The electric vehicle (EV) tax credit is a financial incentive designed to encourage the adoption of electric cars and reduce greenhouse gas emissions. This credit is typically available on a yearly basis, providing a significant boost to the purchase of EVs. The amount of the credit can vary from year to year, and it is crucial for potential EV buyers to stay informed about the latest tax credit regulations to make informed decisions about their vehicle purchases. Understanding the yearly nature of this credit is essential for anyone considering an electric vehicle, as it can impact the overall cost and financial benefits of owning an EV.

What You'll Learn

- Eligibility Requirements: Who qualifies for the EV tax credit and what vehicles are eligible

- Income Limits: Are there income caps for receiving the EV tax credit

- Credit Amount: How much is the EV tax credit and how is it calculated

- Filing Process: Steps to claim the EV tax credit on tax returns

- Changes Over Time: How has the EV tax credit policy evolved

Eligibility Requirements: Who qualifies for the EV tax credit and what vehicles are eligible?

The Electric Vehicle (EV) tax credit is a financial incentive offered by the government to encourage the adoption of electric cars and reduce the environmental impact of transportation. This credit is a significant benefit for those looking to purchase an electric vehicle, as it can provide substantial savings on the overall cost. However, it's important to understand the eligibility criteria to ensure you qualify for this credit.

Eligibility for the EV tax credit is primarily based on the type of vehicle you purchase and the year of its manufacture. The credit is available for new electric vehicles, which are defined as those that meet specific criteria set by the Internal Revenue Service (IRS). These criteria include the vehicle's battery capacity, range, and the use of domestically produced batteries and components. The credit is also tied to the manufacturer's production volume, ensuring that the incentive supports a growing market.

To qualify, the vehicle must be new and acquired primarily for personal use. This means that used electric vehicles or those purchased for business purposes may not be eligible. Additionally, the credit is generally available for vehicles purchased and placed in service during the tax year for which the credit is claimed. This requirement ensures that the credit is targeted at recent purchases, providing an incentive for current market activity.

The EV tax credit is also subject to income limitations. The credit amount is phased down based on the taxpayer's adjusted gross income (AGI). For tax years 2023 and 2024, the credit is available up to $7,500 for vehicles with a qualified battery capacity of at least 40 kWh. However, the credit is reduced by $0.40 for every $1 of AGI above $150,000 for individuals or $300,000 for married couples filing jointly. These income limits ensure that the credit supports lower- to middle-income taxpayers.

Furthermore, the credit is also tied to the vehicle's final assembly location. The IRS has specific rules regarding the percentage of the vehicle's final assembly that must occur in the United States or a qualifying free trade agreement country. This rule is designed to promote domestic manufacturing and job creation. Vehicles that meet these assembly requirements are eligible for the full credit, while those that don't may receive a reduced amount or none at all. Understanding these assembly requirements is crucial for ensuring eligibility.

Maximize Your EV Purchase: A Guide to Claiming Tax Credits

You may want to see also

Income Limits: Are there income caps for receiving the EV tax credit?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to make the switch to electric mobility. However, it's important to understand that this credit is not universally available to all income levels. The Internal Revenue Service (IRS) has set specific income limits to ensure that the credit is accessible to those who need it most and can benefit from it. These income thresholds are adjusted annually to account for inflation and changes in the cost of living.

For the 2023 tax year, the income limits for the EV tax credit are as follows: For single filers, the limit is $153,000, and for joint filers, it is $306,000. These figures represent a significant increase from the previous year, reflecting the IRS's efforts to make the credit more accessible. It's worth noting that these limits are based on adjusted gross income (AGI), which is a measure of income after certain deductions.

If your income exceeds these limits, you may still be eligible for a partial credit. The credit amount gradually decreases as income increases, eventually phasing out completely at the specified thresholds. This phase-out rule ensures that the credit remains targeted at lower- to middle-income earners who may need the financial assistance more.

It's crucial to review the IRS guidelines and consult a tax professional to understand your eligibility. The EV tax credit can vary depending on the type of vehicle purchased and the taxpayer's filing status. For instance, the credit for plug-in hybrid vehicles is generally lower than that for all-electric cars. Additionally, the credit amount can be affected by the vehicle's price, battery capacity, and the taxpayer's income level.

In summary, while the EV tax credit is a valuable incentive, it is not available to everyone. The income limits set by the IRS ensure that the credit supports those who can benefit the most from it. Understanding these limits and the associated phase-out rules is essential for maximizing the potential savings when purchasing an electric vehicle.

Ford's Future: Electric Vehicle Cuts and the Industry's Shift

You may want to see also

Credit Amount: How much is the EV tax credit and how is it calculated?

The Electric Vehicle (EV) tax credit is a financial incentive offered by the United States government to promote the adoption of electric cars and reduce greenhouse gas emissions. This credit is a significant benefit for EV buyers, as it directly reduces the cost of purchasing an electric vehicle. The credit amount varies depending on several factors, and understanding these factors is crucial for EV buyers to maximize their savings.

The credit amount is calculated based on the vehicle's battery capacity and the manufacturer's sales volume. For the 2023 model year, the credit ranges from $3,750 to $7,500 per vehicle. The higher the battery capacity and the lower the manufacturer's sales volume, the higher the credit amount. This structure encourages manufacturers to produce more electric vehicles and consumers to choose vehicles with larger batteries, which can store more energy and provide longer driving ranges.

Battery capacity is measured in kilowatt-hours (kWh). Vehicles with higher kWh ratings generally have larger batteries, which can store more energy and result in a higher credit amount. For example, a vehicle with a 100 kWh battery will likely qualify for a higher credit compared to one with a 50 kWh battery.

The sales volume of the EV manufacturer also plays a role in determining the credit amount. The credit is designed to incentivize the production and sale of electric vehicles, so manufacturers with lower sales volumes may receive a higher credit per vehicle. This encourages smaller, domestic EV manufacturers to enter the market and compete with established brands.

It's important to note that the EV tax credit is a non-refundable credit, meaning that if the credit exceeds the buyer's tax liability, the excess cannot be carried forward to future years. Additionally, the credit is subject to phase-out rules, which means that the credit amount decreases for vehicles with higher prices or those purchased after a certain date. These rules ensure that the credit is targeted towards a broader range of EV buyers and encourages manufacturers to offer more affordable electric vehicles.

The Green Revolution: Are Electric Vehicles the Ultimate Sustainable Choice?

You may want to see also

Filing Process: Steps to claim the EV tax credit on tax returns

The process of claiming the Electric Vehicle (EV) tax credit can be straightforward, but it requires careful attention to detail to ensure you receive the full benefit. Here's a step-by-step guide to help you navigate the filing process:

- Determine Your Eligibility: Before diving into the filing process, understand that the EV tax credit is typically available to individuals who purchase or lease a new electric vehicle. The credit amount varies based on the vehicle's battery capacity and the manufacturer. Research and confirm your eligibility based on the IRS guidelines for the specific tax year in question.

- Gather Required Documents: Collect all the necessary documents related to your EV purchase or lease. This includes the sales or lease agreement, which should provide details such as the vehicle's make, model, and battery capacity. You might also need the manufacturer's statement of origin and a certificate of vehicle compliance. These documents are crucial for verifying your eligibility and the vehicle's specifications.

- Calculate the Credit: The EV tax credit is generally a percentage of the vehicle's base price, adjusted for certain factors. You can find detailed calculations and guidelines on the IRS website or consult a tax professional to ensure accurate computation. This step is essential to determine the exact amount you are entitled to claim.

- Complete the Tax Return: When filing your tax return, you'll need to fill out the appropriate forms. For individuals, this typically involves Schedule 3 (for additional standard deductions and credits) and Form 1040. You'll need to provide the calculated EV tax credit amount and supporting documentation. Ensure you accurately report all the required information to avoid any issues during the review process.

- Submit and Follow Up: After submitting your tax return, keep a record of the submission date and any tracking information provided by the IRS. If you filed electronically, you should receive a confirmation. If you mailed your return, allow sufficient time for processing. If you haven't received a response or have questions, contact the IRS or seek professional advice to ensure your claim is processed correctly.

Remember, the EV tax credit can significantly reduce your tax liability, so it's essential to be thorough and accurate in your filing process. Staying organized and keeping all relevant documents will make the process smoother and increase the chances of a successful claim.

Unleash Your Electric Dreams: A Guide to Launching Your EV Empire

You may want to see also

Changes Over Time: How has the EV tax credit policy evolved?

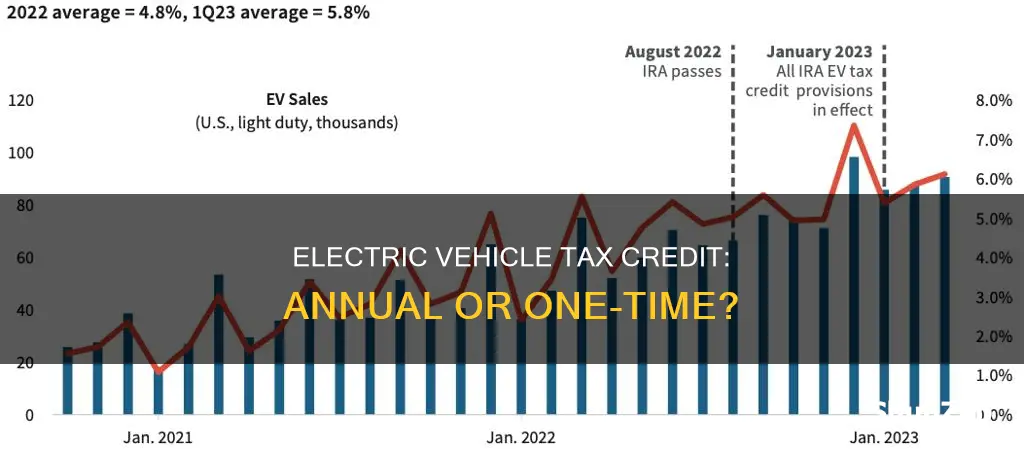

The evolution of EV tax credit policies has been a dynamic journey, reflecting the growing importance of electric vehicles (EVs) in the global automotive landscape. Initially, many countries introduced tax credits as a means to incentivize consumers to adopt electric cars, addressing environmental concerns and promoting sustainable transportation. These early policies often had a limited scope, targeting specific vehicle types or technologies, and were typically short-term measures. For instance, the United States' initial EV tax credit, introduced in the late 2000s, was a temporary program aimed at stimulating the market for electric cars.

Over time, as the environmental and economic benefits of EVs became more apparent, governments began to reevaluate and expand their tax credit programs. The evolution of these policies can be traced through several key phases. In the initial phase, tax credits were often used as a rapid-response tool to address immediate market challenges, such as the high upfront costs of EVs, which were a significant barrier to adoption. This phase saw the introduction of various incentives, including direct purchase credits, tax deductions, and rebates, designed to make electric vehicles more affordable and attractive to consumers.

The second phase of evolution focused on long-term sustainability and broader market penetration. Governments started to phase out short-term incentives and introduced more permanent solutions. This shift aimed to create a stable environment for the EV market, encouraging manufacturers to invest in research and development and consumers to make long-term commitments. For example, the US's Tax Cuts and Jobs Act of 2017 extended and expanded the EV tax credit, making it a more consistent and reliable incentive.

In the current phase, EV tax credit policies are becoming more sophisticated and tailored to specific market needs. Many countries are now implementing targeted incentives for specific segments, such as affordable EVs for low-income buyers or incentives for fleet operators. This targeted approach aims to address the diverse challenges within the EV market, ensuring a more inclusive and sustainable transition to electric mobility. Additionally, there is a growing trend towards integrating tax credits with other policies, such as subsidies for charging infrastructure, to create a comprehensive support system for EV owners.

The evolution of EV tax credit policies is a testament to the dynamic nature of government incentives and their role in shaping market trends. As the automotive industry continues to embrace electrification, these policies will likely undergo further transformations, adapting to new technological advancements, environmental goals, and economic considerations. Understanding this historical context is crucial for policymakers, industry stakeholders, and consumers alike, as it provides insights into the potential future directions of EV tax credit programs and their impact on the widespread adoption of electric vehicles.

Unlocking EV Tax Credits: A Guide to Maximizing Your Federal Benefits

You may want to see also

Frequently asked questions

No, the tax credit is specifically for electric vehicles, including plug-in hybrids, but it is not available for all types of electric vehicles. It is designed to encourage the purchase of new electric vehicles and applies to vehicles that meet certain criteria, such as having a battery capacity and range that meet the Internal Revenue Service (IRS) standards.

The tax credit is calculated based on the vehicle's battery capacity and the vehicle's price. The credit is generally a percentage of the vehicle's price, up to a certain limit. For the 2023 tax year, the credit is up to $7,500 for vehicles with a battery capacity of at least 40 kWh and a price of up to $80,000.

Yes, if you lease an electric vehicle, you can still claim the tax credit. However, the credit is generally available to the lessee, not the lessor. You can claim the credit on your personal tax return, provided you meet the eligibility criteria and have the necessary documentation.

Yes, the electric vehicle tax credit has an annual limit. For each tax year, the credit is limited to one vehicle per household. This means that if you purchase more than one electric vehicle in a year, you can only claim the credit for one of them.

You can check the IRS website or consult a tax professional to determine if your specific electric vehicle model meets the eligibility requirements. The IRS provides a list of qualified vehicles, and you can also find this information on the manufacturer's website. It's important to verify the details to ensure you are eligible for the tax credit.