The Inflation Reduction Act (IRA) has sparked significant interest in the electric vehicle (EV) market, offering a range of incentives and subsidies to boost adoption. This legislation provides tax credits for EV purchases, making electric cars more affordable for consumers. It also includes provisions for tax credits for EV charging infrastructure, which is crucial for supporting the growing number of EVs on the road. Additionally, the IRA promotes the domestic production of EVs and their components, aiming to reduce reliance on foreign supply chains and stimulate the American auto industry. These measures collectively contribute to a more sustainable transportation future by encouraging the widespread adoption of electric vehicles.

What You'll Learn

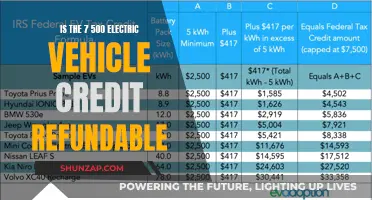

- Tax Credits: Incentivizes EV purchases with up to $7,500 tax credits for buyers and manufacturers

- Charging Infrastructure: Act funds EV charging stations, boosting accessibility and reducing range anxiety

- Battery Production: Promotes domestic battery manufacturing, creating jobs and reducing reliance on imports

- Grid Resilience: Enhances the electric grid, ensuring reliable charging and supporting renewable energy integration

- Environmental Benefits: Reduces greenhouse gas emissions, contributing to a cleaner, more sustainable transportation future

Tax Credits: Incentivizes EV purchases with up to $7,500 tax credits for buyers and manufacturers

The Inflation Reduction Act (IRA) includes a significant provision that aims to boost the adoption of electric vehicles (EVs) in the United States. One of its key mechanisms is the introduction of tax credits, which offer substantial incentives for both buyers and manufacturers in the EV market.

For EV buyers, the IRA provides a tax credit of up to $7,500. This credit is designed to make purchasing an electric vehicle more affordable and attractive to consumers. The credit is generally available for new EV purchases, including fully electric cars and utility vehicles. Buyers can claim this credit when filing their federal income tax return, reducing their taxable income and, consequently, their overall tax liability. This financial incentive can significantly lower the upfront cost of owning an EV, making it a more viable option for those considering a switch from traditional gasoline vehicles.

Additionally, the IRA offers a tax credit for EV manufacturers, which further stimulates the production and sale of electric vehicles. This credit is intended to encourage domestic manufacturing and the growth of the EV industry. Manufacturers can receive a tax credit based on the number of qualified EVs produced and sold in the United States. The credit is designed to incentivize the production of electric vehicles with a focus on domestic assembly and the use of domestic-made parts. This dual incentive structure aims to create a positive feedback loop, where lower prices for buyers lead to increased demand, and increased demand drives more production and investment in the EV sector.

The tax credits provided by the IRA are a strategic move to accelerate the transition to a more sustainable transportation system. By making EVs more affordable and supporting domestic manufacturing, the government aims to reduce greenhouse gas emissions and promote energy independence. This approach not only benefits the environment but also stimulates economic growth and innovation in the automotive industry.

In summary, the Inflation Reduction Act's tax credits play a pivotal role in encouraging EV purchases and fostering the growth of the electric vehicle market. These incentives provide financial relief to buyers and manufacturers, making EVs more accessible and economically viable. As a result, the IRA is expected to contribute significantly to the widespread adoption of electric vehicles and the development of a robust domestic EV industry.

Powering the Future: Unlocking Electric Vehicles' Energy Secrets

You may want to see also

Charging Infrastructure: Act funds EV charging stations, boosting accessibility and reducing range anxiety

The Inflation Reduction Act (IRA) has allocated significant funding to support the expansion of charging infrastructure for electric vehicles (EVs), addressing a critical need in the EV market. This initiative aims to alleviate range anxiety, a common concern among potential EV buyers, by ensuring convenient and accessible charging options across the country. By investing in charging stations, the Act is not only making EVs more appealing but also contributing to the broader goal of reducing greenhouse gas emissions and transitioning towards a sustainable transportation system.

One of the key aspects of this funding is the establishment of a network of fast-charging stations along major highways and in urban areas. These stations are designed to provide rapid charging, enabling EV drivers to quickly replenish their battery levels during long-distance travel. The IRA's support for this infrastructure is crucial, as it encourages the adoption of EVs by addressing the practical challenges associated with long-range travel, such as the time required for traditional charging methods.

In addition to fast-charging stations, the Act also promotes the development of Level 2 charging stations, which offer faster charging rates than standard home chargers. These stations are particularly beneficial for residential areas, office parks, and commercial properties, providing a convenient charging solution for EV owners. By funding the installation of these stations, the IRA is fostering a more comprehensive charging network, ensuring that EV owners have access to reliable charging options wherever they are.

The impact of these investments is twofold. Firstly, it directly benefits EV owners by reducing the time spent waiting for their vehicles to charge, thereby enhancing the overall driving experience. Secondly, it encourages the growth of the EV market by addressing a significant barrier to entry. As charging infrastructure becomes more widespread and accessible, more people are likely to consider purchasing EVs, contributing to a more sustainable and environmentally friendly transportation ecosystem.

Furthermore, the IRA's focus on charging infrastructure extends beyond the immediate benefits to EV owners. It also supports the creation of jobs in the renewable energy sector, as the installation and maintenance of charging stations require skilled labor. This economic aspect of the Act is crucial in driving the transition to a greener economy and fostering local job markets. The combination of improved charging accessibility and job creation is a powerful incentive for both consumers and businesses to embrace the EV revolution.

The Green Revolution: Should You Go Electric?

You may want to see also

Battery Production: Promotes domestic battery manufacturing, creating jobs and reducing reliance on imports

The Inflation Reduction Act (IRA) includes significant provisions aimed at boosting domestic battery manufacturing for electric vehicles (EVs), which has far-reaching implications for the industry and the economy. One of its key objectives is to reduce the United States' reliance on imported batteries, a critical component in the EV supply chain. By encouraging the production of batteries within the country, the IRA aims to create a more resilient and self-sufficient EV market.

This legislation provides substantial incentives for domestic battery manufacturing, including tax credits and grants. These financial incentives are designed to attract investments in new battery production facilities and research and development. For instance, the IRA offers a tax credit for the production of batteries and battery components, which can significantly reduce the cost of setting up and operating a domestic battery manufacturing plant. This, in turn, makes it more economically viable for companies to establish a presence in the US market, creating a competitive environment that could drive innovation and efficiency.

The impact of these incentives is twofold. Firstly, they stimulate job creation in the battery manufacturing sector. As domestic production increases, so does the need for skilled labor, leading to the creation of numerous jobs across various roles, from engineers and technicians to factory workers. This not only addresses the immediate need for skilled labor in the EV industry but also contributes to the overall economic growth of the region where these facilities are established.

Secondly, promoting domestic battery production reduces the country's reliance on imports, which is a strategic move towards energy security. By decreasing the dependence on foreign sources for battery components, the IRA ensures a more stable supply chain for EVs. This is particularly important as the demand for electric vehicles continues to rise, and the industry aims to meet the growing market demand while maintaining a consistent and reliable supply of batteries.

In summary, the Inflation Reduction Act's focus on battery production has a direct and positive impact on the electric vehicle industry. It encourages the establishment of domestic manufacturing, fostering job creation and reducing the need for imports. This strategic approach not only strengthens the US's position in the global EV market but also contributes to a more sustainable and secure energy future.

Ford's Future: Electric Vehicle Cuts and the Industry's Shift

You may want to see also

Grid Resilience: Enhances the electric grid, ensuring reliable charging and supporting renewable energy integration

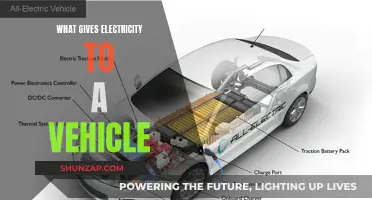

The Inflation Reduction Act (IRA) has significant implications for the electric vehicle (EV) market and the broader energy landscape, particularly in the context of grid resilience and the integration of renewable energy sources. One of its key focuses is on enhancing the electric grid to accommodate the growing number of EVs and ensure a reliable and efficient charging infrastructure.

The IRA aims to improve grid resilience by implementing several measures. Firstly, it encourages the development of smart grid technologies, which can monitor and manage electricity flow in real-time. This includes advanced metering infrastructure and demand response systems. By enabling dynamic pricing and load management, these technologies can optimize charging patterns, reducing strain on the grid during peak hours. For instance, smart charging systems can be programmed to charge EVs during off-peak hours when electricity rates are lower, ensuring a stable and cost-effective power supply.

Additionally, the act promotes the expansion of charging infrastructure, especially in rural and underserved areas. This involves deploying fast-charging stations along highways and in public spaces, reducing range anxiety and providing convenient charging options for EV owners. The IRA provides incentives and grants to encourage private sector investment in this critical infrastructure, ensuring that the grid can support the increasing demand for EV charging.

In the realm of renewable energy integration, the IRA plays a pivotal role. It offers substantial tax credits and incentives for renewable energy projects, including solar, wind, and hydropower. By encouraging the adoption of clean energy sources, the act reduces the reliance on the traditional power grid, which is often less resilient and more susceptible to disruptions. As a result, the grid becomes more stable and less prone to blackouts or power outages, especially during extreme weather events or natural disasters.

Furthermore, the IRA's emphasis on grid resilience supports the transition to a more sustainable and decentralized energy model. It promotes the development of microgrids and local energy storage systems, which can provide backup power during grid failures. These microgrids can be powered by local renewable sources, ensuring that critical EV charging stations and other essential services remain operational even when the main grid is down. This level of grid resilience is crucial for maintaining the reliability of EV charging and the overall stability of the energy system.

Unleash the Power: Is an Electric Vehicle Your Next Ride?

You may want to see also

Environmental Benefits: Reduces greenhouse gas emissions, contributing to a cleaner, more sustainable transportation future

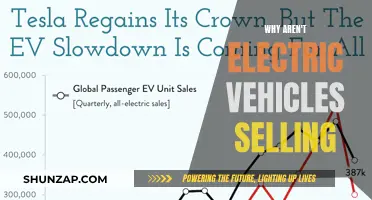

The Inflation Reduction Act (IRA) is a significant piece of legislation that has far-reaching implications for the electric vehicle (EV) market and the environment. One of its primary environmental benefits is the reduction of greenhouse gas emissions, which is a crucial step towards combating climate change. By incentivizing the adoption of electric cars, the IRA aims to accelerate the transition from traditional internal combustion engine (ICE) vehicles to zero-emission EVs.

The act provides substantial tax credits and incentives for EV buyers, making electric cars more affordable and accessible. These financial incentives encourage consumers to choose electric vehicles over their gasoline or diesel counterparts, leading to a rapid shift in the transportation sector. As a result, the overall carbon footprint of the transportation industry decreases significantly. Electric vehicles produce zero tailpipe emissions, meaning they don't release harmful pollutants or greenhouse gases during operation, unlike conventional cars. This shift in consumer behavior, driven by the IRA, can lead to a substantial reduction in air pollution and a cleaner environment.

Furthermore, the IRA's focus on EV infrastructure is another critical aspect of its environmental impact. The legislation allocates funds for the development of charging stations across the country, ensuring that EV owners have convenient access to charging facilities. This infrastructure expansion enables longer-range electric vehicles and encourages more people to make the switch. With improved charging networks, the range anxiety associated with EVs is reduced, making them a more attractive and practical option for daily commutes and long-distance travel.

The environmental benefits of the IRA extend beyond the direct reduction of greenhouse gas emissions. The production and use of electric vehicles also contribute to a more sustainable future. For instance, the manufacturing of EVs often involves the use of renewable energy sources, further reducing the carbon footprint of the automotive industry. Additionally, the IRA's emphasis on domestic manufacturing and supply chain resilience can lead to the development of a more environmentally friendly and resource-efficient EV production process.

In summary, the Inflation Reduction Act plays a pivotal role in promoting environmental sustainability by reducing greenhouse gas emissions and fostering a cleaner transportation system. Through financial incentives and infrastructure development, the IRA encourages the widespread adoption of electric vehicles, leading to improved air quality and a more sustainable future for the automotive industry and the planet as a whole. This legislation is a significant step towards achieving global climate goals and creating a greener, more environmentally conscious society.

Ford's Future: Rumors of EV Shutdown Unraveled

You may want to see also

Frequently asked questions

The Inflation Reduction Act is a landmark piece of legislation in the United States that aims to reduce inflation and address climate change. It provides significant incentives and subsidies for EV purchases, making them more affordable and accessible to consumers.

The act offers a tax credit of up to $7,500 for new EV purchases, which can be claimed by individual buyers. This credit is designed to encourage the adoption of EVs and reduce the upfront cost, making them more competitive against traditional gasoline vehicles.

Yes, the IRA has certain eligibility criteria. The vehicle must be new and purchased from a dealership or manufacturer that participates in the program. Additionally, the buyer's modified adjusted gross income (MAGI) must be below a certain threshold, ensuring that the benefit reaches a wide range of income levels.

Absolutely. The IRA's incentives not only lower the purchase price but also potentially reduce the cost of charging and maintaining EVs. It includes provisions for tax credits for EV charging infrastructure, making it more convenient and affordable for EV owners to charge their vehicles at home or public stations.

By providing substantial incentives, the IRA aims to boost the production and sale of EVs in the US. It encourages domestic manufacturing and investment in EV-related technologies, creating jobs and fostering a sustainable transportation ecosystem. This, in turn, can lead to a more diverse and resilient automotive industry.