Electric vehicles (EVs) have gained significant popularity in recent years, and many governments have offered incentives to encourage their adoption. One such incentive is the tax credit, which provides financial benefits to EV buyers. However, it's important to note that these tax credits are often time-limited and subject to specific eligibility criteria. This paragraph aims to explore the current status of electric vehicles that are still eligible for tax credits, shedding light on the latest offerings and helping potential buyers make informed decisions in the rapidly evolving EV market.

What You'll Learn

- Vehicle Type: Determine if the EV is a car, truck, or SUV

- Price Range: Check if the vehicle's price falls within the eligible range

- Manufacturer: Verify if the car is produced by a qualified manufacturer

- Battery Capacity: Assess the battery capacity to meet tax credit criteria

- Production Date: Ensure the vehicle was manufactured in a specific year or later

Vehicle Type: Determine if the EV is a car, truck, or SUV

When considering the eligibility of electric vehicles (EVs) for tax credits, understanding the vehicle type is crucial. The classification of EVs into cars, trucks, or SUVs can significantly impact their tax credit status. Here's a breakdown of how to determine the vehicle type and its relevance to tax credit eligibility:

Car:

- Definition: A car is typically a four-wheeled vehicle designed primarily for passenger transportation. It usually has a compact or mid-size body and is often more maneuverable and agile.

- Tax Credit Eligibility: Many electric cars are eligible for tax credits. The Internal Revenue Service (IRS) has specific guidelines for classifying vehicles as "qualified electric vehicles" for tax purposes. These guidelines often consider factors like battery capacity, range, and vehicle weight. For example, the Tesla Model 3 and Model Y, as well as the Chevrolet Bolt EV, are known to be eligible for tax credits due to their classification as electric cars.

Truck:

- Definition: Trucks are generally larger vehicles designed for carrying cargo or passengers. They often have a higher ground clearance and are built for durability and strength.

- Tax Credit Considerations: Electric trucks, especially those with a focus on commercial or heavy-duty applications, may also qualify for tax credits. The IRS criteria for electric trucks might differ from those for cars. For instance, the Ford F-150 Lightning, an all-electric version of a popular pickup truck, has been promoted for its potential tax credit eligibility.

SUV (Sport Utility Vehicle):

- Definition: SUVs are versatile vehicles that combine elements of cars and trucks. They offer a higher ride height, more interior space, and often provide a comfortable driving experience.

- Tax Credit Rules: The classification of SUVs as electric vehicles for tax credits can vary. Some compact or mid-size SUVs with electric powertrains may be eligible. However, larger SUVs might have different eligibility criteria. For example, the Hyundai Ioniq 5 and Kia EV6, which are compact SUVs, have been mentioned as eligible for tax credits.

To determine if an EV is eligible for a tax credit, it's essential to consult the IRS guidelines or seek professional advice. The vehicle's make, model, and specific specifications play a significant role in determining its classification and eligibility. Additionally, staying updated with the latest tax regulations and incentives is crucial, as these can change over time.

Warren Buffett's Electric Vehicle Stake: Selling or Holding?

You may want to see also

Price Range: Check if the vehicle's price falls within the eligible range

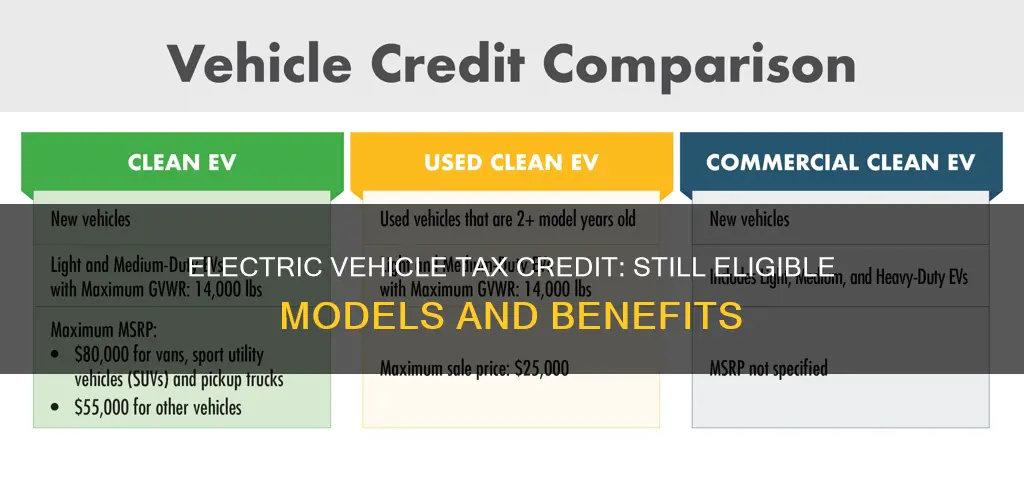

When considering the tax credit for electric vehicles, one crucial aspect to verify is whether the vehicle's price aligns with the specified eligible range. This criterion is in place to ensure that the tax credit is directed towards affordable and accessible electric vehicles, promoting a wider adoption of sustainable transportation. Here's a detailed guide on how to check the price range for electric vehicles eligible for the tax credit:

Research the Eligible Price Range: Start by researching the current guidelines provided by the relevant government or tax authority. The price limits for electric vehicles eligible for the tax credit can vary over time. For instance, in some countries, the eligible range might be set between $30,000 and $50,000 for the vehicle's sticker price, including destination charges. It's essential to have the most up-to-date information to ensure accuracy.

Sticker Price and Destination Charges: The price of an electric vehicle includes the sticker price, which is the manufacturer's suggested retail price, and destination charges, which cover the cost of delivering the vehicle to the dealership. When checking the price, consider both components. For example, if a vehicle's sticker price is $45,000 and the destination charge is $1,000, the total price would be $46,000. Ensure that this total falls within the eligible range.

Compare with Similar Models: If you're eyeing a specific electric vehicle, compare its price with similar models from the same manufacturer or competitors. Sometimes, slight variations in trim levels or additional features can impact the price. Understanding the price range of comparable vehicles will help you make an informed decision and ensure you're considering eligible options.

Check for Discounts and Incentives: Keep in mind that the price of an electric vehicle can be influenced by various factors, including manufacturer incentives, dealer discounts, and regional promotions. These additional savings can make a vehicle more affordable and potentially bring it within the eligible price range. Research and inquire about any available discounts or incentives that could further reduce the vehicle's cost.

Stay Informed and Plan Ahead: Tax credit eligibility criteria can change, so staying informed is crucial. Keep an eye on updates from government sources and automotive websites. Planning your purchase in advance will allow you to research and compare vehicles, ensuring you make a well-informed decision that aligns with the tax credit requirements.

The Future of Non-Electric Cars: A Look at the U.S. Market

You may want to see also

Manufacturer: Verify if the car is produced by a qualified manufacturer

To determine if an electric vehicle is eligible for a tax credit, one of the key factors to consider is the manufacturer. The tax credit for electric vehicles is designed to incentivize the purchase of these vehicles, and it is crucial to ensure that the car is produced by a qualified manufacturer. Here's a step-by-step guide to verifying this:

Research and Verify the Manufacturer: Start by researching the manufacturer of the specific electric vehicle you are interested in. Many governments or relevant authorities maintain lists of approved or qualified manufacturers for tax credit purposes. These lists often include companies that meet certain criteria, such as producing vehicles in compliance with environmental standards and adhering to specific manufacturing processes. You can find these lists on official government websites or through environmental agencies.

Check for Compliance and Accreditation: Once you have identified the manufacturer, verify their compliance with relevant regulations and standards. Look for certifications and accreditations that indicate the manufacturer's commitment to producing high-quality, environmentally friendly vehicles. For example, some manufacturers might have received certifications for their adherence to the Corporate Average Fuel Economy (CAFE) standards or other industry-specific certifications. These credentials ensure that the manufacturer meets the necessary requirements to be eligible for the tax credit.

Review Manufacturing Processes: Understanding the manufacturing processes can provide further insight. Some manufacturers might have specific assembly lines or production facilities dedicated to electric vehicles, ensuring a consistent and controlled environment for production. This attention to detail can be an indicator of the manufacturer's commitment to quality and compliance.

Cross-Reference with Tax Credit Guidelines: Tax credit guidelines often provide specific criteria that manufacturers must meet to be eligible for the incentive. These criteria may include production volume, environmental impact, and adherence to certain manufacturing practices. By cross-referencing the manufacturer's information with these guidelines, you can ensure that the vehicle is indeed produced by a qualified entity.

Stay Updated: It's important to note that eligibility criteria and manufacturer lists may change over time. Therefore, it is essential to stay updated with the latest information. Regularly checking official sources and government websites will ensure that you have the most current data, allowing you to make informed decisions regarding electric vehicle purchases and tax credits.

The Green Promise of Electric Vehicles: Unveiling the Reality

You may want to see also

Battery Capacity: Assess the battery capacity to meet tax credit criteria

When considering the eligibility of electric vehicles for tax credits, battery capacity is a critical factor that determines whether a vehicle qualifies for the incentives. The tax credit for electric vehicles is designed to encourage the adoption of zero-emission transportation, and one of the key criteria is the vehicle's ability to store and utilize energy efficiently.

Battery capacity refers to the amount of energy a vehicle's battery can store, typically measured in kilowatt-hours (kWh). The higher the battery capacity, the more energy the vehicle can carry, allowing for longer driving ranges. As of my cut-off date, January 2023, the tax credit guidelines for electric vehicles in the United States specify that vehicles must have a battery capacity of at least 40 kWh to be eligible for the full tax credit amount. This threshold ensures that the vehicle can provide a practical and convenient driving experience for most consumers.

Assessing battery capacity is essential because it directly impacts the vehicle's performance and range. A higher battery capacity generally results in a longer driving range, which is a significant selling point for potential buyers. For instance, vehicles with larger batteries can offer over 300 miles on a single charge, making them suitable for long-distance travel and reducing range anxiety among consumers. On the other hand, vehicles with lower battery capacities might have shorter ranges, which could limit their eligibility for the tax credit, especially if the vehicle's primary purpose is for shorter daily commutes.

Manufacturers often provide detailed specifications about their electric vehicles' battery capacity and range. It is crucial for consumers to review these specifications to ensure the vehicle meets their needs and the tax credit criteria. Additionally, some regions or countries may have different tax credit programs with varying battery capacity requirements, so it's essential to check local regulations.

In summary, battery capacity is a vital consideration when evaluating electric vehicles for tax credit eligibility. A higher battery capacity generally leads to a more competitive vehicle in the market, offering longer driving ranges and potentially attracting more buyers. Understanding the battery capacity requirements and specifications of electric vehicles is essential for both consumers and manufacturers to ensure compliance with tax credit programs and provide consumers with the information they need to make informed purchasing decisions.

Powering Up: A Beginner's Guide to Electric Vehicle Ownership

You may want to see also

Production Date: Ensure the vehicle was manufactured in a specific year or later

The availability of tax credits for electric vehicles (EVs) is a crucial aspect for potential buyers, especially those interested in purchasing a new EV. One of the key eligibility criteria is the production date of the vehicle. To ensure you are getting the most up-to-date information, it is recommended to check the latest guidelines and resources provided by government agencies or relevant authorities.

When considering the production date, it is essential to note that the vehicle must have been manufactured in a specific year or later to qualify for the tax credit. This criterion is in place to encourage the adoption of newer, more advanced electric vehicles. As technology advances, newer models often come with improved performance, efficiency, and additional features. By focusing on more recent production years, you can take advantage of these advancements and potentially benefit from the tax credit.

For example, if you are interested in a tax credit, you should look for vehicles manufactured in 2022 or later. This ensures that the EV meets the production date requirement and provides an opportunity to explore the latest models available in the market. Keep in mind that the specific year may vary depending on the region and the policies set by the governing bodies.

Additionally, it is worth mentioning that the tax credit eligibility may also depend on other factors, such as the vehicle's battery capacity, range, and overall performance. These factors are often considered to ensure that the EV meets certain standards and contributes to a more sustainable transportation ecosystem. Therefore, when researching eligible electric vehicles, it is crucial to consider both the production date and other relevant specifications.

By focusing on the production date as a key factor, you can efficiently narrow down your options and identify the electric vehicles that are still eligible for tax credits. This approach ensures that you are making an informed decision and taking advantage of the incentives available to promote the adoption of electric transportation. Remember to stay updated with the latest information to make the most of the tax credit opportunities.

Unlocking EV Tax Savings: A Guide to Maximizing Your Credit

You may want to see also

Frequently asked questions

The tax credit is available for new electric vehicles that meet specific criteria, including being purchased or leased by an individual or business. The vehicle must be new and not used, and it should be designed primarily for passenger use, with a battery range of at least 40 miles.

You can check the eligibility of a particular electric vehicle by referring to the IRS's list of qualified models. This list is regularly updated and includes information about the vehicle's make, model, and year. You can also contact the vehicle manufacturer or dealer to confirm if their specific model qualifies.

Yes, there are income limits in place for the electric vehicle tax credit. The credit amount is phased out for individuals with adjusted gross income (AGI) above $150,000 ($75,000 for married filing separately) and for married couples filing jointly with AGI above $300,000. The credit is completely eliminated for individuals with AGI above $200,000 ($100,000 for married filing separately) and for married couples filing jointly with AGI above $400,000.

Yes, the tax credit is available for both purchased and leased electric vehicles. However, the rules for claiming the credit differ between purchases and leases. For leased vehicles, the credit is typically claimed by the lessee, and the lessor must provide specific information to the lessee to facilitate the claim.