Investing in electric vehicle (EV) stocks can be a lucrative opportunity for those looking to capitalize on the growing demand for sustainable transportation. With the global push towards reducing carbon emissions and the increasing popularity of electric cars, the EV market is expected to expand rapidly. This guide will provide an overview of the key considerations and strategies for investing in EV stocks, including identifying top performers, assessing market trends, and understanding the risks and rewards associated with this emerging sector. By exploring these aspects, investors can make informed decisions and potentially benefit from the long-term growth of the electric vehicle industry.

What You'll Learn

- Market Analysis: Study industry trends, company performance, and market sentiment

- Company Research: Evaluate financial health, management, and competitive advantage

- Risk Assessment: Identify potential risks and mitigate them through diversification

- Investment Strategies: Explore long-term growth, short-term trades, and sector-specific approaches

- Regulatory Environment: Understand government policies and their impact on the EV industry

Market Analysis: Study industry trends, company performance, and market sentiment

When considering how to invest in electric vehicle (EV) stocks, a comprehensive market analysis is crucial. This involves studying industry trends, evaluating company performance, and assessing market sentiment to make informed investment decisions. Here's a detailed breakdown of each aspect:

Industry Trends:

The EV industry is experiencing rapid growth and transformation. Key trends to focus on include:

- Technological Advancements: Keep track of advancements in battery technology, charging infrastructure, and autonomous driving systems. These innovations directly impact the performance and competitiveness of EV manufacturers.

- Government Policies and Incentives: Governments worldwide are implementing policies to promote EV adoption, such as tax credits, subsidies, and stricter emissions regulations. These policies can significantly influence the market landscape and individual company prospects.

- Market Penetration and Competition: Analyze the market share of major EV manufacturers and emerging players. Understand the competitive dynamics, including pricing strategies, product differentiation, and brand reputation.

Company Performance:

A thorough analysis of individual companies within the EV sector is essential. Here's how to approach it:

- Financial Metrics: Examine financial statements, focusing on revenue growth, profitability, cash flow, and debt levels. Look for companies with strong financial fundamentals, sustainable growth prospects, and efficient management.

- Product Portfolio and Innovation: Assess the company's product lineup, including its electric vehicle models, battery offerings, and charging solutions. Evaluate their innovation pipeline and ability to stay ahead of the competition.

- Management Team and Strategy: Research the experience and track record of the company's leadership team. Understand their strategic vision, market positioning, and ability to execute their plans.

Market Sentiment:

Market sentiment reflects the overall investor confidence and optimism towards the EV industry. Here's how to gauge it:

- News and Media Coverage: Monitor news articles, industry reports, and analyst opinions to gauge market sentiment. Positive news about technological breakthroughs, company partnerships, or favorable policies can indicate a bullish sentiment.

- Social Media and Online Discussions: Analyze social media platforms and online forums to understand investor sentiment. Trends in online discussions can provide insights into investor concerns, expectations, and potential risks.

- Technical Analysis: Utilize technical analysis tools to identify patterns in stock price movements. This can help identify potential support and resistance levels, indicating market sentiment and possible turning points.

By combining industry trend analysis, company performance evaluation, and market sentiment assessment, investors can make well-informed decisions about investing in EV stocks. Remember that market conditions are dynamic, so ongoing research and analysis are essential for success in this rapidly evolving sector.

Boosting Electric Vehicle Performance: Tips for Efficiency and Range

You may want to see also

Company Research: Evaluate financial health, management, and competitive advantage

When considering how to invest in electric vehicle (EV) stocks, a thorough company research process is essential to make informed decisions. Here's a detailed guide on evaluating the financial health, management, and competitive advantage of EV-focused companies:

Financial Health:

- Revenue and Profitability: Examine the company's financial statements, focusing on revenue growth, profit margins, and profitability trends over several years. Look for consistent revenue growth, especially in the EV sector, as this indicates market acceptance and demand.

- Cash Flow: Healthy cash flow is crucial for any business. Analyze the company's cash flow statements to assess its ability to generate cash, manage debt, and invest in future projects. Positive cash flow from operations is a strong indicator of financial stability.

- Debt-to-Equity Ratio: A low debt-to-equity ratio suggests the company relies less on debt financing and is financially sound. Excessive debt can be a risk, especially in volatile markets.

- Market Capitalization and Share Price: While not solely indicative, a company's market cap and share price can provide insights into investor sentiment and overall valuation.

Management:

- Leadership Team: Research the experience and track record of the company's executives, particularly in the EV industry. Look for a strong understanding of the market, a proven history of successful product development, and effective strategic vision.

- Board of Directors: A diverse and experienced board can provide valuable guidance and oversight. Assess their expertise in the automotive sector, technology, and business management.

- Corporate Governance: Evaluate the company's governance practices, including transparency, accountability, and shareholder rights. Strong governance practices contribute to long-term sustainability.

Competitive Advantage:

- Technology and Innovation: EV companies with cutting-edge technology, innovative battery solutions, or unique vehicle designs have a significant edge. Look for patents, research & development (R&D) investments, and partnerships that foster innovation.

- Market Position and Brand: Strong brand recognition, a loyal customer base, and a solid market position can provide a competitive advantage. Analyze market share, customer satisfaction, and brand reputation.

- Supply Chain and Manufacturing: Efficient supply chains and manufacturing processes are crucial for cost-effectiveness and timely product delivery. Research their sourcing strategies, partnerships, and production capabilities.

- Regulatory and Policy Environment: Favorable government policies and regulations can boost the company's prospects. Stay informed about industry-specific regulations and their potential impact.

Additional Considerations:

- Industry Trends: Keep abreast of industry trends, technological advancements, and market dynamics. This will help you understand the broader context of the company's performance.

- Risk Assessment: Identify potential risks associated with the company, such as reliance on specific markets, supply chain disruptions, or technological obsolescence.

- Peer Analysis: Compare the company's performance against its competitors to gauge its relative strength and position in the market.

Remember, investing in EV stocks involves a comprehensive analysis of various factors. By thoroughly researching financial health, management capabilities, and competitive advantages, you can make more informed investment decisions in this rapidly evolving sector.

Mastering Short Electrical Wiring: Extending Vehicle Connections Efficiently

You may want to see also

Risk Assessment: Identify potential risks and mitigate them through diversification

When considering investments in the electric vehicle (EV) sector, it's crucial to recognize that this is a relatively new and rapidly evolving industry. As with any investment, there are inherent risks that investors should be aware of. Here's a breakdown of potential risks and strategies to mitigate them through diversification:

Market Volatility: The EV market is still in its infancy, and as such, it can be highly volatile. Stock prices of EV companies may fluctuate significantly due to various factors. These include technological advancements, regulatory changes, and shifts in consumer preferences. To mitigate this risk, investors should consider a long-term investment horizon. Diversifying your portfolio across multiple EV companies and related sectors can help smooth out short-term market volatility.

Regulatory and Policy Risks: Government policies and regulations play a critical role in the success of the EV industry. Changes in incentives, subsidies, or even stricter emissions standards can impact the profitability of EV manufacturers and suppliers. Investors should stay informed about policy developments and consider companies with a strong track record of adapting to regulatory changes. Diversification across different geographic regions can also reduce the risk associated with specific country-level policies.

Competition and Market Saturation: The EV market is attracting a lot of attention, leading to increased competition. Established automotive giants and new entrants are vying for market share. While this competition can drive innovation, it may also lead to price wars or reduced profit margins. To manage this risk, investors should research and invest in companies with a competitive edge, strong brand recognition, and a solid business model. Diversifying across different market segments and technologies can also provide a buffer against intense competition.

Supply Chain and Production Risks: The production and supply of electric vehicles rely on various components, including batteries, semiconductors, and raw materials. Disruptions in the supply chain can impact production timelines and costs. Natural disasters, geopolitical tensions, or logistical issues can cause shortages or delays. Investors should focus on companies with robust supply chain management and a diverse supplier base. Diversification across different suppliers and regions can help minimize the impact of potential disruptions.

Innovation and Technological Obsolescence: The EV industry is characterized by rapid technological advancements. Companies that fail to innovate risk becoming obsolete. Newer, more efficient, or sustainable technologies can quickly disrupt the market. Investors should research and invest in companies with a strong R&D focus and a history of successful product launches. Diversification across different technologies and business models can ensure that your portfolio is exposed to a range of innovations.

By identifying these risks and implementing a diversification strategy, investors can navigate the EV sector more confidently. It's essential to stay informed, conduct thorough research, and regularly review your investment portfolio to make informed decisions and adapt to the dynamic nature of the electric vehicle industry.

Unlocking EV Tax Credits: A Guide to Maximizing Your Federal Benefits

You may want to see also

Investment Strategies: Explore long-term growth, short-term trades, and sector-specific approaches

When it comes to investing in electric vehicle (EV) stocks, understanding different strategies can help you navigate the dynamic and rapidly evolving EV market. Here's an exploration of various investment approaches:

Long-Term Growth Strategy:

Investing in EV stocks for long-term growth is a popular choice for many investors. This strategy involves identifying companies that are well-positioned to benefit from the long-term shift towards electric mobility. Look for established EV manufacturers or suppliers with a strong market presence and a solid track record. These companies often have a competitive advantage due to their brand recognition, technological expertise, and established supply chains. Research and invest in companies that have a clear vision for innovation, such as developing cutting-edge battery technology or expanding their EV lineup. While this approach may require patience, it can lead to substantial gains as the EV market continues to mature and gain mainstream adoption.

Short-Term Trades:

For more active traders, short-term trades in EV stocks can be an exciting opportunity. This strategy involves taking advantage of short-term price fluctuations and market trends. Keep an eye on news and events that can impact EV stocks, such as new government policies, technological breakthroughs, or company-specific announcements. For instance, a positive announcement about a new battery technology partnership could drive the stock price up, providing a short-term trading opportunity. However, short-term trades often require a higher level of market knowledge and risk tolerance. It's crucial to stay updated on industry news and conduct thorough research to make informed decisions.

Sector-Specific Approach:

The EV industry is diverse, encompassing various sectors such as automotive, battery technology, charging infrastructure, and raw material suppliers. A sector-specific approach allows investors to focus on particular areas of the industry that align with their investment goals. For example, you might choose to invest in renewable energy companies that supply raw materials for EV batteries or focus on the development of fast-charging stations. This strategy requires a deep understanding of each sector's dynamics and potential growth drivers. By concentrating on specific sectors, investors can capitalize on the unique opportunities within the EV industry and potentially benefit from the rapid growth in these areas.

Additionally, consider diversifying your portfolio across different EV-related companies and sectors to manage risk. Stay informed about industry trends, regulatory changes, and technological advancements to make timely investment decisions. Remember, the EV market is still evolving, and a well-researched and strategic approach can lead to successful investments in this exciting and transformative sector.

Revolutionizing Design: A Guide to Crafting the Future of Electric Vehicles

You may want to see also

Regulatory Environment: Understand government policies and their impact on the EV industry

The regulatory environment plays a pivotal role in shaping the electric vehicle (EV) industry and, consequently, the investment landscape. Governments worldwide are implementing policies and incentives to accelerate the transition to electric mobility, which presents both opportunities and challenges for investors. Understanding these policies is essential for making informed investment decisions in the EV sector.

One of the most significant government initiatives is the establishment of emission standards and regulations. Many countries have set stringent emission targets to reduce air pollution and combat climate change. These regulations often mandate a certain percentage of electric or low-emission vehicles in the overall market. For instance, the European Union's (EU) 'Roadmap for moving to a competitive low-carbon economy in 2050' aims to make all new cars zero-emission by 2035. Such policies create a favorable market for EVs and can drive investment in the industry. Investors should research and identify regions with the most aggressive emission standards, as these areas are likely to experience faster EV adoption and technological advancements.

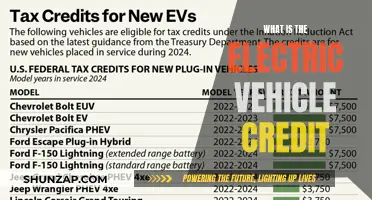

Government subsidies and incentives are another critical aspect of the regulatory environment. Many countries offer tax credits, rebates, and other financial incentives to encourage consumers to purchase electric vehicles. For example, the United States' Inflation Reduction Act provides tax credits for EV purchases, making them more affordable and attractive to consumers. These incentives not only boost sales but also stimulate investment in EV infrastructure and manufacturing. Investors can benefit from identifying regions with the most generous incentives, as it may lead to increased demand for EV-related services and products.

Additionally, governments are investing in EV infrastructure development, such as building charging stations and improving public transportation systems. These investments create opportunities for businesses to provide charging solutions, battery technology, and other supporting services. Investors can focus on companies that are well-positioned to benefit from these infrastructure projects, ensuring a steady stream of revenue and long-term growth prospects.

Staying informed about policy changes and their potential impact is crucial. Governments often introduce new regulations and incentives, or modify existing ones, to address industry challenges and keep up with technological advancements. Investors should regularly monitor policy developments, attend industry conferences, and engage with regulatory bodies to ensure they are aware of any changes that could affect their investments.

In summary, the regulatory environment is a critical factor in the EV industry's growth and investment opportunities. Investors should familiarize themselves with emission standards, government incentives, and infrastructure development plans to make strategic investment choices. By understanding the policies driving the EV market, investors can position themselves to capitalize on the industry's potential while navigating the associated risks.

Revolutionizing EVs: Top Tips for Enhanced Performance and Efficiency

You may want to see also

Frequently asked questions

Investing in EV stocks is a popular choice for those looking to support and benefit from the transition to sustainable transportation. You can invest in individual EV companies, such as Tesla, which is a well-known pioneer in the industry, or explore broader EV-focused funds and ETFs (Exchange-Traded Funds) that provide exposure to multiple companies. Diversifying your portfolio across different segments of the EV market, such as battery manufacturers, charging infrastructure providers, and traditional automakers transitioning to EVs, can be a strategic approach.

Research and due diligence are key. Look for companies with a strong market position, innovative technology, and a clear strategy for growth. Consider factors like brand reputation, financial health, and management team expertise. Analyze the company's competitive advantage, market share, and growth prospects. Stay updated on industry trends, regulatory changes, and consumer preferences, as these can significantly impact EV stock performance.

Like any investment, there are risks involved. The EV industry is rapidly evolving, and companies may face challenges related to technological advancements, regulatory changes, and market competition. Volatility in stock prices is common due to the industry's growth and the influence of external factors. It's essential to monitor industry news, company-specific risks, and broader economic trends that could impact the EV sector. Diversification and a long-term investment strategy can help mitigate some of these risks.

Absolutely! Most major brokerage platforms offer the ability to trade individual stocks, including those in the EV industry. You can open a brokerage account, research and select the EV companies you want to invest in, and execute trades. Additionally, many brokers provide research tools and resources to help investors make informed decisions. It's advisable to start with a small investment and gradually build your portfolio as you gain experience and knowledge about the EV market.