The federal electric vehicle (EV) tax credit has sparked interest in its potential impact on sales tax. This credit, designed to incentivize the purchase of EVs, has led to discussions about its relationship with state sales taxes. Some argue that the credit effectively reduces the overall cost of an EV purchase, which could be seen as a reduction in sales tax. Others question whether the credit's value is solely in the federal tax savings or if it also influences the final price paid by consumers, potentially affecting state sales tax obligations. This paragraph aims to explore these perspectives and shed light on the complex interplay between federal incentives and state-level taxation in the EV market.

| Characteristics | Values |

|---|---|

| Federal Tax Credit for Electric Vehicles | The federal tax credit for electric vehicles is a financial incentive offered to consumers who purchase or lease new electric vehicles. |

| Sales Tax Reduction | The tax credit does not directly reduce sales tax. Sales tax is typically a state or local tax imposed on the sale of goods and services, and it is separate from the federal tax credit. |

| Impact on Sales | While the federal tax credit can make electric vehicles more affordable and attractive to buyers, it does not directly influence the sales tax amount. The credit is usually applied as a reduction in the purchase price of the vehicle. |

| State Variations | Some states may offer additional incentives or tax credits for electric vehicles, which could potentially interact with the federal credit. However, this is not a universal rule and varies by state. |

| Eligibility Criteria | The federal tax credit is generally available to individuals who purchase or lease new electric vehicles, but there may be income limits and other eligibility requirements. |

| Tax Credit Amount | The credit amount varies based on the vehicle's price and other factors, but it typically ranges from a few thousand to several thousand dollars. |

| Tax Year Application | The credit is usually applied to the federal income tax return for the tax year in which the vehicle is purchased or leased. |

What You'll Learn

Eligibility: Who qualifies for the federal EV tax credit?

The federal electric vehicle (EV) tax credit is a significant incentive for consumers to purchase electric cars, offering a substantial reduction in the overall cost of ownership. However, understanding who qualifies for this credit is crucial to ensure you can take full advantage of it.

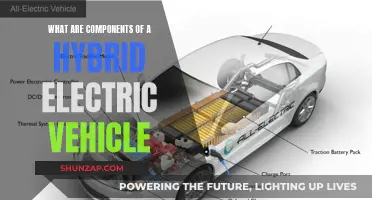

To be eligible for the federal EV tax credit, you must meet specific criteria set by the Internal Revenue Service (IRS). Firstly, the vehicle must be purchased from a dealership or retailer that participates in the program. This credit is available for new, untaxed electric vehicles, including cars, trucks, and motorcycles. The vehicle must be new and not used, and it should be purchased for personal use. This means that purchasing a used EV from a private seller would not qualify for the credit.

One of the key requirements is that the vehicle must be manufactured in the United States. This is a critical aspect, as the credit is designed to support American-made products and stimulate the domestic auto industry. Vehicles assembled overseas, even if they are electric, may not qualify for the tax credit. Additionally, the vehicle's battery must be contained in the U.S. or a free trade agreement country, ensuring that the production and supply chain meet certain standards.

Another important factor is the vehicle's price. The federal EV tax credit is capped at a certain amount, and the vehicle's price plays a role in determining the credit amount. Generally, the credit is available for vehicles with a sticker price of $80,000 or less for new cars and $85,000 or less for new trucks and SUVs. However, the credit amount is also tied to the vehicle's battery capacity and the manufacturer's suggested retail price (MSRP).

Furthermore, the credit is typically available to individual consumers, but there are some exceptions. For instance, businesses and fleets can also qualify, provided they meet the IRS's criteria. This includes purchasing the vehicle for business use or as part of a fleet program. Additionally, the credit can be transferred to a dealer or retailer if the vehicle is not purchased directly by the consumer. This transfer allows for a more flexible application of the credit, benefiting both consumers and businesses in the EV market.

Unraveling the GM EV Tax Credit: Current Status and Impact

You may want to see also

Sales Tax Interaction: How does the credit affect state sales tax?

The federal electric vehicle (EV) tax credit has sparked discussions about its potential impact on state sales tax revenues. When a federal tax credit is offered for EV purchases, it can significantly influence the sales tax landscape, especially in states that rely heavily on sales tax revenue. Here's an analysis of how this credit might affect state sales tax:

Reduced Sales Tax Revenue: One of the primary effects of the federal EV tax credit is that it can lead to a decrease in sales tax income for states. When consumers purchase electric vehicles, they often benefit from the federal credit, which directly reduces the final price they pay. As a result, the taxable amount for the sale is lower, leading to a reduction in sales tax revenue for the state. This impact is particularly noticeable in states with high sales tax rates, where the credit can result in a more substantial decrease in tax revenue.

Compensation Mechanisms: To mitigate the loss of revenue, some states might consider implementing compensation mechanisms. These could include adjusting sales tax rates, expanding the tax base to include new goods or services, or even introducing a dedicated EV sales tax to offset the federal credit's impact. For instance, a state might temporarily increase its sales tax rate on vehicles or introduce a new tax category specifically for EVs to ensure a steady flow of revenue.

Economic Incentives and Consumer Behavior: The federal EV tax credit not only affects sales tax revenue but also influences consumer behavior. With the credit, consumers might be more inclined to purchase electric vehicles, potentially shifting their spending from traditional gasoline-powered cars. This change in consumer preference could have a ripple effect on the state's economy, impacting various industries and tax sources. States may need to adapt their tax policies to account for these behavioral changes and ensure a balanced approach to revenue generation.

State-Level Considerations: Each state's response to the federal EV tax credit will depend on its unique tax structure and economic landscape. States with a significant automotive industry or those heavily reliant on sales tax revenue might face more significant challenges. They may need to carefully analyze the credit's impact on their budget and consider long-term strategies to maintain stable tax revenues. This could involve collaboration between state governments, automotive manufacturers, and environmental agencies to develop sustainable solutions.

In summary, the federal electric vehicle tax credit has the potential to significantly interact with state sales tax systems. While it may reduce sales tax revenue in the short term, states can explore various strategies to adapt and ensure a fair distribution of tax responsibilities. Understanding these interactions is crucial for policymakers to make informed decisions regarding tax policies and economic incentives.

Electric Revolution: Quiet, Green, and Future-Ready

You may want to see also

Credit Amount: What is the maximum credit value?

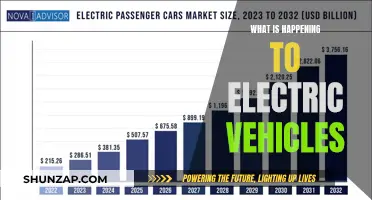

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to purchase these eco-friendly cars. This credit is designed to promote the adoption of EVs and reduce the environmental impact of the transportation sector. When it comes to the credit amount, the maximum value is a crucial aspect to understand for potential EV buyers.

The maximum credit value for the federal EV tax credit is $7,500. This amount is applicable to new electric vehicle purchases made after December 31, 2020, and before January 1, 2027. It is important to note that this credit is generally available to individuals who purchase or lease a new electric vehicle, and the credit amount is based on the vehicle's battery capacity and the manufacturer's suggested retail price (MSRP). The credit is designed to encourage the purchase of more efficient and environmentally friendly vehicles, and it can significantly reduce the overall cost of ownership for EV buyers.

To calculate the credit, the IRS provides a formula that takes into account the vehicle's battery capacity and the vehicle's base price. The base price is the manufacturer's suggested retail price, adjusted for certain optional equipment. The credit amount is then determined based on a sliding scale, with higher credits for vehicles with larger batteries and lower base prices. This ensures that the credit is targeted towards a wider range of EV models, not just the most expensive ones.

It is worth mentioning that the credit is not a direct reduction in the purchase price but rather a credit that can be claimed against federal income tax. This means that the credit is typically used to offset the buyer's tax liability, and the actual savings may vary depending on the individual's tax situation. However, for those who are eligible and can utilize the full credit, it can result in a substantial financial benefit.

Understanding the maximum credit value is essential for anyone considering an EV purchase, as it provides a clear idea of the potential savings. This information can be a powerful motivator for consumers, especially those who are environmentally conscious and eager to contribute to a greener future. Additionally, knowing the credit amount can help individuals plan their budgets and make informed decisions when choosing an electric vehicle.

Unveiling the Power of Pure Electric Vehicles: A Comprehensive Guide

You may want to see also

Timing: When is the credit applied to the purchase?

The timing of when the federal electric vehicle (EV) tax credit is applied to a purchase is an important consideration for buyers. This credit, which was introduced to encourage the adoption of electric vehicles, can significantly reduce the overall cost of purchasing an EV. However, understanding when this credit is applied is crucial to ensure that you receive the full benefit.

When you purchase an eligible electric vehicle, the credit is typically applied at the point of sale. This means that the dealership or seller will subtract the credit amount from the total purchase price before finalizing the transaction. The credit is generally available for new, qualified electric vehicles, and the timing of its application is designed to be immediate and transparent.

The credit is usually applied at the time of purchase, which can be a significant advantage for buyers. This immediate reduction in price can make a substantial difference, especially for high-end electric vehicles. For instance, a $7,500 credit on a $40,000 vehicle results in a final price of $32,500, which is a substantial saving. This immediate application of the credit ensures that buyers receive the benefit without any delay, making the purchase more attractive and potentially more timely.

It's worth noting that the credit is not retroactive; it is applied at the time of purchase, and any additional costs incurred after the sale, such as delivery or accessories, are not eligible for the credit. This clarity in timing ensures that buyers can make informed decisions and take advantage of the credit without any confusion or delay.

In summary, the federal electric vehicle tax credit is applied at the point of purchase, providing an immediate reduction in the cost of an eligible electric vehicle. This timing is designed to benefit buyers by making the purchase more affordable and potentially more timely, encouraging the adoption of electric vehicles as a more cost-effective and environmentally friendly option.

The Weighty Secret Behind Porsche's Electric Powerhouses

You may want to see also

State Variations: Do states have their own EV incentives?

The federal government's incentives for electric vehicles (EVs) have undoubtedly been a significant boost for the industry, but it's important to understand that these incentives don't operate in isolation. States, too, play a crucial role in promoting EV adoption, and they often have their own unique incentive programs. These state-level incentives can either complement or compete with the federal tax credit, depending on the state's policies.

For instance, some states offer their own tax credits or rebates for EV purchases, which can be used in conjunction with the federal credit. This means that a vehicle buyer could potentially receive a double benefit: the federal tax credit and a state-specific incentive. California, for example, has been a leader in EV incentives, offering a rebate of up to $7,000 for new electric cars, which can be combined with the federal credit. This combined approach can significantly reduce the overall cost of purchasing an EV.

On the other hand, some states have chosen to implement their own sales tax exemptions for EVs. This means that the sales tax on an EV purchase is waived, providing an immediate financial benefit to buyers. States like New York and New Jersey have adopted this strategy, which can be particularly attractive to EV buyers in those regions. However, it's worth noting that this approach might not be as comprehensive as a direct credit, as it doesn't address the upfront cost of the vehicle.

In addition to tax credits and exemptions, some states have also introduced other incentives such as reduced registration fees, carpool lane access, and even free or discounted charging station memberships. These additional benefits can make owning an EV more appealing and cost-effective, especially in states with limited federal incentives. For instance, states like Oregon and Washington offer free registration for EVs for the first two years of ownership, which can be a significant savings over time.

Understanding the specific incentives offered by your state can be crucial when considering an EV purchase. While the federal tax credit provides a broad-based incentive, state-specific programs can offer additional advantages, making the transition to electric mobility more accessible and affordable for residents in those states. It is always advisable to check with local authorities and EV dealerships to gather the most up-to-date information on the incentives available in your area.

The Future of Electric Vehicles: Are They Here to Stay?

You may want to see also

Frequently asked questions

The federal tax credit is applied to the vehicle's purchase price before any sales tax is added. This means the credit reduces the taxable amount, which can result in a lower sales tax liability.

The federal credit does not dictate state tax laws, but it can influence the final price and tax amount. Some states may offer additional incentives or credits, while others might have different tax rates, impacting the overall cost.

Yes, the federal tax credit is available to cash buyers as well. It is based on the vehicle's price and the taxpayer's income, not the payment method.

If the vehicle's price is above the federal tax credit threshold, the credit will be reduced proportionally. This means the credit will be applied up to the limit, and any remaining amount will not be transferable.

The federal tax credit is primarily for new electric vehicles. Used EVs may be eligible for different incentives or tax benefits, but they do not qualify for the same federal credit amount as new purchases.