Texas offers a range of incentives to promote the adoption of electric vehicles (EVs), including rebates and tax credits. These programs aim to encourage residents to switch to cleaner transportation options and reduce the state's carbon footprint. The Electric Vehicle Rebate Program, for instance, provides financial assistance to Texans purchasing or leasing new electric vehicles, helping to offset the higher upfront costs associated with EVs. This initiative is part of a broader strategy to enhance the state's infrastructure for electric vehicles and support the growth of the EV market in Texas.

| Characteristics | Values |

|---|---|

| State | Texas |

| Rebate Program | Yes |

| Eligible Vehicles | Electric cars, trucks, and motorcycles |

| Rebate Amount | Up to $7,500 |

| Income Limits | Varies by vehicle type and model year |

| Eligibility Criteria | Residents of Texas, new or used vehicle purchases, and meeting specific vehicle requirements |

| Application Process | Online application through the Texas Department of Motor Vehicles (DMV) |

| Funding Source | State and federal grants, including the Clean Vehicle Rebate Project |

| Eligibility Duration | Rebates are available for a limited time and may be subject to change |

| Additional Benefits | Tax incentives, reduced maintenance costs, and environmental benefits |

| Contact Information | Texas Clean Vehicle Rebate Project, Website |

What You'll Learn

- Statewide Rebate Programs: Texas offers incentives for EV buyers through state-funded rebate programs

- Local Incentives: Cities and counties in Texas provide additional EV purchase incentives

- Federal Tax Credits: Federal tax credits for EVs are available to Texas residents

- Used EV Rebates: Some Texas programs offer rebates for purchasing used electric vehicles

- EV Charging Infrastructure: Rebates may be available for installing home EV charging stations in Texas

Statewide Rebate Programs: Texas offers incentives for EV buyers through state-funded rebate programs

Texas, known for its vast landscapes and diverse culture, has been making strides in promoting electric vehicles (EVs) through various incentive programs. One of the key initiatives is the state-funded rebate programs, which aim to encourage residents to make the switch to electric mobility. These programs provide financial assistance to EV buyers, making the transition more affordable and accessible.

The Texas state government has implemented a structured approach to incentivizing EV adoption. The rebate programs are designed to offer financial support directly to individuals purchasing electric vehicles. These rebates can significantly reduce the upfront cost of EVs, which often presents a substantial barrier for potential buyers. By providing financial assistance, Texas aims to make electric vehicles more affordable and attractive to a wider range of consumers.

Eligible EV buyers can receive a substantial amount in rebates, depending on the specific program and vehicle type. The rebate amounts may vary based on factors such as the vehicle's battery capacity, range, and the buyer's residency status. For instance, the Texas Commission on Environmental Quality (TCEQ) offers a rebate program that provides up to $5,000 for the purchase or lease of an electric vehicle. This substantial incentive can significantly offset the cost of buying an EV, making it a more viable option for many residents.

To qualify for these rebate programs, buyers must meet certain criteria. Typically, applicants need to be Texas residents, provide proof of residency, and meet income eligibility requirements. Additionally, the vehicle must meet specific standards set by the state's environmental agencies. These criteria ensure that the rebate programs benefit a diverse range of EV buyers, including those from various socioeconomic backgrounds.

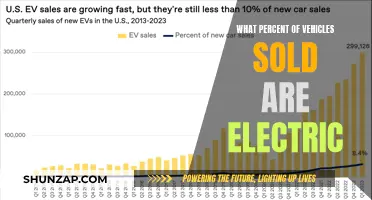

The statewide rebate programs in Texas have proven to be successful in boosting EV sales and reducing the state's carbon footprint. By making electric vehicles more affordable, these initiatives encourage residents to adopt cleaner transportation options. As a result, Texas has witnessed a steady increase in EV registrations, contributing to a more sustainable and environmentally conscious future. This approach aligns with the state's commitment to reducing greenhouse gas emissions and promoting renewable energy sources.

Electric Vehicle Sales: Are We Reaching a Plateau?

You may want to see also

Local Incentives: Cities and counties in Texas provide additional EV purchase incentives

Texas, known for its vast landscapes and diverse communities, offers a range of incentives to encourage residents to embrace electric vehicles (EVs). While the state doesn't have a statewide rebate program, many cities and counties have stepped up to provide additional financial support for EV purchases. These local incentives can significantly reduce the upfront cost of going electric, making EVs more accessible to a wider range of Texans.

City-Specific Rebates and Grants:

Several cities in Texas have implemented their own rebate programs to promote EV adoption. For instance, Austin, the state capital, offers a rebate of up to $5,000 for the purchase or lease of new electric vehicles. This rebate is available to residents who meet certain income criteria, ensuring that lower-income families can also benefit from the program. Similarly, Houston provides a rebate of up to $5,000 for electric vehicles, with an additional $1,000 for the installation of home charging stations. These city-specific incentives can be a significant factor in the decision-making process for potential EV buyers.

County-Level Support:

Counties in Texas also contribute to the EV incentive landscape. For example, the Harris County Public Works Department offers a rebate program for electric vehicles, with amounts varying based on the county's population. This initiative aims to reduce air pollution and promote sustainable transportation options within the county. Additionally, some counties provide grants for the installation of charging infrastructure, ensuring that EV owners have convenient access to charging stations.

Community-Based Initiatives:

Beyond direct rebates, some Texas communities have taken a more holistic approach to EV incentives. These initiatives often include a combination of educational programs, charging station installations, and financial assistance. For instance, a local government in Texas might partner with businesses to offer discounted charging rates for EV owners or provide tax incentives for the purchase of electric vehicles. Such comprehensive programs not only make EVs more affordable but also create a supportive environment for EV owners.

Benefits of Local Incentives:

Local incentives play a crucial role in the widespread adoption of EVs by addressing the financial barriers associated with EV ownership. These programs often target specific communities, ensuring that the benefits reach those who need them most. By providing additional financial support, cities and counties can accelerate the transition to a cleaner, more sustainable transportation system. Moreover, local incentives foster a sense of community engagement, encouraging residents to embrace innovative technologies that contribute to a healthier environment.

In summary, while Texas may not have a statewide EV rebate program, its cities and counties have taken proactive steps to incentivize EV purchases. These local initiatives demonstrate a commitment to environmental sustainability and offer tangible benefits to residents. As the demand for electric vehicles continues to grow, these additional incentives will likely play a significant role in shaping Texas' future as a leader in sustainable transportation.

Electric Vehicles: The Truth About Clutches

You may want to see also

Federal Tax Credits: Federal tax credits for EVs are available to Texas residents

Texas residents can take advantage of federal tax credits for electric vehicles (EVs), which can significantly reduce the cost of purchasing an EV. These tax credits are part of the federal government's efforts to promote the adoption of clean energy and reduce greenhouse gas emissions. Here's an overview of the federal tax credits available for EVs in Texas:

The federal tax credit for EVs is designed to encourage the purchase of new electric vehicles. Texas residents who buy or lease a qualified EV can claim a tax credit of up to $7,500. This credit is applied directly to the buyer's federal income tax liability, reducing the amount of tax owed. The credit amount varies depending on the vehicle's battery capacity and the manufacturer's final assembly location. Vehicles with a higher battery capacity and those assembled in North America generally qualify for the full credit.

To be eligible for this tax credit, the EV must meet specific criteria. The vehicle should be new and acquired primarily for personal use. It should have a qualified battery and be purchased from a dealership or manufacturer that participates in the federal tax credit program. Additionally, the vehicle's final assembly must occur in the United States or a qualifying country, ensuring that the production process aligns with environmental goals.

When filing your federal income tax return, you can claim the EV tax credit by completing the appropriate forms. The IRS provides detailed instructions and forms to help taxpayers navigate the process. It is essential to keep records of the EV purchase, including sales documents and any relevant information about the vehicle's battery capacity and assembly location.

It's worth noting that the federal tax credit for EVs is a valuable incentive for Texas residents considering an EV purchase. This credit can make EVs more affordable and accessible, contributing to the state's transition to a cleaner and more sustainable transportation system. Staying informed about the eligibility criteria and application process ensures that Texas residents can take full advantage of this federal benefit.

Unraveling the Recycling Mystery: Can Electric Vehicles Be Recycled?

You may want to see also

Used EV Rebates: Some Texas programs offer rebates for purchasing used electric vehicles

Texas has been actively promoting the adoption of electric vehicles (EVs) through various incentives and programs, and while new EV purchases are often the focus, there are also opportunities for those looking to buy used electric cars. Here's an overview of the used EV rebate programs available in Texas:

The Texas Commission on Environmental Quality (TCEQ) has implemented the Clean Air Vehicle Rebate Program, which provides rebates for the purchase of electric vehicles, including used ones. This program is designed to encourage the use of cleaner transportation options and reduce air pollution. The rebate amount varies depending on the vehicle's model year and the state's emissions standards. For used EVs, the rebate can be substantial, especially for older models that meet the required emissions criteria. To be eligible, the vehicle must be purchased from an authorized dealer or participating dealership, and the buyer must meet certain income requirements.

Additionally, some local governments and utility companies in Texas offer used EV rebate programs. For instance, Austin Energy, a public utility in Austin, provides the 'Drive Electric Austin' program, which includes incentives for purchasing used electric vehicles. The rebate amount is typically based on the vehicle's battery capacity and the buyer's residency in the service area. Similarly, other cities like Dallas and Houston might have their own initiatives, so it's advisable to check with local authorities.

When considering a used EV purchase, it's essential to research the specific requirements and limitations of each program. Some programs may have restrictions on vehicle age, mileage, or the seller's location. For instance, a program might only accept vehicles that are less than five years old or have under a certain number of miles. Therefore, potential buyers should carefully review the guidelines to ensure their used EV qualifies for the rebate.

Furthermore, the used EV market in Texas is growing, and there are various resources available to help buyers find suitable vehicles. Online platforms and local dealerships often have listings of used EVs, making it easier for consumers to compare models, prices, and available incentives. By taking advantage of these programs, Texas residents can not only benefit from financial savings but also contribute to a more sustainable and environmentally friendly transportation system.

In summary, while Texas primarily focuses on new EV purchases, there are indeed rebate opportunities for those interested in buying used electric vehicles. These programs aim to make clean transportation more accessible and affordable, and with the right research and planning, Texans can take advantage of these incentives to drive a more sustainable future.

The Green Revolution: Should You Go Electric?

You may want to see also

EV Charging Infrastructure: Rebates may be available for installing home EV charging stations in Texas

Texas has been actively promoting the adoption of electric vehicles (EVs) and has implemented various incentives to encourage residents to make the switch. One of the key aspects of this promotion is the development of a robust EV charging infrastructure, especially for home installations. Home EV charging stations are essential for EV owners to ensure convenient and efficient charging, and Texas offers rebates to make this process more accessible and affordable.

The state's efforts to support EV charging infrastructure are part of a broader strategy to reduce greenhouse gas emissions and promote sustainable transportation. By providing rebates for home charging stations, Texas aims to empower its residents to take an active role in the transition to electric mobility. These rebates can significantly offset the initial cost of installing charging equipment, making it more financially viable for EV owners.

To be eligible for these rebates, EV owners in Texas typically need to meet certain criteria. This includes owning a compatible EV, ensuring the charging station is installed at their primary residence, and meeting specific technical requirements. The rebates are designed to cover a portion of the installation costs, which can vary depending on the type of charging station, its power output, and additional features.

The process of applying for a rebate usually involves several steps. EV owners need to locate authorized charging station installers who can provide the necessary equipment and installation services. These installers often have experience with the specific requirements and guidelines set by the Texas government. After installation, the owner must submit an application, including documentation of the purchase and installation, to the relevant state agency. The agency then reviews the application and, upon approval, disburses the rebate amount.

It is important to stay updated on the latest rebate programs and guidelines, as Texas may introduce new initiatives or modify existing ones. The state's website or designated EV-related portals can provide the most current information. Additionally, local utility companies and EV associations may offer resources and support to help residents navigate the rebate process and make informed decisions about EV charging infrastructure.

Unlocking EV Ownership: The Battery Lease Advantage

You may want to see also

Frequently asked questions

Yes, Texas provides several incentives to promote the adoption of electric vehicles. One of the main programs is the Texas Clean Energy Incentive Program (TCEIP), which offers rebates for the purchase or lease of new electric vehicles. The amount of the rebate depends on the vehicle's battery capacity and the model year.

The rebate amount varies based on the specific vehicle. For example, as of 2023, the rebate for a new electric vehicle with a battery capacity of 40 kWh or more can be up to $7,500. This amount is significantly higher compared to traditional gasoline vehicle incentives.

No, the TCEIP does not have income restrictions. The program is designed to encourage the widespread adoption of electric vehicles, so any Texas resident can qualify for the rebates, regardless of their income level.

Yes, you can take advantage of multiple incentives. The Texas EV rebates can be combined with federal tax credits, which further reduce the cost of purchasing an electric vehicle. Additionally, some local governments or utility companies may offer additional incentives, creating a comprehensive support system for EV buyers.

The application process typically involves submitting a rebate form to the relevant authority, which is usually the Texas Commission on Environmental Quality (TCEQ). You will need to provide proof of purchase or lease, vehicle specifications, and other required documentation. The TCEQ website provides detailed guidelines and forms to ensure a smooth application process.