The electric vehicle (EV) tax credit is a significant incentive for consumers to purchase electric cars, offering a substantial refund on the federal income tax. This credit is designed to promote the adoption of environmentally friendly vehicles and reduce the environmental impact of the transportation sector. However, understanding the refundability of this credit is crucial for EV buyers to maximize their financial benefits. This paragraph will explore the refundability aspect of the electric vehicle tax credit, providing insights into how and when this credit can be refunded to consumers.

| Characteristics | Values |

|---|---|

| Refundability | The electric vehicle tax credit is generally not refundable. However, there are exceptions and specific conditions that may allow for a refund. |

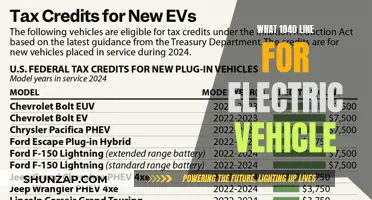

| Tax Credit Amount | The tax credit for electric vehicles can vary depending on the vehicle's battery capacity and other factors. It typically ranges from $2,500 to $7,500 per vehicle. |

| Eligibility | This credit is available to individuals and businesses purchasing or leasing new electric vehicles. The vehicle must be new and meet certain emissions and battery requirements. |

| Income Limits | There are income limits for claiming the tax credit. For individuals, the modified adjusted gross income (MAGI) cannot exceed $150,000 for joint filers or $75,000 for single filers. For businesses, the credit is generally limited to the first 200,000 vehicles sold. |

| Carryforward Option | If the tax credit exceeds the taxpayer's tax liability, the excess can be carried forward to future tax years until fully utilized. |

| Documentation | Proper documentation is required to claim the credit, including proof of vehicle purchase or lease, battery capacity, and compliance with emissions standards. |

| Recent Changes | The tax credit rules have evolved over time, with changes in eligibility criteria, income limits, and credit amounts. It is essential to refer to the latest legislation for accurate information. |

What You'll Learn

- Eligibility Criteria: Who qualifies for the EV tax credit

- Refund Process: How and when is the refund issued

- Taxable Income Impact: Does the credit affect taxable income

- Timing of Refund: When can taxpayers expect to receive the refund

- Documentation Requirements: What documents are needed for the refund claim

Eligibility Criteria: Who qualifies for the EV tax credit?

The eligibility criteria for the electric vehicle (EV) tax credit are designed to encourage the adoption of electric cars and promote environmental sustainability. Here's an overview of who qualifies for this financial incentive:

Vehicle and Manufacturer Requirements: To be eligible, the EV must be purchased or leased from a qualified dealer or manufacturer. The vehicle should be new and meet specific performance and emission standards. These standards often include a minimum range, battery capacity, and compliance with environmental regulations. For instance, the Internal Revenue Service (IRS) has set guidelines that EVs must have a battery range of at least 40 miles for the credit to apply. Additionally, the vehicle should be purchased or leased after the enactment of the tax credit legislation.

Income and Residency: The tax credit is generally available to individuals who meet certain income thresholds. These thresholds are adjusted annually and are typically based on the federal poverty level. For the latest year, the credit may be claimed by individuals with adjusted gross income (AGI) of up to $150,000 for single filers and $300,000 for joint filers. However, it's important to note that the credit phases out for income above these limits. Residency also plays a role, as the credit is available to U.S. citizens, residents, and certain non-resident aliens who meet specific requirements.

Personal Use and Ownership: The EV tax credit is intended for personal use. Therefore, individuals who purchase or lease EVs for business or commercial purposes may not qualify. Additionally, the credit is typically available to the first buyer or lessee of the vehicle. This means that if an EV is purchased as a gift or inherited, the original buyer may not be eligible for the tax credit.

Timing and Application: Eligibility is also tied to the timing of the purchase or lease. The tax credit is generally available for vehicles purchased or leased after the enactment of the relevant legislation. It's essential to keep records and documentation to support the claim. Applicants must file Form 8936 with their tax return to claim the credit, providing details of the EV purchase or lease.

Understanding these eligibility criteria is crucial for individuals interested in the EV tax credit. It ensures that the financial incentive reaches those who meet the necessary requirements, promoting the widespread adoption of electric vehicles and contributing to a more sustainable future.

Electric Vehicles: Green Revolution or Environmental Trade-Off?

You may want to see also

Refund Process: How and when is the refund issued?

The process of obtaining a refund for the electric vehicle tax credit can vary depending on the country and specific regulations. In the United States, for instance, the Internal Revenue Service (IRS) handles the refund process for the credit. Here's an overview of how and when the refund might be issued:

Claiming the Refund: To initiate the refund process, eligible taxpayers must file an amended tax return or claim the credit on their current year's tax return. This is typically done using Form 1040 or the appropriate tax return form for the respective tax year. When filing, taxpayers should ensure they have all the necessary documentation, including proof of the electric vehicle's purchase or lease, and any other supporting documents required by the tax authorities.

Refund Processing Time: After submitting the amended return or claiming the credit, the IRS will review the application. The processing time can vary, but it is generally recommended to allow several weeks for the IRS to process the refund. The agency may request additional information or documentation to verify the claim, which could further extend the processing period. Once approved, the refund will be issued and disbursed according to the standard payment methods.

Refund Disbursement: The refund amount is typically issued as a payment to the taxpayer. This can be in the form of a direct deposit into the taxpayer's bank account, a check mailed to the address on file, or, in some cases, a payment through the Electronic Federal Tax Payment System (EFTPS). The timing of the disbursement depends on the IRS's payment schedule and the taxpayer's chosen payment method. Taxpayers can check the status of their refund online through the IRS's 'Where's My Refund?' tool, which provides an estimated refund arrival date.

It is important to note that the refund process may differ for other countries and regions with their own tax credit systems. Taxpayers should consult their respective tax authorities or seek professional advice to understand the specific refund procedures and requirements applicable to their jurisdiction.

Toyota's Electric Lag: A Missed Opportunity in EV Innovation

You may want to see also

Taxable Income Impact: Does the credit affect taxable income?

The impact of the electric vehicle tax credit on taxable income is a crucial consideration for individuals and businesses looking to make the switch to electric vehicles. When it comes to understanding the tax implications, it's important to clarify that the tax credit itself is not directly added to your taxable income. Instead, it serves as a reduction in the amount of tax owed. This means that the credit directly lowers the tax liability, which can have a significant effect on your overall financial situation.

For individuals, the electric vehicle tax credit can be a substantial benefit, especially for those who have recently purchased an electric vehicle. The credit is typically applied to the federal income tax return, and it can be used to reduce the taxable income. This reduction in taxable income can result in a lower tax bill or, in some cases, a refund if the credit exceeds the tax liability. It's essential to keep detailed records of the electric vehicle purchase and any related expenses to ensure accurate reporting and maximize the potential benefits.

Businesses, particularly those in the automotive industry, can also benefit from the electric vehicle tax credit. When a business purchases electric vehicles, they can claim the credit as a deduction against their taxable income. This deduction directly impacts the company's profitability and can be a significant incentive for businesses to invest in sustainable transportation options. However, it's important to note that businesses may need to provide additional documentation and adhere to specific guidelines to qualify for the credit.

The refundability of the credit is an essential aspect to consider. In some cases, if the credit exceeds the tax liability, it may be carried forward to future tax years, allowing for potential refunds in those years. This provision ensures that individuals and businesses can benefit from the credit even if they don't have a significant tax liability in the current year. Understanding the refundability aspect is crucial for financial planning and ensuring that the credit is utilized effectively.

In summary, the electric vehicle tax credit does not directly impact taxable income but rather serves as a reduction in tax liability. This credit can provide significant benefits to individuals and businesses, offering financial incentives for the adoption of electric vehicles. By understanding the tax implications and the potential for refunds, individuals and businesses can make informed decisions and maximize the advantages of this credit.

GM's Electric Future: Unveiling Plans for a Green Revolution

You may want to see also

Timing of Refund: When can taxpayers expect to receive the refund?

The timing of the refund for the electric vehicle tax credit is an important consideration for taxpayers who are eligible for this benefit. The Internal Revenue Service (IRS) has specific guidelines regarding when and how the refund is processed, ensuring a smooth and efficient process for those entitled to it.

Taxpayers can expect to receive their refund within a standard timeframe after filing their tax return. The IRS typically processes returns and issues refunds within a few weeks to a month. However, it's important to note that the exact timing can vary depending on several factors. These factors include the complexity of the return, the accuracy of the information provided, and the IRS's current workload. During peak tax seasons, processing times may be longer, so it's advisable to file early to ensure a quicker refund.

Once the tax return is processed and the electric vehicle tax credit is determined to be applicable, the refund is issued accordingly. The IRS provides refunds through various methods, including direct deposit into the taxpayer's bank account or by issuing a check in the mail. The choice of method depends on the taxpayer's preference and the information provided on the tax return.

In some cases, if the tax credit exceeds the amount owed in taxes, the excess may be refunded as a payment. This can be a significant benefit for taxpayers, especially those who have already paid their taxes for the year. The refund process ensures that eligible individuals receive the financial assistance they are entitled to, promoting the adoption of electric vehicles and contributing to environmental sustainability goals.

It is recommended that taxpayers keep accurate records and monitor their tax return status regularly. They can use the IRS's online tools or contact their tax professional for updates on the refund process. Being proactive and well-informed about the refund timeline can help taxpayers manage their finances effectively and take advantage of the electric vehicle tax credit benefits.

China's EV Revolution: How It's Surpassing the US

You may want to see also

Documentation Requirements: What documents are needed for the refund claim?

When it comes to claiming a refund for the electric vehicle tax credit, the documentation process is crucial to ensure a smooth and successful application. Here's an overview of the key documents you'll need:

Proof of Purchase: This is the cornerstone of your refund claim. You must provide a comprehensive set of documents that prove the purchase of an eligible electric vehicle. This includes the original sales receipt or invoice, which should clearly state the vehicle's make, model, and purchase date. In some cases, a copy of the vehicle's title or registration might be required to verify ownership.

Vehicle Identification Number (VIN): The VIN is a unique identifier for your vehicle. It is essential to provide this number as it helps in verifying the vehicle's eligibility for the tax credit. You can typically find the VIN on the vehicle's dashboard or engine compartment, and it might also be listed on the sales documents.

Tax Credit Application Form: Most tax credit refund processes require a specific application form. This form will ask for detailed information about the vehicle purchase, including the price, date of purchase, and any applicable discounts or incentives. Ensure that you provide accurate and complete information to avoid delays in processing.

Supporting Documentation: Depending on your jurisdiction and the specific tax credit program, you might need additional supporting documents. This could include proof of residency, income verification (if the credit is means-tested), or even a declaration of vehicle usage. These documents aim to ensure that the tax credit is utilized by eligible individuals or entities.

Record-Keeping Tips: It's essential to maintain organized records throughout the process. Keep all original receipts, invoices, and any correspondence with the tax authorities. This documentation will be crucial if you need to provide additional information or respond to any inquiries during the refund claim process. Proper record-keeping also ensures that you have the necessary evidence if any disputes arise.

Powering Hybrid Vehicles: Understanding the Battery Voltage

You may want to see also

Frequently asked questions

The electric vehicle tax credit, also known as the Plug-In Electric Vehicle (PEV) Tax Credit, is a financial incentive offered by the U.S. government to encourage the purchase of electric vehicles. It provides a tax credit to individuals and businesses for the cost of qualified electric vehicle purchases, including cars, trucks, and motorcycles.

The refundability of the tax credit means that if the credit amount exceeds the taxpayer's tax liability, the excess can be refunded to the taxpayer. In other words, if the electric vehicle tax credit is larger than the taxes owed, the taxpayer can receive a refund for the difference. This ensures that the credit is not limited to those with high tax liabilities and provides a more significant benefit to those who may need it most.

Yes, even if you don't owe any taxes, you can still claim the electric vehicle tax credit and receive a refund. The credit is designed to be a direct benefit to taxpayers, and the refund process ensures that eligible individuals can access the financial incentive, regardless of their tax liability. This encourages the adoption of electric vehicles and promotes environmental sustainability.