Electric vehicles (EVs) are becoming increasingly popular, and many governments are offering incentives to encourage their adoption. One such incentive is the tax credit, which can significantly reduce the cost of purchasing an EV. However, not all electric vehicles qualify for this tax credit. The eligibility criteria can vary depending on the country and region, as well as the specific model of the vehicle. This article aims to provide an overview of the factors that determine which electric vehicles are eligible for tax credits, helping consumers make informed decisions when considering an EV purchase.

What You'll Learn

- Eligibility Criteria: Income limits, vehicle type, and purchase price caps

- Tax Credit Amounts: Varies by vehicle type, range, and manufacturer

- Application Process: Steps to claim the credit, including documentation

- Timing and Deadlines: When to apply, renew, and potential expiration dates

- State Incentives: Additional state-level tax credits or rebates

Eligibility Criteria: Income limits, vehicle type, and purchase price caps

The availability of tax credits for electric vehicles (EVs) is a significant incentive for potential buyers, but understanding the eligibility criteria is crucial to ensure you qualify for this benefit. Here's a breakdown of the key factors to consider:

Income Limits: Tax credits for EVs often come with income restrictions to ensure the benefit reaches those who may need it most. These limits can vary depending on the country and specific program. For instance, in the United States, the Internal Revenue Service (IRS) sets income thresholds for the Clean Vehicle Credit. As of 2023, individuals with adjusted gross income (AGI) below $150,000 and married couples filing jointly with AGI below $300,000 are eligible for the full credit. Above these limits, the credit gradually phases out. It's important to note that these income thresholds may change annually, so staying updated is essential.

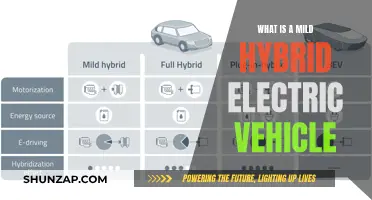

Vehicle Type: Not all electric vehicles are created equal, and the tax credit may favor certain types. Typically, the credit is available for all-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). BEVs are fully electric and run exclusively on electricity, while PHEVs can switch between electric and gasoline power. However, there might be specific requirements regarding the vehicle's range, battery capacity, or other technical specifications. For instance, the IRS's Clean Vehicle Credit in the US requires the vehicle to have a battery capacity of at least 4 kWh and a range of at least 100 miles for BEVs, and a combined fuel economy of at least 50 mpg-e (miles per gallon equivalent) for PHEVs.

Purchase Price Caps: One of the most critical aspects of qualifying for the tax credit is the vehicle's purchase price. Governments often set a maximum price limit to ensure the credit is accessible to a broader range of buyers. In the US, the Clean Vehicle Credit has a price cap of $80,000 for individuals and $160,000 for married couples filing jointly. Vehicles above these price points may still be eligible, but the credit amount will be reduced proportionally. This cap is adjusted annually for inflation, so it's worth checking the current year's criteria.

Additionally, some programs might have separate price caps for different vehicle categories. For instance, certain models may have a higher price limit for BEVs compared to PHEVs. It's essential to research the specific requirements of the tax credit you are interested in to understand these nuances.

In summary, eligibility for EV tax credits involves meeting income thresholds, owning a qualifying vehicle type, and purchasing a vehicle within a specified price range. These criteria ensure that the financial incentive is accessible to a diverse range of buyers, promoting the adoption of electric transportation. Always refer to official government sources and guidelines for the most accurate and up-to-date information regarding EV tax credits in your region.

Electric Convenience: Your Guide to Flying with Style

You may want to see also

Tax Credit Amounts: Varies by vehicle type, range, and manufacturer

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to go green and is a crucial factor in the growing popularity of EVs. However, it's important to note that the tax credit amount varies depending on several factors, including the vehicle type, its range, and the manufacturer. This variability ensures that the credit system remains dynamic and adaptable to the evolving EV market.

For plug-in hybrid electric vehicles (PHEVs), the tax credit is generally lower compared to all-electric vehicles. PHEVs, which combine a traditional internal combustion engine with an electric motor, typically qualify for a credit of up to $7,500. This credit is designed to encourage the adoption of more efficient and environmentally friendly hybrid technology.

All-electric vehicles, on the other hand, are eligible for a higher tax credit, which can reach up to $7,500. The credit amount is directly tied to the vehicle's range, with longer-range EVs attracting a higher credit. For instance, EVs with a range of 100 miles or more may qualify for the full $7,500 credit. This incentivizes manufacturers to produce vehicles with improved range, making EVs more practical for long-distance travel.

Additionally, the tax credit system considers the manufacturer's impact. Some EV manufacturers may offer additional incentives or discounts, which can further reduce the cost of purchasing an EV. These manufacturer-specific offers can vary widely, so it's essential for potential buyers to research and compare these additional benefits.

Understanding these variations in tax credit amounts is crucial for consumers looking to purchase an EV. By considering the vehicle type, range, and manufacturer, buyers can make informed decisions and take full advantage of the available tax credits. This knowledge empowers individuals to choose the most suitable EV for their needs while also benefiting from the financial incentives provided by the government.

Lacerte EV Credit: A Guide to Inputting Your Electric Vehicle Tax Credit

You may want to see also

Application Process: Steps to claim the credit, including documentation

The process of claiming the federal tax credit for electric vehicles (EVs) involves several steps, ensuring that you provide the necessary documentation to support your claim. Here's a detailed guide on how to navigate this process:

Step 1: Determine Your Eligibility

Before diving into the application, understand that not all electric vehicles qualify for the tax credit. The Internal Revenue Service (IRS) has specific criteria for EV models that can be claimed. Research and identify the make and model of your vehicle to ensure it meets the requirements. You can find this information on the IRS website or through reliable automotive sources.

Step 2: Gather Required Documents

The key to a successful application is having the right documents ready. Here's a list of what you'll typically need:

- Sales or Lease Agreement: This should include the vehicle's make, model, year, and purchase or lease date.

- Vehicle Identification Number (VIN): A unique identifier for your car, usually found on the dashboard or title.

- Proof of Ownership: This could be a vehicle title, registration documents, or a letter from the dealership confirming your ownership.

- Purchase or Lease Receipt: A detailed receipt showing the price, any applicable fees, and the date of purchase or lease.

- Additional Documentation: Depending on your purchase method, you might need dealer certifications, warranty information, or other relevant papers.

Step 3: Complete the Tax Credit Form

The IRS provides Form 8936, "Qualified Plug-In Electric Vehicle Credit," which you need to fill out. This form requires details about the vehicle, purchase/lease information, and your personal data. Ensure accuracy and completeness when filling it out. You can find this form on the IRS website or through your tax professional.

Step 4: File Your Tax Return

Submit your completed tax credit form along with your annual tax return. This can be done electronically or through paper filing. If you're e-filing, ensure you use the correct forms and software to claim the credit. For paper filing, send the form and all supporting documents to the IRS address specified for tax returns.

Step 5: Keep Records and Follow Up

Maintain copies of all documents related to your EV purchase and the tax credit application. This includes the sales agreement, receipt, and any correspondence with the IRS. If you encounter any issues or have questions, contact the IRS or seek assistance from a tax advisor to ensure your application is processed smoothly.

Remember, the EV tax credit is a valuable incentive, so it's essential to follow the application process carefully. By gathering the necessary documentation and completing the required forms accurately, you can successfully claim this credit and potentially save on your tax liability.

The Cost of Green: Industry Insights on EV Production

You may want to see also

Timing and Deadlines: When to apply, renew, and potential expiration dates

The timing of your application is crucial when it comes to electric vehicle (EV) tax credits. These incentives are often time-sensitive, and understanding the deadlines can help you make the most of the benefits. Here's a breakdown of when and how to approach the process:

Application Process:

- Research and Planning: Start by researching the specific EV models that qualify for the tax credit. This information is typically available on government websites or through vehicle manufacturers. Identify the criteria and ensure your vehicle meets all the requirements.

- Eligibility Check: Verify your eligibility for the tax credit. This may include factors like residency, income, and vehicle purchase or lease details. Keep all necessary documentation ready to streamline the application process.

- Application Submission: The application process usually involves filling out forms and providing supporting documents. This can often be done online or through designated portals. Ensure you submit your application well in advance of the deadline to avoid any last-minute issues.

Renewal and Annual Considerations:

- Annual Review: Some EV tax credits may require an annual review or renewal process. This is especially true for credits that are tied to vehicle usage or performance. Keep track of any annual requirements and ensure you meet the criteria to continue receiving the credit.

- Documentation: Gather and maintain all relevant documents related to your EV purchase or lease. This includes sales invoices, registration papers, and any other paperwork that supports your eligibility.

Expiration Dates and Updates:

- Credit Expiration: Be aware of the expiration dates for different EV tax credits. These dates can vary, and some credits may have a limited duration. Stay informed about any changes or extensions to these deadlines.

- Legislative Updates: Tax credit programs can be subject to changes in legislation. Keep yourself updated with the latest information from government sources. Subscribe to relevant newsletters or follow official channels to ensure you don't miss any important updates regarding EV incentives.

Tips for Success:

- Start Early: Begin your application process well before the deadline. This allows for any potential delays or additional research.

- Keep Records: Maintain a record of all your EV-related documents, including purchase/lease agreements, maintenance records, and any correspondence with manufacturers or government agencies.

- Stay Informed: Regularly check for updates on EV tax credits and related policies. Being proactive ensures you take advantage of the latest incentives and stay compliant with any changing regulations.

The Electric Revolution: Autonomous Vehicles and Their Green Future

You may want to see also

State Incentives: Additional state-level tax credits or rebates

State incentives play a crucial role in promoting the adoption of electric vehicles (EVs) and can significantly impact the financial benefits of owning an EV. Many states in the United States offer additional tax credits or rebates to encourage residents to make the switch to electric mobility. These state-level incentives often complement federal tax credits, providing a more comprehensive financial boost for EV buyers.

The availability and specifics of state incentives vary widely, so it's essential to research the programs in your state. Some states offer tax credits that directly reduce the purchase price of an EV, while others provide rebates that reimburse buyers for a portion of the cost after the purchase. For instance, California's Clean Vehicle Rebate Project offers rebates of up to $5,000 for the purchase or lease of new electric cars, helping to offset the higher upfront costs often associated with EVs. Similarly, New York's EV Tax Credit provides a credit of up to $2,000 for the purchase or lease of an electric vehicle, making it more affordable for residents.

State incentives can be particularly beneficial for those who are considering purchasing an EV but are concerned about the initial financial burden. By offering additional tax credits or rebates, states aim to make EVs more accessible and affordable, thereby encouraging a faster transition to cleaner transportation options. These incentives can also stimulate the local economy by supporting EV manufacturers and related industries.

When considering the purchase of an EV, it's advisable to check with your state's government or relevant environmental agencies to understand the specific incentives available. Many states provide detailed information on their websites, outlining the eligibility criteria and application processes for these incentives. This ensures that potential EV buyers can make informed decisions and take advantage of the financial benefits offered by their state.

In summary, state-level tax credits and rebates are essential components of the overall financial package for EV buyers. They provide additional support beyond federal incentives, making EVs more attractive and affordable. By researching and utilizing these state-specific programs, individuals can maximize their savings and contribute to a greener future.

Unlocking Electric Vehicle Leasing Secrets: Tips for Extreme Savings

You may want to see also

Frequently asked questions

The federal tax credit for electric vehicles, also known as the Clean Vehicle Credit, is a financial incentive offered by the U.S. government to promote the adoption of electric cars and trucks. This credit allows eligible taxpayers to claim a percentage of the vehicle's price as a tax refund, which can significantly reduce the overall cost of purchasing an electric vehicle.

To qualify for the tax credit, the electric vehicle must meet certain criteria. Firstly, it should be a new or used vehicle that is primarily powered by a battery. Secondly, the vehicle must be purchased or leased from a dealership or manufacturer that participates in the program. Additionally, the vehicle's final assembly must take place in North America, and it should comply with the Environmental Protection Agency's (EPA) emissions standards.

Yes, there are income limits to ensure that the tax credit benefits lower- and middle-income families. For the 2023 tax year, the credit is available to individuals with adjusted gross income (AGI) of up to $150,000 for single filers and $300,000 for joint filers. However, the credit amount is phased out for income above these thresholds. The phase-out begins at $140,000 for single filers and $280,000 for joint filers, with a complete elimination of the credit at $200,000 for single filers and $400,000 for joint filers.