The electric vehicle (EV) market is rapidly expanding, and a key aspect of its growth is the demand for high-quality batteries. As the race to dominate the EV battery market intensifies, understanding who leads in sales becomes crucial. This paragraph will explore the current landscape of EV battery sales, highlighting the top players and their contributions to the industry. From traditional automakers to innovative startups, the market is witnessing a shift towards more sustainable and efficient energy storage solutions. The following discussion will delve into the strategies and innovations that have propelled certain companies to the forefront of this competitive field.

What You'll Learn

- Global Market Share: Top EV battery suppliers by sales volume and revenue

- Regional Distribution: Sales breakdown by region and country

- Technology Leadership: Innovations and advancements in battery technology

- Corporate Partnerships: Strategic alliances and partnerships in the EV industry

- Supply Chain Management: Efficient production and distribution networks

Global Market Share: Top EV battery suppliers by sales volume and revenue

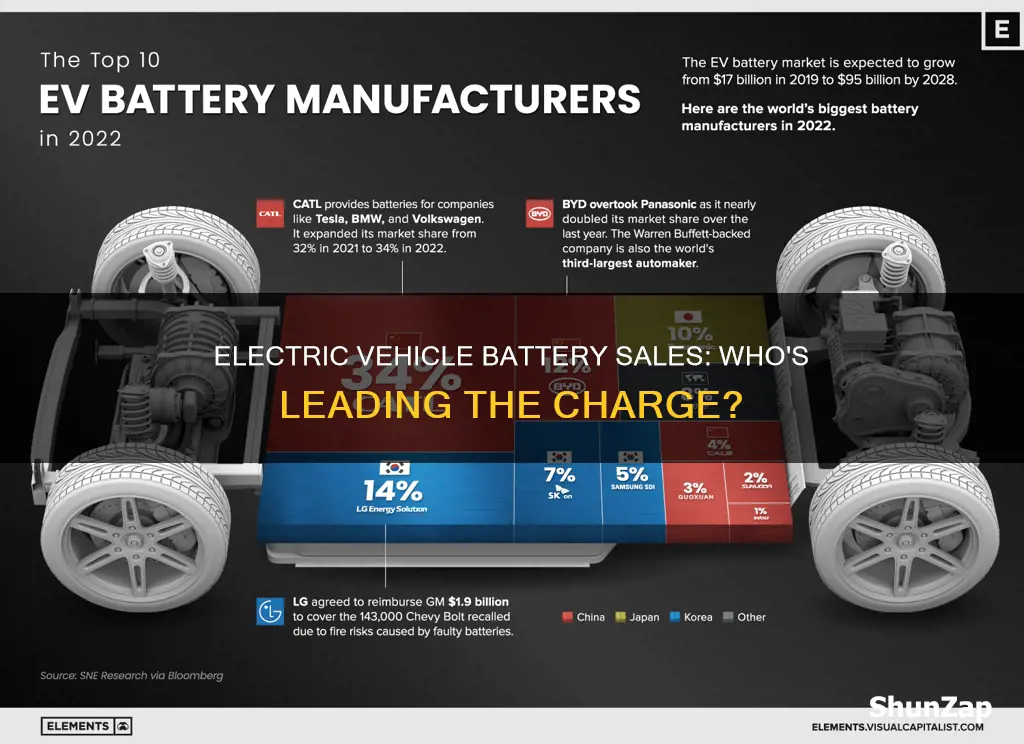

The global market for electric vehicle (EV) batteries is a rapidly growing industry, driven by the increasing demand for sustainable transportation solutions. As the world shifts towards cleaner energy, the race to dominate the EV battery market is on, with several key players vying for the top spot. Here, we delve into the global market share of the top EV battery suppliers, analyzing their sales volume and revenue to identify the leaders in this emerging sector.

Sales Volume Leaders:

The sales volume of EV batteries is a critical indicator of a company's market presence and production capacity. As of 2023, the top three suppliers in terms of sales volume are:

- CATL (Contemporary Amperex Technology Limited): Based in China, CATL has become the undisputed leader in the EV battery market. With a dominant market share, they supply batteries to major EV manufacturers worldwide. Their advanced technology, including high-capacity lithium-ion cells, has positioned them as a preferred partner for many automotive brands. CATL's global sales volume in 2022 was estimated to be over 100 GWh, a significant increase from the previous year.

- Panasonic: A Japanese electronics giant, Panasonic, has a strong presence in the EV battery supply chain. They have established partnerships with renowned EV manufacturers, particularly in the North American and European markets. Panasonic's focus on quality and innovation has led to a steady growth in sales volume. In 2022, they supplied over 50 GWh of batteries, solidifying their position as a top supplier.

- LG Energy Solution: This South Korean company has rapidly risen in the rankings, offering advanced battery solutions for EVs. LG Energy Solution has secured partnerships with major automotive brands, especially in the US and European markets. Their high-performance batteries and innovative designs have contributed to their growing sales volume, reaching approximately 40 GWh in 2022.

Revenue and Market Share:

While sales volume provides an insight into production capacity, revenue reflects the financial success and market dominance of these suppliers. Here's a glimpse into the revenue landscape:

- CATL: With an impressive revenue growth, CATL has consistently topped the revenue charts. In 2022, their revenue reached an astonishing $35.8 billion, a significant leap from the previous year. This dominance is attributed to their extensive global supply chain and strategic partnerships.

- Panasonic: Despite slightly lower revenue compared to CATL, Panasonic's financial performance is robust. In the same year, they generated approximately $14.5 billion in revenue, showcasing their strong market position and customer base.

- LG Energy Solution: LG's revenue has been steadily increasing, reaching $11.3 billion in 2022. Their focus on innovation and expanding global presence has contributed to this growth, making them a formidable competitor.

The global EV battery market is highly competitive, with these suppliers constantly innovating to improve energy density, reduce costs, and enhance performance. As the demand for electric vehicles surges, these companies are expected to further solidify their market positions and drive the industry's growth.

Understanding the Check Electric Vehicle System: A Comprehensive Guide

You may want to see also

Regional Distribution: Sales breakdown by region and country

The global market for electric vehicle (EV) batteries is highly competitive, with several key players dominating the industry. As of 2023, the top sellers of EV batteries include Contemporary Amperex Technology (CATL), Panasonic, and LG Energy Solution, with a significant market share. These companies have established themselves as leading suppliers to major EV manufacturers worldwide.

In terms of regional distribution, the sales of EV batteries vary across different parts of the globe. Here is a breakdown by region and country:

Asia-Pacific Region:

- China: The Asian giant is a major player in the EV battery market. CATL, a Chinese company, has become the world's largest battery manufacturer, supplying batteries to numerous Chinese and international EV brands. The country's massive EV market and government incentives have fueled the growth of local battery producers.

- South Korea: LG Energy Solution, a South Korean company, is a significant player in the region. It has a strong presence in the domestic market and also exports batteries to global EV manufacturers. South Korea's expertise in electronics and battery technology has contributed to its success in the EV battery industry.

- Japan: Panasonic, a Japanese multinational, has a substantial market share in the Asia-Pacific region. With a focus on quality and reliability, Panasonic supplies batteries to various EV manufacturers, including Toyota and Nissan. Japan's advanced manufacturing capabilities have made it a preferred choice for EV battery production.

North America:

- United States: The US market for EV batteries is growing, with several local and international companies operating in the region. Companies like Tesla, with its in-house battery division, and suppliers like Contemporary Amperex Technology (CATL) and Panasonic have a significant presence. The country's push for electric mobility has led to increased investment in battery production.

- Canada: While not as dominant as the US, Canada has a few local battery manufacturers and suppliers. The country's proximity to the US market and its own growing EV industry have contributed to the development of the battery supply chain.

Europe:

- Germany: Europe, particularly Germany, has a robust EV battery market. German companies like Mercedes-Benz and BMW have invested heavily in battery production and research. The region's focus on sustainability and the development of the European Battery Alliance have further boosted the industry.

- France and the United Kingdom: These countries also have a significant presence in the EV battery supply chain, with local manufacturers and suppliers catering to the domestic market and exporting to other European countries.

South America and Africa:

The sales of EV batteries in these regions are relatively smaller compared to the Asia-Pacific, North America, and Europe. However, there is a growing interest in electric mobility, and local battery manufacturers are emerging to cater to the increasing demand.

In summary, the regional distribution of EV battery sales is diverse, with Asia-Pacific, particularly China, South Korea, and Japan, dominating the market. North America and Europe also have significant players, while South America and Africa are witnessing growth and development in the EV battery industry.

Unveiling the Average Cost of Neighborhood Electric Vehicles: A Comprehensive Guide

You may want to see also

Technology Leadership: Innovations and advancements in battery technology

The electric vehicle (EV) market is rapidly growing, and at the heart of this revolution are advancements in battery technology. As the demand for sustainable transportation increases, so does the need for efficient and powerful battery systems. Technology leadership in this field is crucial, driving innovation and shaping the future of the EV industry.

One of the key areas of focus in battery technology is energy density. Researchers and engineers are constantly striving to pack more energy into smaller spaces, allowing for longer driving ranges and improved performance. This has led to significant developments in lithium-ion battery technology, which is currently the dominant power source for EVs. By utilizing advanced materials and innovative cell designs, manufacturers are achieving higher energy densities, making electric cars more practical for everyday use. For instance, the development of solid-state batteries, which replace the liquid electrolyte with a solid conductive material, promises even greater energy density and improved safety.

Another critical aspect of battery technology is charging speed and efficiency. Fast-charging capabilities are essential to reduce the time required to recharge EV batteries, making the technology more convenient and user-friendly. Technology leaders are investing in research to optimize charging processes, including the development of advanced charging stations and improved battery management systems. These systems monitor and control the charging process, ensuring optimal performance and longevity of the battery. Additionally, efforts are being made to enhance the overall efficiency of the battery-charging infrastructure, reducing energy losses and making the entire process more sustainable.

The longevity and reliability of batteries are also areas of intense research. Prolonged battery life and reduced degradation rates are essential to ensure the long-term viability of EVs. Scientists are exploring various strategies to achieve this, such as developing advanced electrode materials that can withstand more charge-discharge cycles without significant performance decline. Furthermore, improving the thermal management of batteries is crucial to prevent overheating and extend their operational lifespan.

In the realm of technology leadership, collaboration and knowledge-sharing among industry leaders, researchers, and startups are vital. Open innovation platforms and partnerships can accelerate the development and commercialization of cutting-edge battery technologies. By combining expertise and resources, these collaborations can address the complex challenges associated with battery production, recycling, and sustainability. As a result, the EV market can benefit from faster adoption and a more robust infrastructure to support the growing demand for electric transportation.

In summary, the continuous innovation and advancements in battery technology are driving the success of the electric vehicle industry. From increased energy density to faster charging and improved longevity, these developments are making EVs more accessible and appealing to a wider audience. Technology leadership in this field is essential to stay ahead of the competition and contribute to a sustainable future.

Unlocking California's EV Future: Exploring Tax Credits and Incentives

You may want to see also

Corporate Partnerships: Strategic alliances and partnerships in the EV industry

The electric vehicle (EV) industry is a rapidly growing sector, and the demand for its core component, batteries, is soaring. As a result, numerous companies are investing in and developing advanced battery technologies to meet this rising demand. However, the market is highly competitive, and many businesses are seeking strategic alliances and partnerships to gain a competitive edge and ensure their long-term success. These collaborations are becoming increasingly important as the industry matures and players strive to optimize their offerings.

One of the most prominent examples of corporate partnerships in the EV battery space is the collaboration between Tesla, Inc. and Panasonic Corporation. Tesla, a leading EV manufacturer, has partnered with Panasonic to design and manufacture its battery packs at the Gigafactory in Nevada, USA. This strategic alliance has allowed Tesla to secure a reliable supply of high-quality batteries, ensuring the production of its vehicles at a large scale. In return, Panasonic gains access to Tesla's cutting-edge technology and expertise in EV manufacturing, fostering innovation in both companies.

Another significant partnership is the one between Volkswagen Group and Northvolt AB. Volkswagen, a global automotive giant, has invested heavily in Northvolt, a Swedish battery manufacturer. This collaboration aims to develop and produce advanced lithium-ion batteries for Volkswagen's EV lineup. By partnering with Northvolt, Volkswagen can focus on its core automotive expertise while leveraging Northvolt's technology and manufacturing capabilities. This strategic move enables Volkswagen to accelerate its EV strategy and compete more effectively in the market.

Furthermore, the EV industry is witnessing a trend of vertical integration, where battery manufacturers are also investing in EV assembly and even car manufacturing. For instance, Contemporary Amperex Technology (CATL), a leading battery producer, has established its own EV assembly plant in China. This move allows CATL to have more control over the quality and consistency of its battery packs and to quickly adapt to market demands. Such vertical integration strategies are becoming common, as battery makers aim to secure a steady supply of raw materials and streamline the production process.

These corporate partnerships and alliances are crucial for the EV industry's growth and development. By collaborating, companies can share resources, expertise, and risks, leading to faster innovation and market penetration. Strategic alliances also help in reducing costs, improving efficiency, and ensuring a consistent supply chain. As the industry continues to evolve, these partnerships will likely become even more prevalent, shaping the future of EV battery production and the overall EV market.

Toyota's Electric Evolution: A Green Revolution in the Works?

You may want to see also

Supply Chain Management: Efficient production and distribution networks

The electric vehicle (EV) market is experiencing rapid growth, and at the heart of this industry are the batteries that power these vehicles. The supply chain for EV batteries is complex and involves multiple stages, from raw material sourcing to final assembly. Efficient supply chain management is crucial to ensure timely production and distribution, meet customer demands, and maintain a competitive edge in the market.

One of the key aspects of efficient supply chain management is optimizing the production process. This involves streamlining manufacturing processes to reduce costs and increase output. For EV battery manufacturers, this means implementing advanced technologies and automation to enhance productivity. For instance, using automated assembly lines can significantly reduce the time and labor required to produce batteries, allowing for higher production volumes. Additionally, implementing just-in-time inventory management can minimize storage costs and reduce the risk of excess inventory, ensuring that raw materials and components are available when needed for production.

Distribution networks play a vital role in delivering the batteries to the end-users, which includes EV manufacturers and, ultimately, consumers. Building an efficient distribution network involves careful logistics planning and collaboration with various partners. Companies should aim to establish a robust network of suppliers and distributors to ensure a steady supply of batteries. This includes negotiating contracts with reliable suppliers, optimizing transportation routes to reduce delivery times, and implementing effective inventory management systems to track and control the flow of goods. By doing so, companies can minimize lead times, ensure product availability, and provide timely deliveries to meet customer expectations.

Furthermore, supply chain management should focus on sustainability and environmental considerations. The EV battery supply chain is closely tied to the extraction of raw materials, such as lithium, cobalt, and nickel. Companies should prioritize responsible sourcing and recycling practices to minimize the environmental impact. Implementing closed-loop supply chains, where used batteries are collected, recycled, and reused, can help reduce waste and ensure a sustainable supply of materials. This approach also contributes to building a positive brand image and meeting the growing consumer demand for environmentally friendly products.

In summary, efficient supply chain management is essential for the success of EV battery manufacturers. By optimizing production processes, building robust distribution networks, and adopting sustainable practices, companies can ensure a consistent supply of high-quality batteries. This, in turn, supports the growth of the electric vehicle industry and contributes to a more sustainable future. Staying competitive in this rapidly evolving market requires a well-managed supply chain that can adapt to changing demands and technological advancements.

Electric Vehicle Mileage Tax: Fair or Unfair for Drivers?

You may want to see also

Frequently asked questions

As of 2023, Contemporary Amperex Technology (CATL) is the leading manufacturer and supplier of lithium-ion batteries for electric vehicles, holding a significant market share worldwide.

The market for electric vehicle batteries has been rapidly growing, with several key players entering the industry. While CATL has maintained its dominance, other companies like Panasonic, LG Energy Solution, and Samsung SDI have also made substantial inroads, offering competitive products and expanding their global presence.

Several factors drive the success of these battery manufacturers. These include technological advancements in battery chemistry, such as higher energy density and faster charging capabilities, which are crucial for EV performance. Additionally, cost reduction strategies, strong relationships with major EV manufacturers, and a global supply chain network play significant roles in their market leadership.

Yes, the electric vehicle battery market is witnessing the emergence of new players, including startups and traditional automakers diversifying into battery production. Companies like Tesla, with its Gigafactory, and traditional automakers like Volkswagen and Stellantis, are investing heavily in battery technology and production capacity, potentially disrupting the market dynamics and increasing competition.