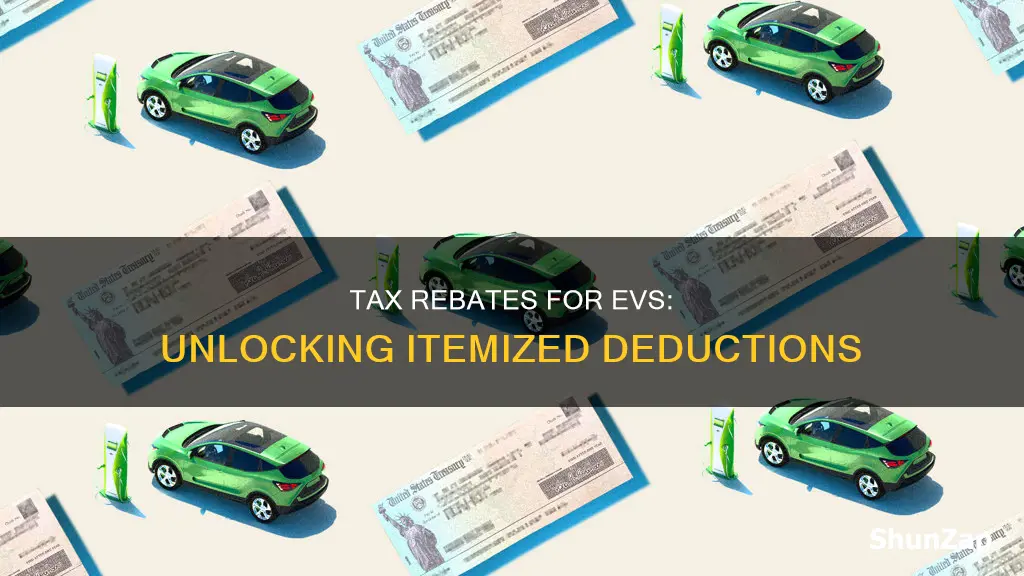

Tax rebates for electric vehicles (EVs) have become increasingly popular as governments worldwide aim to promote sustainable transportation. These financial incentives are designed to encourage the adoption of EVs, reduce carbon emissions, and support the growth of the green economy. However, understanding the tax implications of these rebates is essential for EV owners. This paragraph will explore whether tax rebates for electric vehicles qualify as an itemized deduction, shedding light on the potential tax benefits and considerations for individuals who have invested in these eco-friendly vehicles.

| Characteristics | Values |

|---|---|

| Tax Rebates for Electric Vehicles | Not an itemized deduction |

| Tax Rebate Eligibility | Varies by state and federal programs |

| Deduction Type | Generally considered a tax credit or a direct refund |

| Income Tax Implications | May reduce taxable income, but not typically classified as an itemized deduction |

| Itemized Deductions | Typically include expenses like mortgage interest, charitable contributions, and medical expenses |

| Tax Rebate Programs | Offered by governments to encourage EV adoption |

| Tax Filing | Rebates are usually claimed as a credit on the tax return, reducing the overall tax liability |

| Documentation | Receipts or proof of purchase may be required for verification |

| Tax Year | Rebates are often applied in the year of purchase or in subsequent years |

What You'll Learn

- Eligibility Criteria: Taxpayers must meet specific requirements to qualify for the rebate

- Rebate Amounts: The amount varies based on vehicle type and price

- Filing Process: Rebates are claimed during tax filing, typically as an itemized deduction

- Documentation: Receipts and proof of purchase are necessary for claiming the rebate

- State Variations: Rebate policies differ by state, affecting eligibility and amounts

Eligibility Criteria: Taxpayers must meet specific requirements to qualify for the rebate

To be eligible for tax rebates for electric vehicles, taxpayers must meet certain criteria set by the relevant tax authorities. These requirements are in place to ensure that the financial support is directed towards eligible recipients who have made significant investments in electric vehicles. Here are the key eligibility criteria:

Vehicle Ownership and Purchase Date: Taxpayers must be the owner of an electric vehicle (EV) and have purchased it after a specified date. This is typically a recent purchase to encourage the adoption of new electric vehicles. The exact date may vary depending on the tax jurisdiction and the specific rebate program. For instance, some programs might require the purchase to have been made within the last year or two.

Income Limits: There are often income thresholds that taxpayers must meet to qualify for the rebate. These limits are designed to target financial assistance towards lower- to middle-income earners who may benefit the most from the financial incentive. The income criteria can vary widely, with some programs offering rebates to all eligible EV owners, while others may have a cap on the income level to ensure the funds are distributed efficiently.

Vehicle Type and Range: The type of electric vehicle and its range can also impact eligibility. Some rebate programs might have specific requirements regarding the vehicle's make, model, and battery capacity. For example, a program might only cover fully electric cars with a certain minimum range, excluding hybrid or plug-in hybrid vehicles. These criteria ensure that the rebate is targeted at vehicles that provide significant environmental benefits.

Residency and Citizenship: Taxpayers must be residents of the specific region or country offering the rebate. Citizenship or residency requirements may apply, ensuring that the financial support is directed towards local residents. This criterion helps in tracking and managing the rebate program effectively.

Additionally, taxpayers should be aware of any specific documentation or proof required to demonstrate eligibility. This might include vehicle purchase records, income verification, and other relevant documents. Meeting these eligibility criteria is essential to ensure that taxpayers can claim the rebate and take full advantage of the financial incentives provided for electric vehicle ownership.

The Future of Electric Vehicles: A Timeline

You may want to see also

Rebate Amounts: The amount varies based on vehicle type and price

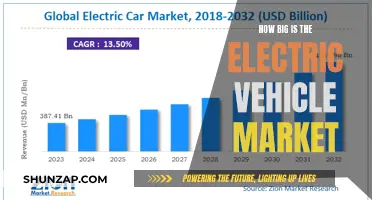

The tax rebate for electric vehicles is a financial incentive offered by governments to encourage the adoption of cleaner and more sustainable transportation options. The rebate amount for these vehicles can vary significantly, and understanding these variations is crucial for anyone looking to take advantage of this benefit.

One of the primary factors influencing the rebate amount is the type of electric vehicle. This includes the distinction between all-electric vehicles (100% electric) and plug-in hybrid electric vehicles (PHEVs). All-electric vehicles, which run solely on electricity, often qualify for higher rebates compared to PHEVs, which have both electric and gasoline engines. The reason for this difference is that all-electric vehicles contribute more significantly to reducing greenhouse gas emissions and improving air quality.

Another critical factor is the price of the vehicle. Rebates are typically structured as a percentage of the vehicle's price, and this percentage can vary. For instance, a government might offer a 5% rebate on the first $30,000 of a vehicle's price for all-electric cars, and a 3% rebate on the same price range for PHEVs. This means that higher-priced vehicles may receive a more substantial rebate, but the overall benefit is still dependent on the vehicle's cost.

In some cases, the rebate amount can also be influenced by the vehicle's battery capacity and efficiency. Vehicles with larger batteries and higher energy efficiency ratings may be eligible for additional incentives. This is because these vehicles can travel longer distances on a single charge, making them more practical and appealing to consumers.

Understanding these variations in rebate amounts is essential for maximizing the financial benefit of purchasing an electric vehicle. It is advisable to research and compare the specific rebate programs offered in your region, as they can vary by jurisdiction. Additionally, keeping track of any changes in rebate policies and vehicle eligibility criteria is important, as these programs may evolve over time to support the transition to a more sustainable transportation ecosystem.

Unveiling the Future: Understanding Electric Vehicles and Their Impact

You may want to see also

Filing Process: Rebates are claimed during tax filing, typically as an itemized deduction

The process of claiming tax rebates for electric vehicles involves a specific procedure during tax filing, which is crucial for maximizing potential savings. When it comes to electric vehicle (EV) rebates, these financial incentives are often structured as itemized deductions, allowing taxpayers to claim them as part of their taxable income. This approach is particularly beneficial for those who have already itemized their deductions, as it provides an additional avenue to reduce their taxable income.

During the tax filing process, individuals who have purchased or leased an electric vehicle can claim the rebate amount as a deduction. This is typically done by completing the relevant sections of Form 1040, the U.S. individual income tax return. Taxpayers need to provide detailed information about the EV purchase or lease, including the make and model of the vehicle, the purchase or lease date, and the amount of the rebate received. It is essential to keep all the necessary documentation, such as the rebate agreement, payment receipts, and any other supporting materials, to ensure a smooth and accurate filing process.

When filing taxes, individuals should carefully review the instructions provided by the tax authorities or seek professional advice to ensure compliance with the specific requirements. The rebate amount can be claimed as a deduction in the year it was received, provided that the individual meets the eligibility criteria set by the tax authorities. This may include factors such as the vehicle's use, the taxpayer's income level, and the specific EV models that qualify for the rebate.

For those who have already filed their taxes and missed the opportunity to claim the rebate, there might be options to amend the return. However, it is generally recommended to file the initial return accurately and promptly to avoid potential issues. Taxpayers should be aware of the deadlines for filing and any specific rules related to EV rebates in their region, as these may vary.

In summary, claiming tax rebates for electric vehicles as itemized deductions during tax filing is a strategic approach to maximizing tax savings. By providing detailed information and adhering to the relevant tax regulations, individuals can ensure a smooth and successful filing process, ultimately benefiting from the financial incentives provided for EV purchases or leases.

Electric Vehicle Lease: Is It Worth It?

You may want to see also

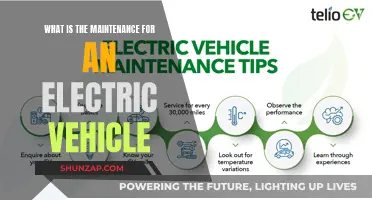

Documentation: Receipts and proof of purchase are necessary for claiming the rebate

When it comes to claiming tax rebates for electric vehicles, proper documentation is crucial. One of the essential requirements is providing receipts and proof of purchase. These documents serve as tangible evidence that you have indeed made the eligible purchase, which is a prerequisite for receiving the rebate. Without these, your claim may be delayed or even denied, causing unnecessary inconvenience and potential financial loss.

The process of obtaining these documents is straightforward. At the time of purchase, ensure that you receive a sales receipt that clearly indicates the date, the specific model and make of the electric vehicle, and the amount paid. Additionally, request a certificate of origin or a vehicle identification number (VIN) statement from the dealership or seller. These documents provide further proof of the vehicle's authenticity and your ownership.

It is important to keep these records in a safe and organized manner. You may need to provide them to the relevant tax authorities or the rebate program administrators during the application process. Having a digital copy or a physical backup of these documents can be beneficial, especially if you plan to file your taxes online or through a tax preparation service.

In some cases, the rebate program might require additional proof, such as a bill of sale or a manufacturer's warranty document. These supplementary documents further validate your purchase and ensure that the rebate is awarded to the correct recipient. Therefore, it is advisable to inquire about any specific requirements beforehand to avoid any potential issues.

Lastly, remember that the rebate process may vary depending on your location and the specific program. Always refer to the official guidelines provided by the government or the relevant authorities to ensure you meet all the criteria. Proper documentation is a key step in securing your tax rebate for the electric vehicle, so be diligent in gathering and retaining the necessary proof of purchase.

Unveiling Toyota's EV Deduction: Which Models Make the Cut?

You may want to see also

State Variations: Rebate policies differ by state, affecting eligibility and amounts

Tax rebates for electric vehicles (EVs) are a popular incentive to encourage the adoption of cleaner transportation options, and these rebates can vary significantly depending on the state you reside in. Each state has its own unique policies and criteria that determine who is eligible for these rebates and the amount they can receive. Understanding these state variations is crucial for maximizing the benefits of purchasing an EV.

For instance, some states offer rebates directly to the consumer, providing a lump sum payment upon the purchase of an EV. These rebates can range from a few hundred to several thousand dollars, depending on the state's budget and the specific vehicle model. On the other hand, other states might provide incentives through dealers or manufacturers, where the rebate is applied as a discount on the vehicle's purchase price. This approach can make the upfront cost of an EV more manageable for buyers.

Eligibility criteria for these rebates often include factors such as the vehicle's battery capacity, the type of EV (whether it's a fully electric car or a plug-in hybrid), and the buyer's residency status. Some states may also have income limits, meaning only those with lower or moderate incomes are eligible for the full rebate amount. For example, a state might offer a $5,000 rebate for a new electric car, but only to residents with an annual income below a certain threshold.

Furthermore, the amount of the rebate can vary based on the state's budget and the popularity of EV incentives. States with more generous budgets might provide higher rebates, while those with tighter fiscal constraints may offer smaller amounts or fewer rebates overall. It's essential for EV buyers to research their state's specific policies to understand the potential savings.

In summary, the tax rebate landscape for electric vehicles is complex and varies widely by state. Prospective EV buyers should familiarize themselves with their state's rebate policies, including eligibility requirements and rebate amounts, to make informed decisions about their vehicle purchases and potentially save significant amounts of money.

Electric Vehicle Resale Value: Strategies for Accurate Forecasting

You may want to see also

Frequently asked questions

A tax rebate is a direct payment from the government to the consumer, typically in the form of a check or a reduction in the purchase price of the vehicle. It is a financial incentive to encourage the purchase of electric vehicles (EVs) and reduce the environmental impact of traditional gasoline-powered cars. On the other hand, an itemized deduction is a specific expense that can be claimed on your tax return, reducing your taxable income and, consequently, the amount of tax you owe.

Yes, in many cases, you can benefit from both incentives. Tax rebates are often provided by state or local governments to promote EV adoption, and these rebates can be claimed as a refund or a reduction in the purchase price. Additionally, you may be eligible for an itemized deduction related to the purchase of an electric vehicle, which could include expenses like sales tax, registration fees, and even the cost of charging equipment at home.

The specific rules and regulations regarding tax rebates and itemized deductions for EVs can vary by jurisdiction. It's essential to consult the tax guidelines provided by your local or state government. Generally, a tax rebate is a direct financial benefit, while an itemized deduction is an expense that can be claimed on your tax return. Keep in mind that the availability and eligibility criteria for these incentives may also depend on factors such as income, vehicle type, and the time of purchase.