In New York, the tax implications for electric vehicles (EVs) can be a bit complex. While EVs are generally exempt from certain taxes, such as the state's sales tax, there are specific rules and regulations that EV owners should be aware of. This article aims to clarify whether there is a sales tax on electric vehicles in New York and provide insights into the tax benefits and considerations for EV owners in the state.

| Characteristics | Values |

|---|---|

| Sales Tax on Electric Vehicles | No |

| State | New York |

| Vehicle Type | Electric |

| Tax Rate | 0% (no sales tax) |

| Additional Fees | May include registration fees and other charges |

| Exemption | Electric vehicles are exempt from sales tax under certain conditions |

| Conditions for Exemption | Vehicles must be used primarily for personal transportation and meet specific emission standards |

| Recent Changes | No significant changes in sales tax policy for electric vehicles in recent years |

| Future Outlook | Potential for policy changes based on environmental goals and technological advancements |

What You'll Learn

- Sales Tax Exemption: EVs in New York are exempt from sales tax

- Tax Rates: The state's tax rate is 4% for most purchases

- Local Variations: Some counties and cities may have additional taxes

- Rebates and Incentives: State programs offer rebates to reduce overall cost

- Used EV Tax: Sales tax may apply to used electric vehicles

Sales Tax Exemption: EVs in New York are exempt from sales tax

In New York, the purchase of electric vehicles (EVs) is currently exempt from sales tax, which is a significant benefit for EV buyers. This exemption was introduced as part of the state's efforts to promote the adoption of cleaner and more sustainable transportation options. By removing the sales tax burden, New York aims to make EVs more affordable and accessible to its residents.

The sales tax exemption applies to the purchase of new electric vehicles, including cars, trucks, and motorcycles, as long as they meet the state's definition of an electric vehicle. This typically includes vehicles powered by electric motors and rechargeable batteries, excluding those with internal combustion engines. The exemption covers the entire purchase price, including any additional fees or charges associated with the sale.

To take advantage of this exemption, EV buyers should ensure that they purchase the vehicle from a dealership or seller that complies with New York's tax laws. The seller must provide a certificate of exemption, which confirms that the vehicle qualifies for the tax break. This certificate is essential for the buyer to claim the exemption and receive the sales tax refund.

It's important to note that this exemption is specific to the state of New York and may not apply in other regions. EV buyers should verify the tax laws in their respective areas to understand any potential variations or additional requirements. Additionally, while the sales tax is waived, other fees and taxes may still apply, such as registration fees, title fees, and any applicable environmental fees.

The sales tax exemption for EVs in New York is a valuable incentive for consumers, making the transition to electric transportation more financially viable. This initiative encourages the widespread adoption of EVs, contributing to a more sustainable and environmentally friendly future for the state.

Electric Vehicle Express Lanes: Free or Fee-Based?

You may want to see also

Tax Rates: The state's tax rate is 4% for most purchases

In New York, the sales tax rate for most purchases, including electric vehicles, is a flat 4%. This means that regardless of the vehicle's price, the tax amount will be 4% of the total purchase price. For example, if you buy an electric car for $30,000, the sales tax would be $1,200 (4% of $30,000). This tax rate applies to all electric vehicles, whether they are new or used, and it is an essential consideration for buyers to factor into their overall costs.

The 4% tax rate is consistent across the state, but it's important to note that there might be additional local taxes or fees that vary by county or city. These local taxes can sometimes be substantial and should be considered in addition to the state sales tax. For instance, New York City has its own tax rate, which is higher than the state rate, and this could impact the total cost of an electric vehicle purchase in the city.

Understanding the tax implications is crucial for electric vehicle buyers in New York. The 4% state tax is a significant amount, especially for more expensive vehicles, and it can make a substantial difference in the overall cost. Buyers should be aware of this tax when budgeting and planning their purchase to ensure they are prepared for the financial commitment.

Additionally, it's worth mentioning that the tax laws and rates can change over time, so it's advisable to stay updated with the latest regulations. While the current state tax rate is 4%, any changes in legislation could impact future purchases. Therefore, buyers should consult the most recent tax information provided by the New York State government to ensure they have the most accurate and current details.

In summary, for electric vehicle buyers in New York, the state sales tax rate of 4% is a key factor to consider. This tax applies to all purchases and can significantly contribute to the overall cost. Being aware of this tax and its potential impact on the vehicle's price is essential for making informed decisions and ensuring a smooth buying process.

Vehicle Electrical Drain: Tips for Isolating Power to Prevent Drain

You may want to see also

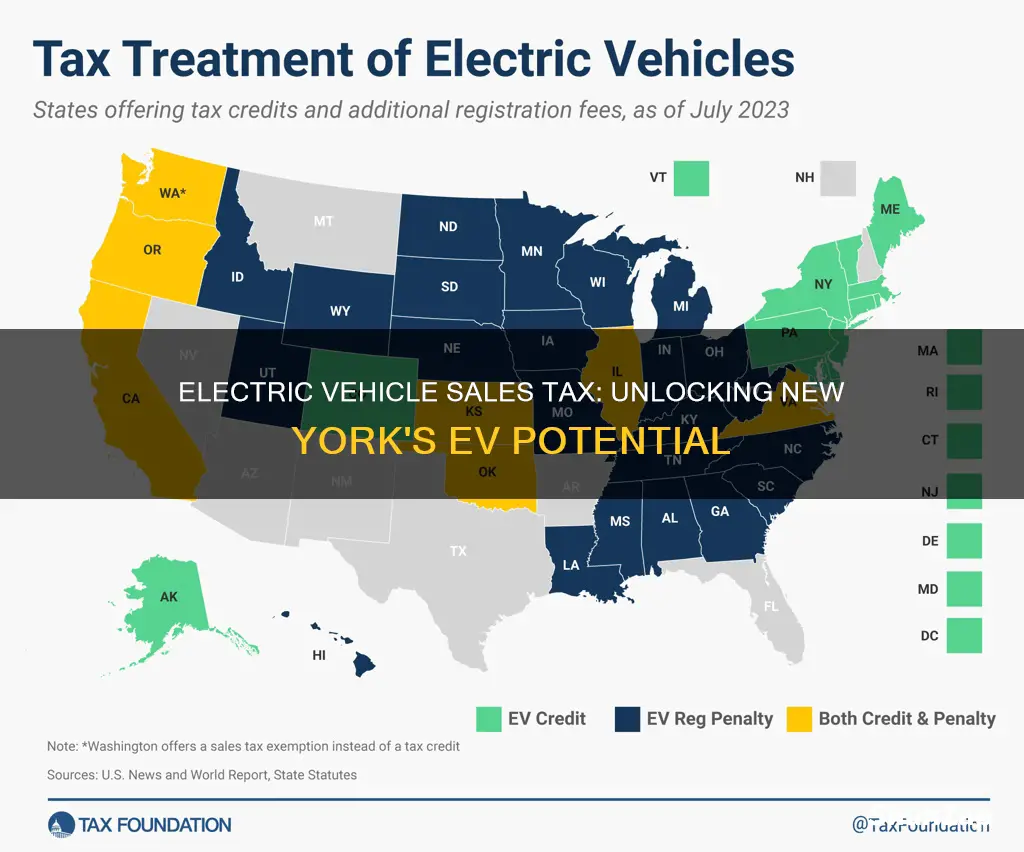

Local Variations: Some counties and cities may have additional taxes

In New York, the sales tax on electric vehicles can vary depending on the specific location within the state. While the state has implemented a sales tax on electric vehicles, certain counties and cities have the authority to impose additional local taxes, which can significantly impact the overall cost for buyers. These local variations are essential to consider for anyone purchasing an electric vehicle in New York.

Some counties in New York have chosen to levy an additional local tax on electric vehicles. For instance, the city of New York itself has a higher sales tax rate compared to the state average. This means that residents of the city may face a higher overall tax burden when purchasing an electric vehicle. Similarly, other urban areas or counties might have their own unique tax structures, which could result in varying costs for electric vehicle buyers.

The additional local taxes can be a result of various factors, such as local government initiatives to promote sustainable transportation or to generate revenue for specific projects. These taxes might be applied as a percentage of the vehicle's price or as a flat fee. It is crucial for potential buyers to research the specific tax rates in their desired county or city to understand the financial implications fully.

For example, let's consider a scenario where an individual is purchasing an electric vehicle in a county with an additional local tax. If the state sales tax rate is 4%, and the county imposes an extra 2%, the total sales tax would be 6%. This additional tax could amount to a significant sum, especially for more expensive electric vehicles. Therefore, buyers should be aware of these local variations to make informed decisions and budget accordingly.

Understanding these local tax variations is essential for electric vehicle buyers in New York to ensure they are prepared for the financial obligations associated with their purchase. It is advisable to consult local tax authorities or seek professional advice to stay informed about the specific tax rates and any potential changes that may occur in different regions of the state.

Electric Vehicles in Colorado: Worth the Switch?

You may want to see also

Rebates and Incentives: State programs offer rebates to reduce overall cost

In New York, the state government has implemented various programs and incentives to encourage the adoption of electric vehicles (EVs) and reduce the overall cost for consumers. These initiatives aim to make EVs more affordable and accessible to residents, ultimately contributing to a more sustainable transportation ecosystem. One of the primary methods to achieve this is through state-offered rebates and incentives.

The New York State Energy Research and Development Authority (NYSERDA) is a key player in this regard. They administer several rebate programs specifically designed for EV buyers. For instance, the NYSERDA's Clean Energy Vehicle Rebate Program provides financial assistance to individuals and businesses purchasing new electric vehicles. The amount of the rebate varies depending on the vehicle's battery capacity and the applicant's income level, ensuring that low- and moderate-income residents can also benefit from these incentives. This program is a significant step towards making EVs more affordable and accessible to a broader population.

Additionally, the state offers incentives for the installation of home charging stations, which is essential for EV owners. NYSERDA's Home Charging Rebate Program provides financial assistance for the purchase and installation of Level 2 home charging equipment. This incentive not only reduces the cost of charging an EV at home but also encourages the widespread adoption of EVs by addressing the convenience of charging infrastructure.

Furthermore, New York's state government has also partnered with local utilities to offer additional incentives. These partnerships result in further rebates and discounts for EV owners. For example, some utility companies provide rebates for home charging equipment, reducing the upfront cost of installing a charging station. These collaborative efforts between state agencies and local businesses demonstrate a comprehensive approach to promoting EV adoption.

It is important for potential EV buyers in New York to research and understand the specific rebate programs and incentives available to them. These state-offered rebates and incentives can significantly lower the overall cost of purchasing and owning an electric vehicle, making it a more attractive and feasible option for environmentally conscious consumers. By taking advantage of these programs, residents can contribute to a greener future while also enjoying the benefits of modern, efficient transportation.

Out-of-State EV Owners: Register Your Car in California

You may want to see also

Used EV Tax: Sales tax may apply to used electric vehicles

In New York, the tax implications for used electric vehicles (EVs) can be a bit complex, especially when it comes to sales tax. Unlike new EVs, which are often exempt from sales tax due to incentives and environmental benefits, used EVs may not enjoy the same privilege. When purchasing a used electric vehicle, it's essential to understand the tax regulations to avoid any surprises.

The state of New York imposes sales tax on the sale of most goods, including used vehicles. However, the tax rate can vary depending on the county and the specific circumstances of the sale. For used EVs, the tax rate might be applied based on the vehicle's value, age, and the seller's location. It is crucial to research and identify the applicable tax rate for the particular county where the transaction takes place.

One important consideration is the definition of a 'used' vehicle. In New York, a used vehicle is typically considered to be any vehicle that has been registered for more than one year or has been in use for more than 12,000 miles. If the EV falls into this category, sales tax may be applicable. The tax is calculated based on the vehicle's fair market value, which can be determined by various factors such as the vehicle's age, condition, and recent sales data.

To ensure compliance with tax laws, buyers should obtain a bill of sale that clearly states the vehicle's value and any applicable taxes. This documentation is essential for tax purposes and can help prevent disputes with the tax authorities. Additionally, keeping records of the vehicle's history, including previous ownership and maintenance, can be beneficial in establishing its value and eligibility for tax exemptions.

In summary, when purchasing a used EV in New York, it is essential to be aware of the potential sales tax implications. Understanding the tax regulations, defining what constitutes a used vehicle, and obtaining proper documentation are key steps to ensure a smooth transaction and avoid any unnecessary tax burdens. Staying informed about local tax laws and seeking professional advice can help buyers navigate this process effectively.

India's Electric Revolution: Are We Charged and Ready?

You may want to see also

Frequently asked questions

Yes, there is a sales tax on electric vehicles in New York. The state's general sales tax rate is 4% and is applied to the purchase of most goods and services, including electric vehicles.

New York offers several incentives to promote the adoption of electric vehicles. These include the New York State Energy Research and Development Authority's (NYSERDA) EV Incentive Program, which provides rebates for electric vehicle purchases and lease payments. Additionally, the state's sales tax exemption for electric vehicle charging equipment may indirectly benefit EV buyers.

The sales tax on electric vehicles in New York is the same as for gasoline vehicles, which is 4%. However, the total cost of ownership for electric vehicles can be lower due to reduced fuel and maintenance expenses, making them an attractive option for environmentally conscious consumers.

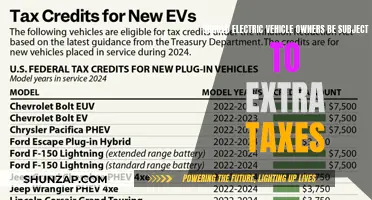

While there isn't a specific tax credit for electric vehicle purchases, the state offers various incentives and programs to encourage EV adoption. These may include rebates, tax credits for renewable energy systems, and grants for public transportation and infrastructure. It's recommended to review the latest tax laws and consult with a tax professional to understand any potential benefits.