Understanding the intricacies of tax returns can be challenging, especially when it comes to electric vehicle (EV) credits. This paragraph aims to clarify where EV credits are reported on tax returns. When taxpayers claim the federal tax credit for electric vehicles, they typically report this credit on their federal tax return, specifically on Form 1040. The credit is calculated as a reduction of the taxpayer's taxable income, which directly impacts their overall tax liability. It's important to note that the rules and limitations surrounding EV credits can vary, so taxpayers should consult the IRS guidelines or seek professional advice to ensure accurate reporting and compliance with tax regulations.

What You'll Learn

- EV Tax Credit Eligibility: Determine if you qualify for the EV tax credit based on vehicle purchase and residency

- Credit Amount Calculation: Understand how the credit amount is calculated based on vehicle price and battery capacity

- Filing Requirements: Learn the necessary steps to claim the EV tax credit when filing your tax return

- Documentation Needed: Gather the required documents to support your EV tax credit claim

- Credit Carryforward/Refund: Explore options for handling excess credit, including carryforward or refund

EV Tax Credit Eligibility: Determine if you qualify for the EV tax credit based on vehicle purchase and residency

The Electric Vehicle (EV) tax credit is a financial incentive offered by the government to encourage the purchase of electric cars, which can significantly reduce the cost of ownership for eligible buyers. To determine if you qualify for this credit, it's essential to understand the criteria, which primarily revolve around the vehicle purchase and your residency status.

Vehicle Purchase Criteria:

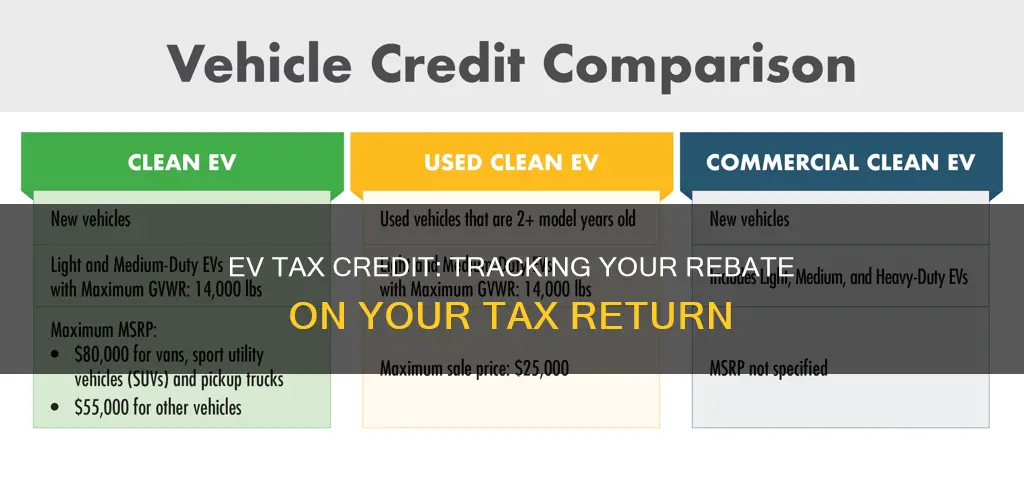

- Eligible Vehicles: The EV tax credit applies to new and used electric vehicles, including plug-in hybrids. However, the credit amount varies depending on the type of vehicle. For new electric cars, the credit can range from $2,500 to $7,500, while used vehicles may qualify for a lower amount.

- Manufacturers and Dealers: The credit is typically tied to the vehicle's manufacturer. You must purchase the EV from an authorized dealer or directly from the manufacturer. Ensure that the dealer or manufacturer provides the necessary documentation to verify the vehicle's eligibility.

- Purchase Date: The purchase must be made after December 31, 2009, and before the end of the tax year in which you claim the credit. This is a crucial detail to keep in mind when planning your EV purchase.

Residency and Income Requirements:

- Residency: You must be a U.S. citizen or resident alien for the entire tax year in which you claim the credit. This means your permanent address should be in the U.S. for the entire year.

- Income Limits: There are income thresholds to qualify for the full credit amount. For the 2023 tax year, the modified adjusted gross income (MAGI) limits are $150,000 for single filers and $300,000 for joint filers. If your income exceeds these limits, you may still be eligible for a partial credit.

Determining Eligibility:

To ensure you receive the correct credit amount, you'll need to provide specific documentation when filing your tax return. This includes a statement from the vehicle dealer or manufacturer confirming the purchase, the vehicle's make and model, and the credit amount. Additionally, you'll need to report your income and residency status for the tax year in question.

In summary, qualifying for the EV tax credit involves meeting specific vehicle purchase criteria and residency and income requirements. It is a valuable incentive for those looking to go green and save on their vehicle purchase. Always consult with a tax professional or accountant to ensure you understand the latest regulations and can maximize your potential savings.

Powering the Future: Understanding Electric Vehicle Infrastructure

You may want to see also

Credit Amount Calculation: Understand how the credit amount is calculated based on vehicle price and battery capacity

The calculation of the electric vehicle (EV) tax credit amount is a crucial step in determining the financial benefits available to EV buyers. This credit is designed to incentivize the adoption of electric vehicles and promote a more sustainable transportation ecosystem. The credit amount is directly tied to the vehicle's price and battery capacity, ensuring that the support is targeted towards eligible and environmentally friendly purchases.

The formula for calculating the credit is straightforward: it is based on a percentage of the vehicle's price, with certain limitations. The credit percentage is typically a fixed rate, and it is applied to the vehicle's price up to a specific threshold. For instance, the credit might be 30% of the vehicle's price, but only up to a certain amount, say $8,000. This means that if a vehicle costs $10,000, the credit would be calculated as 30% of $8,000, resulting in a credit of $2,400. This approach ensures that the credit remains substantial while also providing a clear cap to manage financial incentives.

Battery capacity also plays a role in the credit calculation. The credit amount can vary based on the vehicle's battery capacity, often measured in kilowatt-hours (kWh). Larger battery capacities generally lead to higher credit amounts. This aspect encourages manufacturers to invest in advanced battery technology, as it directly impacts the financial benefits for consumers. For example, a vehicle with a 100 kWh battery might qualify for a higher credit compared to one with a 50 kWh battery, assuming all other factors are equal.

It's important to note that the specific credit calculation details can vary depending on the region and the applicable tax laws. Different countries or states might have their own EV tax credit programs with unique rules and thresholds. Therefore, it is essential to consult the relevant tax authorities or financial advisors to understand the precise credit calculation method and any additional requirements or restrictions.

In summary, the EV tax credit amount is calculated by applying a percentage of the vehicle's price, with a cap, and considering the vehicle's battery capacity. This calculation ensures that the credit is both substantial and environmentally focused, providing a strong incentive for consumers to choose electric vehicles. Understanding these calculation methods is key to maximizing the benefits of EV ownership and staying informed about the financial advantages available.

The Future is Electric: Why We Should Embrace EVs

You may want to see also

Filing Requirements: Learn the necessary steps to claim the EV tax credit when filing your tax return

To claim the electric vehicle (EV) tax credit, you must follow specific filing requirements to ensure a smooth and accurate process. Here's a step-by-step guide to help you navigate the necessary procedures:

- Gather Required Information: Before you begin, collect all the relevant documents and details. This includes the completed and signed Form 8936, which is specifically designed for EV tax credits. You will also need proof of purchase, such as a sales invoice or bill of sale, showing the vehicle's details, including make, model, and purchase date. Additionally, gather your tax return forms, such as Form 1040 or 1040-SR, and any supporting schedules or forms required for your specific tax situation.

- Determine Your Eligibility: The EV tax credit is available to individuals who purchase or lease qualified electric vehicles. Ensure that your vehicle meets the IRS criteria for EV tax credits. This includes checking the vehicle's battery capacity, range, and other specifications. You can find detailed information on the IRS website or consult a tax professional to confirm your eligibility.

- Complete Form 8936: This form is crucial for claiming the EV tax credit. You'll need to provide details about the vehicle, including its make, model, year, and purchase or lease date. Also, include the vehicle's battery capacity and range. Make sure to accurately report the purchase price or lease payment and any applicable discounts or incentives. This form requires specific calculations, so double-check your entries to avoid errors.

- Attach Form 8936 to Your Tax Return: When filing your tax return, ensure that you attach Form 8936 to the appropriate pages. The IRS provides instructions on how to properly attach forms to your tax return. This step is essential to ensure that your EV tax credit claim is considered during the processing of your return.

- Submit Your Tax Return: After completing all the necessary forms and ensuring accuracy, submit your tax return as usual. You can file electronically or by mail, depending on your preference and the IRS guidelines for your tax jurisdiction. Keep a copy of your submitted tax return and all supporting documents for your records.

Remember, it's crucial to stay organized and pay attention to detail when filing for the EV tax credit. Double-checking your calculations and ensuring all required forms are accurately completed will help avoid any issues during the tax filing process. If you have any doubts or complex tax situations, consulting a tax professional is highly recommended to ensure compliance with the IRS regulations.

Jeep's Electric Revolution: Rumors of a Green Future

You may want to see also

Documentation Needed: Gather the required documents to support your EV tax credit claim

When it comes to claiming the electric vehicle (EV) tax credit, ensuring you have the necessary documentation is crucial. This process involves verifying your eligibility and the specific details of your EV purchase. Here's a breakdown of the documents you'll need to gather:

- Proof of Purchase: Start by collecting all relevant documents related to your EV purchase. This typically includes the original sales receipt or invoice. Make sure it clearly shows the vehicle's make, model, and year. Additionally, keep the contract or agreement between you and the dealership or seller, as it provides essential details about the purchase.

- Vehicle Identification Number (VIN): The VIN is a unique identifier for your vehicle. It is essential for verifying the EV's eligibility for the tax credit. You can find the VIN on the vehicle itself, often located on the dashboard or driver's side door jamb. Include this number in your documentation to ensure accuracy.

- Sales Tax Proof: If you've paid sales tax on your EV, you'll need to provide proof of this payment. This could be a copy of the sales tax return or a statement from the tax authority. It is important to note that not all states offer sales tax exemptions for EVs, so check your state's regulations beforehand.

- Financial Statements: Gather your financial records related to the EV purchase. This may include bank statements or credit card receipts showing the transaction. These documents will help verify the amount you paid for the vehicle and support your claim for the tax credit.

- Additional Documentation: Depending on your specific circumstances, you might need extra paperwork. For instance, if you leased the EV instead of purchasing it, you'll require lease agreements. If you received a rebate or incentive, provide the corresponding documentation. These additional documents ensure a comprehensive and accurate representation of your EV acquisition.

By organizing and gathering these documents, you'll be well-prepared to support your EV tax credit claim. It is essential to keep all records in a secure and accessible place, as you may need to provide them to tax authorities or during audits. Remember to review the specific requirements of your region or country, as tax regulations can vary.

Electric Vehicles: Green Revolution or Greenwashing?

You may want to see also

Credit Carryforward/Refund: Explore options for handling excess credit, including carryforward or refund

When it comes to electric vehicle credits, understanding how to handle excess credits and the process of claiming them on your tax return is essential for maximizing your financial benefits. The Internal Revenue Code (IRC) provides a credit for electric vehicles, which can be a significant advantage for taxpayers. However, the credit amount may vary depending on the vehicle's battery capacity and other factors. This can result in a situation where the credit exceeds the tax liability, leading to a credit carryforward or refund.

One option for managing excess electric vehicle credits is to carry them forward. This means that the unused credit can be applied to future tax years, reducing the tax liability for those subsequent years. This is particularly useful if you expect your tax liability to increase in the future or if you plan to purchase another electric vehicle in the coming years. By carrying forward the credit, you can ensure that the benefit is utilized when it is most needed, providing long-term financial advantages.

Alternatively, taxpayers can choose to receive a refund for the excess credit. This option allows you to receive a payment from the government for the difference between the credit amount and your tax liability. Refunds can be beneficial if you have a low tax liability in the current year and want to recover the unused credit immediately. However, it's important to consider that refunds may result in a loss of potential future benefits, as the credit carryforward option provides a more substantial advantage in subsequent years.

To explore these options, taxpayers should carefully review their tax situation and consult relevant IRS guidelines. The IRS provides detailed instructions on how to handle excess credits, including the process for carryforward and refund claims. It is recommended to seek professional advice to ensure compliance with tax regulations and to make an informed decision based on your individual circumstances.

In summary, when dealing with electric vehicle credits, taxpayers have the flexibility to choose between credit carryforward and refund. Carryforward allows for the utilization of excess credits in future years, while refunds provide immediate financial recovery. Understanding these options and their implications is crucial for optimizing the benefits of electric vehicle ownership and ensuring a smooth tax return process.

Electric Vehicles: Revolutionizing the Automotive Industry

You may want to see also

Frequently asked questions

The EV tax credit is available to individuals who purchase or lease certain qualified electric vehicles. You can check if your vehicle meets the criteria by referring to the IRS's list of qualified models. This information is typically available on the IRS website or through their publications.

The EV tax credit is reported on Form 8936, "Qualified Electric Vehicle Charging Station Costs." You'll need to fill out this form and attach it to your federal tax return. The credit amount will be shown on the form, and you can carry forward any unused credit to future years.

Yes, you should keep records and documentation to support your claim. This may include a copy of the vehicle purchase or lease agreement, sales tax exemption certificates, and any other relevant paperwork. These documents will help verify your eligibility and the amount of the credit claimed.

Yes, there are income limits and vehicle price restrictions for the EV tax credit. The credit amount is generally limited to the amount of the vehicle's base price, and there are phase-out rules based on your modified adjusted gross income (MAGI). You can find more details about these limits in the IRS instructions for Form 8936.