Claiming a federal tax credit for leasing an electric vehicle is a great way to save money and promote sustainable transportation. This guide will walk you through the process of qualifying for and receiving the tax credit, which can significantly reduce the cost of leasing an electric vehicle. It will cover the eligibility criteria, the application process, and important deadlines to ensure you take full advantage of this financial incentive.

What You'll Learn

- Eligibility: Determine if you qualify for the federal tax credit based on income and vehicle type

- Lease Agreement: Review your lease contract to ensure it meets IRS requirements

- Documentation: Gather necessary paperwork, including lease agreement, vehicle purchase/lease confirmation, and IRS Form 8865

- Claiming Credit: File IRS Form 1040, Schedule E, and claim the credit on your federal tax return

- Timing: Claim the credit in the year the lease begins, not when the vehicle is purchased

Eligibility: Determine if you qualify for the federal tax credit based on income and vehicle type

The federal tax credit for electric vehicle leases is a valuable incentive for individuals looking to go green and save on their vehicle purchases. However, it's important to understand the eligibility criteria to ensure you can take full advantage of this benefit.

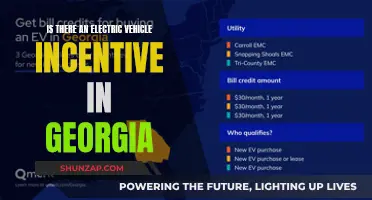

Eligibility for the tax credit is primarily based on two factors: income and vehicle type. Firstly, your income must fall within specific limits set by the IRS. These limits are adjusted annually and are based on your filing status (single, married filing jointly, etc.). For the 2023 tax year, the income threshold for single filers is $100,000, while for married filers filing jointly, it is $150,000. If your income exceeds these limits, you may still be eligible if you meet certain other criteria, such as being a full-time student or a member of a household with a dependent.

Secondly, the vehicle you lease must meet specific criteria. The vehicle must be a new electric vehicle, meaning it has never been registered for use on public roads. It should be designed primarily for use on roads and have a top speed of at least 35 miles per hour. Additionally, the vehicle must be purchased from a dealership or leased from a leasing company that participates in the federal tax credit program.

To determine your eligibility, you can start by checking your income against the IRS limits. If your income is below the threshold, you are likely eligible. However, if your income is above the limit, you can still explore other options, such as purchasing a used electric vehicle or applying for a state-specific tax credit.

It's important to note that the federal tax credit is a non-refundable credit, meaning it can only be used to reduce your tax liability to zero. Any excess credit can be carried forward to future tax years. Additionally, the credit is typically available for the first 200,000 electric vehicles sold or leased, so be mindful of this limit when considering your eligibility.

Unlocking Savings: A Guide to Colorado's EV Tax Credit

You may want to see also

Lease Agreement: Review your lease contract to ensure it meets IRS requirements

When considering the federal tax credit for electric vehicle leases, it's crucial to thoroughly review your lease agreement to ensure it complies with IRS regulations. This process is essential to avoid any potential issues when it comes to claiming the tax credit. Here's a step-by-step guide to help you navigate this process:

Understanding the Lease Agreement: Begin by carefully reading through the entire lease contract. Pay close attention to the terms and conditions related to the vehicle, lease duration, and any specific clauses related to electric vehicles. Look for sections that mention the vehicle's purpose, usage, and any restrictions on its use. Ensure that the lease clearly states the vehicle is leased for business or personal use, as this distinction is critical for tax purposes.

Lease Term and Mileage: Verify that the lease term aligns with the IRS guidelines. The IRS specifies that the lease term must be at least 24 months for new electric vehicles to qualify for the tax credit. Check if your lease agreement meets this requirement. Additionally, confirm the mileage allowance. The IRS allows a maximum of 14,000 miles per year for the first year and 12,000 miles per year thereafter. Ensure your lease contract does not exceed these limits, as it may impact your eligibility.

Lease Payments and Vehicle Ownership: Examine the lease payment structure. The IRS requires that the lease payments be based on the fair market value of the vehicle. This includes the purchase price, any applicable taxes, and any additional fees. Ensure that the lease agreement clearly outlines the monthly payment amount and the method of calculating it. Furthermore, confirm that the lease does not transfer ownership of the vehicle to the lessee during the lease term, as this could affect your tax credit claim.

Lease Add-Ons and Options: Some lease agreements may include add-ons or options that could impact your eligibility. For instance, if the lease includes additional services or accessories, ensure that these are not considered part of the vehicle's purchase price. The IRS has specific rules regarding lease add-ons, and any additional costs must be clearly separated from the base lease agreement. Review the lease to ensure all add-ons are properly documented and do not violate IRS requirements.

Seek Professional Advice: Given the complexity of tax regulations, it is advisable to consult a tax professional or accountant who specializes in electric vehicle incentives. They can provide personalized guidance based on your lease agreement and help ensure that all aspects comply with IRS standards. Their expertise will be invaluable in navigating any potential complexities and maximizing your chances of successfully claiming the federal tax credit.

Unlocking Federal EV Tax Credit: A Step-by-Step Guide

You may want to see also

Documentation: Gather necessary paperwork, including lease agreement, vehicle purchase/lease confirmation, and IRS Form 8865

When it comes to claiming the federal tax credit for leasing an electric vehicle, proper documentation is crucial. Here's a step-by-step guide on what you need to gather:

Lease Agreement: Start by obtaining a copy of your lease agreement. This document should outline the terms of your lease, including the vehicle's make, model, and lease duration. It should also specify the lease payment amount and the total lease period. Make sure the lease agreement is in your name and clearly states that you are leasing the electric vehicle.

Vehicle Purchase/Lease Confirmation: In addition to the lease agreement, you'll need a confirmation document that verifies the purchase or lease of the electric vehicle. This could be a sales receipt, a lease confirmation letter from the dealership, or a similar document that provides the vehicle's details and the date of acquisition. Ensure that this document matches the information in your lease agreement.

IRS Form 8865: This is a critical form for claiming the tax credit. IRS Form 8865, "Taxable Income and Alternative Minimum Tax—Individuals, Estates, and Trusts," is used to report certain tax benefits, including the electric vehicle tax credit. You'll need to fill out this form accurately, providing details about the vehicle, the lease or purchase, and the tax credit amount. It's essential to have this form ready as it will be required when filing your tax return.

Gathering these documents is the initial step in the process of claiming the federal tax credit. Make sure to keep them organized and easily accessible to ensure a smooth tax filing process. It's always a good idea to double-check the requirements with the IRS or a tax professional to ensure you have all the necessary paperwork in order.

Unlocking EV Savings: A Guide to Claiming Your Subsidy

You may want to see also

Claiming Credit: File IRS Form 1040, Schedule E, and claim the credit on your federal tax return

To claim the federal tax credit for leasing an electric vehicle, you'll need to follow these steps and complete the necessary forms for your tax return. Firstly, ensure you have all the relevant documentation, including the lease agreement and any supporting materials that prove your eligibility for the credit. This information is crucial for accurately reporting your expenses and claiming the credit.

When filing your federal tax return, you'll use IRS Form 1040, which is the primary form for reporting your income and claiming deductions and credits. Schedule E of this form is specifically designed for reporting income and expenses related to business activities, including those related to electric vehicle leasing. Here's how you can proceed:

Step 1: Identify the Credit

The federal tax credit for electric vehicles is typically available for both the purchase and lease of qualified vehicles. You need to identify the specific credit you are eligible for based on your lease agreement. This credit is often a percentage of the lease payment, and it can significantly reduce your tax liability.

Step 2: Complete Schedule E

Schedule E requires you to provide details about your income and expenses related to business activities. For the electric vehicle lease credit, you'll need to fill out the relevant sections, including income and expenses. You'll likely need to provide the lease payment amount, the lease term, and any other relevant details. Ensure you accurately report the credit amount you are claiming.

Step 3: Attach Supporting Documents

Along with Form 1040 and Schedule E, you should attach any supporting documents that verify your lease agreement and the credit claimed. This may include a copy of the lease contract, receipts, or any other evidence that demonstrates your eligibility and the amount of the credit.

Step 4: Calculate and Claim the Credit

Carefully calculate the total credit you are entitled to based on your lease agreement and the IRS guidelines. This calculation ensures you claim the correct amount. Then, transfer the calculated credit amount to the appropriate line on Form 1040, where you report your total credits.

By following these steps and accurately completing the necessary forms, you can successfully claim the federal tax credit for leasing an electric vehicle. It is essential to keep all relevant documentation organized to support your claim and ensure compliance with IRS regulations.

Maximize Your EV Purchase: A Guide to Claiming Tax Credits

You may want to see also

Timing: Claim the credit in the year the lease begins, not when the vehicle is purchased

When it comes to claiming the federal tax credit for leasing an electric vehicle, timing is crucial. Many taxpayers mistakenly believe that the credit should be claimed when the vehicle is purchased, but this is not the case. The key is to understand that the lease begins the year you start using the vehicle, and that's when you can claim the credit.

The Internal Revenue Service (IRS) provides clear guidelines on this matter. According to the IRS, if you lease an electric vehicle, you can claim the credit in the year the lease agreement is signed and you start using the vehicle. This is important because the credit is designed to incentivize the adoption of electric vehicles, and by claiming it in the year of lease commencement, you are effectively supporting the transition to more sustainable transportation.

Here's a step-by-step breakdown of the process: First, ensure you have a valid lease agreement for an electric vehicle. This agreement should outline the terms of the lease, including the start date and the duration. Next, calculate the total lease payments for the year in which the lease begins. These payments are typically made monthly, so you'll need to sum up the monthly amounts for that year. Then, you can claim the credit by adjusting your income tax liability or as a refund, depending on your preference and tax situation.

It's essential to note that the credit amount may vary depending on the vehicle's price and the year it was manufactured. Therefore, it's advisable to consult the IRS guidelines or a tax professional to determine the exact credit amount you are eligible for. By claiming the credit in the year the lease begins, you can take advantage of the incentive promptly and potentially reduce your tax liability.

In summary, claiming the federal tax credit for leasing an electric vehicle is a straightforward process, but it requires careful timing. By starting the lease and claiming the credit in the same year, you can maximize the benefit and contribute to a greener future. Remember to keep all the necessary lease documents and consult the IRS guidelines for the most up-to-date information regarding electric vehicle tax credits.

Unleash Savings: Your Guide to Federal EV Credit Claims

You may want to see also

Frequently asked questions

The federal tax credit for electric vehicle lease is a financial incentive offered by the U.S. government to encourage the adoption of electric vehicles. It allows eligible individuals and businesses to claim a tax credit when leasing or purchasing an electric vehicle, reducing the overall cost of ownership.

To qualify, you must meet certain criteria. Firstly, the vehicle must be new and originally purchased or leased for personal or business use. Secondly, the vehicle should be powered by a battery electric system with a qualified battery weight and range. The specific requirements and eligible vehicle models can be found on the IRS website or by consulting a tax professional.

The process involves several steps. Firstly, ensure you have the necessary documentation, including the vehicle's lease agreement and proof of purchase. Then, file an accurate tax return, claiming the credit on the appropriate form. You may need to provide details about the vehicle's specifications and the lease terms. It is recommended to consult IRS guidelines or seek professional advice to ensure compliance with the latest regulations.