Electric vehicles (EVs) are becoming increasingly popular, and many people are considering making the switch from traditional gasoline-powered cars. As the adoption of EVs grows, it's important to understand the financial implications, including whether the purchase and operation of electric vehicles can be tax-deductible. This paragraph will explore the tax benefits associated with electric vehicles, providing insights into how individuals and businesses can potentially reduce their tax liabilities while contributing to a more sustainable future.

What You'll Learn

- Eligibility: Who qualifies for tax deductions on electric vehicles

- Deduction Methods: How to claim tax deductions for EVs

- Purchase Price: Deductions related to EV purchase costs

- Operating Expenses: Tax benefits for EV maintenance and charging

- Resale Value: Tax implications of selling an electric vehicle

Eligibility: Who qualifies for tax deductions on electric vehicles?

The tax benefits for electric vehicles (EVs) are an attractive incentive for many drivers, but understanding who qualifies for these deductions is crucial. Here's a breakdown of the eligibility criteria:

Business Owners:

If you own a business, you may be eligible for significant tax deductions related to your electric vehicle. This includes not only the purchase price but also expenses like charging station installation, maintenance, and registration fees. The IRS allows businesses to deduct the cost of an EV as a business expense, which can be particularly beneficial for those in industries with high mileage or those who use their vehicles for client meetings and deliveries.

Employees Using Company-Provided EVs:

Some companies provide electric vehicles to their employees for work purposes. In such cases, the employee may be able to deduct certain expenses related to the EV. This typically includes mileage deductions for business-related travel and a portion of the vehicle's cost if the company provides it as a benefit. However, the rules can be complex, and it's essential to consult IRS guidelines or a tax professional to ensure compliance.

Personal Use:

For individuals purchasing electric vehicles for personal use, tax deductions are generally limited. You can deduct a portion of the vehicle's cost based on its business use percentage. For example, if you use the car 20% of the time for business, you can deduct 20% of the purchase price and related expenses. This rule applies to both new and used EVs.

Income and Asset Limits:

There are income and asset limits that may affect your eligibility for certain EV tax credits and deductions. For instance, the federal tax credit for EV purchases is capped at a certain income level. Similarly, some states have their own income thresholds for EV incentives. It's important to check the specific requirements of your state and federal tax authorities.

Second-Hand EVs:

When purchasing a used electric vehicle, the tax deduction rules might differ. You may still be eligible for deductions based on the vehicle's original purchase price and subsequent expenses. However, the IRS may require additional documentation, such as the original sales invoice and any modifications made to the vehicle.

Remember, tax laws are complex and can change frequently. It's always advisable to consult a qualified tax professional or refer to the IRS website for the most up-to-date and accurate information regarding electric vehicle tax deductions.

Electric Vehicles: Powering Progress Without Neet

You may want to see also

Deduction Methods: How to claim tax deductions for EVs

When it comes to electric vehicles (EVs), many drivers are curious about the tax benefits they can enjoy. The good news is that there are indeed methods to claim tax deductions for your EV, which can help reduce your overall tax liability. Here's a breakdown of the deduction methods and how to navigate the process:

- Mileage Deduction: One of the most common ways to claim tax deductions for your EV is through mileage. You can deduct a portion of the vehicle's expenses based on the miles driven for business or personal use. To calculate this, you'll need to determine the vehicle's total usage and then allocate a percentage for business-related travel. Keep detailed records of your mileage, including the date, purpose, and destination of each trip. This documentation is crucial for accurate deductions.

- Fixed and Variable Expenses: EVs have both fixed and variable expenses that can be deducted. Fixed expenses include insurance, registration fees, and lease payments (if applicable). Variable expenses encompass fuel costs, maintenance, repairs, and even charging station fees. It's important to keep receipts and records for these expenses, as they contribute to the overall cost of owning and operating your EV.

- Business Use Deduction: If you use your EV for business purposes, you can claim a deduction for the vehicle's total business-related expenses. This includes mileage, fuel, maintenance, and other variable costs. To qualify, you must meet the IRS mileage rate for business travel, which is typically adjusted annually. You'll also need to provide evidence of your business use, such as receipts for business-related purchases or a log of business trips.

- Capitalized Cost and Depreciation: For individuals who own their EV, you can deduct a portion of the vehicle's cost over time through depreciation. This method allows you to claim a deduction for the vehicle's decrease in value each year. The IRS provides specific guidelines for calculating depreciation, and you can choose between different depreciation methods, such as straight-line or declining balance. Keep in mind that you'll need to provide detailed information about the vehicle's purchase price, trade-in value (if applicable), and any other relevant costs.

Claiming the Deductions: When it's time to file your taxes, you can claim these deductions on your tax return. Ensure you have all the necessary documentation and records to support your claims. You may also consider consulting a tax professional or accountant who specializes in EV tax deductions to ensure you're maximizing your benefits and adhering to IRS guidelines.

Remember, the key to successfully claiming tax deductions for your EV is maintaining accurate records and staying informed about the latest tax regulations. By utilizing these deduction methods, you can potentially reduce your tax burden and make owning an electric vehicle more financially advantageous.

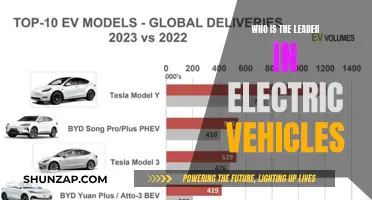

The Green Revolution: Who's Driving the Electric Vehicle Movement?

You may want to see also

Purchase Price: Deductions related to EV purchase costs

When it comes to electric vehicles (EVs), many car buyers are curious about the potential tax benefits associated with their purchases. The good news is that there are indeed deductions and incentives available for those who opt for electric cars, which can significantly reduce the overall cost of ownership. One of the primary considerations is the purchase price of the EV itself, and how it can be addressed through tax deductions.

For individuals and businesses, the cost of purchasing an electric vehicle can be substantial, but it may be partially offset by tax deductions. The Internal Revenue Service (IRS) offers a valuable incentive in the form of a tax credit for qualified plug-in electric vehicles. This credit is designed to encourage the adoption of EVs and can be claimed by the buyer when filing their tax return. The amount of the credit varies depending on the vehicle's battery capacity and the manufacturer's specific guidelines. It is essential to note that this credit is generally applied to the purchase price, effectively reducing the overall cost of the EV.

To be eligible for this tax credit, the vehicle must meet certain criteria, including having a qualified battery electric range and meeting specific environmental and safety standards. Additionally, the vehicle's manufacturer must provide a certification statement, ensuring that the car qualifies for the credit. This process ensures that only genuine electric vehicles are incentivized, promoting a greener and more sustainable transportation option.

For businesses, the tax deductions related to EV purchases can be even more advantageous. Companies can claim a deduction for the entire purchase price of the electric vehicle as a business expense. This deduction is available for both the vehicle itself and any related expenses, such as installation costs for charging stations. By taking advantage of this deduction, businesses can significantly reduce their taxable income, resulting in substantial savings.

Furthermore, some states and local governments also offer their own incentives and tax benefits for EV buyers. These additional deductions can further reduce the effective cost of purchasing an electric vehicle. It is advisable for individuals and businesses to research and understand the specific tax laws and regulations in their respective jurisdictions to maximize their deductions and take full advantage of the available incentives.

Unlocking the Power: V2G Electric Vehicles and Their Potential

You may want to see also

Operating Expenses: Tax benefits for EV maintenance and charging

Electric vehicles (EVs) are becoming increasingly popular, and with their growing adoption, it's important to understand the financial benefits that come with owning one. One significant aspect to consider is the tax implications of owning and maintaining an EV, particularly in terms of operating expenses. When it comes to tax deductions, the maintenance and charging of electric vehicles can provide substantial savings for EV owners.

Operating expenses for EVs often include regular maintenance tasks such as battery replacements, tire changes, and routine servicing. While these costs might seem daunting, they can be partially or fully tax-deductible, depending on the jurisdiction and the specific circumstances. For instance, in many countries, the cost of replacing a vehicle's battery, which is a significant expense, can be claimed as a business expense or a capital expenditure, especially for fleet owners or businesses using EVs for commercial purposes. This deduction can significantly reduce the overall tax liability for these entities.

Charging your EV at home or using public charging stations is another area where tax benefits can be realized. The cost of electricity used to charge your vehicle is generally tax-deductible as a business expense if the EV is used for work-related purposes. This includes charging at a home office or designated charging stations at your workplace. Additionally, some governments and local authorities offer incentives and tax credits for installing home charging stations, further reducing the overall cost for EV owners.

It's worth noting that the rules and regulations regarding tax deductions for EVs can vary widely, and it's essential to consult with a tax professional or accountant to ensure compliance with local laws. They can provide guidance on the specific expenses that are eligible for deduction and help you navigate the complex tax landscape surrounding EVs. By taking advantage of these tax benefits, EV owners can not only reduce their financial burden but also contribute to a more sustainable transportation ecosystem.

In summary, the maintenance and charging of electric vehicles offer significant tax advantages, making EVs an even more attractive option for environmentally conscious consumers and businesses. Understanding these deductions can lead to substantial savings and encourage the widespread adoption of electric transportation.

Powering the Future: AC or DC for Electric Vehicles?

You may want to see also

Resale Value: Tax implications of selling an electric vehicle

When it comes to electric vehicles (EVs), understanding the tax implications associated with their resale value is essential for vehicle owners. The tax treatment of selling an EV can vary depending on several factors, including the vehicle's age, the reason for the sale, and the tax laws in your jurisdiction. Here's an overview of the tax considerations related to the resale of an electric vehicle:

Depreciation and Capital Gains Tax: One of the primary tax implications is the depreciation of the vehicle and the potential capital gains tax. EVs, like other vehicles, depreciate over time. When you sell an EV, you may be subject to capital gains tax on the profit made from the sale. The tax rate for capital gains can vary, and it's often lower than the regular income tax rate. However, the tax rules for EVs can be complex, especially if the vehicle was acquired for business purposes. In some cases, the entire sale may be taxable, while in others, only the depreciation and any additional gains are taxed.

Special Tax Incentives: Governments worldwide have introduced various tax incentives to promote the adoption of electric vehicles. These incentives can significantly impact the resale value and tax implications. For instance, some countries offer tax credits or rebates for EV purchases, which can be claimed when selling the vehicle. These incentives may reduce the taxable gain or even result in a loss if the vehicle is sold at a lower price than its purchase price. It's crucial to research and understand the specific tax laws and incentives applicable in your region to ensure compliance and potential tax savings.

Age and Usage of the Vehicle: The age and usage of the electric vehicle play a significant role in determining tax implications. Older EVs or those with high mileage might have a lower resale value, potentially resulting in a smaller taxable gain or even a loss. Additionally, if the vehicle was used for business purposes, the tax treatment may differ, and you might be eligible for different depreciation methods and tax deductions.

Reporting and Documentation: Proper documentation is essential when dealing with the tax implications of selling an electric vehicle. You will need to provide detailed records of the vehicle's purchase, maintenance, and any modifications. When selling, you should report the sale and any associated gains or losses on your tax return. This process ensures compliance with tax laws and allows for accurate tax calculations.

Understanding the tax implications of selling an electric vehicle is crucial for vehicle owners to make informed financial decisions. Consulting with a tax professional or accountant who specializes in EV-related tax matters can provide personalized guidance based on your specific circumstances and the tax laws in your jurisdiction.

Electric Vehicles: A Repair-Free Revolution or a Maintenance Myth?

You may want to see also

Frequently asked questions

Yes, in many countries, the cost of purchasing an electric vehicle (EV) can be tax-deductible, especially for businesses. However, the rules and eligibility criteria may vary, so it's essential to check your local tax regulations.

The requirements can vary depending on the jurisdiction and the type of business. Typically, you may need to provide proof of the EV's purchase, such as a receipt or invoice, and demonstrate how it is used for business purposes. For personal use, the rules might be different, and you might need to meet certain mileage or usage criteria.

The calculation method can vary. For businesses, it might be a straightforward deduction of the purchase price. For personal use, it could be based on the vehicle's fair market value or its business use percentage. Some jurisdictions may also offer incentives or grants in addition to tax deductions.

Yes, you can potentially claim deductions for various expenses related to owning an EV, such as electricity costs for charging, maintenance, insurance, and registration fees. These expenses should be documented and may be subject to specific limitations and rules.

Yes, there are often limitations and restrictions. For example, some jurisdictions may cap the deduction amount, set a maximum annual deduction, or require a minimum period of ownership. Additionally, personal use deductions might have different rules and limitations compared to business use. It's crucial to consult tax professionals or authorities to understand the specific regulations in your area.