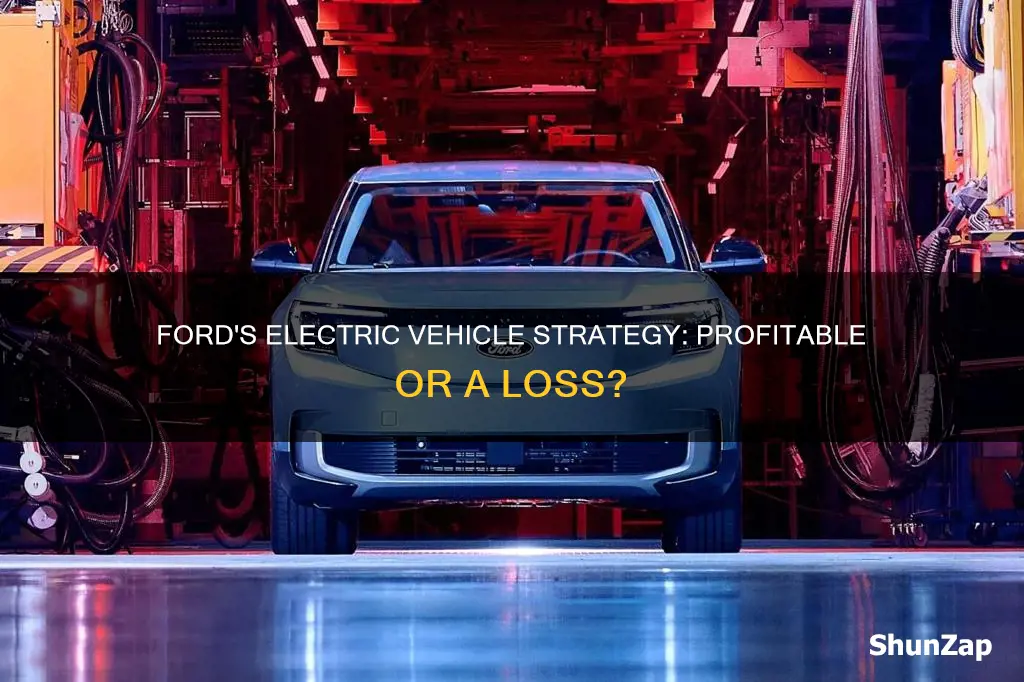

The rise of electric vehicles (EVs) has sparked curiosity and concern regarding the profitability of traditional automakers like Ford. With the automotive industry undergoing a rapid transition towards electrification, it's natural to question whether Ford, a longstanding player in the internal combustion engine market, is losing money on its electric vehicle ventures. This introduction aims to explore the financial implications of Ford's shift towards EVs, examining the challenges and opportunities it faces in this evolving landscape.

What You'll Learn

- Production Costs: Ford's EV production costs are high due to battery technology and supply chain complexities

- Market Penetration: Slow market adoption of EVs may hinder Ford's ability to recoup investment

- Technology Investment: Heavy investment in EV technology and infrastructure could impact profitability in the short term

- Competitive Landscape: Ford faces competition from established EV brands and startups, impacting market share and profits

- Regulatory Changes: Shifting regulations and incentives may affect Ford's EV profitability and long-term strategy

Production Costs: Ford's EV production costs are high due to battery technology and supply chain complexities

The high production costs associated with Ford's electric vehicle (EV) lineup are a significant factor in the company's financial challenges in this sector. One of the primary reasons for these elevated costs is the advanced battery technology required for EVs. Developing and manufacturing lithium-ion batteries, which are the standard power source for electric cars, is a complex and resource-intensive process. Ford, like many other automakers, has invested heavily in research and development to create efficient and powerful battery systems, which has contributed to the overall expense. The complexity of battery production includes the need for specialized equipment, skilled labor, and the sourcing of rare earth minerals, all of which drive up manufacturing costs.

Additionally, the supply chain for EV components is intricate and often global, presenting further challenges. Sourcing and assembling the various parts required for an electric vehicle, such as electric motors, power electronics, and advanced driver-assistance systems, demand a sophisticated supply network. Ford's supply chain management must ensure a steady and reliable flow of these components, which can be difficult to maintain due to the specialized nature of the parts and the potential for geopolitical issues. Delays in the supply chain can lead to production bottlenecks, increasing costs and impacting overall efficiency.

Another critical aspect is the infrastructure required to support EV production. Ford has been investing in building or retrofitting manufacturing plants to accommodate the unique needs of electric vehicle assembly. This includes installing specialized equipment for battery pack assembly, as well as adapting existing assembly lines to handle the different processes compared to traditional internal combustion engine (ICE) vehicles. The infrastructure development is a significant expense, and it takes time to implement, which can delay the launch of new EV models.

Furthermore, the high production costs are also influenced by the learning curve associated with EV manufacturing. As Ford transitions from producing ICE vehicles to EVs, there is a period of adjustment and optimization required. This includes fine-tuning production processes, improving quality control, and ensuring consistent performance and reliability. The learning curve can result in increased costs during the initial production phases until the processes are refined and optimized.

Despite these challenges, Ford is committed to its EV strategy and continues to invest in technology and infrastructure to reduce production costs. The company aims to streamline processes, improve supply chain efficiency, and benefit from economies of scale as it increases its EV production volume. While the current high production costs are a concern, Ford's long-term goal is to make electric vehicles more affordable and competitive in the market.

Powering the Future: Unlocking the Potential of Battery Electric Vehicles

You may want to see also

Market Penetration: Slow market adoption of EVs may hinder Ford's ability to recoup investment

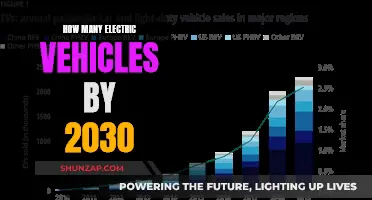

The market penetration of electric vehicles (EVs) is a critical factor in Ford's ability to recoup its investments in this technology. Despite the company's significant efforts and resources dedicated to developing and producing EVs, the slow adoption rate in the market poses a challenge. This is particularly concerning given the substantial financial outlay required to enter the EV space, which includes research and development, infrastructure, and marketing expenses.

One of the primary reasons for the slow market adoption of EVs is consumer hesitation. Many potential buyers are still uncertain about the reliability and performance of electric vehicles, often citing concerns about range anxiety, charging infrastructure, and the overall cost compared to traditional gasoline vehicles. This hesitation is further exacerbated by the limited availability of charging stations in certain regions, making the practicalities of EV ownership less appealing.

Ford's market research indicates that while consumer interest in EVs is growing, the pace of adoption is slower than expected. This is evident in the company's sales figures, which show a steady but not rapid increase in EV sales. The slow market penetration directly impacts Ford's ability to achieve economies of scale, which are essential for reducing production costs and making EVs more affordable and competitive in the market.

To address this challenge, Ford must continue to invest in marketing and education campaigns to build consumer confidence. Additionally, the company should focus on expanding its charging infrastructure network to alleviate range anxiety. By doing so, Ford can accelerate the market adoption of EVs, ensuring that it can eventually recoup its investments and achieve profitability in this rapidly evolving industry.

In summary, the slow market adoption of EVs is a significant hurdle for Ford, impacting its ability to generate returns on its substantial investments in electric vehicle technology. To overcome this challenge, Ford must employ strategic marketing, infrastructure development, and continued innovation to drive consumer acceptance and market growth.

UK's Electric Revolution: Unlocking the Green Car Shift

You may want to see also

Technology Investment: Heavy investment in EV technology and infrastructure could impact profitability in the short term

The automotive industry is undergoing a significant transformation with the rise of electric vehicles (EVs), and Ford Motor Company is no exception. While the company has made substantial strides in its EV lineup, the path to long-term profitability in this sector is not without challenges. One of the primary obstacles Ford faces is the substantial investment required in EV technology and infrastructure.

As Ford aims to expand its EV portfolio and meet the growing demand for sustainable transportation, it is making significant strides in this direction. The company has committed to investing billions of dollars in EV development, including the construction of new assembly plants and the adaptation of existing facilities to produce electric vehicles. This investment is crucial for Ford's future success, as it aims to become a leading player in the EV market. However, these initial costs can be a significant burden on the company's financial health.

The short-term impact of this technology investment is evident in Ford's financial statements. The company has reported increased spending on research and development, as well as capital expenditures, to support its EV initiatives. While these investments are necessary for long-term growth, they can lead to reduced profitability in the immediate future. Ford's earnings may take a hit as the company allocates a larger portion of its revenue to cover these expenses, potentially affecting its bottom line.

Furthermore, the competition in the EV market is intense, with established automakers and new entrants alike vying for market share. This competition can further pressure Ford's pricing strategies and profit margins. To remain competitive, Ford may need to offer incentives and discounts to attract customers, which could further impact its short-term profitability.

Despite the challenges, Ford's commitment to EV technology is strategic and essential for its future. The company's investment in EV infrastructure and technology will likely pay off in the long run, as it positions itself to capitalize on the growing demand for electric vehicles. However, the short-term financial impact is undeniable, and investors and stakeholders should be aware of the potential trade-off between immediate profitability and future market dominance in the EV space.

Ford's Electric Future: Shifting Focus or Staying Committed?

You may want to see also

Competitive Landscape: Ford faces competition from established EV brands and startups, impacting market share and profits

The electric vehicle (EV) market is a highly competitive space, and Ford, a traditional automotive giant, is not immune to the challenges it presents. The company has been investing heavily in its EV lineup, but the competitive landscape is fierce, with both established EV brands and innovative startups vying for market share. This intense competition has significant implications for Ford's profitability and overall market position.

One of the primary competitors in the EV space is Tesla, a company that has revolutionized the industry. Tesla's early entry into the market and its focus on premium, high-performance EVs have set a high bar for competitors. While Ford has been working on its own EV models, such as the Mustang Mach-E and the F-150 Lightning, Tesla's strong brand presence and loyal customer base have already established a solid foothold in the market. This has led to a direct head-to-head competition between the two companies, especially in the crucial North American market.

Additionally, traditional automotive manufacturers like General Motors (GM) and Volkswagen are also making significant strides in the EV sector. GM's Chevrolet Bolt and the upcoming GMC Hummer EV are direct rivals to Ford's offerings. Volkswagen, with its ID.4 and the upcoming ID.5, is another formidable player. These established brands bring a wealth of experience and resources to the table, allowing them to quickly adapt to the changing market dynamics and challenge Ford's market share.

The rise of startups in the EV industry further intensifies the competition. Companies like Rivian, Lucid Motors, and Arrival are disrupting the market with their innovative designs and unique value propositions. These startups often target specific niches, such as off-road vehicles or luxury EVs, and offer cutting-edge technology that attracts early adopters. While Ford has been working on its own innovative projects, keeping up with these agile competitors can be challenging, especially in terms of product development speed and market responsiveness.

As a result of this competitive environment, Ford faces the challenge of maintaining its market share and profitability in the EV segment. The company's ability to differentiate its products, offer competitive pricing, and provide an exceptional customer experience will be crucial in this competitive landscape. Ford's strategy to diversify its EV lineup and cater to various consumer segments is a step in the right direction, but it must also stay agile and responsive to the dynamic nature of the EV market to ensure long-term success and profitability.

Electric Vehicles: Manual or Automated? Transmission Explained

You may want to see also

Regulatory Changes: Shifting regulations and incentives may affect Ford's EV profitability and long-term strategy

The automotive industry is undergoing a rapid transformation as governments worldwide push for a shift towards electric vehicles (EVs) to reduce carbon emissions and combat climate change. This shift has significant implications for traditional automakers like Ford, which has been a major player in the internal combustion engine (ICE) market. Ford's transition to EVs is a strategic move, but it is not without its challenges, especially when considering the impact of regulatory changes and incentives.

One of the primary regulatory changes that could affect Ford's EV strategy is the implementation of stricter emission standards. Many countries are introducing more stringent regulations to limit greenhouse gas emissions, which directly impacts the profitability of ICE vehicles. As a result, Ford might need to invest more in developing and producing EVs to meet these new standards, potentially diverting resources from other projects. For instance, the European Union's (EU) upcoming 'Fit for 55' package aims to reduce emissions by 55% by 2030, which could make it more challenging for Ford to maintain its current business model.

Government incentives play a crucial role in shaping the EV market. Tax credits, subsidies, and other financial incentives can significantly boost the adoption of EVs, making them more affordable and attractive to consumers. However, these incentives often change frequently, creating uncertainty for automakers. Ford's long-term strategy might be influenced by the unpredictability of these incentives. For example, if a government decides to phase out certain incentives, it could impact Ford's sales and market share, especially if competitors are better positioned to take advantage of the changing landscape.

The regulatory environment also includes the potential for new trade policies and tariffs, which could affect the cost structure of EV production. Ford, being a global automaker, needs to consider the impact of these policies on its supply chain and manufacturing operations. Shifting regulations might require Ford to adapt its production strategies, potentially leading to increased costs in the short term. Moreover, the company's ability to manage these costs and maintain profitability will be crucial for its success in the EV market.

In summary, regulatory changes and incentives are critical factors that can influence Ford's EV profitability and long-term strategy. The company must carefully navigate the evolving legal landscape to ensure its transition to EVs is sustainable and profitable. Staying agile and responsive to these changes will be essential for Ford's success in the rapidly changing automotive industry. This includes investing in the right technologies, forming strategic partnerships, and making informed decisions to optimize its EV business while adapting to the dynamic regulatory environment.

Unlocking EV Tax Savings: A Guide to Maximizing Your Credit

You may want to see also

Frequently asked questions

Ford has been investing heavily in its electric vehicle (EV) lineup and has seen significant growth in this segment. While the company has not disclosed specific profit margins for individual EV models, it has reported overall financial gains from its EV business. Ford's focus on sustainability and its commitment to reducing emissions have positioned it as a key player in the EV market, allowing it to capture a growing share of the market.

Ford's electric vehicle strategy is designed to be profitable in the long term. The company has outlined plans to invest in EV technology and infrastructure, aiming to increase its market share and brand presence in the EV space. By diversifying its product portfolio with both traditional and electric vehicles, Ford aims to balance its financial performance and cater to a wide range of consumer preferences.

Ford's transition to electric vehicles does come with certain financial challenges. The initial investment in EV technology and research and development can be substantial, and the company needs to manage these costs while also ensuring profitability. Additionally, Ford must navigate the competitive EV market, where established automakers and new entrants are vying for market share. However, Ford's global reach and established brand reputation provide a solid foundation for its EV strategy.