Navigating the tax credit process for electric vehicles can be a complex task, but understanding the steps to report and claim your credit is essential. This guide will provide a comprehensive overview of the reporting process, ensuring you can maximize your benefits and stay compliant with tax regulations. From gathering necessary documentation to understanding the specific requirements, we'll cover everything you need to know to report your electric vehicle tax credit accurately and efficiently.

What You'll Learn

- Eligibility: Determine if you qualify for the EV tax credit based on vehicle type and purchase date

- Documentation: Gather necessary paperwork, including sales receipts and vehicle information, for tax credit claims

- Filing Process: Understand the steps to file for the credit, including forms and deadlines

- Claim Methods: Learn how to claim the credit, either through tax returns or directly with the IRS

- Refund Timeline: Be aware of the typical timeline for receiving the tax credit refund after filing

Eligibility: Determine if you qualify for the EV tax credit based on vehicle type and purchase date

To determine your eligibility for the electric vehicle (EV) tax credit, it's crucial to understand the specific criteria set by the government. The EV tax credit is a financial incentive designed to encourage the purchase of electric cars, and it's important to know if you qualify to take full advantage of this benefit.

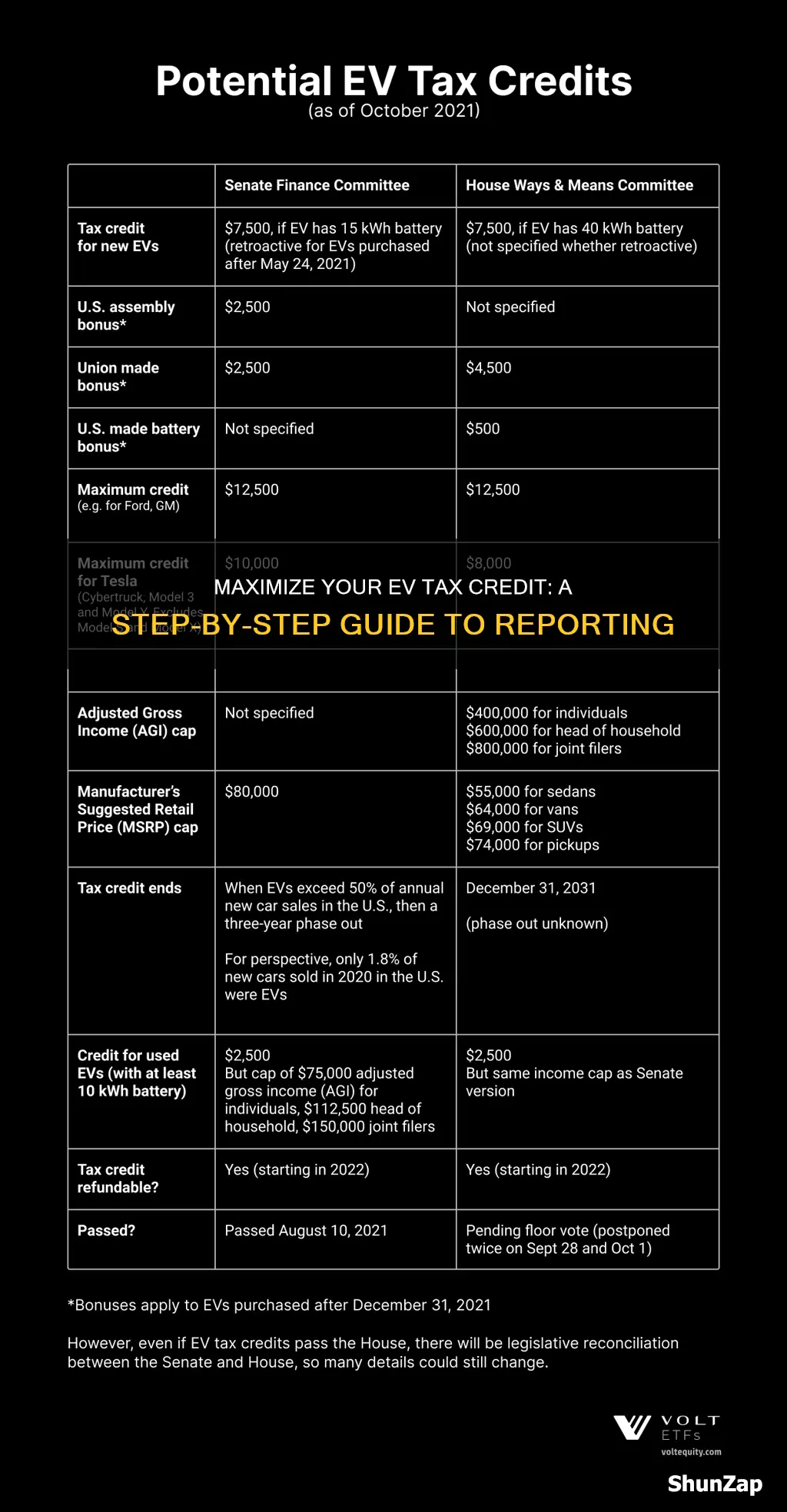

The primary factor in eligibility is the type of vehicle you purchase. The tax credit is available for new electric vehicles, which are typically defined as those with a battery range of at least 40 miles. This includes fully electric cars and plug-in hybrid electric vehicles (PHEVs) that can be driven in all-electric mode for a significant distance. However, it's essential to note that the credit is generally not applicable to traditional hybrid vehicles that primarily rely on a gasoline engine.

Another critical aspect is the purchase date of the vehicle. The EV tax credit is often time-sensitive, and there are specific periods during which you must make the purchase to be eligible. For instance, the credit might be available for vehicles bought within a certain calendar year or a specific period after the legislation was enacted. It's important to check the current regulations to ensure you meet the timing requirements.

Additionally, the credit may have limitations based on the vehicle's manufacturer and the number of vehicles you or your employer have purchased. Some manufacturers may have limits on the number of tax credits they can claim, and there could be restrictions on the total value of the credit based on the vehicle's price. These factors can vary, so it's essential to research the specific rules for the vehicle you intend to buy.

Lastly, keep in mind that eligibility rules can change over time due to updates in legislation or policy shifts. Therefore, it's advisable to consult the latest information provided by the relevant government authorities or seek professional advice to ensure you meet all the current requirements for the EV tax credit.

Firefighting Strategies: Extinguishing EV Fires: A Comprehensive Guide

You may want to see also

Documentation: Gather necessary paperwork, including sales receipts and vehicle information, for tax credit claims

When it comes to claiming tax credits for electric vehicles, proper documentation is crucial. Here's a step-by-step guide on how to gather the necessary paperwork:

Sales Receipts: Start by collecting all the sales receipts related to your electric vehicle purchase. This includes the original invoice or receipt provided by the dealership or seller. Ensure that the document clearly states the vehicle's make, model, and year. Additionally, verify that it includes the purchase date, price, and any applicable taxes. Keep in mind that some dealerships might provide a digital copy of the invoice, so make sure to save all electronic versions as well.

Vehicle Information: Obtaining comprehensive vehicle information is essential. This includes the Vehicle Identification Number (VIN), which is a unique identifier for your car. You can usually find the VIN on the vehicle itself, often near the dashboard or on the engine block. Also, gather any additional documentation that provides details about the vehicle's specifications, such as the manufacturer's statement of origin or a certificate of title. These documents will help confirm the vehicle's eligibility for the tax credit.

Other Supporting Documents: Depending on your specific situation, you might need additional paperwork. For instance, if you purchased the vehicle privately, you may require a bill of sale that includes the vehicle's details and the purchase price. In some cases, a written agreement or contract between the buyer and seller can also serve as proof of purchase. It's important to keep all these documents organized and easily accessible to ensure a smooth tax credit reporting process.

To ensure accuracy and avoid any potential issues during the tax filing process, double-check that all the gathered documents are up-to-date and relevant. Organizing your paperwork by category, such as sales receipts, vehicle information, and supporting documents, can make the process more manageable. This organized approach will enable you to quickly locate the required information when it's time to report your electric vehicle tax credit.

Navigating California's EV Battery Warranty: A Step-by-Step Guide to Filing a Complaint

You may want to see also

Filing Process: Understand the steps to file for the credit, including forms and deadlines

The process of filing for the electric vehicle tax credit involves several key steps to ensure you receive the financial benefit you're entitled to. Here's a breakdown of the filing process:

- Gather Required Information: Before you begin, collect all the necessary documentation and details. This includes proof of purchase or lease of your electric vehicle, such as the sales contract or lease agreement. You'll also need information about the vehicle's make, model, and VIN (Vehicle Identification Number). Additionally, gather your personal financial information, including income details and any other relevant tax-related documents.

- Determine Eligibility: Understand the eligibility criteria for the tax credit. Typically, this credit is available to individuals who purchase or lease new electric vehicles. Research the specific requirements, such as vehicle price limits, income thresholds, and any restrictions on vehicle types or manufacturers. This step ensures you meet all the necessary conditions to claim the credit.

- Complete the Required Forms: The Internal Revenue Service (IRS) provides the necessary forms for claiming the electric vehicle tax credit. The most common form is Form 8936, "Expanded Business Use of Vehicles." This form requires you to provide detailed information about your vehicle purchase or lease, including the vehicle's value, purchase or lease date, and the percentage of business use. Carefully fill out the form, ensuring accuracy and completeness.

- File Your Tax Return: Include Form 8936 with your annual tax return. You can file electronically or by mail, depending on your preference and the IRS's instructions for the tax year in question. Make sure to meet the filing deadlines to avoid any penalties or delays in receiving your credit.

- Deadlines and Timing: The IRS sets specific deadlines for filing tax returns and claiming credits. It's crucial to be aware of these dates to ensure timely submission. Typically, the deadline for filing federal tax returns is April 15 (or the next business day if it falls on a weekend or holiday). However, the exact deadlines may vary depending on your tax situation and the tax year in question. Stay updated with the IRS's guidelines to avoid missing out on your credit.

- Keep Records: Maintain a record of all the documents and forms you submit. This includes copies of the completed forms, supporting documentation, and any correspondence with the IRS. Proper record-keeping is essential for future reference and in case of any audits or inquiries.

Remember, the filing process may vary slightly depending on your specific circumstances and the tax year. Always refer to the IRS's official guidelines and resources for the most accurate and up-to-date information regarding the electric vehicle tax credit and the filing process.

Electric Vehicle Decision: Factors to Consider for Your Next Car

You may want to see also

Claim Methods: Learn how to claim the credit, either through tax returns or directly with the IRS

To claim the electric vehicle tax credit, you have two main options: filing your taxes or directly contacting the IRS. Here's a breakdown of each method:

Filing Your Taxes:

The most common approach is to claim the credit when you file your annual tax return. Here's a step-by-step guide:

- Gather Information: Collect all relevant documents related to your electric vehicle purchase, including the sales invoice, bill of sale, and any additional paperwork provided by the dealership or manufacturer.

- Identify the Credit Amount: Determine the specific credit amount you qualify for based on the vehicle's battery capacity and purchase price. The IRS provides detailed guidelines on their website, outlining the credit limits and eligible vehicle types.

- Complete Form 8936: This is the form specifically designed for reporting the electric vehicle tax credit. You'll need to provide information about the vehicle, including its make, model, year, and purchase date. Carefully follow the instructions on the form to ensure accurate reporting.

- Include Form 8936 with Your Tax Return: When you file your tax return, attach Form 8936 to your 1040 or 1040-SR form. Double-check all the information to avoid errors that could lead to delays or penalties.

Directly with the IRS:

If you prefer a more direct approach, you can contact the IRS directly to claim your credit. Here's how:

- Contact the IRS: Reach out to the IRS through their official channels, such as phone or online chat. Be prepared to provide detailed information about your electric vehicle purchase and the credit amount you're claiming.

- Follow IRS Instructions: The IRS will guide you through the process and may require you to complete additional forms or provide supporting documentation. Follow their instructions carefully to ensure a smooth process.

- Receive Credit Refund (if applicable): If you've already paid taxes on the credit amount, the IRS will process a refund to cover the difference. If you haven't paid taxes on the credit, they will adjust your tax liability accordingly.

Remember, it's crucial to keep accurate records and follow the IRS guidelines to ensure a successful claim. Whether you choose to file your taxes or contact the IRS directly, proper documentation and adherence to instructions are key to receiving your electric vehicle tax credit.

Boosting Electric Vehicle Performance: Tips for Efficiency and Range

You may want to see also

Refund Timeline: Be aware of the typical timeline for receiving the tax credit refund after filing

When it comes to reporting your electric vehicle (EV) tax credit, understanding the refund timeline is crucial to ensure you receive the financial benefit you're entitled to. Here's a detailed guide on what to expect:

Understanding the Process:

The EV tax credit is a significant incentive for purchasing electric vehicles, and the reporting process involves a few key steps. After purchasing your EV, you'll need to file the necessary forms with the tax authorities. This typically includes providing details about the vehicle, the purchase price, and any applicable discounts or credits. The refund process then begins, and it's essential to be aware of the typical timeline.

Refund Processing Time:

The Internal Revenue Service (IRS) has a standard processing time for tax credit refunds. After submitting your return, it can take several weeks for the IRS to review and process your claim. On average, it may take around 4-6 weeks for the refund to be issued once your return is accepted. However, this timeline can vary depending on various factors, including the complexity of your return and the IRS's current workload.

Potential Delays:

It's important to note that there can be delays in the refund process. If your return requires additional review or verification, the IRS may take longer to process it. In some cases, the IRS might request further documentation or clarification, which can extend the timeline. Additionally, filing during peak tax seasons or with certain tax preparation methods might also impact the processing time.

Stay Informed:

To ensure a smooth process, consider the following:

- Keep all relevant documents related to your EV purchase and tax filing.

- Stay updated with the IRS's guidelines and any changes to the tax credit regulations.

- If you have any doubts or concerns, contact the IRS or seek professional tax advice to ensure your return is filed correctly and promptly.

The refund timeline for the EV tax credit is an essential aspect of the reporting process. By understanding the typical processing time and potential delays, you can better prepare and manage your expectations. Being proactive and staying informed will help you navigate the tax credit system effectively and ensure you receive your well-deserved refund.

Mastering Battery Module Design: A Guide to Electric Vehicle Power

You may want to see also

Frequently asked questions

To be eligible for the EV tax credit, you must purchase or lease a new electric vehicle that meets the IRS's criteria for plug-in electric vehicles. This includes vehicles that can be powered by a battery or fuel cell and have a minimum range of 40 miles. The vehicle must also be acquired and used primarily for personal use.

The process typically involves the following steps: First, ensure you have all the necessary documentation, including the vehicle's purchase or lease agreement, bill of sale, and any additional paperwork required by the IRS. Then, file your federal income tax return, where you can claim the credit as a deduction. You can use Form 8936, "Qualified Electric Vehicle Tax Credit," to report the credit and provide details about your EV purchase.

Yes, there are income limits to ensure the credit is directed towards those who may need it the most. For the 2023 tax year, the credit is generally available to individuals with modified adjusted gross income (MAGI) of $150,000 or less for single filers and $300,000 or less for joint filers. However, there are phase-out rules, and the credit amount may be reduced or eliminated for those above these income thresholds.

Yes, the EV tax credit is an above-the-line credit, which means you can claim it even if you don't itemize your deductions. It is designed to provide a direct benefit to taxpayers, and you can claim it on your original tax return without the need for itemization.