Electric vehicles (EVs) are becoming increasingly popular, but their insurance rates often leave drivers puzzled. The high cost of EV insurance can be attributed to several factors. Firstly, the advanced technology and specialized components of EVs, such as powerful batteries and sophisticated electronics, make them more expensive to repair and replace. Secondly, the relatively new market for EVs means that insurers have limited historical data to assess risk, often resulting in higher premiums to account for potential unknowns. Additionally, the limited availability of specialized repair shops and the need for specialized parts can drive up repair costs, further impacting insurance rates. Understanding these factors can help drivers navigate the complexities of EV insurance and potentially find more affordable coverage.

What You'll Learn

- High-Value Assets: EVs are expensive, leading to higher insurance costs

- Limited Repair Options: Specialized repair shops increase insurance premiums

- Technology Risk: Advanced tech in EVs can be costly to fix

- Environmental Impact: Insurance reflects the environmental benefits of EVs

- Market Demand: Increased demand for EV insurance drives up prices

High-Value Assets: EVs are expensive, leading to higher insurance costs

The high cost of electric vehicle (EV) insurance can be attributed to several factors, primarily related to the unique characteristics of these vehicles. Firstly, EVs are expensive to purchase, and this high upfront cost is a significant factor in the insurance rates. When an asset is valuable, insurers often charge more to cover potential risks and losses. The advanced technology and components in EVs, such as powerful batteries and sophisticated electric motors, also contribute to the higher insurance premiums. These components can be costly to repair or replace if damaged or stolen, which increases the overall risk for insurers.

Another reason for the elevated insurance costs is the relatively new nature of the EV market. As a relatively recent innovation, EVs have not yet been extensively tested and analyzed in terms of their long-term reliability and performance. Insurers often require more data and historical information to accurately assess the risks associated with these vehicles, which can lead to higher premiums until sufficient data is collected. Additionally, the specialized knowledge required to repair and maintain EVs is not as widespread as that for traditional gasoline-powered cars, which can result in higher repair costs and, consequently, more expensive insurance.

The environmental benefits of EVs, while positive, also play a role in their insurance pricing. As the demand for eco-friendly transportation increases, insurers might consider the potential for increased claims due to natural disasters or extreme weather events, which could impact EV owners differently compared to conventional vehicle owners. For instance, the risk of flooding or water damage might be higher in certain regions, and insurers may reflect this in their pricing.

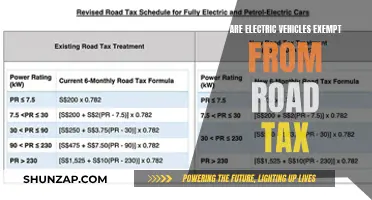

Furthermore, the infrastructure supporting EVs is still developing. The availability of charging stations and the time required to recharge an EV can influence insurance rates. Insurers might consider the convenience and accessibility of charging options when setting premiums, especially for those living in areas with limited charging infrastructure.

In summary, the high cost of EV insurance is a result of the vehicles' expensive nature, advanced technology, the evolving market and data availability, specialized repair requirements, and the unique risks associated with these vehicles. As the EV market continues to grow, insurers will likely adapt their pricing strategies to better reflect the specific characteristics and risks of electric vehicles.

Global Leaders in Electric Vehicle Innovation: Who's Leading the Charge?

You may want to see also

Limited Repair Options: Specialized repair shops increase insurance premiums

The high cost of insuring electric vehicles (EVs) is often attributed to various factors, and one of the key reasons is the limited repair options available for these specialized vehicles. When an accident occurs, repairing an EV can be a complex and costly endeavor due to the unique nature of their technology and design.

EVs are equipped with advanced battery systems, sophisticated electric motors, and intricate electronic components. These parts are not easily replaced or repaired like traditional internal combustion engine (ICE) vehicles. Specialized knowledge and equipment are required to diagnose and fix these issues, which often means that not all repair shops are equipped to handle EV repairs. As a result, insurance companies may charge higher premiums to account for the increased costs and potential complexities associated with EV claims.

The limited availability of repair shops specifically trained in EV maintenance and repairs further contributes to the expense. These specialized shops often have higher operational costs due to the need for advanced diagnostic tools, specialized training, and access to specific parts. Insurance providers consider the higher costs associated with these specialized services when setting premiums, especially when the likelihood of EV-related claims is higher compared to conventional vehicles.

Additionally, the rapid evolution of EV technology presents another challenge. As manufacturers introduce new models and updates, the repair processes become more intricate. Insurance companies must stay updated with the latest repair techniques and part availability, which can be a continuous challenge. This dynamic nature of EV technology may lead to higher insurance rates to ensure adequate coverage for policyholders.

In summary, the limited repair options and specialized requirements for fixing electric vehicles contribute significantly to the higher insurance premiums. Insurance providers must consider the unique aspects of EV repairs, including the complexity of technology, specialized training needs, and the rapid advancement of vehicle designs, all of which factor into the overall cost of insuring these vehicles. Understanding these challenges is essential for both consumers and insurance companies to navigate the financial complexities of EV ownership.

Arrival's Electric Vehicle Dreams: A Story of Unfulfilled Potential

You may want to see also

Technology Risk: Advanced tech in EVs can be costly to fix

The rapid advancement of technology in electric vehicles (EVs) has brought numerous benefits, from improved performance and efficiency to enhanced safety features. However, this technological sophistication also presents unique challenges for insurance companies, leading to higher insurance premiums for EV owners. One of the primary concerns is the complexity and cost of repairing and replacing advanced components within these vehicles.

EVs are equipped with sophisticated systems, including advanced driver-assistance systems (ADAS), autonomous driving capabilities, and powerful electric motors. These components are not only intricate but also often rely on specialized microprocessors and sensors. When an accident occurs, repairing or replacing these advanced parts can be extremely expensive due to their specialized nature and the need for skilled technicians who are well-versed in EV technology. For instance, a single advanced driver-assistance sensor can cost several thousand dollars, and the labor to replace or repair it may be significantly higher than that of a traditional vehicle part.

The high cost of repairs is further exacerbated by the limited availability of replacement parts. As EVs are relatively new to the market, the supply chain for specialized components may not yet be fully established. This scarcity drives up the prices of replacement parts, making repairs even more financially burdensome for EV owners. Additionally, the specialized nature of EV technology means that not all repair shops have the necessary expertise and equipment to handle these complex systems, further increasing the overall repair costs.

Insurance companies must consider these factors when setting premiums. The advanced technology in EVs introduces a higher risk profile, as repairs and replacements are more costly and time-consuming. As a result, insurers may charge higher premiums to account for the increased potential for damage and the associated financial burden. This is particularly true for high-end EVs with cutting-edge features, which often come with a higher price tag and, consequently, more expensive insurance.

In summary, the advanced technology in electric vehicles, while offering numerous advantages, presents a significant challenge for insurance providers. The complexity and cost of repairing or replacing specialized components can lead to higher insurance premiums, reflecting the unique risks associated with these vehicles. As the EV market continues to grow, insurance companies will need to adapt their pricing strategies to accurately reflect the technological risks and associated costs.

Unleashing the Power of EVs: Strategies to Boost Demand and Revolutionize Transportation

You may want to see also

Environmental Impact: Insurance reflects the environmental benefits of EVs

The high cost of electric vehicle (EV) insurance can be attributed to various factors, including the relatively new technology and the unique risks associated with EVs. However, one aspect that often goes unnoticed is the environmental impact of this insurance and how it reflects the benefits of electric cars.

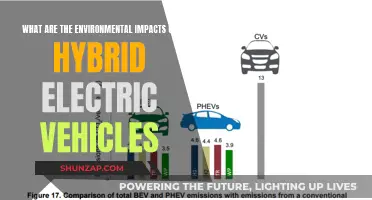

EVs are known for their reduced environmental footprint compared to traditional internal combustion engine (ICE) vehicles. They produce zero tailpipe emissions, which significantly lowers air pollution and contributes to improved public health. This aspect is crucial in many regions where air quality is a growing concern. Insurance companies are increasingly recognizing these environmental advantages and incorporating them into their policies. By offering lower premiums or incentives for EV owners, insurers are essentially rewarding the environmental benefits of these vehicles. This approach encourages more people to make the switch to electric, further reducing the overall environmental impact of the transportation sector.

The environmental impact of insurance for EVs is a relatively new concept, but it is gaining traction. Insurance providers are now considering the long-term benefits of promoting eco-friendly transportation. For instance, some companies offer discounts or special rates for EVs that have been certified as low-emission or zero-emission vehicles. These certifications often take into account the entire lifecycle of the vehicle, including its production, operation, and end-of-life recycling or disposal. By supporting such vehicles through insurance incentives, companies are actively contributing to a greener future.

Additionally, the insurance industry's focus on environmental impact can drive innovation in the EV market. As insurers promote the use of electric cars, manufacturers might be encouraged to invest more in research and development, leading to improved battery technology, more efficient charging systems, and even faster charging times. These advancements would not only benefit the environment but also enhance the overall ownership experience for EV drivers, potentially making insurance costs more competitive over time.

In summary, the high insurance costs for EVs can be seen as a reflection of the technology's environmental benefits. Insurance companies are increasingly incorporating these advantages into their policies, offering incentives that encourage the adoption of electric vehicles. This shift not only benefits the environment but also has the potential to drive positive changes in the automotive industry, making eco-friendly transportation more accessible and affordable.

Unraveling the Cost of EV Batteries: A Comprehensive Guide

You may want to see also

Market Demand: Increased demand for EV insurance drives up prices

The surge in popularity of electric vehicles (EVs) has led to a significant increase in the demand for insurance coverage tailored to these eco-friendly automobiles. As more drivers are embracing the switch to electric, the insurance market is witnessing a unique challenge: a rise in demand that, in turn, drives up insurance prices. This phenomenon can be attributed to several factors. Firstly, the specialized nature of EV insurance is a key consideration. EVs often come equipped with advanced technologies, such as regenerative braking and advanced driver-assistance systems (ADAS), which require specific expertise to assess and manage risks. Insurers need to invest in training their staff to understand these technologies and their potential implications for claims, which can increase operational costs. Moreover, the relatively small number of EV insurance providers in the market contributes to the limited competition. With fewer players offering specialized policies, insurers can set higher premiums to cover their costs and generate profits. This lack of competition can lead to a monopoly-like situation, where consumers have limited options and must pay more for EV insurance.

Secondly, the unique risks associated with EVs further contribute to the rising insurance costs. While traditional vehicles are more susceptible to theft and collision damage, EVs present distinct challenges. For instance, the high value of EV batteries and the potential for fire incidents in rare cases can lead to more expensive repairs and higher claims. Insurers must factor in these specific risks when setting premiums, ensuring they have sufficient reserves to cover potential losses. As a result, the increased demand for EV insurance, coupled with the specialized nature of the vehicles and the associated risks, allows insurers to charge higher prices. This dynamic is further exacerbated by the limited number of insurance providers who are willing and able to offer specialized EV coverage.

The market's response to this situation is a natural consequence of supply and demand economics. When the demand for a product or service exceeds the available supply, prices tend to rise. In the case of EV insurance, the growing popularity of electric vehicles has outpaced the insurance industry's ability to quickly adapt and provide comprehensive coverage. This imbalance creates an opportunity for insurers to increase prices, knowing that consumers are willing to pay more for the specialized protection their EVs require. As a result, the market demand for EV insurance becomes a driving force behind the higher premiums, encouraging both insurers and consumers to adapt to this new reality.

Additionally, the environmental benefits of EVs are often cited as a reason for their increasing popularity. However, this shift towards eco-friendly transportation also has implications for the insurance industry. With a focus on sustainability and reduced carbon footprints, insurers might need to consider alternative risk assessment methods and adjust their pricing structures accordingly. This could involve factoring in environmental factors, such as the impact of climate change on vehicle performance and maintenance, which could further influence the cost of insurance.

In summary, the increased demand for electric vehicle insurance is a significant factor in the higher prices consumers are paying. This demand is driven by the growing popularity of EVs, which presents unique risks and challenges for insurers. The specialized nature of EV insurance, limited competition, and the specific risks associated with these vehicles all contribute to the market's response, allowing insurers to set higher premiums. As the market continues to evolve, insurers and consumers alike must adapt to this new dynamic, ensuring that the insurance coverage for EVs remains relevant and affordable in the long term.

Transform Your Ride: The Ultimate Guide to Electric Vehicle Conversion

You may want to see also

Frequently asked questions

Electric vehicles often come with a higher upfront cost, and this can impact insurance rates. Additionally, the specialized technology and components in EVs, such as advanced batteries and electric motors, can make them more expensive to repair and replace. Insurers may also consider the limited availability of EV-specific repair facilities, which can drive up costs.

Yes, insurance rates can vary depending on the specific EV model and its features. Factors like the vehicle's performance, range, and the manufacturer's reputation can influence the premium. For instance, high-performance EVs with advanced technology might have higher insurance costs due to the potential for more expensive repairs.

The range of an EV can be a consideration for insurers. Longer-range vehicles may have higher insurance rates because they are more attractive to thieves, and the potential for extensive damage in the event of an accident could be higher. However, this is not the sole factor, and other variables like the vehicle's value and the driver's profile also play a significant role.

The availability and accessibility of charging stations can influence insurance rates. In areas with well-developed charging infrastructure, the risk of accidents or theft related to charging stations might be lower, potentially resulting in more affordable insurance. Conversely, regions with limited charging options may have higher insurance premiums due to increased risks.

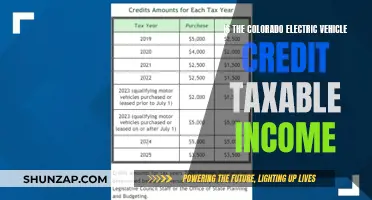

Some governments offer incentives and subsidies to promote the adoption of electric vehicles. These financial benefits can help reduce the overall cost of owning an EV, including insurance. It's advisable to research local and national programs that provide tax credits, rebates, or other incentives, which could make EV insurance more affordable for consumers.