The rise of electric vehicles (EVs) has sparked debates about the fairness of taxation for EV drivers. While traditional gasoline vehicles contribute to fuel taxes, EVs are exempt due to their zero-emission nature. However, concerns have been raised about the environmental impact of EVs, particularly regarding battery production and disposal. This has led to discussions about whether EV drivers should contribute to road maintenance and infrastructure through a mileage-based tax, similar to gasoline vehicle owners. This paragraph introduces the topic by highlighting the need for a balanced approach to taxation, considering both environmental benefits and the maintenance of public infrastructure.

| Characteristics | Values |

|---|---|

| Environmental Impact | Electric vehicles (EVs) produce zero tailpipe emissions, which means they don't contribute to air pollution or greenhouse gas emissions. A mileage tax on EVs could potentially discourage their use, leading to increased emissions from other vehicles. |

| Infrastructure Costs | EVs require less maintenance compared to traditional gasoline or diesel vehicles. They have fewer moving parts, which reduces the need for frequent oil changes, engine repairs, and other maintenance costs. A mileage tax might not account for these savings. |

| Battery Technology | Modern EVs have advanced battery technology, allowing for longer ranges and faster charging. A mileage tax could be seen as an additional burden on EV owners, who already invest in a more efficient and environmentally friendly option. |

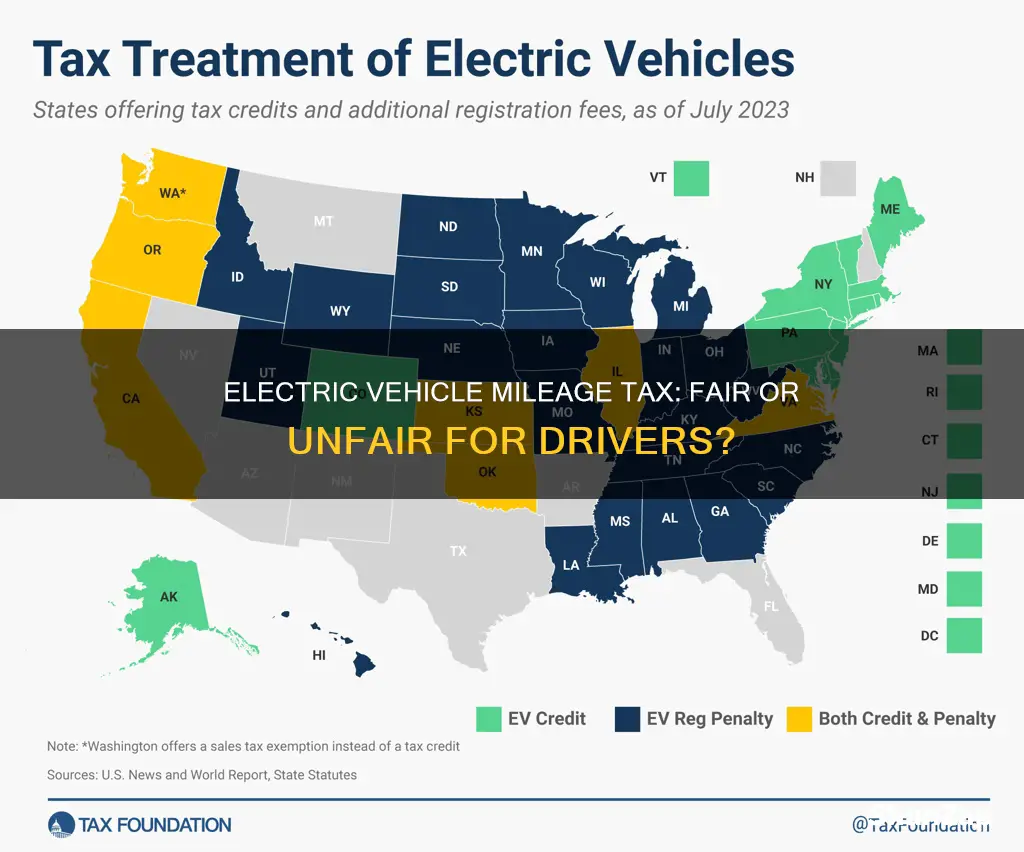

| Government Incentives | Many governments offer incentives and subsidies to promote EV adoption, such as tax credits, rebates, and reduced registration fees. A mileage tax might contradict these incentives and potentially discourage consumers from choosing EVs. |

| Public Perception | There is a growing public awareness and support for environmental sustainability. A mileage tax on EVs could be perceived as unfair and may negatively impact public opinion towards EV owners and the overall adoption of electric transportation. |

| Revenue Generation | Mileage-based taxes can generate revenue for infrastructure improvements, road maintenance, and public transportation. However, the effectiveness of this revenue stream from EVs is uncertain, as their usage patterns might differ from conventional vehicles. |

| Fairness and Equity | Some argue that a mileage tax should be applied to all vehicle owners, regardless of the type of fuel they use. Others believe that EV owners should contribute more due to the benefits they receive from the electric grid and reduced environmental impact. |

| Technological Advancements | The EV market is rapidly evolving, with continuous improvements in battery technology, charging infrastructure, and vehicle performance. A mileage tax might not consider the dynamic nature of the industry and the potential for further advancements. |

| Policy Trade-offs | Implementing a mileage tax on EVs could have trade-offs. While it might generate revenue, it could also discourage EV adoption, impact public perception, and potentially lead to a decrease in the environmental benefits of EVs. |

What You'll Learn

- Environmental Impact: Taxing EV mileage could discourage usage, reducing emissions

- Infrastructure Funding: Proceeds could finance charging stations and road maintenance

- Fairness and Equity: Taxing EVs may be seen as a burden on eco-conscious drivers

- Economic Impact: Potential negative effects on EV sales and the auto industry

- Policy and Regulation: Governments must carefully consider the implications of such a tax

Environmental Impact: Taxing EV mileage could discourage usage, reducing emissions

The environmental benefits of electric vehicles (EVs) are well-documented, with their widespread adoption being a key strategy to combat climate change. One of the primary advantages of EVs is their ability to significantly reduce greenhouse gas emissions compared to traditional internal combustion engine vehicles. However, there is an ongoing debate about whether EV drivers should be taxed based on their mileage, which could have implications for the environment.

Implementing a mileage tax on electric vehicle owners could potentially discourage the use of EVs, leading to a reduction in their overall environmental impact. The primary reason for this is the financial burden that such a tax would impose on EV drivers. As EVs are generally more expensive to purchase and maintain compared to conventional cars, any additional tax could be a significant deterrent. This might lead to a decrease in the number of people opting for electric vehicles, especially those who are price-sensitive. Consequently, the overall reduction in vehicle usage could result in lower emissions, but this outcome is not guaranteed and may not be as effective as intended.

Furthermore, the environmental benefits of EVs are closely tied to their widespread adoption. The more people who switch to electric cars, the more significant the collective reduction in emissions. A mileage tax could disrupt this positive feedback loop, potentially slowing down the transition to a greener transportation system. This is particularly concerning given the urgent need to accelerate the adoption of low-carbon technologies to meet global climate goals.

In addition, the impact of a mileage tax on EV usage could have a cascading effect on the entire transportation ecosystem. With fewer people driving EVs, there might be an increased reliance on other forms of transport, such as public transportation or personal vehicles with internal combustion engines. This shift could lead to a rise in emissions from these alternative modes of transport, potentially offsetting the gains made by the reduced use of EVs.

To ensure a sustainable future, it is crucial to strike a balance between encouraging the use of environmentally friendly vehicles and implementing fair and effective taxation policies. While the environmental impact of taxing EV mileage is a valid concern, it is essential to explore alternative solutions that can promote the adoption of electric vehicles without discouraging their usage. This might include offering incentives, such as tax credits or subsidies, to make EVs more affordable and attractive to a broader range of consumers.

Electric Fleet Incentives: Unlocking Corporate Tax Benefits for Green Transportation

You may want to see also

Infrastructure Funding: Proceeds could finance charging stations and road maintenance

The concept of implementing a mileage tax for electric vehicle (EV) drivers is an intriguing proposition that could have significant implications for infrastructure funding. One of the primary arguments in favor of this idea is the potential to generate revenue for the maintenance and development of essential transportation infrastructure. Here's how this approach could be structured to benefit the public:

Charging Station Network Expansion: Electric vehicles rely on charging stations, and the current infrastructure may not adequately support the growing EV market. A mileage tax could be a strategic solution to address this challenge. The tax proceeds could be allocated to expand the network of charging stations across the country. This expansion would ensure that EV drivers have convenient access to charging facilities, reducing range anxiety and encouraging the widespread adoption of electric vehicles. By investing in this infrastructure, the tax could contribute to a more sustainable and environmentally friendly transportation system.

Road Maintenance and Upkeep: The revenue generated from a mileage-based tax on EV drivers can also be directed towards road maintenance and repair. Electric vehicles, despite their zero-emission nature, still contribute to wear and tear on roads, especially with the increasing weight of battery-powered cars. By implementing a tax, the financial burden of maintaining and improving the road infrastructure can be shared by those who utilize it. This approach ensures that the roads remain in good condition, benefiting all drivers, including those with conventional vehicles. The funds can be utilized for pothole repairs, road resurfacing, and the overall upkeep of the transportation network.

In addition to these benefits, the tax could also be structured to incentivize the development of innovative technologies and infrastructure. For instance, the proceeds could be used to fund research and development in the field of fast-charging technologies, making the charging process more efficient and time-effective. Furthermore, the tax revenue can support the creation of smart infrastructure, where charging stations and road systems are integrated with advanced technologies, optimizing energy usage and reducing environmental impact.

Implementing a mileage tax for EV drivers has the potential to create a self-sustaining cycle of infrastructure development and maintenance. The tax generates revenue, which is then reinvested in the necessary infrastructure, ensuring a continuous improvement in the quality of roads and charging facilities. This approach could be a significant step towards a more sustainable and well-maintained transportation ecosystem, benefiting both electric vehicle owners and the broader community.

Sustainable Power: Recycling EV Batteries for a Greener Future

You may want to see also

Fairness and Equity: Taxing EVs may be seen as a burden on eco-conscious drivers

The idea of taxing electric vehicle (EV) drivers based on mileage has sparked debates, particularly regarding fairness and equity. While the primary goal of such a tax is to generate revenue and address the environmental impact of traditional gasoline vehicles, it could inadvertently place a financial burden on those who have already made a conscious choice to drive eco-friendly cars.

Eco-conscious drivers often view their EV purchases as a step towards a more sustainable future. These individuals typically have a higher environmental awareness and are willing to invest in technologies that reduce carbon emissions. However, implementing a mileage tax on EVs might be perceived as a setback for these drivers, as it could negate the financial benefits they expected from owning an electric car. For instance, EV owners often enjoy lower running costs due to reduced fuel expenses and lower maintenance requirements compared to conventional vehicles. A mileage tax could potentially undermine these savings, making it less appealing for drivers to continue their eco-friendly journey.

Furthermore, the concept of fairness comes into play when considering the potential impact on different socioeconomic groups. EVs are generally associated with higher upfront costs, making them less accessible to lower-income individuals. If a mileage tax is introduced, it might disproportionately affect these drivers, who may already struggle with the initial investment in an EV. This could create a situation where those who are most committed to environmental sustainability are also the ones facing additional financial strain.

To address these concerns, policymakers should carefully consider the potential consequences. One approach could be to ensure that any tax implemented is proportional to the environmental benefits derived from EV ownership. For example, a flat-rate tax based on the vehicle's battery capacity or a tax credit system that rewards low-emission vehicles could be more equitable. Additionally, providing incentives for EV adoption, such as tax breaks or subsidies, could help offset the potential burden and encourage continued investment in sustainable transportation.

In conclusion, while the intention behind a mileage tax on EVs may be to promote environmental sustainability, it is crucial to consider the potential impact on fairness and equity. By carefully designing tax policies and offering incentives, policymakers can ensure that eco-conscious drivers are not unduly burdened and that the transition to a greener transportation system remains accessible and beneficial to all.

Unleash Your Portfolio's Potential: A Guide to Electric Vehicle Stocks

You may want to see also

Economic Impact: Potential negative effects on EV sales and the auto industry

The introduction of a mileage tax for electric vehicle (EV) drivers could have significant economic implications, particularly for the automotive industry and the sales of EVs. One of the primary concerns is the potential negative impact on EV sales. Electric cars are often promoted as an environmentally friendly alternative to traditional gasoline vehicles, and many buyers are attracted to the long-term cost savings and reduced environmental impact. However, the implementation of a mileage tax could negate some of these benefits.

For EV owners, the mileage tax would likely be perceived as an additional financial burden. As EVs are generally more efficient and produce fewer emissions per mile compared to conventional vehicles, the tax could be seen as disproportionately affecting EV drivers. This might discourage potential buyers from making the switch, especially those who were initially drawn to EVs for their cost-effectiveness and environmental advantages. As a result, a decline in EV sales could occur, impacting the overall market growth and potentially causing a shift in consumer preferences towards traditional fuel vehicles.

The auto industry, particularly the EV sector, has been experiencing rapid growth and innovation. This industry heavily relies on consumer demand and market trends. A mileage tax could disrupt this dynamic, causing a slowdown in the adoption of electric vehicles. Reduced sales would mean less revenue for EV manufacturers and suppliers, potentially leading to financial strain and a reevaluation of business strategies. This could result in a temporary setback for the industry, hindering its ability to invest in research and development, infrastructure, and the expansion of its market presence.

Furthermore, the economic impact might extend beyond the automotive sector. Many countries and regions have invested in EV charging infrastructure to support the growing EV market. A mileage tax could discourage the further development of this infrastructure, as it may be seen as an unnecessary expense. This could hinder the overall growth of the EV ecosystem, affecting not only the auto industry but also related sectors such as energy, technology, and even tourism, which could experience a temporary decline in the demand for EV-related services.

In summary, the introduction of a mileage tax for EV drivers could have a detrimental effect on the economic landscape of the automotive industry. It may lead to a decrease in EV sales, impacting both consumers and manufacturers. The potential negative consequences could also extend to related industries, creating a ripple effect that may take time to recover from. Therefore, careful consideration and alternative solutions should be explored to ensure a sustainable and thriving EV market.

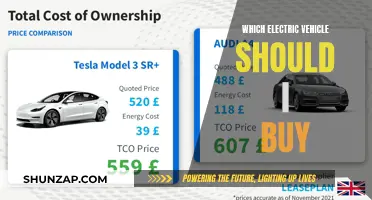

The Ultimate Guide to Choosing the Best EV: A Comprehensive Comparison

You may want to see also

Policy and Regulation: Governments must carefully consider the implications of such a tax

The introduction of a mileage tax for electric vehicle (EV) drivers is a complex policy decision that governments must approach with caution. This tax, if implemented, could have significant implications for both the environment and the economy, particularly in the context of the growing EV market. One of the primary considerations is the potential impact on the environment. EVs are known for their lower carbon emissions compared to traditional gasoline or diesel vehicles. A mileage tax could discourage EV ownership, as drivers might be incentivized to opt for conventional vehicles to avoid the additional cost. This could result in a setback for the government's efforts to promote sustainable transportation and reduce greenhouse gas emissions.

From a policy perspective, governments should carefully assess the environmental benefits of EVs versus the financial burden of the tax. A well-structured policy might involve a gradual implementation, allowing time for the market to adapt and for the environmental impact of EVs to be more thoroughly understood. Additionally, the tax revenue generated from this scheme could be strategically allocated to support further development and infrastructure for EVs, ensuring a sustainable and supportive environment for this emerging technology.

Another critical aspect is the potential economic impact on EV drivers. The mileage tax would likely be structured as a per-mile charge, which could significantly increase the cost of driving for EV owners. This additional expense might affect lower-income drivers disproportionately, as they often rely on more affordable transportation options. Governments should consider providing exemptions or reduced rates for low-income individuals to ensure that the tax does not exacerbate existing social and economic inequalities.

Furthermore, the policy implications extend to the broader transportation sector. A mileage tax could influence the overall demand for transportation services and potentially impact the revenue streams of public transport providers. Governments should carefully analyze these effects to ensure that the tax does not inadvertently undermine the development and maintenance of efficient public transportation systems, which are crucial for sustainable urban development.

In conclusion, the decision to implement a mileage tax for EV drivers requires a comprehensive understanding of its environmental, economic, and social implications. Governments must carefully weigh these factors to ensure that any policy introduced supports the transition to sustainable transportation while also considering the needs of various stakeholders, including drivers, businesses, and the environment. A well-informed and balanced approach will be essential to the successful implementation of such a tax.

Rivian's Electric Revolution: Unlocking the Future of Sustainable Driving

You may want to see also

Frequently asked questions

The answer is not straightforward as it depends on the jurisdiction and the specific tax laws in place. Some regions have introduced or are considering implementing a mileage-based tax for all vehicle owners, including those with EVs. This tax is often structured as a per-mile charge, which can vary depending on the state or country. However, some governments may offer exemptions or reduced rates for EV owners due to their environmental benefits. It's essential to check with local tax authorities to understand the applicable rules.

Electric vehicle drivers might be concerned about an additional financial burden, especially if they are already paying higher upfront costs for their vehicles. However, the primary purpose of a mileage tax is to generate revenue based on the actual usage of roads, which can be seen as a fairer alternative to the traditional gas tax. This approach ensures that those who use the roads more frequently contribute more to their maintenance and improvement. For EV owners, this could mean a slight increase in their annual expenses, but it may also encourage the adoption of more sustainable transportation methods.

Yes, there are a few points to consider. Firstly, some governments might provide incentives or subsidies to offset the potential additional costs for EV owners. Secondly, the introduction of a mileage tax could lead to better road infrastructure and potentially faster EV charging networks, benefiting all drivers. Lastly, with the increasing popularity of EVs, a mileage-based tax system could encourage a shift towards more environmentally friendly transportation options, which might have long-term benefits for the environment and public health.