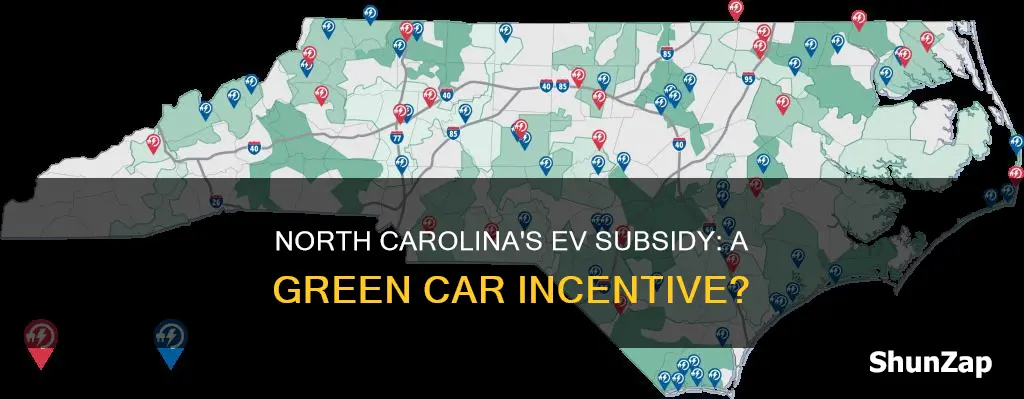

North Carolina has implemented several incentives to promote the adoption of electric vehicles (EVs) and reduce its carbon footprint. The state offers a combination of tax credits, rebates, and other financial assistance programs to make EVs more affordable and accessible to residents. These subsidies aim to encourage the purchase of electric vehicles, reduce greenhouse gas emissions, and support the growth of the EV market in North Carolina. This introduction sets the stage for a detailed exploration of the specific subsidies and their impact on EV adoption in the state.

| Characteristics | Values |

|---|---|

| State | North Carolina |

| Subsidy Type | Incentives and Tax Credits |

| Incentive Program | North Carolina Clean Vehicle Rebate Project (NC Clean Rebate) |

| Rebate Amount | Up to $2,000 for new electric vehicles and $1,500 for used electric vehicles (as of 2023) |

| Eligibility | Residents of North Carolina who purchase or lease a new or used electric vehicle |

| Income Limit | Household income of $45,000 or less for new vehicles and $30,000 or less for used vehicles |

| Vehicle Types | Battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) |

| Additional Benefits | Federal tax credits, reduced registration fees, and access to carpool lanes |

| Application Process | Online application through the North Carolina Department of Environment, Health, and Natural Resources |

| Availability | Ongoing program with annual funding limits |

| Recent Changes | Rebate amounts increased in 2023, with a focus on promoting lower-income vehicle purchases |

What You'll Learn

- Tax Credits: State offers tax breaks for EV purchases and charging infrastructure

- Rebates: Direct financial incentives for EV buyers and chargers

- Grant Programs: Funding for EV charging stations and related projects

- Infrastructure Development: Subsidies for building EV charging networks

- Public Transportation: Incentives for electric buses and transit systems

Tax Credits: State offers tax breaks for EV purchases and charging infrastructure

North Carolina has implemented several tax incentives to encourage the adoption of electric vehicles (EVs) and the development of charging infrastructure. One of the primary benefits is the state's sales and use tax exemption for electric vehicles. When purchasing an EV, residents are exempt from paying sales tax on the vehicle's purchase price, which can result in significant savings. This exemption applies to both new and used electric vehicles, making it an attractive option for consumers.

In addition to the sales tax break, North Carolina offers a personal property tax exemption for electric vehicles. This means that EV owners can exempt the value of their vehicle from property tax assessments, further reducing the overall cost of ownership. The exemption is typically valid for a specific period, providing long-term savings for EV owners.

The state also provides tax credits for the installation of residential charging stations. Homeowners and renters can claim a tax credit of up to $3,000 for the purchase and installation of a Level 2 charging station. This credit encourages individuals to invest in charging infrastructure, making it more convenient and accessible to charge their electric vehicles at home. The tax credit is designed to stimulate the market for EV charging solutions and promote the widespread adoption of EVs.

Furthermore, North Carolina offers a tax credit for the purchase of electric vehicles, which can be claimed by the vehicle's first registrant. The credit amount varies based on the vehicle's battery capacity and the model year. This incentive provides a financial boost to consumers, making EV purchases more affordable. The tax credit is a significant factor in attracting EV buyers and fostering a more sustainable transportation ecosystem in the state.

These tax credits and exemptions play a crucial role in North Carolina's strategy to promote EV adoption and charging infrastructure development. By reducing the financial burden on consumers, the state aims to make EVs more accessible and appealing to the public. The combination of sales tax exemption, personal property tax relief, and charging station tax credits creates an attractive environment for EV owners and contributes to North Carolina's goal of reducing its carbon footprint and promoting sustainable transportation options.

Unraveling the Cost: Why Electric Vehicles Are a Luxury

You may want to see also

Rebates: Direct financial incentives for EV buyers and chargers

North Carolina offers a range of financial incentives to encourage the adoption of electric vehicles (EVs) and the installation of charging infrastructure. These incentives are designed to make EVs more affordable and accessible to residents while also promoting the development of a robust charging network across the state. One of the primary mechanisms for providing these incentives is through rebates and grants.

For EV buyers, the North Carolina Department of Environment and Natural Resources (DENR) administers the Electric Vehicle Rebate Program. This program provides direct financial incentives to individuals purchasing new electric vehicles. The rebate amount varies depending on the vehicle's battery capacity and the model year. As of my last update, the maximum rebate for a new EV purchase was $7,500, and for used EVs, it was $5,000. These rebates are typically paid directly to the vehicle purchaser, reducing the upfront cost of ownership. To be eligible, buyers must meet certain income criteria, ensuring that the incentives are accessible to a diverse range of residents.

In addition to buyer rebates, North Carolina also offers incentives for the installation of residential and public charging stations. The state's ChargeNC program provides rebates for the purchase and installation of Level 2 charging stations, which are more powerful and faster than standard chargers. The rebate amount can range from $500 to $1,500, depending on the charging station's specifications and the applicant's location. This initiative aims to address the range anxiety associated with EVs by ensuring convenient and accessible charging options across the state.

Furthermore, the state has established partnerships with private entities to expand the charging infrastructure. For instance, the North Carolina Electric Vehicle Infrastructure Grant Program provides funding to local governments and non-profit organizations for the construction of public charging stations. These grants can cover a significant portion of the project costs, making it more feasible to establish a comprehensive charging network.

These financial incentives play a crucial role in North Carolina's strategy to reduce greenhouse gas emissions and promote sustainable transportation. By offering rebates and grants, the state aims to accelerate the transition to electric mobility, improve air quality, and foster a more environmentally conscious society. It is recommended that interested individuals and businesses stay updated on the DENR's website for the latest program details, eligibility criteria, and application processes.

The Future is Electric: Is Now the Time to Buy?

You may want to see also

Grant Programs: Funding for EV charging stations and related projects

North Carolina offers several grant programs to support the development of electric vehicle (EV) charging infrastructure and related projects. These initiatives aim to encourage the adoption of electric vehicles and promote a more sustainable transportation system. Here's an overview of some key grant programs:

North Carolina EV Infrastructure Grant Program: This program is designed to provide financial assistance for the installation of EV charging stations in various locations across the state. The grants are typically awarded to public entities, including municipalities, counties, and state agencies, as well as private organizations and businesses. The funding can be utilized for the purchase, installation, and maintenance of EV charging equipment, ensuring the availability of charging stations in strategic areas. The program often prioritizes projects that address specific needs, such as rural communities, public parking facilities, and locations with high EV ownership rates.

Clean Energy Technology Fund (CETF): The CETF is a significant source of funding for clean energy projects in North Carolina. While it supports various renewable energy initiatives, it also includes provisions for EV charging infrastructure. The fund provides grants and loans to support the development and deployment of EV charging stations, particularly in areas with limited access to charging facilities. The CETF often collaborates with local governments and businesses to identify and implement projects that will have a substantial impact on reducing greenhouse gas emissions and promoting sustainable transportation.

Transportation Alternatives Program (TAP): TAP is a federal grant program administered by the North Carolina Department of Transportation (NCDOT). It offers funding opportunities for a wide range of transportation projects, including EV charging infrastructure. The program provides grants to local governments, transit agencies, and other public entities to improve transportation systems and promote alternative fuels. EV charging station projects can be funded through TAP, especially those that enhance public access to charging facilities and support the transition to electric mobility.

Rural Community Assistance Program (RCAP): RCAP is specifically tailored to support rural communities in North Carolina. It provides technical assistance and financial resources to help rural areas address various challenges, including the lack of EV charging infrastructure. The program offers grants to local governments, non-profit organizations, and businesses to install and maintain EV charging stations in rural locations. By improving access to charging facilities, RCAP aims to encourage EV adoption in underserved areas and promote a more comprehensive charging network across the state.

These grant programs demonstrate North Carolina's commitment to fostering the growth of EV charging infrastructure and supporting the state's transition to a more sustainable transportation ecosystem. By providing financial assistance and technical support, these initiatives enable the development of a robust network of EV charging stations, making electric vehicles more accessible and convenient for residents and visitors alike.

Powering the Future: Unveiling the Heart of Electric Vehicles

You may want to see also

Infrastructure Development: Subsidies for building EV charging networks

North Carolina has implemented several initiatives to encourage the adoption of electric vehicles (EVs) and the development of charging infrastructure. One of the key strategies is the provision of subsidies and grants to support the construction and expansion of EV charging networks across the state. These subsidies aim to address the critical need for accessible and reliable charging stations, which are essential for the widespread adoption of electric vehicles.

The North Carolina Department of Transportation (NCDOT) has been instrumental in this infrastructure development. They have established the EV Charging Infrastructure Grant Program, which provides financial assistance to local governments, private entities, and non-profit organizations for the installation of EV charging stations. The program's primary goal is to ensure that EV charging infrastructure is strategically located along major transportation corridors, in urban areas, and in locations that serve as destinations for travelers. This approach helps to create a comprehensive and efficient charging network, reducing range anxiety and encouraging longer-distance travel with electric vehicles.

Eligible projects under this program include the installation of direct current (DC) fast chargers, which can significantly reduce charging times, and alternating current (AC) level 2 chargers, which provide faster charging compared to standard household outlets. The grants typically cover a substantial portion of the project costs, including equipment, installation, and associated expenses. This financial support is crucial in attracting investors and businesses to invest in EV charging infrastructure, especially in areas where the market may not yet be strong enough to justify private investments alone.

In addition to the NCDOT's program, the North Carolina Clean Energy Technology Center (NC Clean Energy Tech Center) offers technical assistance and resources to support EV charging infrastructure development. They provide guidance on project planning, site selection, and compliance with relevant regulations. The center also facilitates partnerships between stakeholders, including local governments, utilities, and businesses, to streamline the implementation process and ensure the successful deployment of charging stations.

By combining financial incentives with technical expertise, North Carolina is fostering a robust EV charging network. This infrastructure development is vital for the state's transition to a more sustainable transportation system, reducing greenhouse gas emissions and improving air quality. The subsidies and grants not only encourage the construction of charging stations but also contribute to the overall economic growth of the state by creating jobs and attracting investments in clean energy technologies.

TurboTax: Electric Vehicle Deductions: Where to Enter Your EV Info

You may want to see also

Public Transportation: Incentives for electric buses and transit systems

North Carolina has implemented several incentives to promote the adoption of electric buses and improve public transportation systems, particularly in the context of electric vehicles. The state recognizes the environmental benefits and long-term cost savings of transitioning to electric buses, which can help reduce air pollution and noise levels while also lowering operating costs compared to traditional diesel buses.

One key incentive is the Electric Bus Grant Program, which provides financial assistance to public transportation agencies for the purchase of new electric buses. This program is designed to accelerate the deployment of zero-emission buses in the state's public transportation fleet. The grants are typically awarded based on a competitive process, ensuring that the funds are allocated to agencies with the most promising projects and plans for electric bus integration. The program has been instrumental in encouraging local governments and transit authorities to invest in modern, efficient electric buses, which can enhance the overall reliability and attractiveness of public transportation services.

In addition to grants, North Carolina offers tax credits for the purchase and lease of electric buses. These tax credits can significantly reduce the upfront cost of acquiring electric buses, making it more financially viable for transportation agencies to make the switch. The tax credit amount may vary depending on factors such as the bus's battery capacity, efficiency, and the agency's overall fleet size. By providing tax relief, the state aims to encourage the adoption of electric buses and stimulate the market for these environmentally friendly vehicles.

The state also provides support for the development of charging infrastructure for electric buses. This includes funding for the installation of charging stations at bus depots and along transit routes. Adequate charging infrastructure is crucial for the successful integration of electric buses into existing transit systems, ensuring that they can be conveniently charged during their scheduled stops and operations. North Carolina's investment in charging infrastructure not only supports the current electric bus fleet but also facilitates the future expansion of electric bus services.

Furthermore, North Carolina offers incentives for the modernization and expansion of public transportation systems, which often involve the introduction of electric buses. These incentives can include grants, low-interest loans, and technical assistance for projects that improve transit services, increase capacity, or introduce new technologies. By supporting the overall enhancement of public transportation, the state aims to make these services more efficient, accessible, and environmentally friendly. This holistic approach to public transportation development ensures that the transition to electric buses is accompanied by improvements in the overall transit experience for North Carolina residents.

Electric Vehicle Tax Credit: Still Available for Your Next Purchase?

You may want to see also

Frequently asked questions

Yes, North Carolina offers several incentives to promote the adoption of electric vehicles (EVs). The state provides a tax credit of up to $3,000 for the purchase or lease of new electric vehicles. This credit is available to residents who buy or lease EVs from participating dealers.

The qualification criteria for the EV tax credit are based on the vehicle's manufacturer and the year of manufacture. You can check the North Carolina Department of Revenue website for a list of eligible vehicle models and their respective tax credits. It's recommended to consult the official guidelines for the most up-to-date information.

Absolutely! North Carolina also offers a special property tax exemption for electric vehicle charging equipment. This means that EV owners can be exempt from paying property taxes on their home-based charging stations. Additionally, some utility companies provide discounted rates or incentives for EV charging, further reducing the cost of ownership.

The EV tax credit is typically claimed when filing your state income tax return. You may need to provide documentation regarding the purchase or lease of the vehicle. For other subsidies, such as the property tax exemption, you might need to submit an application to the relevant authorities, so it's best to check the specific requirements.

The state's incentives for electric vehicles are subject to change, and it's advisable to stay updated with the latest policies. The North Carolina General Assembly periodically reviews and adjusts the EV incentives. It is recommended to follow official government sources and stay informed about any legislative updates regarding EV subsidies.