Navigating the complexities of electric vehicle (EV) ownership can be simplified with the right financial strategies. One such strategy is understanding how to apply the federal tax credit for electric vehicles when filing your tax return. This guide will provide a step-by-step breakdown of the process, ensuring you maximize your savings and stay compliant with tax regulations. From gathering necessary documents to calculating the credit amount, we'll cover the essential steps to help you make the most of your EV purchase and enjoy the benefits of a greener commute.

What You'll Learn

- Eligibility: Determine if you qualify for EV tax credits based on vehicle purchase and residency

- Documentation: Gather necessary paperwork, including sales receipts and vehicle information, for tax credit claims

- Credit Amount: Understand the maximum credit value and any income limits

- Filing Process: Follow IRS guidelines for claiming EV credits on your federal tax return

- Deadlines: Be aware of the tax filing deadline and any extension options for EV credit claims

Eligibility: Determine if you qualify for EV tax credits based on vehicle purchase and residency

To determine your eligibility for electric vehicle (EV) tax credits, you need to consider several factors, primarily focusing on the vehicle purchase and your residency status. Here's a detailed guide on how to assess these aspects:

Vehicle Purchase:

- New or Used EV: The Internal Revenue Service (IRS) offers tax credits for both new and used EVs, but the amount of credit can vary. For new EVs, the credit is generally higher, and it's essential to understand the specific model's qualification. You can find this information on the manufacturer's website or by checking the IRS's list of qualified vehicles.

- Purchase Date: The timing of your purchase is crucial. The credit is typically available for vehicles purchased after a certain date, which has been adjusted over the years. For instance, for the 2023 tax year, the credit is available for vehicles purchased after December 31, 2022. It's best to consult the IRS guidelines for the specific year you are claiming.

- Price and Value: EV tax credits are often limited to vehicles with a certain price tag. The IRS sets a maximum price limit for new and used EVs to ensure the credit's fairness and accessibility. For 2023, the credit is available for vehicles with a federal retail price not exceeding $80,000 for new EVs and $55,000 for used EVs.

Residency and Citizenship:

- U.S. Citizen or Resident Alien: If you are a U.S. citizen or a resident alien, you are generally eligible for the EV tax credit. The credit is available to individuals who own or lease the EV and meet the residency requirements.

- Non-Resident Aliens and Partnerships: Non-resident aliens and partnerships are not eligible for the EV tax credit. However, if you are a non-resident alien and meet certain criteria, you may still be able to claim the credit through a U.S. citizen or resident alien spouse or parent.

Additional Considerations:

- Income Limits: There are income thresholds that may affect your eligibility. For the 2023 tax year, the credit is phased out for individuals with modified adjusted gross income (MAGI) above $150,000 ($200,000 for joint filers).

- State Residency: While state residency is not a primary factor, it's worth noting that some states offer additional EV incentives, which may have different eligibility criteria.

When applying for the EV tax credit on your federal tax return, ensure you have all the necessary documentation, including the vehicle's purchase agreement, sales tax receipt, and any relevant forms provided by the manufacturer or dealer. Understanding these eligibility criteria is crucial to ensure you receive the correct amount of tax credit and to avoid any potential issues during the tax filing process.

Can Electric Vehicles Be Flat-Towed? Exploring Towing Capabilities

You may want to see also

Documentation: Gather necessary paperwork, including sales receipts and vehicle information, for tax credit claims

When it comes to claiming the federal tax credit for electric vehicles, proper documentation is crucial. This ensures that you have the necessary paperwork to support your claim and can help avoid any potential issues during the tax filing process. Here's a step-by-step guide on gathering the required documents:

Sales Receipts: Start by collecting all the sales receipts related to your electric vehicle purchase. These receipts should clearly indicate the date of purchase, the vehicle's make and model, and the amount paid. Make sure to keep both the original and a copy for your records. If you bought the vehicle used, you'll need to provide proof of purchase, which could be a bill of sale or a similar document showing the transaction details.

Vehicle Information: Obtain essential details about your electric vehicle. This includes the vehicle identification number (VIN), which is unique to every car and can be found on the dashboard or title. Additionally, gather any available documentation related to the vehicle's battery capacity, range, and any other specifications that might be relevant to the tax credit. These details will help verify your eligibility for the credit.

Additional Documentation: Depending on your specific situation, there might be other documents you need to gather. For instance, if you leased the vehicle, you'll require lease agreements or contracts. If you received a rebate or incentive from a manufacturer or government agency, collect those documents as well. Any paperwork that provides evidence of your investment in an electric vehicle should be included.

Organizing your documents is essential to ensure a smooth tax filing process. Create a dedicated folder or spreadsheet to store all the gathered information. Label each section clearly, making it easy to find specific documents when needed. This organized approach will save time and reduce the risk of losing important paperwork.

Remember, the IRS may request additional documentation or verification during the tax credit claim process. Having a comprehensive and well-organized collection of papers will make it easier to provide the necessary information and support your claim for the electric vehicle tax credit.

Unveiling the Secret: Where's Your EV's Power Source?

You may want to see also

Credit Amount: Understand the maximum credit value and any income limits

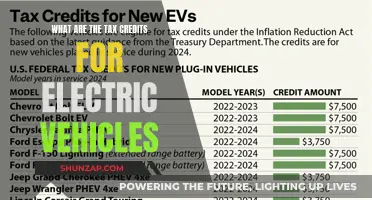

When it comes to claiming the federal tax credit for electric vehicles (EVs), understanding the credit amount and any associated income limits is crucial. The maximum credit value for EVs can vary, and it's essential to be aware of these details to ensure you're eligible and to know how much you can potentially save.

The federal tax credit for EVs is designed to encourage the purchase of electric vehicles and reduce the environmental impact of transportation. The credit amount is typically based on the vehicle's battery capacity and the manufacturer's suggested retail price (MSRP). Higher battery capacity and lower MSRP can result in a more substantial credit. However, there are income limits that determine the maximum credit value one can claim. These limits are set to ensure that the credit benefits those who may need it most, often lower- to middle-income earners.

To find the maximum credit value, you can refer to the Internal Revenue Service (IRS) guidelines. The IRS provides a table that outlines the credit amounts for different vehicle types and battery capacities. This table is a valuable resource to determine the highest credit you can receive. Additionally, it's important to note that the credit amount may decrease as the vehicle's price increases, so understanding the price range you fall into is essential.

Income limits are another critical factor. The IRS sets these limits to ensure the credit is accessible to a broader range of taxpayers. For the 2023 tax year, the income limits for the EV tax credit are $150,000 for single filers and $300,000 for joint filers. These limits are adjusted annually, so it's advisable to check the IRS website for the most up-to-date information. Taxpayers who exceed these income thresholds may still be eligible for a partial credit, but the amount will be reduced proportionally.

Understanding these credit amounts and income limits is the first step in maximizing your potential savings when purchasing an electric vehicle. It's a significant benefit for those looking to go green and can make a substantial difference in the overall cost of the vehicle. Being aware of these details will enable you to plan and take advantage of this federal incentive effectively.

Electric Vehicle Lease: Is It Worth It?

You may want to see also

Filing Process: Follow IRS guidelines for claiming EV credits on your federal tax return

The process of claiming the electric vehicle (EV) tax credit on your federal tax return involves following specific IRS guidelines to ensure accuracy and compliance. Here's a step-by-step guide to help you navigate this process:

- Gather Required Information: Before you begin, collect all the necessary documents and information. This includes proof of purchase or lease of the EV, such as a sales invoice or lease agreement. You'll also need details about the vehicle's make, model, and year. Additionally, gather your personal identification documents and any relevant financial records related to the purchase or lease.

- Determine Eligibility: The IRS has specific criteria to determine eligibility for the EV tax credit. Ensure that your vehicle meets the requirements, such as being a new or used EV, and that you are the original owner or lessee. The IRS provides detailed instructions on their website, outlining the eligibility rules for different vehicle types and purchase/lease scenarios.

- Complete Form 8936: This is the primary form used to claim the EV tax credit. You will need to provide details about the vehicle, including its purchase or lease price, and any applicable down payment or trade-in value. The form also requires information about your income and other tax-related details. Carefully fill out Form 8936, ensuring you provide accurate and complete information.

- Calculate the Credit: The EV tax credit is generally a non-refundable credit, meaning it can be used to reduce your federal income tax liability. Calculate the credit amount based on the IRS guidelines, which may vary depending on the vehicle's price and your income level. The IRS provides detailed tables and calculations to help you determine the exact credit amount.

- Attach the Form to Your Tax Return: When filing your federal tax return, include Form 8936 with the necessary supporting documents. Ensure that you follow the IRS instructions for attaching the form to your return. Double-check all the information provided to avoid any errors or omissions that could lead to delays or rejections.

- Stay Updated: Tax laws and regulations can change frequently. Stay updated with the latest IRS guidelines and instructions for claiming EV credits. The IRS website is a reliable source for the most current information. If you have any doubts or complex situations, consider seeking advice from a tax professional to ensure you comply with all requirements.

Remember, accuracy and attention to detail are crucial when dealing with tax credits. By following these steps and staying informed, you can successfully claim the EV tax credit on your federal tax return.

Unveiling the Environmental Impact: Green Driving, Green Future

You may want to see also

Deadlines: Be aware of the tax filing deadline and any extension options for EV credit claims

Understanding the deadlines for claiming the electric vehicle (EV) tax credit is crucial when filing your federal tax return. The Internal Revenue Service (IRS) has specific rules and timelines for EV credit claims, and being aware of these can help ensure your claim is processed correctly and on time.

The standard tax filing deadline is April 15th of the following year for which you are filing. For example, if you purchased an EV in 2022, you would typically file your 2022 tax return by April 15, 2023. However, it's important to note that the IRS may offer an extension, allowing you to file for an additional six months, until October 15th. This extension can be particularly useful if you need more time to gather the necessary documentation or if you are waiting for a refund from a previous tax year.

When claiming the EV tax credit, it's essential to be mindful of the deadlines set by the IRS. The credit is generally available for vehicles purchased and placed in service during the tax year. If you bought your EV in December, for instance, you may still be able to claim the credit for that year, but you must file your tax return by the standard deadline or the extended date, whichever applies.

To avoid any issues or penalties, it is recommended to file your tax return well before the deadlines. This gives you ample time to ensure all the required forms and supporting documents are accurate and complete. The EV tax credit can be claimed on Form 8936, and it's important to carefully follow the instructions provided by the IRS to ensure your claim is processed correctly.

Additionally, if you anticipate needing an extension, it's a good idea to file the initial return by the regular deadline and then request an extension. This way, you can file your return without incurring any late fees or penalties, and you'll have the extra time to gather any additional information or documentation required for your EV credit claim. Being proactive and aware of these deadlines will help you navigate the process smoothly and ensure you take full advantage of the EV tax incentives.

The Future of Driving: When Will the Next EV Arrive?

You may want to see also

Frequently asked questions

The EV tax credit is available to individuals who purchase or lease certain qualified electric vehicles. To qualify, you must meet specific criteria, such as purchasing the vehicle from a dealership or retailer that participates in the program, and the vehicle must meet the IRS's definition of a qualified EV. You can find detailed information on the IRS website about the eligibility requirements and a list of qualified vehicles.

When claiming the EV tax credit, you will need to provide supporting documentation to prove your purchase. This typically includes a copy of the vehicle's bill of sale or a lease agreement, which should show the vehicle's make, model, and vehicle identification number (VIN). You may also need to provide additional documentation, such as a dealer's certification or a statement from the manufacturer, to verify the vehicle's qualification.

Yes, the EV tax credit can also apply to leased vehicles. If you lease a qualified EV, you can claim the credit based on the lease payments you make. However, there are specific rules and limitations for leased vehicles, including a cap on the total credit amount you can claim. It's important to review the IRS guidelines for leased vehicles to ensure you understand the eligibility criteria and any restrictions.