Investing in electric vehicle (EV) batteries is a promising venture as the demand for sustainable transportation solutions continues to grow. With the global shift towards electrification, understanding how to invest in this sector is crucial for investors seeking to capitalize on the potential of this rapidly evolving market. This guide will explore the key considerations and strategies for investing in EV battery technology, including the importance of research and development, supply chain dynamics, and the impact of government policies on the industry. By delving into these aspects, investors can make informed decisions and navigate the complex landscape of EV battery investments.

What You'll Learn

- Battery Chemistry: Understand lithium-ion and solid-state battery technologies

- Manufacturing Processes: Learn about cell production, assembly, and quality control

- Recycling and Sustainability: Explore recycling methods and environmental impact reduction

- Market Analysis: Study EV battery demand, supply, and pricing trends

- Investment Strategies: Identify investment opportunities in battery startups and established companies

Battery Chemistry: Understand lithium-ion and solid-state battery technologies

The world of electric vehicles (EVs) is rapidly evolving, and at the heart of this revolution are batteries. Understanding the chemistry behind these power sources is crucial for anyone looking to invest in the EV battery market. The most prevalent technology in EVs today is the lithium-ion battery. These batteries utilize a lithium-based electrolyte, typically a lithium salt dissolved in an organic solvent, to facilitate the movement of lithium ions between the anode and cathode during charging and discharging. This design allows for high energy density, making lithium-ion batteries a popular choice for EVs. The anode is often made of graphite, while the cathode can be composed of various materials, such as lithium cobalt oxide (LCO) or lithium iron phosphate (LFP), each offering different performance characteristics.

The key advantage of lithium-ion batteries is their ability to provide high energy density, which translates to longer driving ranges for EVs. This technology has been refined over decades, leading to significant improvements in performance and safety. However, it's important to note that lithium-ion batteries also have limitations, such as their relatively short lifespan and the potential for thermal runaway under extreme conditions. Despite these challenges, the widespread adoption of EVs has driven significant investments in lithium-ion battery technology, ensuring its dominance in the market for the foreseeable future.

Now, let's turn our attention to the next-generation battery technology: solid-state batteries. These batteries replace the liquid or gel electrolyte in traditional lithium-ion cells with a solid conductive material, typically a ceramic or polymer. This solid electrolyte offers several potential benefits, including higher energy density, improved safety, and faster charging capabilities. Solid-state batteries can store more energy in a smaller space, which is crucial for reducing the weight and increasing the range of EVs. Additionally, the solid electrolyte is less flammable, addressing the safety concerns associated with liquid electrolytes.

The development of solid-state batteries is an active area of research and development, with numerous companies and startups investing in this technology. While solid-state batteries are not yet widely used in commercial EVs, they hold immense promise for the future of the industry. The transition from lithium-ion to solid-state batteries could revolutionize the EV market, offering improved performance and addressing some of the current limitations of lithium-ion technology. As such, investors should keep a close eye on this emerging technology and the companies driving its development.

In summary, the EV battery market is primarily driven by lithium-ion technology, which has proven its worth in providing reliable power for EVs. However, the potential of solid-state batteries cannot be overlooked, as they offer a glimpse into a future where EVs can go further, charge faster, and be even safer. Understanding these battery chemistries is essential for investors to make informed decisions and stay ahead in the rapidly evolving world of electric vehicles.

Diagnosing Electrical Shorts: A Guide for Vehicle Owners

You may want to see also

Manufacturing Processes: Learn about cell production, assembly, and quality control

The production of electric vehicle (EV) batteries involves a complex manufacturing process that requires precision and specialized equipment. Cell production is a critical step, as it involves the creation of individual battery cells, which are the building blocks of the battery pack. This process typically begins with the selection of high-quality materials, such as lithium-ion or lithium-polymer, which are known for their energy density and stability. The materials are then carefully mixed and coated to form the cathode and anode, which are the key components of the cell. Advanced mixing and coating techniques ensure a consistent and uniform composition, which is vital for the battery's performance and longevity.

Once the materials are prepared, the cell manufacturing process commences. This involves several steps, including electrode fabrication, where the cathode and anode materials are shaped and formed into thin layers. These layers are then stacked and wound to create the cell's structure. Precision is key here, as the alignment and winding of the electrodes must be exact to ensure optimal performance and safety. After winding, the cells undergo a process called 'formation,' where they are charged and discharged in a controlled manner to activate the materials and prepare them for the final assembly.

Assembly is a critical phase in the manufacturing process, where individual cells are combined to form the battery pack. This involves several intricate steps: first, the cells are arranged in a specific pattern, often in a modular design, to maximize energy storage and efficiency. Then, they are connected in series and parallel configurations using specialized connectors and terminals. Each connection point must be secure and reliable to ensure the battery pack's overall performance and safety. The assembly process also includes the integration of various components like cooling systems, protective casing, and management systems, which monitor and control the battery's operation.

Quality control is an essential aspect of EV battery manufacturing. It involves rigorous testing and inspection at various stages of production. During cell manufacturing, samples are tested for electrical performance, thermal stability, and mechanical integrity. Advanced testing equipment, such as battery testers and thermal analyzers, are used to simulate real-world conditions and ensure the cells meet the required specifications. In the assembly phase, each battery pack undergoes comprehensive inspections, including visual checks, electrical testing, and safety assessments. This ensures that the final product is reliable, efficient, and safe for use in electric vehicles.

To maintain high standards, manufacturers often implement automated inspection systems and employ trained personnel to oversee the process. Quality control teams may use advanced imaging techniques, such as X-ray and ultrasound, to identify defects or inconsistencies within the cells and battery packs. Additionally, environmental testing is conducted to simulate various climate conditions, ensuring the battery's performance and safety across different regions and seasons. This meticulous approach to quality control is essential to building a reputation for reliability and safety in the EV battery market.

Boosting EV Efficiency: Tips for Optimal Battery Performance

You may want to see also

Recycling and Sustainability: Explore recycling methods and environmental impact reduction

The electric vehicle (EV) industry is rapidly growing, and with it, the demand for lithium-ion batteries is soaring. As the world shifts towards more sustainable transportation, it's crucial to understand the recycling and sustainability aspects of these batteries to ensure a circular economy and minimize environmental impact. Here's an exploration of recycling methods and their role in reducing the environmental footprint of electric vehicle batteries:

Recycling Methods:

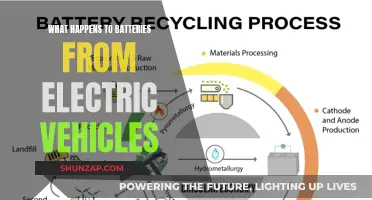

- Hydrometallurgy: This process involves dissolving the battery's components in a chemical solution to separate and recover valuable metals. The lithium, cobalt, and nickel can be extracted and reused. For instance, lithium can be recovered from the electrolyte, and cobalt and nickel from the cathode material. This method is energy-efficient and can handle large-scale recycling.

- Pyrometallurgy: A more traditional approach, pyrometallurgy uses high temperatures to melt and separate the battery's components. It is suitable for recycling nickel-cadmium (Ni-Cd) and lead-acid batteries but may not be as efficient for lithium-ion batteries due to the risk of thermal runaway. However, it can still play a role in recycling certain battery types.

- Mechanical Processing: This method involves physically breaking down the battery into its individual components. It is a simple process but may not recover all materials, especially those bonded strongly. Mechanical processing is often used in conjunction with other methods to enhance material recovery.

- Direct Recycling: This innovative approach aims to recycle the entire battery without disassembly. It involves specialized equipment to process the battery as a whole, making it more efficient and cost-effective. Direct recycling is still an emerging technology but holds great potential for large-scale battery recycling.

Environmental Impact Reduction:

Recycling electric vehicle batteries is crucial for several reasons. Firstly, it helps conserve natural resources. By reusing materials from recycled batteries, we reduce the need for extracting raw materials like lithium, cobalt, and nickel, which often come from environmentally sensitive areas. This conservation effort contributes to a more sustainable and eco-friendly approach to energy storage.

Secondly, proper recycling minimizes the environmental and health hazards associated with battery disposal. Lithium-ion batteries contain toxic substances, and improper disposal can lead to soil and water contamination. Recycling ensures that these hazardous materials are handled and treated safely, preventing potential ecological disasters.

Additionally, the recycling process itself has environmental benefits. Recycling facilities can be designed to be energy-efficient, reducing the overall carbon footprint. For instance, using renewable energy sources to power recycling plants can significantly lower the environmental impact compared to traditional manufacturing processes.

In summary, investing in electric vehicle batteries and their recycling is a multifaceted approach to sustainability. It involves adopting efficient recycling methods like hydrometallurgy and mechanical processing to recover valuable materials. By doing so, we can reduce the environmental impact of EV production and disposal, contributing to a greener and more sustainable future. As the EV market expands, implementing and improving recycling infrastructure will be essential to handle the increasing number of batteries that need recycling.

Navigating California's EV Battery Warranty: A Step-by-Step Guide to Filing a Complaint

You may want to see also

Market Analysis: Study EV battery demand, supply, and pricing trends

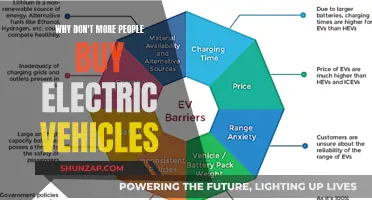

The electric vehicle (EV) market is experiencing rapid growth, and a key aspect of this expansion is the demand for advanced battery technology. As the popularity of EVs soars, the demand for high-performance, long-lasting batteries is increasing exponentially. This surge in demand is primarily driven by government incentives, environmental regulations, and consumer preferences for sustainable transportation. The market analysis of EV battery demand reveals a consistent upward trend, with a particular focus on lithium-ion batteries, which are currently the most prevalent technology in the EV sector.

In terms of supply, the EV battery market is witnessing a complex interplay of factors. On one hand, the demand for batteries is outpacing the current production capacity, leading to a supply-demand gap. This gap is further exacerbated by the limited availability of raw materials, especially lithium, which is a critical component in battery manufacturing. On the other hand, the industry is witnessing a wave of new investments and partnerships aimed at expanding production capabilities. Companies are investing in cutting-edge manufacturing processes and exploring innovative materials to meet the growing demand. This strategic expansion of supply chains is crucial to ensuring a stable and sustainable battery market.

Pricing trends in the EV battery market are influenced by various factors, including raw material costs, production efficiency, and market dynamics. Historically, lithium-ion batteries have seen a downward trend in prices due to economies of scale and technological advancements. However, recent supply chain disruptions and the increasing demand for higher-capacity batteries have led to price fluctuations. Investors should closely monitor these pricing trends, as they directly impact the profitability of EV battery manufacturers and the overall competitiveness of the EV market.

To study and understand the market, investors can employ several strategies. Firstly, analyzing historical sales data and market research reports can provide insights into the growth patterns and consumer behavior. Identifying key trends, such as the regions with the highest EV adoption rates, can help in pinpointing potential investment opportunities. Secondly, assessing the supply chain network and its resilience is essential. Investors should evaluate the production capacities of major battery manufacturers and their ability to meet the rising demand. Additionally, understanding the pricing strategies of battery suppliers and their relationships with EV manufacturers can offer valuable insights into the market's pricing dynamics.

In conclusion, the market analysis of EV battery demand, supply, and pricing trends is a comprehensive and dynamic process. Investors should stay informed about technological advancements, raw material availability, and market regulations to make strategic decisions. With the EV market's rapid growth, there are significant opportunities for those who can navigate the complexities of this evolving industry and identify the most promising investment avenues in the realm of electric vehicle batteries.

Unleash Savings: Your Guide to Federal EV Credit Claims

You may want to see also

Investment Strategies: Identify investment opportunities in battery startups and established companies

The electric vehicle (EV) industry is experiencing rapid growth, and investing in battery technology is a strategic move for investors looking to capitalize on this trend. Battery technology is a critical component of EVs, and advancements in this field are essential for improving performance, range, and overall efficiency. Here are some investment strategies to consider when focusing on battery startups and established companies:

Research and Due Diligence: Begin by thoroughly researching the battery technology market. Identify the key players, both startups and established corporations, that are developing innovative battery solutions. Look for companies with a strong focus on EV battery technology, including those specializing in lithium-ion batteries, solid-state batteries, or next-generation battery chemistries. Analyze their research and development (R&D) efforts, partnerships, and the uniqueness of their technology. Due diligence is crucial to understanding the company's potential, market fit, and competitive advantage.

Startups and Early-Stage Investments: Early-stage battery startups often offer high growth potential but carry higher risks. These companies might be developing cutting-edge battery technologies, such as solid-state batteries or advanced lithium-ion chemistries. Investors can consider funding these startups through venture capital firms or angel investment networks. Due diligence should focus on the team's expertise, the technology's scalability, and the potential impact on the EV industry. Diversifying your portfolio across multiple startups can mitigate risk while capturing significant upside.

Established Companies with Strong Battery Divisions: Many traditional automotive manufacturers and energy storage companies have already invested heavily in battery technology. These established companies may have a more mature business model and a larger market presence. Look for corporations that have dedicated battery research facilities, strategic partnerships with EV manufacturers, and a clear roadmap for growth. Investing in these companies can provide stability and the potential for steady returns. Analyze their market share, financial health, and the competitive landscape to determine their long-term prospects.

Industry Trends and Partnerships: Stay updated on industry trends and news to identify emerging opportunities. Keep an eye on partnerships and collaborations between battery manufacturers and EV companies, as these can lead to significant technological advancements and market growth. Additionally, monitor government policies and incentives that promote EV adoption and battery research. These factors can significantly impact the investment landscape and provide insights into potential market shifts.

Risk Management and Diversification: Investing in battery technology is a high-risk, high-reward endeavor. Diversify your investment portfolio across different battery startups, established companies, and related sectors. Consider the overall market sentiment and economic conditions when making investment decisions. Regularly review and assess your investments to manage risks and take advantage of emerging opportunities.

Unlocking EV Tax Credits: A Guide to Maximizing Your Federal Benefits

You may want to see also

Frequently asked questions

Investing in the EV battery market can be done through various avenues. One approach is to consider companies that manufacture and supply batteries for EVs, as these businesses are crucial to the industry's growth. You can invest in these companies directly by purchasing their stocks or through exchange-traded funds (ETFs) that track the EV battery sector. Another strategy is to look for companies that develop advanced battery technologies, as these innovations can significantly impact the industry's future.

Researching and analyzing companies in the EV battery space is essential. Look for firms with a strong track record of innovation, a solid financial position, and a clear strategy for growth. Examine their battery technology, production capabilities, and partnerships within the EV industry. Additionally, consider companies with a diverse customer base, including major EV manufacturers, as this indicates a stable and reliable business model.

The EV battery market is interconnected with various sectors. One critical area is the automotive industry, where battery manufacturers supply components to EV producers. Another sector is energy storage, as batteries are used for grid-scale energy storage solutions. Additionally, consider the impact of government policies and incentives that promote EV adoption, as these can drive demand for batteries. Keep an eye on emerging trends like solid-state batteries and second-life battery applications, which could bring new investment opportunities.

The EV battery market is not without its risks. One significant concern is the highly competitive nature of the industry, with many players vying for market share. Technological obsolescence is another risk, as rapid advancements in battery technology can make existing investments outdated. Supply chain disruptions and raw material sourcing are also critical factors, especially with the increasing demand for batteries. Lastly, regulatory changes and policy shifts can impact the market, so staying informed about industry regulations is essential.

Staying informed is crucial for making timely investment decisions. Follow reputable financial news sources and industry publications that cover the EV battery market. Attend industry conferences and webinars to gain insights from experts. Network with professionals in the field, and consider joining investment groups or forums where you can discuss trends and opportunities. Additionally, monitoring company filings, earnings calls, and industry research reports will provide valuable information about the market's direction.