The federal electric vehicle (EV) tax credit has been a significant incentive for consumers to purchase electric cars, but its future remains uncertain. This credit, which has been a driving force behind the growing popularity of EVs, has been extended and modified over the years. With the recent changes in legislation, many are wondering if the federal EV credit is still active and what its implications are for potential EV buyers. This paragraph will explore the current status of the federal EV credit, its impact on the market, and the potential changes that may affect consumers looking to make an electric vehicle purchase.

What You'll Learn

Eligibility Requirements: Who qualifies for the federal EV tax credit?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to go green and has been a driving force behind the growing popularity of EVs in the United States. However, it's important to understand who qualifies for this credit and the specific criteria that must be met.

To be eligible for the federal EV tax credit, you must be a U.S. citizen or resident alien. This credit is not available to non-residents, and it is also not transferable to another party. The vehicle must be purchased or leased from a dealership or manufacturer that participates in the federal EV tax credit program. This ensures that the credit is applied directly to the consumer's purchase or lease.

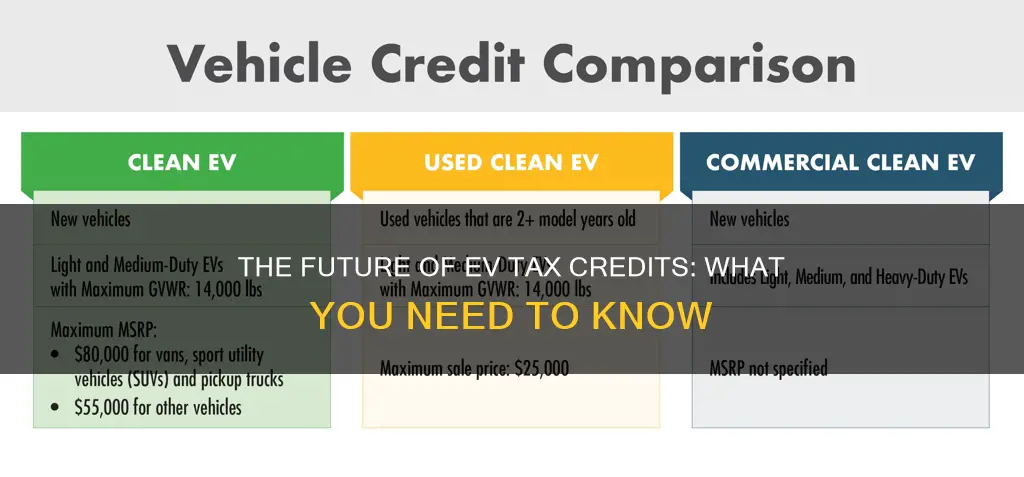

One of the key requirements is that the vehicle must be new and originally purchased or leased for personal use. Used vehicles, even if they are electric, do not qualify. Additionally, the vehicle must be manufactured in North America, which includes the United States, Canada, and Mexico. This is a crucial point, as it ensures that the credit supports the domestic automotive industry and its supply chain.

The credit amount varies depending on the vehicle's price and the battery capacity. For vehicles with a sticker price of up to $80,000, the credit can be up to $7,500. Vehicles priced between $80,000 and $150,000 can receive a credit of up to $3,750. It's important to note that the credit is generally applied to the vehicle's final sale price, including any applicable taxes and fees.

Furthermore, the vehicle's battery capacity must meet specific criteria. The credit is generally available for vehicles with a battery capacity of at least 40 kilowatt-hours (kWh). This ensures that the vehicle has sufficient range and performance to be considered a viable EV option. It's worth mentioning that the Internal Revenue Service (IRS) provides detailed guidelines and definitions for battery capacity, ensuring that only eligible vehicles receive the credit.

Uncover the Mystery: Signs Your Car Has Electric Start

You may want to see also

Credit Amount: How much is the credit worth?

The federal electric vehicle (EV) tax credit, also known as the Clean Vehicle Credit, is a significant incentive for consumers looking to purchase electric cars. This credit has been a driving force behind the growing popularity of EVs in the United States. As of my cut-off date, January 2023, the credit is still active and offers a substantial amount to eligible buyers.

The credit amount varies depending on several factors, primarily the price of the vehicle and its battery capacity. For vehicles priced below $80,000, the credit is generally $7,500. However, for those priced between $80,000 and $100,000, the credit is reduced proportionally. This means that the credit amount decreases as the vehicle's price increases. For instance, a vehicle priced at $85,000 would receive a credit of $6,125 ($7,500 - ($85,000 - $80,000) * 7,500).

It's important to note that the credit is not a fixed amount but rather a percentage of the vehicle's price. This percentage is determined by the Internal Revenue Service (IRS) and is adjusted annually. For the 2022 model year, the credit was $7,500 for vehicles with a battery capacity of at least 40 kWh, and the credit amount decreased for vehicles with lower battery capacities.

Additionally, the credit is also tied to the manufacturer's production volume. To qualify for the full credit, the vehicle must be assembled in North America, and the manufacturer must meet specific production volume requirements. These requirements are designed to encourage domestic production and ensure a steady supply of EVs.

Understanding the credit amount and its eligibility criteria is crucial for consumers considering an EV purchase. It allows buyers to make informed decisions and take advantage of this substantial financial incentive. With the credit still active, those in the market for an electric vehicle can benefit from this significant financial boost.

Upgrading Your Ride: A Guide to Converting Vehicle Axles to Electric Brakes

You may want to see also

Vehicle Types: Which EV models are eligible?

The federal tax credit for electric vehicles (EVs) is a significant incentive for consumers to go green and has been a driving force behind the growing popularity of EVs in the United States. However, it's important to note that this credit has specific eligibility criteria, and not all electric vehicles qualify. The credit is designed to promote the purchase of EVs that meet certain standards, ensuring that the funds go towards vehicles that are both environmentally friendly and meet specific manufacturing and performance requirements.

When it comes to vehicle types, the federal EV tax credit applies to a wide range of electric-powered cars and trucks. This includes fully electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). BEVs are entirely powered by electricity and have a battery pack that can be charged by plugging it into an external power source. PHEVs, on the other hand, combine a traditional internal combustion engine with an electric motor and battery, allowing for both electric and gasoline-powered driving.

To be eligible for the credit, the vehicle must also meet specific performance and manufacturing criteria. The Internal Revenue Service (IRS) has set guidelines for the vehicle's battery capacity, range, and manufacturing location. For example, the vehicle's battery must have a minimum capacity and range, ensuring it can provide a substantial electric driving experience. Additionally, the vehicle's battery pack and other critical components must be manufactured or assembled in North America, with a significant portion of the production taking place in the United States.

The credit is available for a wide variety of EV models, including popular brands and models. Many well-known automotive manufacturers offer eligible EVs, such as Tesla, Ford, Chevrolet, and Volkswagen. These brands provide a range of models, from compact cars to SUVs and trucks, ensuring consumers have various options to choose from. It's worth checking the specific models offered by these and other manufacturers to determine eligibility.

It's important to stay updated on the eligibility criteria, as the credit's rules and regulations may change over time. The IRS regularly updates its guidelines, and new models may become eligible while others may no longer qualify. Staying informed about these changes will help consumers make informed decisions when purchasing an electric vehicle and ensure they take full advantage of the federal tax credit.

Maximize Your EV Purchase: A Guide to Claiming Tax Credits

You may want to see also

Sales and Timing: When was the credit last extended?

The federal tax credit for electric vehicles (EVs) has been a significant incentive for consumers to go green and has played a crucial role in the EV market's growth. However, it's important to note that this credit has not always been available, and its extension has been a topic of interest for potential EV buyers.

The credit was initially introduced in 2009 as part of the American Recovery and Reinvestment Act and was designed to encourage the adoption of electric vehicles. It provided a tax credit of up to $7,500 for the purchase of qualified EVs. This credit was initially set to expire after a certain period, but it has been extended and modified several times.

The most recent extension of the federal EV tax credit was part of the Inflation Reduction Act (IRA) of 2022. This act, signed into law by President Joe Biden, extended the credit and made some significant changes. The IRA extended the credit until 2032, ensuring a longer-term incentive for EV purchases. Additionally, it introduced a new rule that the vehicle must be assembled in North America, with a certain percentage of domestic content, to qualify for the full credit. This change aimed to boost domestic manufacturing and create jobs in the EV industry.

Under the IRA, the credit is now available for vehicles purchased after November 16, 2021, and before January 1, 2024. This timing allows for a smooth transition and provides a clear window for consumers to take advantage of the credit. It's important for potential EV buyers to be aware of this timing to plan their purchases accordingly and ensure they meet the eligibility criteria.

For those interested in purchasing an EV, it is recommended to stay updated on the latest legislation and regulations surrounding the federal tax credit. The credit's availability and terms can change, and being informed will help consumers make timely decisions. The extension of the credit until 2032 indicates a long-term commitment to supporting the EV market, which could be a significant factor in the purchasing process for many consumers.

Sustainable Solutions: Navigating EV Battery Disposal and Recycling

You may want to see also

State Incentives: Are there additional state-level benefits?

The availability of state-level incentives for electric vehicles (EVs) can vary widely depending on the region and the specific policies in place. Many states have recognized the importance of promoting EV adoption and have implemented their own programs to encourage residents to make the switch to electric. These state incentives often complement the federal tax credit, providing an additional layer of financial benefit for EV buyers.

For instance, California, a state with stringent environmental regulations, offers a comprehensive EV incentive program. The California Clean Vehicle Rebate Project provides rebates to residents purchasing or leasing new electric cars, plug-in hybrids, and fuel cell vehicles. The amount of the rebate depends on the vehicle's battery capacity and the state's current funding levels. This program not only helps reduce the upfront cost of EVs but also encourages the purchase of more efficient and environmentally friendly models.

Other states like New York, Massachusetts, and Oregon also offer various incentives, including tax credits, rebates, and reduced registration fees. These incentives are designed to make EVs more affordable and attractive to consumers. For example, New York's EV and Hybrid Vehicle Tax Credit provides a tax credit of up to $2,000 for the purchase or lease of an electric vehicle, while Oregon offers a similar tax credit of up to $2,000 for EV buyers.

In addition to direct financial incentives, some states have implemented policies to support the development of EV charging infrastructure. This includes providing grants or low-interest loans to businesses and municipalities for the installation of public charging stations. By improving access to charging facilities, these states aim to alleviate range anxiety and make EV ownership more convenient and appealing to a broader audience.

It is essential for potential EV buyers to research the specific incentives offered in their state, as these can significantly impact the overall cost of ownership. Many states have dedicated websites or resources to provide information on EV incentives, making it easier for consumers to understand their options and make informed decisions. Staying informed about these state-level benefits can further enhance the financial advantages of purchasing an electric vehicle.

Mastering Battery Module Design: A Guide to Electric Vehicle Power

You may want to see also

Frequently asked questions

Yes, the federal tax credit for electric vehicles is still active and available for consumers. The credit was initially set to expire at the end of 2022 but was extended through 2023 and partially through 2024 under the Inflation Reduction Act (IRA). This means that individuals who purchase or lease eligible EVs can still claim a tax credit of up to $7,500, depending on the vehicle's price and battery capacity.

To qualify, the vehicle must meet certain criteria, including being manufactured or assembled in North America and having a battery capacity of at least 50 kWh. The credit is generally available to individuals who purchase or lease new EVs directly from a dealership or manufacturer. Used EVs purchased from a dealer or private party may also be eligible, but there are specific requirements and limitations.

No, there are no specific income limits for the federal EV tax credit. However, the credit is generally limited to one per household. This means that if you've previously claimed the credit for an EV, you may not be eligible for another one. Additionally, the credit is subject to a phase-out for vehicles with a list price above a certain threshold, which is adjusted annually.

Yes, if you purchased or leased your EV before the extension, you may still be eligible for the federal tax credit. The credit is retroactive, meaning you can claim it for vehicles purchased or leased as early as 2010. However, the amount of the credit may be reduced or phased out depending on the vehicle's price and the timing of your purchase.