Electric vehicles (EVs) have gained significant popularity in recent years due to their environmental benefits and technological advancements. As the global shift towards sustainable transportation accelerates, many governments and policymakers are implementing various incentives to encourage the adoption of EVs. One such incentive is the possibility of duty-free status for electric vehicles. This paragraph aims to explore the concept of duty-free electric vehicles, examining the potential benefits and challenges associated with this approach. By understanding the implications, we can better appreciate the role of duty-free policies in promoting the widespread use of electric cars and contributing to a greener future.

What You'll Learn

- Tax Exemption: EVs may be exempt from certain taxes and duties

- Import Regulations: Understanding import rules for electric cars

- Government Incentives: Some countries offer incentives for EV buyers

- Tariff Rates: Duty-free rates vary by country and model

- Environmental Benefits: Duty-free status linked to eco-friendly vehicles

Tax Exemption: EVs may be exempt from certain taxes and duties

Electric vehicles (EVs) often come with a range of tax benefits and exemptions, which can significantly reduce the overall cost of ownership. These incentives are designed to encourage the adoption of cleaner and more sustainable transportation methods. One of the most common tax exemptions for EVs is the removal of sales tax on the vehicle itself. In many regions, the purchase of an electric car is exempt from sales tax, which can amount to substantial savings. For instance, in certain countries, the sales tax on a new EV could be as high as 10% of the vehicle's price, but with the exemption, buyers can avoid this additional cost. This tax break not only makes EVs more affordable upfront but also promotes a shift towards environmentally friendly transportation options.

In addition to sales tax exemptions, EVs may also qualify for reduced or waived registration fees. Registration fees are typically charged annually or at the time of vehicle registration, and they can vary depending on the region and the vehicle's value. With the exemption, EV owners can save on these recurring costs, further lowering the long-term financial burden associated with owning an electric car. This is particularly beneficial for individuals and businesses looking to invest in sustainable transportation without incurring excessive expenses.

The tax benefits for EVs extend beyond the initial purchase and registration. Many governments offer incentives for the installation of home charging stations, which are essential for EV owners. These incentives can include tax credits or rebates, making it more affordable for individuals to set up convenient charging solutions at their residences. By encouraging the widespread adoption of EVs, these incentives contribute to a more sustainable future.

Furthermore, the environmental impact of EVs often leads to additional tax advantages. Some regions provide tax credits or refunds for the purchase of electric vehicles, especially those with high energy efficiency ratings. These incentives aim to reward consumers for choosing vehicles that produce fewer emissions and contribute to a greener economy. As a result, EV owners can benefit from both immediate cost savings and long-term environmental benefits.

It is important for EV owners and prospective buyers to research and understand the specific tax regulations in their area, as these can vary widely. Local governments and automotive associations often provide detailed information on the tax exemptions and incentives available for electric vehicles. By taking advantage of these tax benefits, individuals can make a significant contribution to a more sustainable future while also enjoying the financial advantages of owning an EV.

Genesis' Electric Evolution: Unveiling the Future of Luxury

You may want to see also

Import Regulations: Understanding import rules for electric cars

Importing electric vehicles (EVs) can be a complex process, especially when it comes to understanding the various regulations and restrictions imposed by different countries. These regulations often vary significantly, and it's crucial for potential importers to be well-informed to ensure compliance and avoid any legal issues. Here's a comprehensive guide to help you navigate the import rules for electric cars:

Research and Familiarize Yourself with the Destination Country's Regulations:

The first step is to thoroughly research the import policies of the country you plan to import the electric vehicle into. Governments often have specific guidelines and restrictions for vehicle imports, including EVs. These rules can cover aspects such as vehicle age, emissions standards, safety requirements, and more. For instance, some countries may impose strict regulations on the age of imported vehicles to protect local industries or ensure environmental standards. Understanding these requirements is essential to ensure your vehicle meets the necessary criteria.

Check for Duty and Tax Implications:

One of the most significant advantages of importing electric cars is often the potential duty-free status. Many countries offer tax incentives or exemptions for electric vehicles to promote eco-friendly transportation. However, this is not a universal rule, and regulations can vary. For example, some countries may exempt EVs from import duties but still levy taxes on the vehicle's value or components. Researching and understanding the specific tax and duty laws of your destination country is vital to estimate the overall cost of importing your electric car.

Compliance with Emission and Safety Standards:

Electric vehicles are subject to specific emission and safety regulations in many countries. These standards ensure that imported EVs meet the local environmental and safety requirements. For instance, the vehicle's emissions may need to comply with the country's air quality standards, and it should also adhere to the mandated safety features and crash-test ratings. Non-compliance with these standards can result in significant fines or even the refusal of import. Therefore, it is essential to verify that your electric car meets or exceeds the necessary regulatory benchmarks.

Import Licensing and Documentation:

Importing any vehicle, including electric cars, typically requires specific licenses and documentation. This process can vary depending on the country and the type of vehicle. You may need to obtain import licenses, provide detailed vehicle specifications, and submit various documents to customs authorities. It is advisable to consult with a local import specialist or a customs broker who can guide you through the entire process, ensuring all necessary paperwork is in order.

Customs and Border Procedures:

When importing an electric vehicle, you must follow the customs procedures of the destination country. This includes declaring the vehicle's value, providing accurate documentation, and paying any applicable fees or taxes. Customs officials may inspect the vehicle and its paperwork to ensure compliance with import regulations. Being well-prepared and having all the required documents readily available can help expedite the process and avoid potential delays or penalties.

Understanding the import regulations for electric cars is a critical aspect of the process, ensuring a smooth and legal import experience. It is always recommended to seek professional advice from import specialists or customs consultants to navigate the specific rules and requirements of your chosen destination country.

Simplifying the Process: A Guide to Registering Your Electric Car

You may want to see also

Government Incentives: Some countries offer incentives for EV buyers

Incentivizing the adoption of electric vehicles (EVs) is a strategy employed by governments worldwide to encourage a shift towards more sustainable transportation. These incentives come in various forms and can significantly benefit EV buyers, making the transition to electric more appealing and accessible. Here's an overview of some common government incentives:

Financial Rebates and Grants: Many governments provide financial assistance to individuals purchasing electric cars. These incentives often take the form of rebates or grants, directly reducing the upfront cost of EVs. For instance, in some countries, buyers may receive a certain percentage of the vehicle's price as a rebate, making electric vehicles more affordable. These financial incentives can be particularly attractive to potential buyers who might otherwise be deterred by the higher initial investment.

Tax Benefits: Tax incentives are another powerful tool used by governments to promote EV adoption. These can include reduced sales taxes, property taxes, or even tax credits for EV owners. For example, a government might offer a tax credit equal to a percentage of the vehicle's value, which can be claimed when filing taxes. This not only makes EVs more affordable but also provides a long-term financial benefit to buyers.

Free or Reduced Registration Fees: In certain regions, EV owners are exempt from paying registration fees or are offered significantly reduced rates. This incentive streamlines the process of owning an electric vehicle, as buyers don't have to worry about additional costs associated with registration. Lower registration fees can also encourage more people to consider EVs, as it directly impacts the overall cost of ownership.

Charging Infrastructure Development: Governments often invest in the development of charging infrastructure to support EV owners. This includes installing public charging stations in various locations, making it more convenient for EV drivers to recharge their vehicles. By providing access to a robust charging network, governments ensure that EV buyers have the necessary infrastructure to support their new purchases, addressing range anxiety and encouraging wider adoption.

These incentives play a crucial role in promoting the use of electric vehicles, addressing environmental concerns, and fostering a more sustainable future. By offering financial relief, tax benefits, and improved charging infrastructure, governments are actively encouraging citizens to make the switch to electric transportation.

Global EV Sales: Top Markets and Trends

You may want to see also

Tariff Rates: Duty-free rates vary by country and model

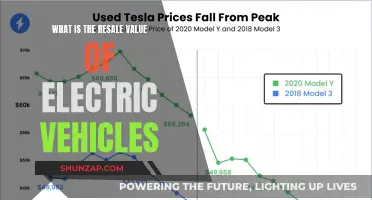

When it comes to electric vehicles (EVs), the concept of duty-free rates can be a complex and varied topic, as different countries and regions have their own unique regulations and tax structures. The duty-free status of EVs is an essential consideration for both manufacturers and consumers, especially when importing or exporting these vehicles across borders.

In many countries, the duty-free status of electric vehicles is determined by specific criteria, including the model, battery capacity, and the purpose of the vehicle's import. For instance, some nations offer duty-free rates for electric cars that meet certain environmental standards or have a specific range capability. These rates can vary significantly, with some countries providing full exemption from import duties, while others may apply reduced rates or specific taxes based on the vehicle's characteristics.

The variation in tariff rates is primarily due to governments' efforts to promote or discourage the adoption of electric vehicles. Some countries heavily subsidize the import of EVs to encourage a shift towards cleaner transportation, while others may impose higher duties to protect domestic industries or generate revenue. For example, a country with a strong automotive sector might introduce higher tariffs on imported electric vehicles to maintain a competitive advantage for its local manufacturers.

Understanding these duty-free rates is crucial for EV manufacturers and importers. They must navigate the complex web of regulations to ensure compliance and optimize costs. For consumers, especially those planning to import or export electric vehicles, knowledge of these rates is essential to make informed decisions and potentially save on significant expenses. It is recommended to consult official government sources or seek professional advice to stay updated on the specific duty-free rates applicable to your country and the model of electric vehicle in question.

Exploring the World of Hybrid Electric Vehicles: A Comprehensive Guide

You may want to see also

Environmental Benefits: Duty-free status linked to eco-friendly vehicles

The concept of duty-free status for electric vehicles (EVs) is an intriguing one, especially when considering its potential environmental benefits. This idea revolves around the idea that exempting EVs from certain taxes and duties could encourage their adoption, which in turn, could significantly reduce environmental impact. Here's an exploration of this concept and its positive environmental implications:

Reducing Carbon Emissions: One of the most significant environmental benefits of EVs is their ability to reduce carbon emissions. Traditional vehicles, especially those powered by internal combustion engines, release substantial amounts of carbon dioxide (CO2) and other harmful pollutants. By making EVs duty-free, governments can incentivize consumers to choose cleaner transportation options. This shift could lead to a substantial decrease in greenhouse gas emissions, contributing to global efforts to combat climate change.

Promoting Sustainable Transportation: Duty-free status for EVs can be a powerful tool to promote sustainable transportation practices. Electric vehicles are known for their zero-emission or low-emission nature, depending on the electricity source. By removing financial barriers, such as import duties or sales taxes, governments can make EVs more affordable and accessible to the public. This accessibility could lead to a rapid increase in the number of EVs on the road, resulting in a more sustainable and environmentally friendly transportation ecosystem.

Encouraging Technological Advancement: The duty-free approach can also stimulate technological innovation in the EV sector. With reduced costs, manufacturers might invest more in research and development, leading to the creation of more efficient, powerful, and environmentally friendly EV models. This could accelerate the transition to a greener future, as improved technology often means better performance, longer ranges, and reduced environmental impact.

Long-Term Environmental Savings: The environmental benefits of duty-free EVs extend beyond immediate emissions reductions. Over time, the widespread adoption of EVs can lead to significant cost savings for both individuals and society. Reduced fuel costs, lower maintenance expenses due to fewer moving parts, and potentially lower insurance premiums can all contribute to a more sustainable and economically viable transportation system. These long-term savings can further encourage the shift towards eco-friendly vehicles.

In summary, the duty-free status for electric vehicles is not just a financial incentive but a strategic move towards a greener and more sustainable future. By linking duty exemptions to eco-friendly vehicles, governments can actively contribute to reducing environmental pollution, promoting sustainable practices, and fostering technological advancements in the automotive industry. This approach has the potential to create a positive feedback loop, where environmental benefits drive further interest and investment in electric transportation.

Electric Vehicle Prices: A Comprehensive Guide to Average Costs

You may want to see also

Frequently asked questions

Yes, in many countries, electric vehicles are considered for duty-free treatment, especially when imported for personal use or for specific purposes like commercial operations.

The duty-free status often applies to the import of electric vehicles, including the battery and associated components. However, the specific regulations can vary based on the country and region.

It depends on the country's regulations. Some countries offer duty-free benefits for residents, while others may have specific criteria, such as the vehicle's intended use or the importer's status.

Regulations can vary, but generally, newer models and those meeting specific environmental standards may be more likely to qualify. Some countries may also have restrictions on the vehicle's age or mileage.

You may need to provide documentation such as the vehicle's specifications, purchase details, and proof of compliance with environmental regulations. Customs authorities may also require a certificate of origin or other relevant paperwork.