Navigating the tax implications of electric vehicles (EVs) can be complex, especially when it comes to claiming incentives and deductions. TurboTax, a popular tax preparation software, offers a comprehensive approach to managing these financial aspects. This guide will explore the specific steps and considerations for users looking to enter their electric vehicle information in TurboTax, ensuring they take full advantage of available tax benefits for their EV ownership.

What You'll Learn

- Electric Vehicle Deductions: Tax credits for EV purchases and charging station expenses

- EV Mileage Tracking: Record and claim mileage for tax benefits

- EV Tax Credits: Understand and claim federal and state tax credits

- EV Purchase Documentation: Gather and organize documents for EV purchases

- EV Usage Records: Track EV usage for accurate tax reporting

Electric Vehicle Deductions: Tax credits for EV purchases and charging station expenses

If you're an electric vehicle (EV) owner, you may be eligible for various tax deductions and credits to offset the costs of your vehicle and charging station. TurboTax, a popular tax preparation software, offers tools to help you navigate these deductions. Here's a breakdown of the key areas to consider:

EV Purchase Deductions:

- Sales Tax: In most states, you can deduct the sales tax paid on your EV purchase. TurboTax will help you calculate this deduction based on your state's tax laws.

- State and Local Taxes: Some states offer additional tax credits or deductions for EV purchases. TurboTax will prompt you to enter relevant information to claim these benefits.

Charging Station Expenses:

- Home Charging Equipment: You can deduct the cost of installing a home charging station, including labor and equipment. This deduction applies to both Level 1 (standard outlet) and Level 2 (240-volt) chargers.

- Public Charging: While not deductible as a business expense, you can deduct the cost of charging your EV at public stations. Keep track of your receipts for these charges.

Other Potential Deductions:

- EV Insurance: You may be able to deduct the cost of your EV insurance premiums.

- Maintenance and Repairs: Expenses related to maintaining and repairing your EV, such as battery replacements or service contracts, could be deductible.

Using TurboTax:

TurboTax will guide you through the process of claiming these deductions and credits. It will ask you specific questions about your EV purchase, charging station setup, and other relevant expenses. Be prepared to provide documentation, such as receipts and invoices, to support your deductions.

Important Considerations:

- State Laws: Tax laws vary by state, so it's crucial to understand the specific deductions and credits available in your state. TurboTax will help you navigate these differences.

- Documentation: Keep all relevant receipts, invoices, and other documentation related to your EV purchase, charging station installation, and expenses. This will be essential for verifying your deductions.

- Consult a Professional: If you have complex tax situations or significant EV-related expenses, consider consulting a tax professional for personalized advice.

Ford's Electric Revolution: Powering the Future with Eco-Friendly Cars

You may want to see also

EV Mileage Tracking: Record and claim mileage for tax benefits

To maximize the tax benefits of owning an electric vehicle (EV), it's crucial to accurately track your EV's mileage. This is because the IRS allows EV owners to claim a portion of their vehicle's expenses, including mileage, as tax deductions. Here's a comprehensive guide on how to effectively track and record your EV mileage for tax purposes:

Choose a Mileage Tracking Method:

- Digital Apps: Numerous smartphone apps are designed specifically for EV mileage tracking. These apps often sync with your vehicle's onboard computer or can be manually entered. Popular options include Evergreen, EV Mileage Tracker, and EV Tax Deduction.

- Manual Records: If you prefer a more traditional approach, keep a detailed logbook. Record the date, mileage, purpose of the trip (e.g., business, personal), and any relevant details. You can use a physical notebook or a digital document.

- Onboard Computer: Some EVs have built-in mileage tracking features. Check your vehicle's manual to see if this function is available.

Understand IRS Mileage Rates:

The IRS sets an annual mileage rate for EV owners. For 2023, the standard mileage rate is 65.5 cents per mile for business miles and 18 cents per mile for personal miles. This rate is subject to change annually, so stay updated.

Record Regularly:

Consistency is key. Make it a habit to record your EV's mileage regularly. Aim to log mileage after each significant trip or at least weekly. The more accurate and up-to-date your records are, the easier it will be to claim deductions.

Include Relevant Details:

When recording mileage, provide as much information as possible. Note the date, starting and ending mileage, purpose of the trip, and any relevant expenses incurred (e.g., charging costs, tolls). This level of detail will make it easier to substantiate your deductions if needed.

Enter Mileage in TurboTax:

When filing your taxes using TurboTax, locate the section dedicated to vehicle expenses. You'll likely find it under "Deductions" or "Tax Savings." TurboTax will guide you through the process, prompting you to enter your mileage and other relevant information. Be sure to select the appropriate mileage rate based on your usage (business or personal).

Keep All Records Secure:

Maintain a secure record-keeping system. Store your mileage logs, receipts for charging and maintenance, and any other relevant documentation in a safe place. This will ensure you have everything you need to support your mileage deductions if the IRS requests verification.

By diligently tracking your EV mileage and following these steps, you can effectively claim the tax benefits you're entitled to. Remember, accurate record-keeping is essential for a smooth tax filing process and maximizing your EV ownership savings.

Unveiling the Power: Understanding EVSE and Its Role in Charging

You may want to see also

EV Tax Credits: Understand and claim federal and state tax credits

Understanding and claiming tax credits for electric vehicles (EVs) can significantly reduce your tax liability and make the transition to eco-friendly transportation more affordable. Here's a comprehensive guide on how to navigate the process:

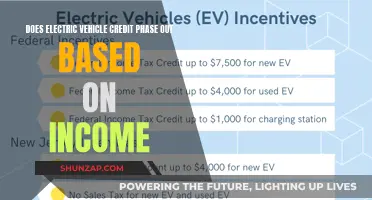

Federal Tax Credits:

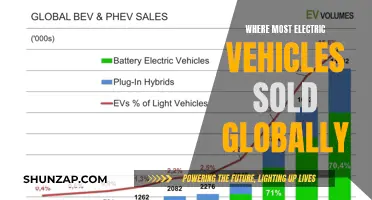

The federal government offers a substantial tax credit for EV purchases, which can be a game-changer for buyers. This credit is designed to encourage the adoption of electric vehicles and reduce greenhouse gas emissions. Here's how it works:

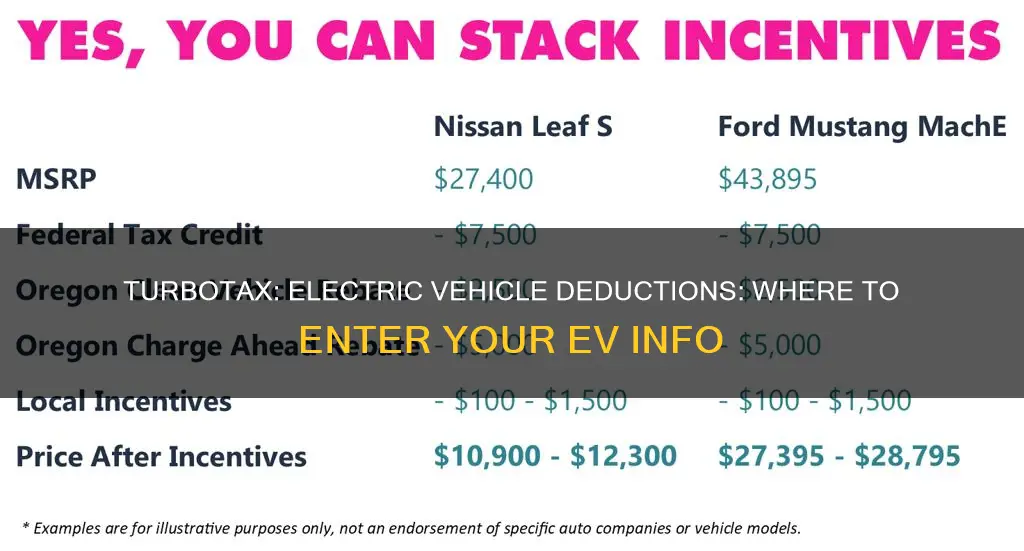

- Credit Amount: As of my last update, the federal tax credit for EVs can reach up to $7,500. This amount is based on the vehicle's battery capacity and the manufacturer's compliance with certain production requirements.

- Eligibility: To qualify, you must purchase or lease a new EV from a dealership or manufacturer that participates in the program. Used EVs may also be eligible, but there are specific guidelines.

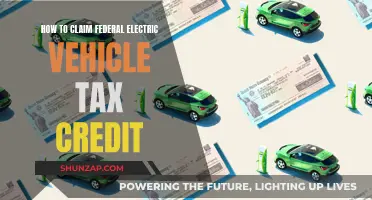

- Claiming the Credit: When filing your federal tax return, you'll find the relevant section in the forms provided by the IRS. You'll need to provide details about the EV, including its make, model, and vehicle identification number (VIN). The credit is typically claimed as a reduction in your taxable income.

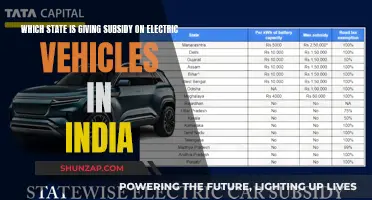

State-Level Incentives:

In addition to federal credits, many states offer their own incentives to promote EV ownership. These can include rebates, tax credits, or even special license plates. Here's a breakdown:

- State-Specific Programs: Research your state's official website or department of revenue to find detailed information. For example, some states provide rebates based on the vehicle's price or offer tax credits for EV purchases.

- Local Benefits: Certain cities or counties might also have their own EV incentives. These could include reduced parking fees, free or discounted charging station access, or other local benefits.

- Claiming State Credits: State tax credits are usually claimed on your state income tax return. The process may vary, so consult your state's tax guidelines or seek professional advice to ensure you're claiming the correct amount.

Documenting Your Purchase:

To successfully claim these credits, proper documentation is essential. Here are some key points:

- Sales Receipt: Keep a copy of your vehicle's sales receipt, which should include the vehicle's details and the price paid.

- Manufacturer's Information: If you're claiming a federal credit, you might need additional documentation from the EV manufacturer, confirming the vehicle's eligibility.

- Lease Agreements: For leased EVs, ensure you have the lease agreement, as it may impact the credit calculation.

TurboTax Tips:

When using TurboTax to file your taxes, here's how to approach EV tax credits:

- Category Selection: Look for the category related to "Electric Vehicle" or "EV Tax Credit" in TurboTax's tax forms.

- Input Vehicle Details: Provide the necessary information about your EV, including its make, model, and any relevant specifications.

- State-Specific Forms: If your state offers credits, ensure you select the appropriate state forms and input the relevant details.

Remember, tax regulations can change, so it's crucial to stay updated or consult a tax professional for the most accurate and current information regarding EV tax credits.

Understanding Drive Cycles: The Key to Electric Vehicle Efficiency

You may want to see also

EV Purchase Documentation: Gather and organize documents for EV purchases

When purchasing an electric vehicle (EV), it's essential to have all the necessary documentation in order to ensure a smooth transaction and potential tax benefits. Here's a step-by-step guide on how to gather and organize the required documents for your EV purchase:

- Sales Agreement or Contract: Start by obtaining a copy of the sales agreement or contract between you and the EV dealership or seller. This document should include essential details such as the vehicle's make, model, year, VIN (Vehicle Identification Number), purchase price, and any additional fees or charges. Make sure to review the terms and conditions, including any warranties or guarantees provided.

- Bill of Sale: A bill of sale is a crucial document that summarizes the transaction. It should include the same vehicle details as the sales agreement, the date of purchase, and the names and signatures of both the buyer and seller. This document serves as proof of ownership and is often required for tax purposes.

- Vehicle Title and Registration: Obtain a copy of the vehicle's title, which proves your legal ownership. If the EV is new, the dealership will typically handle the title transfer. For used EVs, you might need to request a title transfer from the previous owner. Additionally, gather any relevant registration documents, including the vehicle registration certificate and any previous registration cards.

- Financial Documents: Collect all financial-related paperwork related to the purchase. This includes bank statements or receipts for the down payment, any loan agreements or financing contracts, and proof of insurance coverage for the EV. These documents are essential for tracking the financial aspects of your purchase and may be required when filing tax returns.

- Dealer or Seller Information: Make sure to record the contact information of the dealership or seller, including their address, phone number, and email. This information can be useful if you need to follow up on any documentation or have questions regarding the purchase.

- Organization and Storage: Create a dedicated folder or folder system to store all the gathered documents. Organize them chronologically or by category (e.g., sales agreement, title documents, financial records) for easy access. Consider digitizing these documents and storing them securely in the cloud or on an external hard drive for backup purposes.

By following these steps, you can ensure that you have a comprehensive set of documents ready for your EV purchase. Proper organization and documentation will make it easier to navigate any potential tax-related processes and provide proof of your EV ownership. Remember to keep all paperwork up-to-date and easily accessible for future reference.

The Evolution of Hybrid and Electric Cars: A Green Revolution

You may want to see also

EV Usage Records: Track EV usage for accurate tax reporting

To ensure accurate tax reporting for your electric vehicle (EV) usage, it's crucial to maintain detailed records of your EV-related expenses and mileage. This information is essential for claiming the available tax credits and deductions for EV owners. Here's a step-by-step guide on how to track your EV usage effectively:

- Gather Essential Information: Start by collecting all the necessary details related to your EV. This includes the vehicle's make, model, year, and unique identification number (VIN). Also, obtain proof of purchase, such as the bill of sale, to establish the vehicle's acquisition date and any associated costs. Additionally, keep records of any modifications or upgrades made to your EV, as these may impact your tax deductions.

- Track Mileage and Usage: One of the most critical aspects of EV ownership for tax purposes is monitoring your mileage. Keep a logbook or use a digital tracking app to record the distance traveled in your EV and the corresponding dates. You can also utilize the built-in trip counters in many modern vehicles. It's important to note that you can claim a deduction for the portion of your mileage used for business purposes, even if the vehicle is primarily used for personal travel.

- Document Charging and Maintenance: Maintain records of your EV's charging sessions, including the dates, locations, and amounts of electricity consumed. This data is valuable for calculating the cost of charging, which can be deducted as a business expense. Additionally, keep track of regular maintenance and service records. While personal maintenance expenses may not be deductible, business-related maintenance costs can be claimed. Ensure you have receipts or invoices for any services performed, including oil changes, tire replacements, and other routine upkeep.

- Utilize Tax Software or Apps: Consider using tax preparation software or mobile apps specifically designed for EV owners. These tools can simplify the process of tracking and categorizing your EV-related expenses. They often provide pre-populated forms and ensure that your records are organized and readily accessible during tax season. Some popular tax software options include TurboTax, H&R Block, and TaxAct, which offer features tailored to EV owners.

- Stay Organized and Consistent: Consistency is key when it comes to tax reporting. Develop a system to regularly update your EV usage records, ensuring that you capture all relevant details promptly. This might involve setting aside a few minutes each week to review and record your EV's mileage, charging sessions, and maintenance activities. Staying organized will make the tax filing process much smoother and reduce the risk of errors or missed deductions.

By following these steps and maintaining comprehensive EV usage records, you can accurately report your EV-related expenses and maximize the tax benefits available to EV owners. Remember, proper documentation is essential for a successful tax return, so start tracking your EV usage today to ensure a stress-free tax season.

Electric Vehicle Revolution: Are We Seeing a Production Boom?

You may want to see also

Frequently asked questions

TurboTax provides a dedicated section for EV owners to input their vehicle details. Look for the "Motor Vehicles" category, where you'll find a sub-section specifically for electric vehicles. Here, you can input the make, model, and year of your EV, along with any relevant mileage or usage information.

No, you don't need to report the full value of your EV. TurboTax allows you to report the cost of acquisition or the decrease in value (if applicable) for tax purposes. This is typically done through the "Motor Vehicles" section, where you can select the appropriate option and provide the necessary details.

Yes, there are several tax benefits for EV owners. TurboTax guides you through the process of claiming the federal tax credit for electric vehicles, which can be found in the "Tax Credits and Deductions" section. You may also be eligible for state-specific incentives, which can be reported in the appropriate state forms within TurboTax.

TurboTax provides tools to help you calculate and report mileage or usage for your EV. You can input the total distance traveled or the percentage of usage for different purposes (e.g., commuting, business travel). The software will then help you determine the deductible amount based on IRS guidelines.