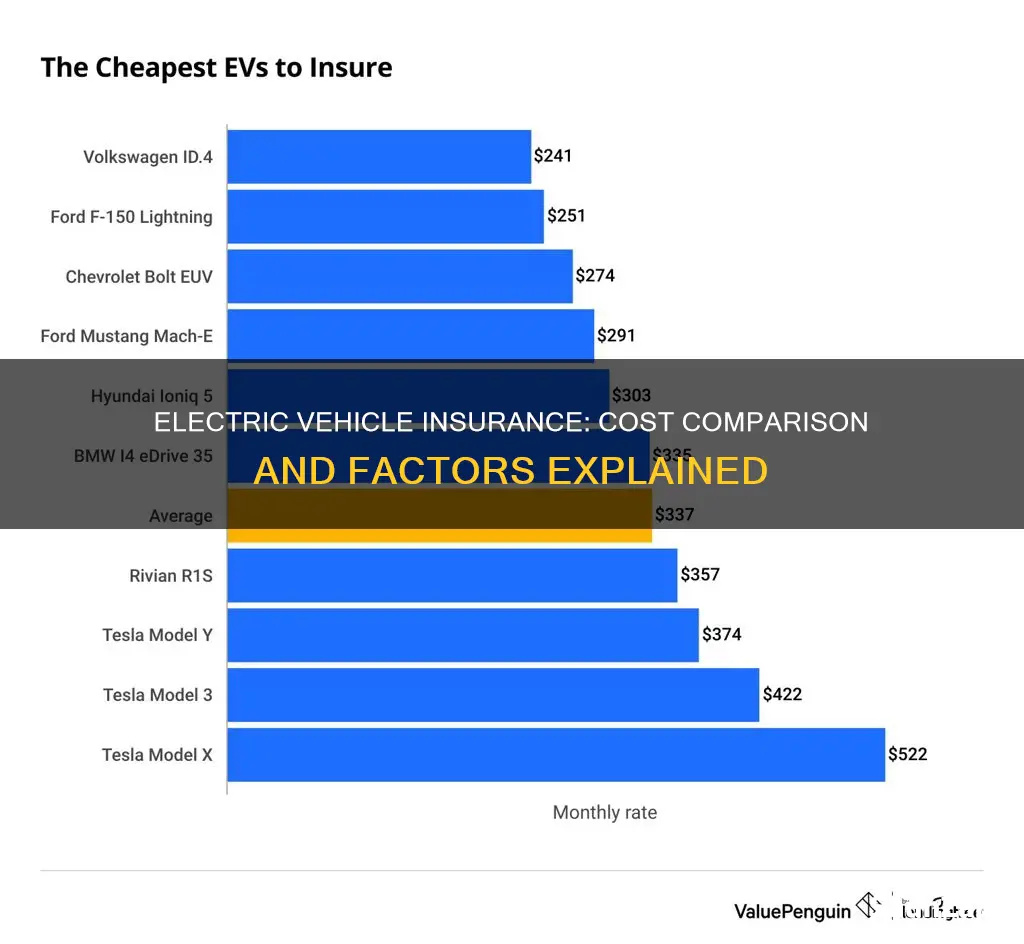

The rising popularity of electric vehicles (EVs) has sparked curiosity about their insurance costs. As the automotive industry embraces sustainability, many wonder if insuring an electric car is more expensive than its traditional counterparts. This question is crucial for EV owners and potential buyers alike, as insurance rates can significantly impact ownership expenses. Understanding the factors that influence these rates is essential to making informed decisions in the evolving world of transportation.

Is It More Expensive to Insure an Electric Vehicle?

| Characteristics | Values |

|---|---|

| Type of Vehicle | Electric vehicles (EVs) are generally considered more expensive to insure compared to traditional gasoline or diesel cars. |

| Age and Model | The insurance cost can vary based on the age and model of the EV. Older models might be cheaper to insure, while newer, more advanced models with higher performance and technology may have higher insurance premiums. |

| Usage and Mileage | Insurance rates often depend on how the vehicle is used. EVs used for daily commuting and frequent short trips might be pricier to insure due to potential wear and tear and higher replacement costs. |

| Battery and Range | The size and capacity of the EV's battery can impact insurance rates. Larger batteries and longer ranges might increase costs due to potential risks associated with battery degradation and replacement. |

| Location and Market Demand | Insurance rates can vary by region and market demand. Areas with a higher concentration of EVs may have different pricing due to increased competition and potential risks. |

| Driver Profile | Age, driving experience, and driving record of the policyholder play a significant role. Younger, less experienced drivers might face higher premiums, while a clean driving record can lead to lower insurance costs. |

| Coverage Options | Different insurance providers offer various coverage options, including comprehensive, collision, and liability coverage. Customizing the policy to include specific EV-related coverage (e.g., battery damage) can affect the overall cost. |

| Safety Features | EVs equipped with advanced safety features like lane-keeping assist, automatic emergency braking, and advanced driver-assistance systems (ADAS) may have lower insurance rates due to reduced accident risks. |

| Deductibles and Discounts | Higher deductibles can lower monthly premiums, but it increases the out-of-pocket cost in case of an accident. Additionally, some insurance companies offer discounts for EV owners, such as loyalty discounts or eco-friendly driving incentives. |

| Market Trends | The insurance market for EVs is evolving, and rates may fluctuate based on technological advancements, government incentives, and changing consumer preferences. |

What You'll Learn

- Battery Cost: Higher battery costs can lead to increased insurance premiums for electric vehicles

- Performance and Safety: EVs with advanced safety features may have lower insurance rates

- Maintenance and Repairs: Reduced maintenance needs can result in lower insurance costs

- Age and Usage: Older or less-used EVs might have different insurance pricing

- Market Demand: High demand for EVs can influence insurance rates

Battery Cost: Higher battery costs can lead to increased insurance premiums for electric vehicles

The cost of insurance for electric vehicles (EVs) is a topic of growing interest as the popularity of EVs continues to rise. One significant factor that influences insurance premiums for these vehicles is the battery cost. Electric cars rely on advanced battery technology to store and supply power, and the price of these batteries can vary widely.

Higher battery costs are a direct result of the advanced technology and materials used in EV batteries. These batteries often contain lithium-ion cells, which are expensive to manufacture and purchase. The complexity of the battery system, including its size, weight, and the number of cells, also contributes to the overall cost. As a result, EVs typically have a higher upfront cost compared to their conventional counterparts.

Insurance companies take into account the value and replacement cost of the vehicle when determining premiums. Since electric vehicles have expensive batteries, the potential financial loss in case of a total loss or significant damage is higher. This increased risk is reflected in the insurance rates, which are often more expensive for EVs. The higher battery cost directly correlates to a higher insurance premium, as insurers need to account for the potential repair or replacement expenses.

Additionally, the advanced technology in EV batteries can make them more susceptible to certain risks. For instance, lithium-ion batteries can be sensitive to extreme temperatures and may pose a fire hazard if damaged. Insurers might consider these factors when setting premiums, as they aim to manage the risk effectively. As a result, drivers of electric vehicles may find themselves with higher insurance costs compared to those of traditional cars.

In summary, the higher battery costs of electric vehicles are a significant contributor to the increased insurance premiums. This relationship is a result of the advanced technology, higher replacement costs, and potential risks associated with EV batteries. As the automotive industry continues to evolve, understanding these factors is essential for both consumers and insurers when considering the financial implications of owning and insuring an electric vehicle.

Green Revolution: Strategies to Boost Electric Vehicle Adoption

You may want to see also

Performance and Safety: EVs with advanced safety features may have lower insurance rates

The relationship between electric vehicles (EVs) and insurance costs is an intriguing one, and it's worth exploring how certain features of EVs can impact insurance premiums. One significant factor that can influence insurance rates for EVs is their performance and safety capabilities, particularly those related to advanced safety features.

EVs equipped with advanced safety systems often have lower insurance rates due to their enhanced safety performance. These safety features can include advanced driver-assistance systems (ADAS), such as lane-keeping assist, adaptive cruise control, automatic emergency braking, and blind-spot monitoring. These technologies are designed to assist drivers in maintaining control of their vehicles, avoid collisions, and mitigate the severity of accidents. By incorporating these advanced safety features, EV manufacturers aim to reduce the risk of accidents and improve overall road safety.

Insurance companies often consider the safety ratings and crash-test results of vehicles when determining insurance rates. EVs with advanced safety features that have achieved high safety ratings from reputable organizations like the National Highway Traffic Safety Administration (NHTSA) or the Insurance Institute for Highway Safety (IIHS) may be considered lower-risk vehicles. Lower-risk vehicles typically result in lower insurance premiums because they are less likely to be involved in accidents, and when accidents do occur, the damage and injuries are often less severe.

Additionally, some insurance providers offer discounts or incentives for EVs with advanced safety features. These discounts can further reduce the overall insurance cost for EV owners. For example, a company might provide a discount for vehicles equipped with a specific set of safety technologies, recognizing the reduced risk associated with these features.

In summary, the integration of advanced safety features in EVs plays a crucial role in determining insurance rates. These features not only enhance the driving experience but also contribute to a safer environment on the road. As a result, insurance companies may offer more competitive rates for EVs with advanced safety systems, making them an attractive option for drivers who prioritize both performance and safety. This trend is likely to continue as the automotive industry focuses on developing and implementing innovative safety technologies in electric vehicles.

Green Revolution: Unveiling the Environmental Impact of Electric Vehicles

You may want to see also

Maintenance and Repairs: Reduced maintenance needs can result in lower insurance costs

The maintenance and repair costs associated with electric vehicles (EVs) are often a significant factor in determining their insurance premiums. One of the most compelling reasons why insuring an electric vehicle might be more affordable is the reduced maintenance requirements compared to traditional internal combustion engine (ICE) cars.

EVs have fewer moving parts, which means they are less prone to mechanical failures and breakdowns. For instance, electric motors, while complex, do not have the same wear-and-tear issues as the countless components in a gasoline engine. This simplicity translates to lower maintenance costs for owners. Routine services like oil changes, spark plug replacements, and engine tune-ups are no longer necessary, saving both time and money. As a result, insurance companies may view EVs as lower-risk vehicles when it comes to maintenance-related claims, potentially leading to more competitive insurance rates.

The reduced maintenance needs of EVs also mean that insurance companies may offer lower premiums because they anticipate fewer claims related to mechanical failures. This is a significant advantage for EV owners, as it can result in substantial savings over the lifetime of the vehicle. With fewer trips to the mechanic, the overall cost of ownership, including insurance, can be more manageable.

Additionally, the advanced technology in EVs often allows for more accurate diagnostics and remote monitoring. This capability enables early detection of potential issues, which can further reduce the likelihood of major breakdowns. As a result, insurance providers might offer more favorable rates, knowing that the vehicle's advanced systems can help prevent costly repairs.

In summary, the reduced maintenance and repair requirements of electric vehicles contribute to lower insurance costs. This is a significant advantage for EV owners, as it aligns with the overall trend of EVs being more cost-effective in the long run. With the potential for substantial savings on insurance premiums, the financial benefits of owning an electric vehicle extend beyond just the fuel economy and environmental impact.

Electric Revolution: Unlocking the Future of Sustainable Mobility

You may want to see also

Age and Usage: Older or less-used EVs might have different insurance pricing

The age and usage of an electric vehicle (EV) can significantly impact its insurance costs. Insurers often consider these factors when determining premiums, as they provide insights into the vehicle's potential risks and value. Here's a breakdown of how age and usage influence EV insurance pricing:

Age of the Vehicle:

Older electric cars may face higher insurance premiums. As with traditional vehicles, age is a critical factor. Newer EVs often come with advanced safety features, advanced driver-assistance systems (ADAS), and cutting-edge technology, making them less prone to certain risks. Insurers might offer lower rates for newer models due to their perceived lower accident rates and reduced repair costs. On the other hand, older EVs may have a higher risk of mechanical failures, accidents, or component obsolescence, leading to increased insurance costs. Additionally, older vehicles might have a higher resale value, which can influence the premium, as insurers consider the potential for a higher return on investment if the car needs to be replaced.

Usage and Mileage:

The frequency and distance traveled in an EV also play a role in insurance pricing. Insurers often categorize vehicles into usage-based tiers. For instance, a car that is primarily used for short daily commutes and has low mileage might be considered less risky than one used for long-distance travel or frequently rented. Lower mileage and usage can result in lower insurance premiums, as the vehicle is less likely to be involved in accidents or require frequent repairs. Conversely, high-mileage EVs or those used intensively might face higher insurance rates due to the increased potential for wear and tear, accidents, or battery degradation.

Depreciation and Resale Value:

The rate of depreciation for electric vehicles can also impact insurance costs. EVs, especially those with longer battery warranties, may have lower depreciation rates compared to traditional cars. This can result in more stable insurance premiums over time. However, for older EVs, depreciation can be a concern, and insurers might adjust premiums accordingly. Additionally, the resale value of an EV can affect insurance pricing. If a specific model is in high demand or has a strong resale market, insurers might offer more competitive rates, considering the vehicle's potential future value.

In summary, when considering insurance for an electric vehicle, age, usage, and mileage are essential factors. Older or less-used EVs may benefit from lower premiums due to reduced risk, while newer or more frequently used vehicles might face higher costs. Insurers aim to balance the potential risks and benefits associated with different vehicle profiles, ensuring that the insurance pricing reflects the true value and characteristics of the electric car in question.

Sparking Safety: A Guide to Electrical Fire Hazards in Cars

You may want to see also

Market Demand: High demand for EVs can influence insurance rates

The market demand for electric vehicles (EVs) has been steadily rising, driven by environmental concerns, government incentives, and technological advancements. As more consumers embrace EVs, the insurance industry is taking note, and this shift in demand can significantly impact insurance rates.

When the demand for a product or service increases, insurance companies often adjust their pricing strategies. In the case of EVs, the growing popularity has led to a higher number of vehicles on the road, which, in turn, increases the risk for insurers. With more EVs, the potential for accidents and claims rises, and insurance providers need to account for this increased risk in their pricing models. As a result, we may see higher insurance premiums for EV owners to cover the potential costs of repairs, replacements, and liability claims.

The high demand for EVs can also lead to a more competitive market for insurance. Insurance companies might offer various policies and packages tailored to EV owners, providing additional coverage options and potentially lower rates to attract and retain customers. This competition can benefit consumers, as it encourages insurers to innovate and provide more comprehensive and cost-effective solutions.

Furthermore, the insurance industry's response to the growing EV market may also include enhanced risk assessment and management strategies. Insurers might invest in advanced data analytics to better understand the risks associated with EVs, such as battery-related issues or the impact of charging infrastructure. By improving risk assessment, insurance companies can more accurately price policies, ensuring that rates reflect the specific risks of insuring electric vehicles.

In summary, the high demand for EVs in the market can directly influence insurance rates. As the popularity of electric vehicles continues to rise, insurance providers will need to adapt their pricing strategies to manage the increased risk. This shift in the market may lead to both higher and more specialized insurance options for EV owners, ultimately shaping the insurance landscape for this rapidly growing segment of the automotive industry.

Hertz's Electric Vehicle Revolution: A Green Car Future

You may want to see also

Frequently asked questions

Not necessarily. While it's a common misconception that EVs are pricier to insure, several factors influence insurance costs, and EVs can be just as affordable or even cheaper to insure in some cases. The insurance rate for an EV depends on various factors, including the vehicle's make and model, its value, the driver's profile, and the insurance company's policies.

Several elements can impact the insurance premium for an electric vehicle. Firstly, the vehicle's value and depreciation rate play a significant role. EVs, especially those with advanced technology and high-end features, might have higher repair costs, which can reflect in the insurance rates. Additionally, the driver's age, driving experience, and location can influence premiums. Some insurance companies also consider the charging infrastructure and the vehicle's range when setting rates.

Yes, many insurance providers offer discounts for electric vehicles. These discounts can be based on factors such as the car's safety features, the driver's safe driving record, or the use of smart charging systems. Some companies also provide incentives for eco-friendly vehicles. It's advisable to compare quotes from different insurers to find the best rates and available discounts for your EV.

While EVs have many advantages, there might be certain considerations for insurers. For instance, the risk of battery-related issues or the potential for technological failures could impact insurance claims. However, as the technology advances and more data becomes available, insurance companies are adapting their policies to cover these specific risks. It's essential to review the policy details and understand the coverage provided for your electric vehicle.