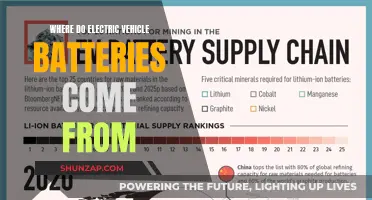

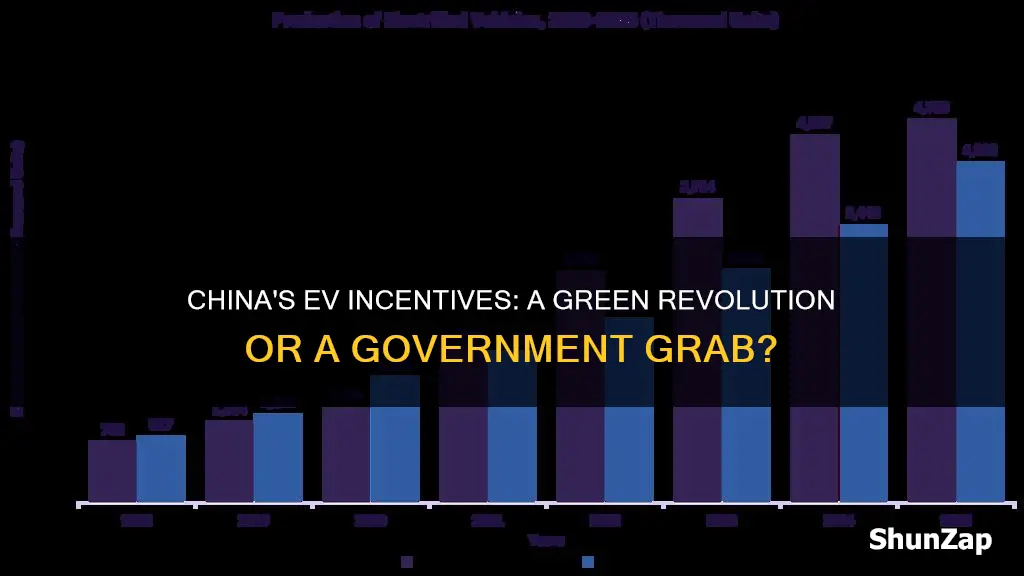

China has implemented a range of incentives and policies to promote the adoption of electric vehicles (EVs) and reduce its reliance on fossil fuels. These initiatives include tax breaks, subsidies, and infrastructure development, aiming to boost the domestic EV market and position China as a global leader in sustainable transportation. The country's efforts have been successful, with a significant increase in EV sales and a growing network of charging stations. This paragraph introduces the topic by highlighting China's comprehensive approach to incentivizing the electric vehicle industry, which has had a notable impact on the country's environmental goals and economic development.

What You'll Learn

- Tax Rebates: Chinese government provides tax incentives for EV purchases

- Subsidies: Direct financial support for EV manufacturers and buyers

- Purchase Tax Exemption: Zero tax on EV purchases for certain periods

- Infrastructure Investment: Funding for EV charging stations and battery recycling

- Research Grants: Financial aid for EV technology research and development

Tax Rebates: Chinese government provides tax incentives for EV purchases

The Chinese government has implemented a range of tax incentives to promote the adoption of electric vehicles (EVs) and reduce the country's reliance on fossil fuels. One of the primary measures is the provision of tax rebates for EV purchases, which has significantly impacted the automotive market. This strategy aims to encourage citizens to opt for environmentally friendly transportation options.

When purchasing an electric vehicle, buyers in China are eligible for a substantial tax rebate. The amount of the rebate varies depending on the type and size of the EV. For instance, compact electric cars may receive a higher rebate percentage compared to larger vehicles. This financial incentive directly reduces the overall cost of ownership, making EVs more affordable and attractive to potential buyers. As a result, many Chinese consumers are now considering electric cars as a viable alternative to traditional gasoline-powered vehicles.

The tax rebate system is designed to stimulate the market and accelerate the transition to electric mobility. By offering financial relief, the government aims to address the initial high cost barrier associated with EVs. This incentive has proven to be effective, as it not only benefits individual buyers but also contributes to the long-term sustainability of the automotive industry in China. With reduced prices, EV manufacturers can compete more effectively, leading to increased production and a wider range of models available to consumers.

Furthermore, the tax rebate program has a broader environmental impact. By encouraging the use of electric vehicles, China is actively working towards reducing air pollution and greenhouse gas emissions. The shift towards EVs is a crucial step in the country's commitment to combating climate change and improving air quality, especially in densely populated urban areas. This initiative also aligns with global trends and international efforts to promote sustainable transportation solutions.

In summary, China's tax rebate system for EV purchases is a powerful tool in the government's strategy to foster a greener and more sustainable future. It provides a direct financial benefit to consumers, making electric vehicles more accessible and appealing. This approach has successfully driven market growth and positioned China as a leader in the global EV market, setting an example for other nations to follow in their pursuit of environmental sustainability.

Unveiling the Green Myth: Are Electric Vehicles Eco-Friendly?

You may want to see also

Subsidies: Direct financial support for EV manufacturers and buyers

China has implemented a comprehensive strategy to promote the adoption of electric vehicles (EVs) through various incentives, with subsidies being a key component. These subsidies are designed to provide direct financial support to both EV manufacturers and buyers, aiming to accelerate the transition to a more sustainable transportation system.

Subsidies for EV Manufacturers:

The Chinese government offers subsidies to encourage the production and sale of electric vehicles. These subsidies are typically provided as grants or tax incentives. For instance, the Central Government provides subsidies for the research and development of core technologies in the EV industry, ensuring that manufacturers invest in innovation. Additionally, regional governments often offer additional incentives, such as tax breaks or subsidies, to attract EV manufacturers to their areas, fostering regional economic development. These subsidies enable manufacturers to lower production costs, making electric vehicles more affordable and competitive in the market.

Subsidies for EV Buyers:

Financial assistance is also extended to consumers purchasing electric vehicles. The most common form of subsidy for buyers is a direct cash rebate or discount. Many Chinese cities and provinces have implemented subsidy programs that provide financial incentives to individuals purchasing EVs. These subsidies can vary based on factors such as vehicle type, battery capacity, and the buyer's residency. For example, the Beijing Municipal Government offers a subsidy of up to 10,000 yuan for the purchase of electric passenger vehicles, while the Shanghai Government provides a subsidy of up to 20,000 yuan. Such incentives make electric vehicles more accessible and attractive to consumers, contributing to the rapid growth of the EV market.

These subsidies have proven to be highly effective in driving the adoption of electric vehicles in China. By providing financial support to both manufacturers and buyers, the government is fostering a sustainable transportation ecosystem. The incentives encourage investment in EV technology, reduce the upfront cost of vehicles, and make the transition to electric mobility more appealing to the general public. As a result, China has become a global leader in the EV market, with a significant portion of its vehicle sales now comprising electric cars, buses, and motorcycles.

The success of these subsidies has also led to the development of a robust domestic EV industry, with numerous Chinese manufacturers establishing themselves as major players in the global market. This shift towards electric mobility is not only benefiting the environment but also driving economic growth and technological advancement in China.

Powering Electric Vehicles: Unlocking the Secrets of Component Swapping

You may want to see also

Purchase Tax Exemption: Zero tax on EV purchases for certain periods

China has implemented a range of incentives to promote the adoption of electric vehicles (EVs) and reduce its reliance on fossil fuels. One of the key measures is the Purchase Tax Exemption, which provides a significant benefit to consumers looking to buy EVs. This incentive is designed to stimulate the market and encourage the widespread adoption of electric vehicles.

Under this policy, the government waives the purchase tax, which is typically a substantial percentage of the vehicle's price, for a specified period. This tax exemption directly translates to substantial savings for EV buyers. For instance, in certain regions, the purchase tax can amount to 10-15% of the vehicle's cost, and this exemption can result in savings of thousands of yuan. The duration of this tax exemption varies across different provinces and cities, with some offering it for a limited time, while others have made it a long-term measure.

To be eligible for this exemption, buyers must purchase EVs that meet specific criteria, such as having a certain level of energy efficiency or being produced by domestic manufacturers. These criteria ensure that the incentive supports the development of the domestic EV industry and encourages the production and sale of high-quality electric vehicles. The exemption is often applied to a wide range of EV models, including passenger cars, SUVs, and even commercial vehicles, making it accessible to various consumer segments.

The Purchase Tax Exemption has proven to be an effective strategy, as it not only reduces the upfront cost of EVs but also makes them more affordable for a broader population. This, in turn, leads to increased sales and a faster transition to a more sustainable transportation system. Many Chinese cities have seen a surge in EV sales due to this incentive, with consumers taking advantage of the tax break to make purchases.

This incentive is part of a comprehensive package of policies that China has implemented to support the EV industry. Other measures include subsidies for EV purchases, infrastructure development for charging stations, and regulations that encourage the production and sale of electric vehicles. By combining these incentives, the Chinese government aims to create a favorable environment for the growth of the EV market, reduce environmental pollution, and enhance energy security.

Electric Vehicle Panel Upgrades: Necessary or Not?

You may want to see also

Infrastructure Investment: Funding for EV charging stations and battery recycling

China has implemented a comprehensive strategy to promote the adoption of electric vehicles (EVs) and build a robust charging infrastructure, offering various incentives and funding opportunities for EV charging stations and battery recycling. The country's commitment to reducing its carbon footprint and transitioning to a more sustainable transportation system is evident through these initiatives.

One of the key funding mechanisms is the establishment of dedicated funds and grants. The Chinese government has allocated substantial financial resources to support the development of EV charging infrastructure. These funds are often provided through national and local government agencies, such as the National Development and Reform Commission (NDRC) and the Ministry of Finance. The NDRC, for instance, has launched the New Energy Vehicle (NEV) Industry Development Plan, which includes financial incentives for EV charging station construction. This plan provides subsidies and tax benefits to encourage private enterprises and local governments to invest in charging infrastructure. The funding can be used to cover a significant portion of the initial setup costs, making it more financially viable for businesses and municipalities to establish charging stations.

In addition to direct funding, China offers tax incentives to attract investments in EV charging infrastructure. The country provides tax breaks and reductions for businesses and individuals investing in charging stations. For example, the Corporate Income Tax (CIT) exemption or reduction can be applied to companies that invest in EV charging infrastructure, especially those located in designated new energy vehicle demonstration zones. This incentive encourages private sector participation and accelerates the deployment of charging stations across the country.

Battery recycling is another critical aspect of China's EV ecosystem, and the government has recognized the importance of establishing a sustainable recycling network. To fund battery recycling initiatives, the government offers grants and subsidies to companies and research institutions. These funds are directed towards developing advanced recycling technologies, establishing recycling facilities, and promoting the circular economy. By investing in battery recycling, China aims to ensure a steady supply of raw materials for the EV industry, reduce environmental pollution, and create a closed-loop system for battery production and disposal.

Furthermore, China's approach to funding EV charging stations and battery recycling includes long-term financing options. Financial institutions and banks have been encouraged to provide loans and financing packages tailored to the specific needs of EV charging infrastructure projects. These loans often offer favorable interest rates and repayment terms, making it more accessible for businesses to invest in the necessary infrastructure. The government's support for long-term financing ensures that the initial investment barriers are lowered, allowing for a faster and more widespread adoption of EVs and their supporting infrastructure.

In summary, China's infrastructure investment in EV charging stations and battery recycling is well-supported by a combination of direct funding, tax incentives, and long-term financing options. These measures have successfully attracted investments, accelerated the development of charging infrastructure, and promoted sustainable practices in the EV industry. As a result, China is witnessing a rapid expansion of its EV market, contributing to its global leadership in the adoption and integration of electric vehicles.

Unraveling the Mystery: Are EV Plugs Universal?

You may want to see also

Research Grants: Financial aid for EV technology research and development

China has indeed implemented various incentives and financial aid programs to promote the development and adoption of electric vehicles (EVs) within its borders. These initiatives are part of the country's broader strategy to reduce its carbon footprint and transition towards a more sustainable transportation system. The Chinese government recognizes the importance of EV technology research and development (R&D) in achieving these goals and has established several grant programs to support this sector.

One of the primary mechanisms for financial aid is the Research and Development (R&D) Funding Program for the New Energy Vehicle (NEV) Industry. This program provides grants to Chinese companies and research institutions working on EV-related technologies. The grants cover a wide range of areas, including battery technology, electric motor development, charging infrastructure, and vehicle design. By offering financial support, the government aims to accelerate innovation, improve the efficiency of EVs, and enhance the overall competitiveness of the NEV industry in China.

Additionally, China's National Key R&D Program has allocated significant resources towards EV technology. This program focuses on strategic areas of research, such as advanced battery materials, energy storage systems, and smart grid integration. Researchers and companies working on these projects can access substantial funding, which enables them to conduct in-depth studies and develop cutting-edge solutions. The grants often come with specific milestones and performance targets, ensuring that the research aligns with the government's long-term vision for the EV industry.

Furthermore, regional governments in China have also introduced their own grant schemes to support EV technology R&D. For instance, the Shanghai Municipal Government has established the Shanghai New Energy Vehicle Industry Development Fund, which provides financial assistance to local EV manufacturers and technology startups. Similarly, other provinces and cities have launched similar initiatives, offering grants, tax incentives, and subsidies to encourage local businesses to invest in EV-related research and development.

These financial aid programs have had a positive impact on the EV industry in China. They have fostered collaboration between government bodies, research institutions, and private companies, leading to significant advancements in EV technology. As a result, China has become a global leader in EV production and innovation, attracting investments and talent from around the world. The country's commitment to supporting research and development in this field is expected to continue, further driving the growth and sustainability of the electric vehicle market.

Unveiling the Green Myth: Is the Toyota Prius an Electric Car?

You may want to see also

Frequently asked questions

China has implemented a range of incentives to promote the adoption of electric vehicles (EVs) and reduce its carbon footprint. These incentives include a combination of tax benefits, subsidies, and purchase grants. For instance, the government provides a subsidy of up to 18,000 yuan (approximately $2,600) for each EV sold, with a total subsidy amount of 80 billion yuan allocated for the 2020-2022 period.

Yes, EV manufacturers must meet certain criteria to be eligible for the incentives. They need to produce vehicles in China, have a certain level of local content (components sourced from domestic suppliers), and comply with environmental standards. Additionally, the vehicles must be included in the National New Energy Vehicle (NEV) Catalog, which is updated regularly.

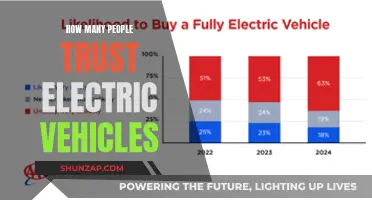

AA: The incentives have significantly boosted the EV market in China, making it the largest EV market globally. The subsidies and purchase grants have encouraged consumers to buy EVs, especially those with lower price tags, which has led to increased sales and a wider range of EV models available. This has also spurred competition among manufacturers, driving innovation and technological advancements in the industry.

The Chinese government has announced plans to gradually phase out the subsidies for EVs as the market matures. The subsidy amounts have been reduced over the years, and it is expected that by 2025, the government will no longer provide subsidies for EV purchases. However, other incentives, such as tax breaks and infrastructure development, are likely to remain in place to support the EV industry's long-term growth.