Many governments around the world are encouraging the adoption of electric vehicles (EVs) to reduce carbon emissions and promote sustainable transportation. As a result, various tax incentives and benefits have been introduced to make electric vehicles more affordable and attractive to consumers. One such incentive is the tax benefit for leasing an electric vehicle. This paragraph will explore the potential tax advantages associated with leasing an electric vehicle, examining how this financial strategy can help individuals and businesses save on costs while contributing to a greener future.

What You'll Learn

- Lease Incentives: Tax benefits for EV lease agreements, often lower than buying

- Environmental Credits: Governments offer tax credits for eco-friendly vehicle choices

- EV Lease Programs: Some manufacturers provide lease deals with tax incentives

- Lease-to-Own Options: Tax breaks for transitioning to electric vehicles through lease-to-own programs

- Lease Tax Deductions: Tax deductions for lease payments on electric cars

Lease Incentives: Tax benefits for EV lease agreements, often lower than buying

Leasing an electric vehicle (EV) can offer significant tax advantages, often making it a more financially attractive option compared to purchasing. Many governments and local authorities worldwide have introduced incentives to encourage the adoption of electric vehicles, recognizing their environmental benefits. These incentives can provide substantial tax benefits for EV lease agreements, making the overall cost of leasing an EV lower than buying one outright.

One of the primary tax incentives for leasing EVs is the ability to claim lease payments as a business expense. For individuals who lease EVs for personal use, this may not be applicable, but for businesses, it can be a substantial benefit. Companies can deduct the lease payments as a business expense, reducing their taxable income and, consequently, their tax liability. This is particularly advantageous for businesses with a high tax rate, as it can lead to significant savings.

Additionally, some governments offer tax credits or rebates specifically for EV lease agreements. These incentives can vary by region and are often designed to promote the use of electric vehicles. For example, in certain countries, leasees may be eligible for a tax credit that directly reduces their taxable income, providing an immediate financial benefit. These credits can be especially valuable for individuals or businesses looking to minimize their tax burden.

The tax benefits of leasing an EV can also extend to other associated costs. For instance, lease agreements often include maintenance and insurance, which can be claimed as business expenses for companies. This comprehensive approach to tax incentives ensures that the overall cost of leasing an EV is more competitive compared to buying, making it an appealing choice for many.

In summary, leasing an electric vehicle can provide substantial tax advantages, including business expense deductions and specific tax credits or rebates. These incentives make leasing an EV a financially viable option, often with lower overall costs than buying, especially for businesses and individuals looking to optimize their tax liabilities. It is essential to research and understand the specific tax laws and incentives in your region to fully utilize these benefits.

Jeep's Electric Revolution: Rumors of a Green Future

You may want to see also

Environmental Credits: Governments offer tax credits for eco-friendly vehicle choices

Environmental credits and tax incentives are powerful tools that governments employ to encourage the adoption of eco-friendly vehicles, particularly electric cars. These incentives are designed to reduce the financial burden associated with purchasing or leasing electric vehicles (EVs), making them more accessible and attractive to consumers. The primary goal is to accelerate the transition to a greener transportation system by providing financial benefits to those who choose environmentally conscious options.

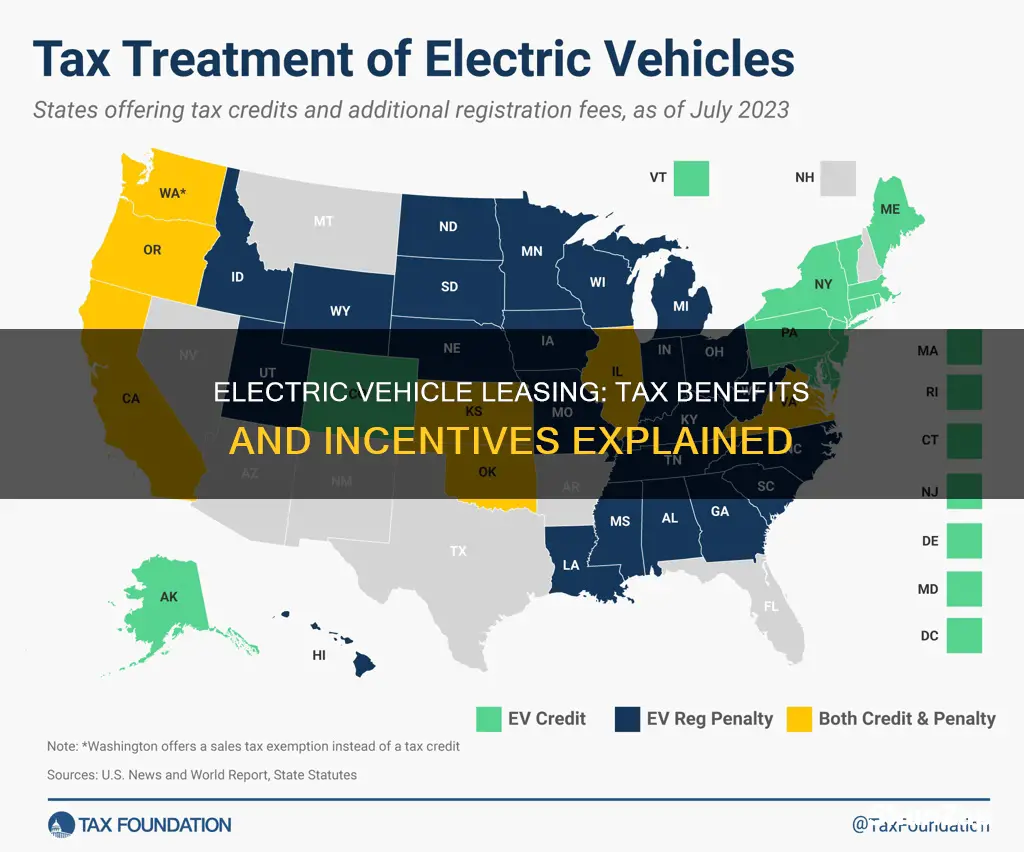

Many countries and regions have implemented tax credit programs specifically targeted at electric vehicle leasing. For instance, in the United States, the Internal Revenue Code offers a credit for qualified plug-in electric vehicles, which includes both purchases and leases. This credit can significantly reduce the overall cost of leasing an EV, making it a more viable option for those seeking an environmentally friendly vehicle. The amount of the credit varies depending on the vehicle's battery capacity and the lease term, providing a substantial incentive for consumers to opt for electric mobility.

Similarly, in the European Union, several member states have introduced their own versions of environmental credits and tax benefits for EV leasing. These initiatives often include reduced value-added tax (VAT) rates or even VAT exemptions for electric vehicles, making them more affordable. For example, some countries offer a reduced VAT rate of 0% or 5% on the lease of electric cars, which can result in substantial savings over the lease period. Such incentives not only make EVs more financially attractive but also contribute to the overall goal of reducing greenhouse gas emissions and improving air quality.

The process of claiming these environmental credits typically involves a straightforward application procedure. Vehicle lessees can usually submit the necessary documentation, including proof of lease, vehicle specifications, and environmental compliance, to the relevant tax authorities. Once approved, the tax credit is applied directly to the lease payments, effectively lowering the monthly cost for the lessee. This streamlined process ensures that individuals can take advantage of these incentives without unnecessary complexity.

In summary, governments worldwide are actively promoting the use of eco-friendly vehicles through various tax incentives, including credits for leasing electric cars. These initiatives provide financial benefits to consumers, making the transition to electric mobility more accessible and cost-effective. By offering such incentives, governments aim to encourage a shift towards sustainable transportation, ultimately contributing to a cleaner and more environmentally conscious society.

Green Revolution: Are Electric Vehicles the Eco-Friendly Choice?

You may want to see also

EV Lease Programs: Some manufacturers provide lease deals with tax incentives

Many car manufacturers now offer lease programs specifically tailored to electric vehicles (EVs), which can be an attractive option for those looking to go green while also saving on costs. These lease deals often come with tax incentives, making the transition to electric mobility more affordable and appealing.

When leasing an EV, you typically pay a fixed monthly fee for a set period, usually two to three years. This arrangement provides several advantages. Firstly, it allows individuals to drive a brand-new electric car without the substantial upfront cost of purchasing one. This is particularly beneficial for those who prefer the convenience of a new car and the latest technology but may not have the financial capacity to invest in a high-end EV.

The tax incentives associated with EV lease programs can vary depending on the manufacturer and the specific lease terms. In some cases, the lease payments themselves may be tax-deductible, providing an immediate financial benefit to the lessee. Additionally, some governments and local authorities offer additional tax credits or rebates for leasing electric vehicles, further reducing the overall cost. For instance, in certain regions, you might be eligible for a tax credit that covers a percentage of the lease payments, effectively lowering your monthly outlay.

These lease programs often target environmentally conscious consumers who want to reduce their carbon footprint. By offering tax incentives, manufacturers aim to encourage the adoption of electric vehicles, contributing to a more sustainable future. This strategy not only benefits the environment but also helps to stimulate the market for electric cars, potentially leading to more competitive pricing and improved technology in the long term.

In summary, EV lease programs with tax incentives are a practical and financially savvy way to acquire an electric vehicle. They provide an opportunity to drive a modern, eco-friendly car without the hefty price tag often associated with EVs. As the market for electric mobility continues to grow, such lease options are likely to become even more prevalent, making the transition to electric vehicles more accessible to a wider range of consumers.

The Future of Transportation: Electric Vehicles Take Center Stage

You may want to see also

Lease-to-Own Options: Tax breaks for transitioning to electric vehicles through lease-to-own programs

The transition to electric vehicles (EVs) is gaining momentum, and for many, the financial barrier to entry can be a significant hurdle. Lease-to-own programs offer a unique solution, providing an alternative to traditional vehicle ownership. These programs are designed to make the switch to electric more accessible and affordable, and they often come with tax incentives that can further reduce the overall cost.

Lease-to-own EV programs typically work by allowing individuals to lease an electric vehicle for a set period, usually with the option to purchase it at the end of the lease. This model is particularly attractive to those who want to experience the benefits of electric driving without the long-term commitment of ownership. During the lease period, individuals can take advantage of various tax benefits. One of the key incentives is the ability to deduct lease payments, which can significantly reduce taxable income. This is especially beneficial for those who lease vehicles for business purposes, as it can lead to substantial tax savings.

In addition to lease payment deductions, some lease-to-own programs offer tax credits for the purchase of electric vehicles. These credits can be substantial and are designed to encourage the adoption of EVs. Tax credits essentially provide a direct reduction in the amount of tax owed, which can be a significant financial boost for individuals and businesses alike. For instance, certain regions or governments may offer tax credits for the purchase of electric vehicles, making the overall cost of the vehicle more manageable.

Furthermore, the environmental impact of these programs should not be overlooked. By incentivizing the lease and purchase of electric vehicles, governments and organizations are promoting sustainable transportation options. This not only benefits the individual by reducing their carbon footprint but also contributes to a broader environmental goal of reducing greenhouse gas emissions.

In summary, lease-to-own programs for electric vehicles provide a practical and tax-efficient way to transition to a more sustainable mode of transportation. The tax incentives, including deductions and credits, can significantly lower the financial barrier, making it an attractive option for those looking to embrace electric driving without the typical long-term commitments associated with vehicle ownership.

Unleash Your Wealth: Strategies for Riding the Electric Vehicle Wave

You may want to see also

Lease Tax Deductions: Tax deductions for lease payments on electric cars

Leasing an electric vehicle (EV) can offer several financial advantages, and one of the most significant is the potential for tax deductions on lease payments. This is a valuable incentive for individuals and businesses looking to reduce their tax liability while contributing to a more sustainable future. Here's a detailed breakdown of how tax deductions for lease payments on electric cars work:

Understanding Tax Deductions:

Tax deductions allow individuals and businesses to reduce their taxable income, which directly lowers the amount of tax owed. When it comes to leasing an electric car, the lease payments can be a significant expense, and in many cases, these payments are fully deductible. This means that a portion of your lease payment can be subtracted from your taxable income, resulting in a reduced tax bill. The key is to understand the specific rules and limitations set by your country's tax authorities.

Lease Payments and Deductions:

Lease payments for electric vehicles often include various components, such as the monthly rental fee, insurance, maintenance, and sometimes even charging costs. The good news is that many of these expenses are tax-deductible. For individuals, this means that a portion of your lease payment can be claimed as a business expense, especially if you use the EV for work-related purposes. Similarly, businesses can deduct lease payments as a business expense, which can significantly impact their bottom line. It's important to keep detailed records of these expenses to ensure compliance with tax regulations.

Electric Vehicle Incentives:

The tax incentives for leasing electric cars are designed to encourage the adoption of environmentally friendly transportation. Governments worldwide are offering these incentives to reduce carbon emissions and promote sustainable practices. By leasing an electric vehicle, you contribute to a greener environment, and the tax system provides a financial reward for this commitment. This incentive is particularly beneficial for businesses aiming to enhance their sustainability profile while also managing costs.

Eligibility and Limits:

Eligibility for tax deductions may vary depending on your jurisdiction and the specific rules governing EV incentives. In some cases, the vehicle must be used primarily for business purposes to qualify for deductions. Additionally, there might be limits on the amount that can be deducted annually. It is crucial to consult tax professionals or refer to official government resources to understand the applicable rules and ensure compliance.

Lease tax deductions for electric cars provide a practical way to reduce the financial burden of leasing an EV while promoting environmental sustainability. By taking advantage of these deductions, individuals and businesses can contribute to a greener future while also managing their tax liabilities effectively. Staying informed about the specific regulations and seeking professional advice will ensure that you maximize these incentives and make the most of your electric vehicle lease.

Uncover the Mystery: Signs Your Car Has Electric Start

You may want to see also

Frequently asked questions

Yes, there are several tax incentives and benefits associated with leasing an electric vehicle (EV). One of the most significant advantages is the ability to claim a tax credit for the purchase or lease of an EV. The Clean Vehicle Debit (CVD) is a federal tax credit that provides a dollar-for-dollar reduction of federal income tax liability for qualified EV purchases or leases. The credit amount varies depending on the vehicle's battery capacity and the manufacturer.

For EV leases, the tax incentive typically applies to the lease payments. When you lease an EV, you can deduct a portion of the lease payment as a business expense if you use the vehicle for business purposes. This deduction is based on the vehicle's fair market value and the lease term. Additionally, if you lease an EV for personal use, you may be eligible for a partial deduction, especially if the vehicle has a significant electric range.

Yes, the tax credit can be applied to both EV purchases and leases. However, the rules and limitations may differ. For purchases, the credit is generally available for new and used EVs, but there are income limits and vehicle specifications to consider. For leases, the credit can be claimed based on the lease payments, and the rules might vary depending on the lease term and the vehicle's value. It's essential to consult the IRS guidelines or a tax professional for accurate information.

In addition to tax incentives, leasing an EV can offer other advantages. Many EV manufacturers provide lease programs with lower monthly payments compared to purchasing. Leasing often includes maintenance and warranty packages, making it a convenient option for those who prefer a more straightforward ownership experience. Furthermore, some states and local governments offer additional incentives, such as tax exemptions, rebates, or reduced registration fees, specifically for EV leases, making it an even more attractive option for environmentally conscious consumers.