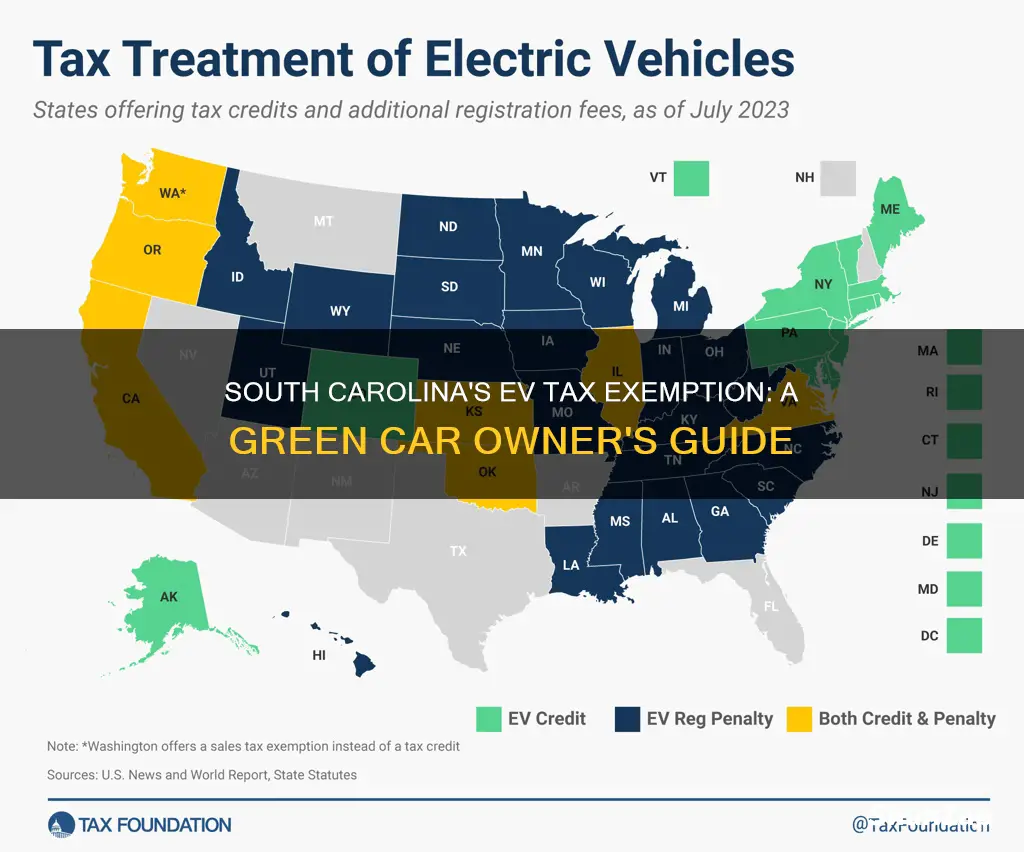

South Carolina has implemented a unique approach to incentivizing electric vehicle (EV) adoption by waiving certain taxes for EV owners. This non-tax state status is a significant benefit for EV drivers, as it reduces the overall cost of ownership and encourages the transition to more sustainable transportation options. The state's policy aims to promote environmental sustainability and reduce reliance on fossil fuels, making it an attractive destination for EV enthusiasts and a model for other regions considering similar initiatives.

| Characteristics | Values |

|---|---|

| Tax Status | South Carolina does not impose a state sales tax on the purchase of electric vehicles (EVs). |

| Registration Fee | The state offers a $500 registration fee waiver for EVs, which is a significant savings compared to the standard registration fee. |

| Exemption from Gas Tax | EVs are exempt from the state's gas tax, which is a benefit for EV owners. |

| Renewable Energy Credits | South Carolina has a Renewable Energy Credit (REC) program, which allows EV owners to generate and sell renewable energy credits, providing an additional financial incentive. |

| Public Charging Infrastructure | The state has been working on expanding public charging infrastructure, making it more convenient for EV owners to charge their vehicles. |

| Federal Tax Credits | While not specific to South Carolina, federal tax credits are available for EV purchases, further reducing the overall cost. |

| Environmental Benefits | The state's focus on EVs contributes to reduced greenhouse gas emissions and a more sustainable transportation system. |

| Growing EV Market | South Carolina has seen a steady growth in EV sales and adoption, indicating a positive market trend. |

| Future Plans | The state has committed to increasing its EV infrastructure and incentives, suggesting a long-term commitment to supporting the EV market. |

What You'll Learn

- Tax Exemption: South Carolina exempts EV purchases from state sales tax

- Registration Fees: EVs are exempt from additional registration fees

- Renewable Energy Incentives: The state offers incentives for EV charging infrastructure

- Public Transportation: South Carolina promotes EV adoption in public transit

- Environmental Benefits: EVs reduce emissions, benefiting the state's air quality

Tax Exemption: South Carolina exempts EV purchases from state sales tax

South Carolina has implemented a unique incentive to encourage the adoption of electric vehicles (EVs) by offering a tax exemption on EV purchases. This exemption is a significant benefit for residents and businesses looking to invest in sustainable transportation. The state's sales tax exemption for EVs means that buyers are not required to pay the standard 6% state sales tax on the purchase of an electric vehicle, which can result in substantial savings. This policy is part of a broader strategy to promote environmental sustainability and reduce the state's carbon footprint.

When purchasing an EV, South Carolina residents can save a considerable amount of money due to this tax break. For instance, a typical EV purchase might cost around $40,000, and without the tax exemption, the sales tax would amount to approximately $2,400. With the exemption, buyers can avoid this additional cost, making EVs more affordable and attractive to potential owners. This financial incentive is particularly appealing to those who are environmentally conscious and wish to contribute to a greener future.

The tax exemption extends beyond the initial purchase, as it applies to the registration and licensing of EVs as well. This means that EV owners in South Carolina will continue to save money over the long term, as they won't incur additional taxes during the vehicle's registration process. The state's approach to incentivizing EV ownership is a strategic move to reduce air pollution, improve public health, and promote a more sustainable transportation system.

This policy has been well-received by the public and environmental organizations alike. It has been cited as a successful example of how governments can actively support the transition to electric mobility. By making EVs more affordable, South Carolina is encouraging residents to make eco-friendly choices, which can have a positive impact on the state's environment and economy. The tax exemption is a powerful tool to accelerate the adoption of electric vehicles and potentially reduce the state's reliance on traditional gasoline-powered cars.

In summary, South Carolina's tax exemption for EV purchases is a significant advantage for residents and a step towards a more sustainable future. This incentive not only makes EVs more accessible but also contributes to the state's goal of reducing environmental impact. As the world moves towards cleaner energy solutions, such initiatives play a crucial role in driving the widespread adoption of electric vehicles.

Unveiling the Secrets: A Guide to Spotting Electric Vehicles

You may want to see also

Registration Fees: EVs are exempt from additional registration fees

In South Carolina, electric vehicles (EVs) are indeed exempt from certain registration fees, which is a significant benefit for EV owners in the state. This exemption is part of the state's broader efforts to promote the adoption of electric and alternative fuel vehicles, aiming to reduce emissions and encourage a more sustainable transportation system.

When it comes to vehicle registration, South Carolina has a structured system with various fees associated with it. Traditionally, vehicle registration has included an annual registration fee, which is typically based on the vehicle's value and age. However, for EVs, the state has implemented a unique approach. EV owners in South Carolina are not subject to the standard annual registration fee, which is a substantial savings. This exemption applies to both new and used electric vehicles, ensuring that EV owners can benefit from this policy regardless of their purchase history.

The absence of additional registration fees for EVs is a direct incentive for consumers. It reduces the overall cost of owning an electric vehicle, making it more financially appealing. This financial advantage can be particularly attractive to potential EV buyers, as it provides a tangible benefit that other vehicle owners do not enjoy. As a result, this policy may contribute to the growing popularity of EVs in South Carolina.

Furthermore, this exemption is part of a larger strategy to support the EV market. By removing these additional fees, the state aims to make EV ownership more accessible and affordable. This approach can encourage more people to consider electric vehicles, potentially leading to a more diverse and environmentally friendly transportation network. It also aligns with the state's commitment to reducing its carbon footprint and promoting sustainable practices.

In summary, South Carolina's exemption of additional registration fees for EVs is a significant advantage for electric vehicle owners. This policy not only reduces the financial burden but also contributes to the state's goal of fostering a greener and more sustainable transportation ecosystem. As the popularity of EVs continues to rise, such incentives play a crucial role in shaping the future of the automotive industry in South Carolina.

Fund Your Electric Dream: Strategies for EV Funding

You may want to see also

Renewable Energy Incentives: The state offers incentives for EV charging infrastructure

South Carolina has implemented several initiatives to promote the adoption of electric vehicles (EVs) and the development of charging infrastructure, aligning with its status as an electric vehicle non-tax state. One of the key incentives is the South Carolina Electric Vehicle Infrastructure Grant Program, which provides financial assistance to local governments, utilities, and private entities for the installation of EV charging stations. This program aims to ensure that EV owners across the state have convenient access to charging facilities, addressing range anxiety and encouraging the widespread use of electric transportation.

The state's commitment to renewable energy and EV infrastructure is further demonstrated through the South Carolina Renewable Energy Trust Fund. This fund allocates a portion of its revenue to various renewable energy projects, including EV charging infrastructure. By investing in these projects, the state not only supports the growth of the EV market but also contributes to a more sustainable and environmentally friendly transportation system.

In addition to grants, South Carolina offers tax credits for EV charging equipment. These credits can significantly reduce the cost of installing charging stations, making it more accessible for businesses and property owners to invest in EV infrastructure. The tax incentives encourage the private sector to take the lead in establishing a robust network of charging stations, which is crucial for the state's EV adoption goals.

Furthermore, the state has established partnerships with federal agencies and other organizations to enhance EV charging infrastructure. For instance, the Department of Energy's EV Project has been instrumental in providing technical assistance and resources to support the development of charging networks. These collaborations ensure that South Carolina's EV charging infrastructure is reliable, efficient, and compliant with industry standards.

By offering a combination of grants, tax incentives, and strategic partnerships, South Carolina is actively fostering a supportive environment for EV owners and charging station operators. These renewable energy incentives play a vital role in accelerating the transition to electric transportation, reducing greenhouse gas emissions, and positioning the state as a leader in sustainable mobility.

Troubleshooting Electrical Issues: A Comprehensive Guide to Diagnosing Vehicle Problems

You may want to see also

Public Transportation: South Carolina promotes EV adoption in public transit

South Carolina has been actively promoting the adoption of electric vehicles (EVs) in its public transportation system, recognizing the potential benefits of reducing emissions and improving sustainability. The state has implemented several initiatives to encourage the use of EVs in public transit, which has led to a growing number of electric buses and vehicles in its fleet.

One of the key strategies is the provision of incentives and grants. South Carolina offers financial assistance to public transportation agencies and municipalities to help cover the initial costs of purchasing electric buses and infrastructure. These grants aim to make the transition to EVs more affordable and accessible. By providing financial support, the state is encouraging public transit providers to invest in cleaner and more efficient transportation options.

In addition to financial incentives, South Carolina has also focused on developing the necessary infrastructure. The state has been working on expanding its network of EV charging stations, ensuring that public transit vehicles have convenient access to charging facilities. This infrastructure development is crucial for the widespread adoption of EVs, as it addresses range anxiety and ensures that public transit operators can efficiently manage their electric fleets.

The benefits of this initiative are twofold. Firstly, it reduces the carbon footprint of public transportation, contributing to South Carolina's environmental goals. Electric buses produce zero tailpipe emissions, improving air quality and reducing pollution in urban areas. Secondly, the adoption of EVs can lead to long-term cost savings for public transit agencies. Electric vehicles have lower operating costs compared to traditional diesel or gasoline buses, as electricity is generally cheaper than fossil fuels. This can result in significant savings over the lifetime of the vehicles, making public transportation more financially sustainable.

Furthermore, South Carolina's efforts in promoting EV adoption in public transit have a positive impact on the state's economy. The growth of the EV market creates opportunities for local businesses, including suppliers of electric vehicle components and charging station manufacturers. This industry development can lead to job creation and economic growth, especially in the manufacturing and infrastructure sectors. By supporting the EV industry, South Carolina is not only improving public transportation but also fostering a more sustainable and resilient economy.

Transform Your Ride: A Comprehensive Guide to Electric Vehicle Conversion

You may want to see also

Environmental Benefits: EVs reduce emissions, benefiting the state's air quality

The adoption of electric vehicles (EVs) in South Carolina and across the United States offers significant environmental advantages, particularly in the realm of air quality improvement. South Carolina, like many other states, has been actively promoting the use of EVs to combat the adverse effects of traditional internal combustion engine vehicles. One of the primary environmental benefits of EVs is their ability to reduce harmful emissions.

Internal combustion engines in conventional cars release a myriad of pollutants, including nitrogen oxides (NOx), volatile organic compounds (VOCs), and particulate matter, which contribute to air pollution and have detrimental effects on human health and the environment. In contrast, EVs produce zero tailpipe emissions, meaning they do not release these harmful pollutants during operation. This is a crucial advantage for states like South Carolina, where air quality is a growing concern.

The reduction in emissions from EVs is particularly beneficial in densely populated urban areas and along major transportation corridors. By encouraging the use of electric cars, South Carolina can help improve air quality in its cities, leading to healthier environments for its residents. This is especially important in areas where pollution levels are already high, as EVs can significantly contribute to reducing smog and improving overall air quality.

Furthermore, the environmental benefits of EVs extend beyond the immediate reduction in local emissions. The electricity used to power EVs can be generated from renewable sources, such as solar, wind, or hydropower, which have a much lower carbon footprint compared to fossil fuels. As South Carolina and other states transition to cleaner energy sources, the environmental impact of EVs will become even more significant, further reducing the state's carbon emissions and contributing to global efforts to combat climate change.

In summary, the environmental benefits of electric vehicles in South Carolina are substantial, particularly in terms of air quality improvement. By encouraging the adoption of EVs, the state can reduce harmful emissions, improve public health, and contribute to a more sustainable and environmentally friendly future. This shift towards electric mobility is a crucial step in addressing the environmental challenges faced by South Carolina and the nation as a whole.

Vehicle Chassis: Conducting the Electrical Circuit Path

You may want to see also

Frequently asked questions

Yes, South Carolina does not impose a state sales tax on the purchase of electric vehicles, which is a significant advantage for EV owners. This policy was introduced to encourage the adoption of cleaner and more sustainable transportation options.

No, there is no specific tax on the sale of electric vehicles. However, if you are selling a used EV, you might be subject to a used vehicle sales tax, which is typically applied to the sale of pre-owned cars.

South Carolina does not have separate registration fees for EVs. The standard registration process and fees apply to all vehicles, including electric ones.

While South Carolina does not have a specific state-level tax credit for EV purchases, there might be federal tax credits available to South Carolina residents who buy qualified electric vehicles. It's best to check the latest federal tax incentives.

Tax policies can change over time, and it's always a good idea to stay updated with the latest legislation. As of my cut-off date, there is no recent announcement indicating a change in South Carolina's non-tax status for electric vehicles. However, it's recommended to verify this information with the state's tax authorities.