantly from state to state.

In the United States, property taxes are a significant source of revenue for local governments and are typically based on the assessed value of a property. Some states have chosen to provide tax benefits to EV owners as a way to encourage the use of cleaner transportation options. For instance, California, a state known for its progressive environmental policies, offers a property tax exclusion for EV owners. This means that the assessed value of the EV is not included in the property's taxable value, resulting in reduced property taxes for EV owners. This benefit can be particularly advantageous for those who own high-value EVs, as it directly translates to substantial savings over time.

The process of claiming this property tax benefit can vary. In California, EV owners need to file a form with the county tax collector, providing details about their vehicle and its environmental impact. This form ensures that the tax assessment reflects the exclusion for EVs, thus providing the owner with the reduced tax rate. It is essential for EV owners to be aware of such programs and take the necessary steps to ensure they receive the benefits they are entitled to.

Other states may have similar programs but with different eligibility criteria and application processes. For example, some states might offer a tax credit or exemption for EV owners, which could be applied directly to their property taxes. These programs often consider factors such as the vehicle's fuel efficiency, emissions, or the owner's income level to determine eligibility. Understanding the specific requirements and guidelines of one's state is crucial to maximizing these property tax benefits.

In summary, while some states provide incentives and rebates to promote EV ownership, others have implemented property tax benefits as a means to encourage the use of electric vehicles. These benefits can significantly reduce the property tax burden for EV owners, making it an attractive financial incentive. Staying informed about such state-specific programs is essential for EV owners to take full advantage of these opportunities and potentially save on their property taxes.

EVs: Lease or Buy? Unlocking the Cost Comparison

You may want to see also

Income Tax Deductions: Tax deductions for hybrid/electric vehicle expenses

The concept of taxing owners of hybrid or electric vehicles varies significantly across different states in the United States. While some states offer incentives and tax benefits for these environmentally friendly vehicles, others impose additional taxes or fees. Understanding these variations is crucial for vehicle owners to optimize their financial planning and ensure compliance with local tax laws.

In certain states, the tax treatment of hybrid or electric vehicles is favorable. For instance, California, a leader in promoting green technology, provides a significant tax credit for the purchase of these vehicles. This credit can be substantial, covering a large portion of the vehicle's cost, making it an attractive option for environmentally conscious consumers. Similarly, some states offer tax exemptions on sales tax or personal property tax for hybrid and electric vehicles, reducing the overall cost of ownership for these vehicle owners.

On the other hand, there are states that impose additional taxes or fees specifically targeting hybrid and electric vehicle owners. For example, some states levy a special fee for the registration of these vehicles, which can be a recurring annual expense. Additionally, certain states may include a luxury tax or a per-mile usage fee for hybrid or electric vehicles, which can vary based on the vehicle's value or the number of miles driven. These additional costs can significantly impact the overall ownership experience and financial burden for vehicle owners in these states.

For individuals who own hybrid or electric vehicles, it is essential to research and understand the specific tax implications in their state. This includes being aware of any tax credits, deductions, or additional fees that may apply. By staying informed, vehicle owners can make informed decisions about their vehicle purchases and maintenance, ensuring they take advantage of available incentives while also being prepared for any potential additional costs.

When it comes to income tax deductions, vehicle owners can claim various expenses related to their hybrid or electric vehicles. These deductions can help reduce taxable income and, consequently, the overall tax liability. Common deductible expenses include the cost of charging the vehicle, which can be significant for electric vehicle owners, and any maintenance or repair costs associated with the vehicle's unique components, such as the battery or electric motor. Additionally, vehicle owners may be able to deduct a portion of the vehicle's depreciation, as hybrid and electric vehicles often have different depreciation schedules compared to traditional gasoline or diesel vehicles.

Eco-Friendly Driving: Unlocking the Benefits of Hybrid Electric Vehicles

You may want to see also

Frequently asked questions

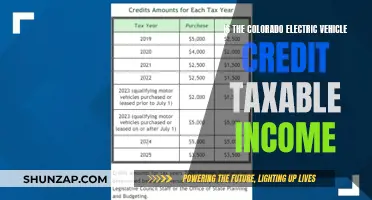

As of 2023, several states in the United States have implemented or are considering taxes on electric and hybrid vehicles. These include California, New York, New Jersey, and Massachusetts, which have specific registration fees or taxes for electric vehicles. It's important to note that tax laws can change, so it's advisable to check the latest legislation for the most accurate and up-to-date information.

The tax amount varies by state and can depend on factors such as the vehicle's value, emissions, or the number of miles driven. For instance, in California, the Clean Air Vehicle Decal fee is $35 for new electric vehicles and $25 for used ones. New York's registration fee for electric vehicles is $140, while New Jersey's fee is $100. These fees are typically annual and may be subject to change.

Yes, many states offer incentives and exemptions to promote the use of electric and hybrid vehicles. For example, California's Clean Air Vehicle (CAV) Decal allows electric vehicle owners to use HOV lanes, and some states provide tax credits or rebates for purchasing these vehicles. These benefits can vary, so it's best to research the specific state's policies.

The tax regulations often target zero-emission vehicles (ZEVs) or those with low emissions. Some states may have specific model or year requirements. For instance, California's ZEV fee applies to new vehicles that do not meet the state's zero-emission standards, and it varies based on the vehicle's emissions. It's crucial to understand the criteria set by each state to determine if your vehicle is subject to these taxes.