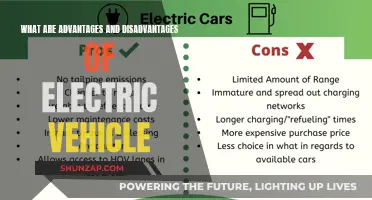

The Florida Tax Credit for Electric Vehicles is a financial incentive designed to encourage residents to purchase or lease electric vehicles (EVs) in the state. This credit allows eligible individuals to claim a percentage of the vehicle's cost as a tax credit, reducing their overall tax liability. The program aims to promote the adoption of environmentally friendly transportation options by making EVs more affordable for Florida residents. By offering this tax credit, the state hopes to contribute to a greener future and reduce the carbon footprint of its transportation sector.

| Characteristics | Values |

|---|---|

| Eligibility | Open to all Florida residents |

| Vehicle Type | New or used electric vehicles (EVs) |

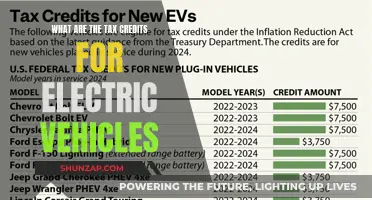

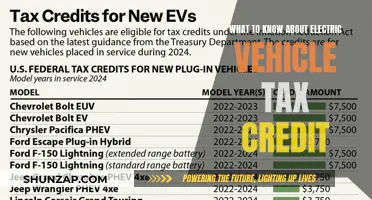

| Credit Amount | Up to $7,500 per vehicle |

| Income Limit | Not specified, but typically, the credit is available to all income levels |

| Vehicle Price | The vehicle's price must not exceed $50,000 |

| Manufacturer's Location | The vehicle must be manufactured in the United States |

| Resale Restriction | EVs purchased with this credit cannot be resold for a profit within 2 years |

| Application Process | Claimable through the Florida Department of Revenue's website |

| Effective Dates | The credit is available for vehicles purchased on or after July 1, 2022 |

| Sunset Clause | The program is set to expire on June 30, 2027, or when funds are depleted |

| Funding Source | The credit is funded by the Florida state government |

| Additional Requirements | Buyers must complete an online application and provide proof of residency and vehicle ownership |

What You'll Learn

Eligibility: Who qualifies for the Florida EV tax credit?

The Florida Tax Credit for Electric Vehicles is a financial incentive designed to encourage residents to purchase and own electric vehicles (EVs). This credit is a valuable benefit for those looking to make an environmentally friendly choice while also saving money. Here's a detailed breakdown of who qualifies for this credit:

Residency and Income Requirements:

To be eligible for the EV tax credit, you must be a resident of Florida. This means you need to have a valid Florida driver's license and be a resident for tax purposes. Additionally, there are income limits to ensure the credit benefits those who may need it most. The credit is available to individuals with adjusted gross income (AGI) of $150,000 or less for single filers and $300,000 or less for joint filers. These income thresholds are adjusted annually, so it's essential to check the latest figures before applying.

Vehicle Ownership and Purchase:

The credit is specifically for the purchase of a new electric vehicle. This includes fully electric cars, trucks, and motorcycles. You must have purchased the vehicle from a dealership or retailer in Florida to qualify. The vehicle must also be new and not a used car. It's important to note that the credit is not applicable to the purchase of a used EV, even if it is an electric vehicle.

Vehicle Price and Value:

There are specific price limits for the vehicles eligible for the tax credit. The vehicle's sticker price, including any applicable fees and taxes, must not exceed $80,000. This price cap ensures that the credit is targeted at a wider range of EV models, making it more accessible to consumers. Additionally, the vehicle's value, as determined by the manufacturer's suggested retail price (MSRP), should not exceed $50,000.

Other Important Considerations:

Eligibility also depends on the type of EV. Plug-in hybrid electric vehicles (PHEVs) are not eligible for the full tax credit. However, they may qualify for a partial credit. It's crucial to understand the differences and ensure your vehicle meets the criteria. Furthermore, the credit is non-transferable, meaning it cannot be sold or assigned to another party.

In summary, the Florida EV tax credit is designed to support residents in their transition to electric vehicles. By meeting the residency, income, and vehicle purchase criteria, eligible individuals can take advantage of this financial incentive, making the switch to electric more affordable and accessible.

Unlocking the Secrets of Qualified Plug-in Electric Vehicles

You may want to see also

Amount: How much is the credit?

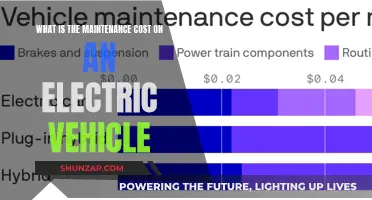

The Florida Tax Credit for Electric Vehicles is a financial incentive program designed to encourage the adoption of electric vehicles (EVs) in the state. This credit is a valuable benefit for EV owners, providing a direct reduction in their state income tax liability. The amount of the credit varies depending on several factors, including the vehicle's price and the taxpayer's income.

For the 2023 tax year, the credit amount is set at $7,500 per qualified electric vehicle. This credit is available to individuals who purchase or lease a new electric vehicle and use it primarily for personal transportation. The credit is non-refundable, meaning it can only be used to reduce the taxpayer's state income tax liability and cannot be refunded as a cash payment.

To qualify for this credit, the electric vehicle must meet specific criteria. It should be new and acquired for personal use, and it must be powered by a battery or fuel cell with a gross vehicle weight rating of 14,000 pounds or less. Additionally, the vehicle's manufacturer must be a U.S. company, and the vehicle must be assembled in North America.

It's important to note that the credit is subject to a phase-out for high-income taxpayers. The credit amount is reduced for individuals with adjusted gross income (AGI) above a certain threshold. For the 2023 tax year, the phase-out begins at $150,000 AGI for joint filers and $75,000 AGI for single filers. The credit is gradually reduced until it phases out completely for taxpayers with AGI above these limits.

Understanding the credit amount and its eligibility criteria is crucial for EV owners in Florida. This tax credit can significantly reduce the financial burden of purchasing an electric vehicle, making it an attractive incentive for those looking to go green and save on their state income taxes.

Disney's Electric Conveyance Vehicles: A Smooth Ride Through the Magic

You may want to see also

Application Process: Steps to claim the credit

The Florida Tax Credit for Electric Vehicles is a financial incentive designed to encourage residents to purchase and use electric vehicles (EVs) in the state. This credit can significantly reduce the cost of buying an EV, making it more affordable for Florida residents. Here's a step-by-step guide on how to claim this credit:

- Purchase an Eligible Vehicle: The first step is to buy an electric vehicle that qualifies for the tax credit. The vehicle must be new and purchased from a dealership or retailer in Florida. Ensure that the vehicle meets the state's criteria for electric vehicle eligibility, which typically includes a minimum battery capacity and range. You can find a list of eligible models on the Florida Department of Revenue's website.

- Obtain a Sales Tax Receipt: When purchasing your EV, make sure to get a sales tax receipt that shows the vehicle's price and the amount of sales tax paid. This document will be essential for the application process.

- Complete the Application: Download and fill out the Florida Electric Vehicle Tax Credit Application form. This form can usually be found on the Florida Department of Revenue's website. Provide all the required information, including your personal details, vehicle specifications, and the purchase details. Double-check all the information to ensure accuracy.

- Gather Supporting Documents: Along with the application, you'll need to submit supporting documents. These typically include the sales tax receipt, a copy of the vehicle's title, and proof of residency in Florida. Ensure that all documents are legible and in the required format.

- Submit the Application: Mail the completed application and supporting documents to the Florida Department of Revenue's office. You can find the specific address on their website. Include a self-addressed, stamped envelope to ensure a quick return of your application if additional information is required.

- Wait for Processing: After submitting your application, the department will review it. This process may take some time, and you should allow for potential delays. Once approved, you will receive a notification, and the tax credit will be applied to your state tax liability. If you are not currently owing state taxes, you may opt to receive a refund check.

Remember, the Florida Tax Credit for Electric Vehicles is a valuable incentive, and following these steps accurately is crucial to ensure a smooth application process. Keep all your purchase documents organized and easily accessible to support your application.

Electric Vehicle Tax Credit: Deduction or Itemization?

You may want to see also

Vehicle Types: Which EVs are eligible?

The Florida Tax Credit for Electric Vehicles is a financial incentive designed to encourage the adoption of electric vehicles (EVs) in the state. This credit is available to individuals and businesses who purchase or lease eligible EVs, providing a significant reduction in the overall cost of ownership. To be eligible for this credit, the vehicle must meet specific criteria, including being a new or used EV and meeting certain environmental and performance standards.

When it comes to vehicle types, the credit applies to a wide range of electric vehicles, but there are some important considerations. Firstly, the vehicle must be a battery-electric vehicle (BEV) or a plug-in hybrid electric vehicle (PHEV). BEVs are fully electric and run solely on electricity, while PHEVs have both an electric motor and a conventional engine. These two types of EVs are the primary focus of the tax credit.

Eligible BEVs include a variety of models, such as the Tesla Model 3, Model Y, and Model S, as well as the Chevrolet Bolt EV and the Ford Mustang Mach-E. These vehicles are known for their high performance, long-range batteries, and advanced technology. PHEVs, on the other hand, offer a more flexible driving experience, combining the benefits of electric power with the convenience of a traditional fuel source. Examples of PHEVs include the Toyota Prius Prime, the Hyundai Ioniq Plug-in Hybrid, and the Chevrolet Volt.

It's important to note that the tax credit is not limited to a specific brand or manufacturer. As long as the vehicle meets the eligibility criteria, it can qualify for the credit. However, the credit amount may vary depending on the vehicle's price and the specific model. Higher-priced vehicles may receive a larger credit, but there are also income limits to ensure the credit benefits those who need it most.

Additionally, used EVs can also be eligible for the tax credit, provided they meet the same criteria as new vehicles. This includes factors such as the vehicle's age, mileage, and overall condition. The used EV market is growing, and this credit can make it more accessible and affordable for consumers. Overall, the Florida Tax Credit for Electric Vehicles is a valuable incentive for those looking to go green and save on their vehicle purchases or leases.

Electric Vehicles: The Future is Now, But Challenges Remain

You may want to see also

Expiration: When does the credit expire?

The Florida Tax Credit for Electric Vehicles is a financial incentive program designed to encourage the adoption of electric vehicles (EVs) in the state. This credit allows eligible individuals and businesses to claim a tax refund based on the purchase or lease of a new electric vehicle. It is a valuable benefit for EV owners, as it can significantly reduce their tax liability. However, it's important to understand the expiration of this credit to ensure timely utilization.

The credit has a specific expiration date, which is set by the Florida legislature. As of my knowledge cutoff in January 2023, the program is currently in effect, but it is subject to change. The Florida Tax Credit for Electric Vehicles typically has a limited duration, and the credit amount may vary over time. For instance, the credit amount might decrease or be phased out as the program reaches its cap or as part of broader tax legislation changes.

To determine the current expiration status, one should refer to the official state government sources or consult with a tax professional. These sources will provide the most up-to-date information regarding the credit's validity and any recent amendments. It is crucial to stay informed about these changes, especially if you are considering purchasing or leasing an electric vehicle in Florida.

Additionally, it is worth noting that the credit might have specific requirements and limitations. These could include restrictions on vehicle types, income thresholds, or limitations on the number of credits per individual or business. Understanding these conditions is essential to ensure eligibility and proper utilization of the credit.

In summary, the Florida Tax Credit for Electric Vehicles is a valuable incentive, but its expiration date and terms are subject to change. Prospective EV buyers or leasers should regularly check official sources or seek professional advice to stay informed about the current status and any potential modifications to the credit program. Being aware of these details will enable individuals to make timely decisions and take advantage of the financial benefits associated with electric vehicle ownership in Florida.

California's Green Shift: Electric Vehicles, Carpool Lanes, and the Future of Transportation

You may want to see also

Frequently asked questions

The Florida Tax Credit for Electric Vehicles is a financial incentive program designed to encourage the adoption of electric vehicles (EVs) in the state. This credit allows Florida residents to claim a tax rebate on the purchase or lease of an eligible electric vehicle.

The credit amount varies depending on the vehicle's price and the type of EV. For model year 2023, the credit is up to $7,500 for new electric vehicles and $4,500 for used EVs. The credit is based on a percentage of the vehicle's price, with a maximum cap.

Florida residents who purchase or lease a new or used electric vehicle are eligible for the tax credit. The vehicle must be primarily used for personal transportation and meet specific environmental and safety standards.

To claim the credit, you need to complete and submit Form DR-140, "Florida Electric Vehicle Tax Credit Claim," along with supporting documents, including proof of vehicle purchase or lease and its eligibility. The form can be submitted online or by mail to the Florida Department of Revenue.