Toyota offers several electric vehicle (EV) options that qualify for tax deductions under the Internal Revenue Code's Section 179D tax incentive. These deductions are available for businesses and individuals who purchase or lease eligible electric vehicles, including plug-in hybrids and all-electric cars. The list of qualifying Toyota models includes the Prius Prime, which is a plug-in hybrid, and the bZ4X, a fully electric crossover SUV. Additionally, the Corolla Cross Hybrid and the RAV4 Hybrid are also eligible for the deduction. These vehicles not only provide environmental benefits but also offer potential tax savings for those looking to invest in sustainable transportation.

What You'll Learn

- Eligible Models: Identify Toyota models with electric powertrains, including hybrid and plug-in hybrid vehicles

- Tax Deduction: Understand the IRS rules for electric vehicle tax deductions

- Purchase Date: Determine the cutoff date for purchasing to qualify for the deduction

- Resale Restrictions: Note any restrictions on reselling the vehicle to maintain eligibility

- Documentation: Keep records of purchase, specifications, and compliance with IRS guidelines

Eligible Models: Identify Toyota models with electric powertrains, including hybrid and plug-in hybrid vehicles

Toyota has several models that qualify for electric vehicle (EV) tax deductions, offering drivers a range of options to choose from. These vehicles are designed to provide efficient and environmentally friendly transportation, making them attractive to those seeking tax benefits and reduced environmental impact. Here's an overview of the eligible Toyota models:

Hybrid Vehicles:

Toyota's hybrid lineup is extensive, and many of these models are eligible for EV tax deductions. The Toyota Prius is undoubtedly one of the most well-known and popular hybrid vehicles. It offers an efficient combination of a gasoline engine and an electric motor, providing excellent fuel economy and low emissions. Other hybrid models include the Toyota Camry Hybrid, which offers a spacious sedan with hybrid efficiency, and the Toyota RAV4 Hybrid, a compact crossover SUV that delivers a balance of performance and fuel economy. The Lexus ES 300h and Lexus RX 350h are also part of this category, offering luxury and hybrid technology.

Plug-in Hybrid Vehicles:

For those seeking even greater electric range, Toyota's plug-in hybrid models are an excellent choice. The Toyota Prius Prime is a plug-in hybrid version of the Prius, offering an all-electric range of approximately 13 miles, which can be extended to over 600 miles in combined fuel economy. The Toyota RAV4 Prime is another versatile plug-in hybrid crossover, providing an electric-only range of around 20 miles and impressive overall efficiency. These plug-in hybrids are eligible for tax deductions as they can be primarily powered by electricity, reducing their environmental impact.

Additionally, the Toyota Corolla Hybrid Prime and Toyota Camry Hybrid Prime are plug-in hybrid variants of the popular Corolla and Camry sedans, respectively. These models offer the convenience of a longer electric range and the versatility of a hybrid system.

It's important to note that the specific tax deductions and eligibility criteria may vary depending on the region and local regulations. Therefore, it is advisable to consult the latest guidelines and Toyota's official documentation to ensure compliance with the EV tax deduction requirements.

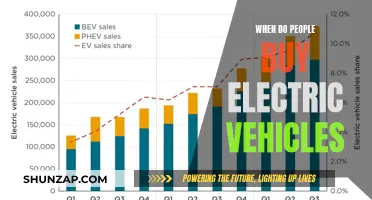

Government Incentives: Accelerating the Shift to Electric Vehicles

You may want to see also

Tax Deduction: Understand the IRS rules for electric vehicle tax deductions

Understanding the IRS rules for electric vehicle tax deductions can be a complex task, especially when considering specific makes and models, such as Toyota. The Internal Revenue Service (IRS) offers tax incentives to encourage the adoption of electric vehicles, which can significantly reduce the cost of ownership for eligible buyers. Here's a breakdown of the key points to help you navigate this process:

Eligibility Criteria: To qualify for the electric vehicle tax deduction, the vehicle must meet certain criteria set by the IRS. Firstly, it should be a new or used electric vehicle, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The vehicle's battery capacity and range must also adhere to specific standards. For Toyota models, it's essential to check the IRS's guidelines, as not all Toyota vehicles may qualify.

Toyota Models: Google search results will reveal that certain Toyota models are eligible for the tax deduction. For instance, the Toyota RAV4 Prime, a plug-in hybrid, and the Toyota Corolla Cross Hybrid are known to qualify. However, it's crucial to verify the specific year and model as IRS rules may change annually. For the latest information, refer to the IRS website or consult a tax professional.

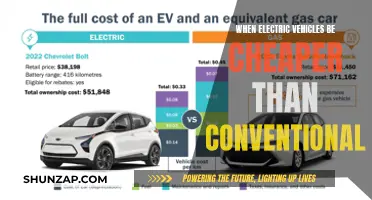

Deduction Amount: The tax deduction amount varies depending on the vehicle's battery capacity and range. The IRS provides a formula to calculate the deduction, which is based on the vehicle's battery capacity in kilowatt-hours (kWh) and its all-electric range in miles. Higher battery capacity and electric range generally result in a more substantial deduction.

Filing Requirements: When filing your tax return, you'll need to provide detailed information about the electric vehicle. This includes the vehicle's make, model, year, and specific specifications related to its electric system. Ensure that you have all the necessary documentation, such as the vehicle's specifications sheet or a professional assessment report.

Stay Updated: Tax laws and regulations can change frequently, so it's essential to stay updated. The IRS may introduce new guidelines or modify existing ones, affecting the eligibility and deduction amounts. Regularly checking the IRS website or subscribing to their updates can ensure you have the most current information. Additionally, consulting a tax advisor can provide personalized guidance based on your specific circumstances.

Remember, while the IRS provides tax incentives for electric vehicles, it's crucial to adhere to the rules and regulations to ensure compliance. Understanding the specific requirements for your chosen Toyota model and staying informed about any changes in tax laws will help you maximize the benefits of this deduction.

Unveiling the Electric Vehicle Revolution: Austin's Green Machines

You may want to see also

Purchase Date: Determine the cutoff date for purchasing to qualify for the deduction

The Internal Revenue Service (IRS) offers a valuable tax deduction for electric vehicles, and Toyota owners might be interested in this benefit. However, to qualify for this deduction, there are specific criteria that must be met, particularly regarding the purchase date. Understanding the cutoff date is crucial for ensuring you can claim this deduction.

For the electric vehicle deduction, the purchase date is a critical factor. The IRS has set a clear rule: the vehicle must be purchased after December 31, 2009, to be eligible for the tax benefit. This means that if you bought your Toyota electric vehicle before this date, you won't qualify for the deduction. It's essential to check the exact purchase date on your vehicle's documentation to ensure compliance with this requirement.

The deduction is designed to encourage the adoption of electric vehicles, and by setting this cutoff date, the IRS ensures that the incentive is relevant to the current market. Vehicles purchased before this date may have been part of an earlier generation of electric cars, which might not align with the current environmental and technological standards.

To maximize your chances of qualifying, it's advisable to research the specific Toyota models that meet the IRS criteria. Some Toyota models, such as the Toyota Prius Prime and the upcoming bZ4X, are known to qualify for this deduction. By purchasing one of these eligible models after the specified cutoff date, you can take advantage of this tax benefit.

In summary, when considering the purchase of a Toyota electric vehicle to qualify for the IRS deduction, be mindful of the purchase date. Ensure that the vehicle is acquired after December 31, 2009, to meet the IRS criteria. This attention to detail will help you make an informed decision and potentially save on taxes while contributing to a more sustainable future.

Unveiling the World's Largest Electric Vehicle: A Comprehensive Guide

You may want to see also

Resale Restrictions: Note any restrictions on reselling the vehicle to maintain eligibility

When considering the tax benefits of electric vehicles (EVs), it's important to understand the specific requirements and restrictions, especially regarding the resale of the vehicle. For Toyota models that qualify for the electric vehicle deduction, there are certain conditions that must be met to maintain eligibility. One crucial aspect is the resale restriction, which is designed to ensure that the vehicle is used for its intended purpose and not simply resold for profit.

Toyota offers various EV models, such as the Prius Prime and the Corolla Cross Hybrid, which are eligible for tax deductions. However, to qualify for these deductions, the vehicle must be used for personal or business purposes for a certain period. This is where the resale restriction comes into play. The Internal Revenue Service (IRS) has specific guidelines regarding the resale of vehicles to maintain eligibility for the tax benefit.

The resale restriction typically requires that the vehicle be used for its intended purpose for a minimum period before it can be resold. For example, if you purchase a Toyota EV for personal use, you may need to own and use the vehicle for a specific duration, such as two years, before you can consider reselling it. This restriction ensures that the vehicle is not being resold prematurely, potentially losing its eligibility for the tax deduction. During this period, the vehicle must be used primarily for personal transportation or for business-related activities that qualify for the deduction.

Additionally, there might be specific mileage or usage requirements that must be met. For instance, the vehicle may need to have a certain number of miles driven or a specific usage pattern to remain eligible for the tax benefit. These restrictions are in place to prevent abuse of the system and ensure that the vehicle is being utilized as an electric vehicle should be. It is essential to review the IRS guidelines and consult with a tax professional to understand the exact resale restrictions for your particular Toyota EV model.

In summary, when considering the resale of a Toyota EV to maintain eligibility for the electric vehicle deduction, it is crucial to be aware of the specific restrictions imposed by the IRS. These restrictions ensure that the vehicle is used for its intended purpose and that the tax benefits are applied correctly. By adhering to these guidelines, you can take full advantage of the tax incentives while also contributing to a more sustainable and environmentally friendly approach to vehicle ownership.

Unveiling the Mystery: Average Weight of Electric Vehicles Explained

You may want to see also

Documentation: Keep records of purchase, specifications, and compliance with IRS guidelines

When it comes to claiming the electric vehicle (EV) tax deduction for your Toyota, proper documentation is crucial. The IRS requires evidence to verify your vehicle's eligibility for the deduction, so it's essential to keep records of the relevant details. Here's a breakdown of what you need to document:

Purchase Documentation: Start by retaining the original sales receipt or invoice for your Toyota vehicle. This document should include the date of purchase, the vehicle's make, model, and year, as well as the vehicle identification number (VIN). The VIN is a unique identifier for your car and is essential for verifying its specifications. Make sure the receipt also mentions the vehicle's purpose, whether it's for personal or business use, as this will impact the deduction amount.

Vehicle Specifications: Keep a record of the Toyota's specifications, especially those related to its electric or hybrid features. This includes the battery capacity, electric motor power, and any other technical details that indicate its electric vehicle status. You can find this information in the vehicle's owner's manual or on the manufacturer's website. If your Toyota is a hybrid, ensure you note the specific hybrid technology and its capabilities.

Compliance with IRS Guidelines: The IRS has specific criteria for EV tax deductions, and you must ensure your Toyota meets these standards. Document the vehicle's compliance with the IRS guidelines, which may include factors like the vehicle's battery range, zero-emission credentials, and any relevant certifications. These guidelines are regularly updated, so it's essential to refer to the IRS website for the most current requirements.

Additionally, keep records of any maintenance or service logs related to your Toyota's electric or hybrid system. This documentation can be useful if you need to provide evidence of regular care and maintenance, which is often a requirement for tax deductions.

In summary, proper documentation is key to successfully claiming the electric vehicle deduction for your Toyota. By keeping records of purchase details, vehicle specifications, and compliance with IRS guidelines, you can ensure a smooth and efficient process when it comes time to file your tax return.

GM's Electric Revolution: Unveiling the Future of Green Cars

You may want to see also

Frequently asked questions

The Toyota models that qualify for the EV tax deduction are the bZ4X, a fully electric crossover SUV, and the upcoming bZ3, a battery-electric sedan. These vehicles are part of Toyota's commitment to offering more electric options in its lineup.

To be eligible for the EV tax deduction, the vehicle must be new and purchased or leased after December 31, 2020. It should also be a battery-electric vehicle (BEV) or a fuel cell vehicle. You can check the specific model's eligibility on the IRS website or consult a tax professional for guidance.

Yes, there are income-based restrictions on the purchase price of electric vehicles to qualify for the tax credit. For the 2023 tax year, the adjusted gross income (AGI) threshold is $150,000 for individuals and $300,000 for married couples filing jointly. Vehicles with a base sticker price of $80,000 or less for individuals and $160,000 or less for joint filers are eligible for the full credit.

Yes, if you lease a Toyota bZ4X, you may still be eligible for the EV tax deduction. However, the rules and eligibility criteria for leasing may differ from those for purchasing. It's recommended to consult a tax advisor to understand the specific regulations and any potential limitations based on your lease agreement.