The electric vehicle (EV) tax credit is a financial incentive designed to encourage the adoption of electric cars and promote sustainable transportation. This credit is a significant benefit for EV buyers, offering a substantial refund on their federal income taxes. Understanding the details of this tax credit is essential for anyone considering purchasing an electric vehicle, as it can significantly reduce the overall cost of ownership. The credit is available to individuals and businesses, and it covers a wide range of electric vehicles, including cars, trucks, and motorcycles. This guide will explore the key aspects of the EV tax credit, including its value, eligibility criteria, and the application process, providing valuable insights for those looking to make an environmentally friendly and potentially cost-saving purchase.

What You'll Learn

Eligibility: Who qualifies for the EV tax credit?

The electric vehicle (EV) tax credit is a financial incentive designed to encourage the adoption of electric cars and promote a more sustainable transportation system. To qualify for this credit, individuals must meet specific criteria, ensuring that the benefits go to those who are most likely to contribute to the environmental and economic goals of the EV market.

Eligibility for the EV tax credit is primarily based on the purchase or lease of a new electric vehicle. The vehicle must be new and originally purchased or leased by the taxpayer. This means that buying a used EV or a pre-owned vehicle does not qualify for the tax credit. Additionally, the vehicle should be acquired for personal use, and the purchase or lease must be made directly from an eligible dealer or manufacturer.

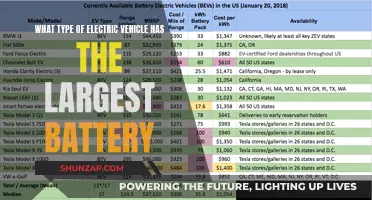

One of the key requirements is that the vehicle must be a plug-in electric vehicle (PEV). This includes battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The tax credit is not available for traditional hybrid vehicles that rely solely on a gasoline engine and regenerative braking systems, as they do not require plugging into an external power source.

Furthermore, the taxpayer's income level plays a significant role in determining eligibility. The EV tax credit is generally available to individuals with adjusted gross income (AGI) below a certain threshold, which is adjusted annually. For the 2023 tax year, the AGI limit for individuals is $150,000, and for married filing jointly, it is $300,000. Taxpayers above these income limits may still be eligible if they meet specific criteria, such as being a disabled person or a veteran.

It's important to note that the EV tax credit is also subject to a cap on the amount that can be claimed. For the 2023 tax year, the credit amount is $7,500 for BEVs and $4,500 for PHEVs. Once the cap is reached, no further credit is available, even if the vehicle's price exceeds the cap. This cap ensures that the credit is targeted towards a wider range of EV buyers and not just those purchasing more expensive vehicles.

Powering the Future: Understanding Electric Vehicle Powertrains

You may want to see also

Vehicle Types: Which electric vehicles are eligible?

When it comes to the electric vehicle (EV) tax credit, understanding which types of electric vehicles are eligible is crucial. The tax credit is designed to incentivize the purchase of electric cars, trucks, and utility vehicles, but there are specific criteria that must be met. Here's a breakdown of the vehicle types that qualify:

Electric Cars:

The term 'electric car' typically refers to a fully electric vehicle powered solely by an electric motor and a battery pack. These cars are eligible for the tax credit, and the key factor is the vehicle's final assembly. If the car is manufactured and assembled in North America (including the United States, Canada, or Mexico), it qualifies. This includes vehicles from domestic and international manufacturers, ensuring a wide range of options for consumers.

Electric Trucks and SUVs:

Both electric trucks and sport utility vehicles (SUVs) are eligible for the tax credit. This category includes battery-electric trucks and SUVs, as well as plug-in hybrid electric vehicles (PHEVs) that can switch to electric mode. The eligibility extends to both passenger and commercial vehicles, making it applicable to a diverse range of EV models.

Utility Vehicles:

Utility vehicles, also known as commercial or cargo vehicles, are another eligible category. These vehicles are designed for transporting goods or people and include electric vans, box trucks, and delivery vehicles. The tax credit can be applied to these utility vehicles, making them an attractive option for businesses and commercial fleets looking to transition to electric power.

Key Considerations:

It's important to note that the tax credit is not limited to a specific brand or manufacturer. As long as the vehicle meets the assembly and eligibility criteria, it qualifies. Additionally, the credit is typically available for new purchases, so used electric vehicles may not be eligible. Understanding these vehicle types and their eligibility ensures that consumers can make informed decisions when considering an electric vehicle purchase.

In summary, the electric vehicle tax credit covers a broad spectrum of electric cars, trucks, SUVs, and utility vehicles. By meeting the assembly requirements, these vehicles can provide significant financial benefits to consumers and businesses, contributing to the widespread adoption of electric transportation.

Vehicle Electrical Drain: Tips for Isolating Power to Prevent Drain

You may want to see also

Income Limits: Are there income caps for the credit?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to make the switch to electric mobility. However, it's important to understand the eligibility criteria, particularly regarding income limits, to ensure you qualify for this benefit.

One key aspect to consider is the income threshold set by the government for this tax credit. The Internal Revenue Service (IRS) has established income limits to ensure that the credit is directed towards those who may need it the most. For the EV tax credit, the income limits are based on the adjusted gross income (AGI) of the taxpayer. The AGI is a measure of your income after certain deductions have been applied. For the 2023 tax year, the income limits for the EV tax credit are as follows: For single filers, the limit is $150,000, and for married filing jointly, the limit is $300,000. These limits are adjusted annually, so it's essential to check the latest IRS guidelines for the most accurate information.

Below these income thresholds, taxpayers may be eligible for the full tax credit. However, the credit begins to phase out as income approaches these limits. This means that if your AGI exceeds the set threshold, the credit will gradually decrease until it reaches zero. For example, if your income is $150,001 for a single filer, the credit will be reduced by a certain percentage based on your income level. This phase-out rule ensures that the credit is targeted at those with lower to moderate incomes, promoting a more equitable distribution of the benefit.

It's worth noting that these income limits apply to the taxpayer claiming the credit, not the vehicle's value or the taxpayer's overall income. Therefore, even if your income is above the threshold, you can still purchase an eligible EV and potentially claim the credit if you meet other eligibility criteria. Additionally, the credit is not limited to individuals; it also applies to businesses and other entities, with slightly different income limits and eligibility requirements.

Understanding these income limits is crucial for anyone considering purchasing an electric vehicle and wanting to take advantage of the tax credit. It ensures that the financial incentive is accessible to those who may need it, promoting the adoption of environmentally friendly transportation options. Always consult the latest IRS guidelines or seek professional advice to ensure you have the most accurate and up-to-date information regarding your eligibility for the EV tax credit.

Electric Vehicle Subsidies: Government Support for a Greener Future

You may want to see also

Timing: When is the best time to claim?

The timing of your electric vehicle (EV) tax credit claim is crucial and can significantly impact your overall savings. Here's a breakdown of when you should consider making your claim:

- Understanding the Rules: Before rushing to claim, familiarize yourself with the IRS guidelines. The tax credit is typically available for new EV purchases, and there are specific criteria for eligibility. This includes factors like the vehicle's final assembly date, the buyer's residency, and the vehicle's use. Understanding these rules ensures you meet the necessary requirements and avoid any potential issues during the claim process.

- Purchase Timing: The best time to claim your EV tax credit is immediately after your vehicle purchase. This is because the credit is generally applied to the year of purchase. If you delay the claim, you might miss out on the benefits for that specific year. It's advisable to act promptly once you've made the purchase to ensure you receive the credit as soon as possible.

- Sales Tax and Registration: In some states, you can claim the EV tax credit against the sales tax and registration fees paid for the vehicle. If your state offers this option, it's beneficial to time your claim around these additional costs. By combining the tax credit with the sales tax refund, you can maximize your savings. However, be aware of any state-specific rules and deadlines for claiming these refunds.

- Annual Income Tax Return: The EV tax credit is typically claimed on your annual income tax return. It's essential to file your taxes on time to ensure you don't miss the deadline for claiming the credit. The IRS provides specific instructions and forms for EV tax credits, so review these carefully to ensure accuracy and compliance. Filing early can also help you take advantage of any other tax benefits or deductions you may be eligible for.

- Keep Records: Proper documentation is vital when claiming the EV tax credit. Keep all relevant receipts, sales invoices, and any other supporting documents related to your vehicle purchase. These records will be essential for verifying your eligibility and ensuring a smooth claim process. Organize these documents in a secure location to easily access them when needed.

Unveiling the Green Fuel: Powering Electric Vehicles with Sustainable Oil

You may want to see also

Documentation: What paperwork is required for the claim?

When it comes to claiming the electric vehicle (EV) tax credit, understanding the necessary documentation is crucial to ensure a smooth and successful process. Here's an overview of the paperwork you'll need:

- Proof of Purchase: The primary document required is proof of purchase, which typically includes a sales receipt or invoice. This should clearly state the date of purchase, the make and model of the electric vehicle, the vehicle's identification number (VIN), and the amount paid. Make sure the documentation is detailed and includes all relevant information to support your claim.

- Vehicle Information: You will need to provide specific details about your EV. This includes the vehicle's make, model, year, and color. In some cases, additional information like the vehicle's battery capacity or range might be required. Ensure that the provided details match the specifications of your electric car.

- Tax Credit Application Form: Most governments or tax authorities will provide an application form specifically for the EV tax credit. This form often requires personal and vehicle-related information. It may include sections for your name, address, contact details, vehicle specifications, and purchase details. Fill out this form accurately and provide all the requested information to avoid any delays in processing.

- Additional Documentation: Depending on your jurisdiction and the specific tax credit program, additional paperwork might be necessary. This could include proof of residency, income verification, or even a declaration of the vehicle's primary use. Check with your local tax authorities or the relevant government website to ensure you have all the required documents.

- Supporting Evidence: Along with the primary purchase documentation, you might need to provide supporting evidence. This could be in the form of a dealer's certification, a manufacturer's statement, or any other documentation that verifies the vehicle's electric nature and its compliance with the tax credit criteria.

It is essential to keep all the required documents organized and easily accessible to ensure a smooth tax credit claim process. Review the guidelines provided by your local tax authorities to ensure you meet all the eligibility criteria and submit the correct paperwork.

Revive Your Ride: A Guide to Putting Dead EVs in Neutral

You may want to see also

Frequently asked questions

The EV tax credit is a financial incentive offered by the government to encourage the purchase of electric vehicles. It provides a tax credit to eligible buyers, reducing the overall cost of the vehicle and making it more affordable.

The amount of the tax credit varies depending on the type of EV and its battery capacity. For plug-in hybrid electric vehicles (PHEVs), the credit can range from $2,500 to $7,500. All-electric vehicles (BEVs) are eligible for a higher credit, typically ranging from $7,500 to $10,000, with some models even qualifying for the full $10,000.

Eligibility criteria include being a U.S. citizen or resident alien, purchasing the vehicle new from a dealership, and meeting specific requirements related to the vehicle's battery capacity and manufacturer's final assembly location. The credit is also subject to a phase-out for high-income earners, with a limit of $150,000 for single filers and $300,000 for joint filers.