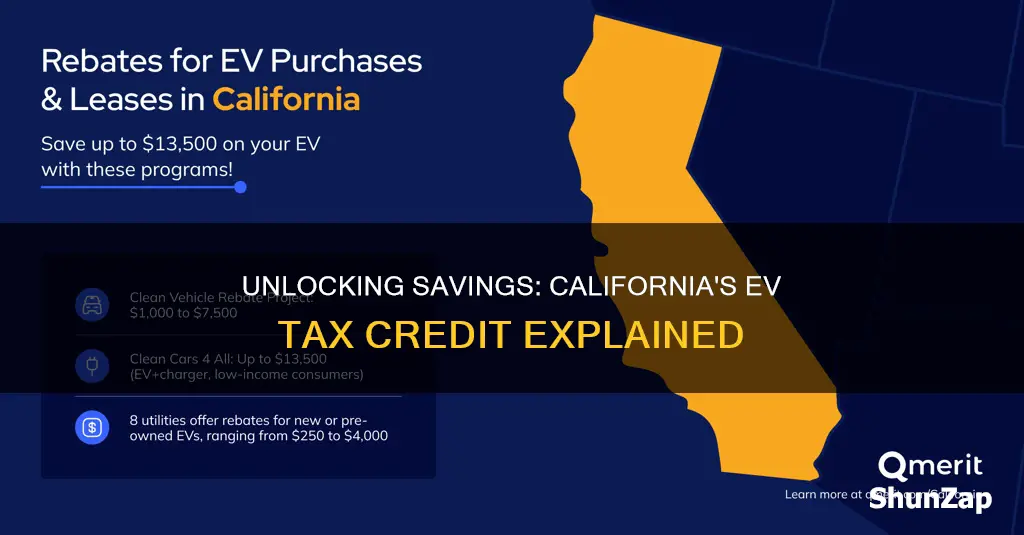

Many states offer incentives to encourage the adoption of electric vehicles (EVs), and California is no exception. With a strong commitment to reducing greenhouse gas emissions and promoting sustainable transportation, the Golden State has implemented various programs to support EV owners. One such initiative is the California Electric Vehicle Tax Credit, which provides financial assistance to residents purchasing or leasing new electric vehicles. This credit aims to make EVs more affordable and accessible to California residents, contributing to the state's goal of achieving a cleaner and greener future. Understanding the details of this tax credit can be beneficial for anyone considering an electric vehicle purchase or lease.

| Characteristics | Values |

|---|---|

| Tax Credit Type | California Clean Vehicle Rebate Project (CVC) |

| Eligible Vehicles | New electric vehicles (EVs) purchased or leased |

| Income Limit | Varies by vehicle type and income level |

| Maximum Rebate | Up to $7,000 for new EVs and $2,500 for used EVs (as of 2023) |

| Vehicle Price | Not to exceed $50,000 for new EVs and $45,000 for used EVs |

| Residency | California residents |

| Application Process | Online application through the California Air Resources Board (CARB) |

| Validity | Rebates are available until funds are depleted or the program ends |

| Additional Requirements | Proof of residency, vehicle ownership, and income verification |

| Program Status | Active as of 2023, with ongoing updates |

| Contact Information | California Air Resources Board (CARB) website or phone |

What You'll Learn

Eligibility: Who qualifies for the California EV tax credit?

The California Electric Vehicle (EV) Tax Credit Program offers a financial incentive to residents of the state who purchase or lease new electric vehicles. This credit is designed to promote the adoption of clean energy vehicles and reduce the state's carbon footprint. To be eligible for this credit, individuals must meet specific criteria, ensuring that the program benefits those who are most in need of financial assistance and actively contribute to the state's environmental goals.

Residency and Income Requirements:

Eligibility is primarily based on the applicant's residency in California and their income level. California residents who purchase or lease a new electric vehicle for personal use may qualify. The income limits are crucial, as the credit is typically available to lower- and middle-income earners. The exact income thresholds are determined annually and are based on the federal poverty guidelines. For the most recent year, the income limits for the credit ranged from $40,000 to $100,000 for individuals, depending on the vehicle's price and the applicant's financial situation.

Vehicle and Price Considerations:

The type of electric vehicle and its price tag also play a significant role in eligibility. The credit is generally available for new, in-state manufactured electric vehicles, including cars, trucks, and motorcycles. However, there are specific price limits for the vehicles. For instance, the credit is typically capped at vehicles priced below $60,000 for new purchases and $85,000 for leases. These price limits ensure that the credit is directed towards affordable EV options, making it more accessible to a broader range of California residents.

Additional Eligibility Criteria:

Other factors may also influence eligibility. Applicants must be the primary user of the vehicle and must have a valid California driver's license. Additionally, the vehicle must be used primarily for personal transportation, and the purchase or lease must be made directly from an authorized dealer or manufacturer. It is essential to review the most up-to-date guidelines and regulations, as the California EV Tax Credit Program may have specific requirements and limitations that can change over time.

Understanding these eligibility criteria is crucial for California residents interested in taking advantage of the EV tax credit. By meeting the residency, income, vehicle, and price requirements, individuals can potentially save a significant amount on their electric vehicle purchase or lease, making the transition to clean energy transportation more affordable and accessible.

Ford's Electric Future: Rumors of Scrapping EV Plans Debunked

You may want to see also

Amount: How much is the tax credit?

The California Electric Vehicle (EV) Tax Credit is a financial incentive designed to encourage the adoption of electric vehicles in the state. This credit is a valuable benefit for EV buyers, offering a direct reduction in the purchase price of eligible vehicles. The amount of the tax credit varies depending on several factors, including the vehicle's price and the type of EV.

For new electric vehicles, the credit is typically a percentage of the vehicle's price, up to a certain limit. As of my last update, the credit amount is 2.5% of the vehicle's price, but this can change over time. For example, in 2022, the credit was 2.5% of the vehicle's price, with a maximum credit of $7,500. This means that if you purchase an EV worth $30,000, you could receive a tax credit of up to $7,500, significantly reducing the overall cost.

It's important to note that this credit is not a refund but rather a reduction in the amount of sales tax owed. The credit is applied directly to the vehicle's price, making it a valuable incentive for buyers. Additionally, the credit is available for both new and used electric vehicles, though the credit amount may differ.

The specific credit amount can also be influenced by the vehicle's manufacturer and model. Some EV manufacturers offer additional incentives or rebates, which can be combined with the state tax credit. For instance, Tesla, a prominent EV manufacturer, provides a $7,500 rebate for its vehicles, which can be used in conjunction with the state tax credit, further reducing the purchase price.

Understanding the tax credit amount is crucial for EV buyers in California, as it can significantly impact the overall cost of their vehicle purchase. It is recommended to research the current credit amount and any additional incentives offered by vehicle manufacturers to make an informed decision when purchasing an electric vehicle.

The Green Revolution: Unlocking the True Value of Electric Cars

You may want to see also

Income Cap: Are there income limits for the credit?

The California Electric Vehicle (EV) Tax Credit is a financial incentive designed to encourage residents to purchase and drive electric vehicles, thereby reducing the state's carbon footprint and promoting sustainable transportation. This credit is a valuable benefit for EV buyers, but it's important to understand the criteria and limitations to ensure eligibility. One key aspect to consider is the income cap associated with this credit.

Income limits do exist for the California EV Tax Credit, and these are set to ensure that the program primarily benefits lower- to middle-income families. The state has implemented a cap on household income to make the credit more accessible to those who might need it the most. For the 2023 tax year, the income limit for the full credit is set at $150,000 for single filers and $300,000 for joint filers. This means that individuals or couples earning below these thresholds may be eligible for the full credit amount, which can significantly reduce their tax liability.

It's important to note that the credit amount gradually decreases as income increases. For example, if a single filer's income is between $150,000 and $200,000, they will receive a partial credit. The credit amount is phased out for incomes above $150,000, ensuring that the benefit remains targeted at those who might need financial assistance to afford an EV. This structure aims to make EV ownership more attainable for a broader range of California residents.

To determine eligibility, one should carefully review the income guidelines provided by the California Franchise Tax Board. These guidelines are regularly updated, so staying informed about the latest income thresholds is essential. Additionally, it's worth mentioning that the credit is not limited to the purchase of new vehicles; it also applies to used EVs, provided they meet specific criteria.

In summary, the California EV Tax Credit is a valuable incentive, but it is means-tested, with income caps in place to ensure fairness and accessibility. Understanding these income limits is crucial for residents considering an EV purchase, as it can impact their eligibility and the overall financial benefits they receive.

Navigating California's EV Battery Warranty: A Step-by-Step Guide to Filing a Complaint

You may want to see also

Vehicle Types: Which EV models are eligible?

The California Electric Vehicle (EV) Tax Credit Program offers financial incentives to residents purchasing new electric vehicles, aiming to promote the adoption of cleaner transportation options. This program is a valuable resource for EV buyers, providing a tax credit that can significantly reduce the overall cost of their vehicle purchase. However, it's important to note that the eligibility criteria for this credit are specific and may vary depending on the vehicle model and its manufacturer.

When it comes to vehicle types, the California EV tax credit is available for a wide range of electric vehicles, but there are certain conditions that must be met. Firstly, the vehicle must be new and purchased from an authorized dealer in the state of California. This ensures that the credit is directed towards new vehicle sales and not used or imported cars. Secondly, the vehicle should be powered exclusively by electricity, meaning it must be a fully electric car or truck. Hybrid vehicles, which combine electric power with a traditional internal combustion engine, are generally not eligible for this tax credit.

The credit is designed to encourage the purchase of electric cars and trucks that meet specific environmental standards. These standards are set by the California Air Resources Board (CARB) and are more stringent than the federal guidelines. As of my cut-off date, January 2023, the eligible vehicles must have a zero-emission vehicle (ZEV) rating, which is determined by the CARB. This rating takes into account the vehicle's battery range, efficiency, and emissions performance. Vehicles that do not meet the ZEV standards, even if they are fully electric, may not qualify for the tax credit.

Additionally, the credit has a price limit, meaning the vehicle's sticker price must not exceed a certain amount. This limit is adjusted annually and is typically set at a competitive level to ensure a fair distribution of credits. As of the latest information, vehicles priced below $50,000 for sedans or $55,000 for SUVs and vans are generally eligible. However, it's crucial to check the current price limits, as these can change over time.

Furthermore, the tax credit is typically available for a limited time, and the specific models that qualify may vary. Therefore, it is essential for potential EV buyers to research the current eligible models and their respective tax credit amounts. This information can usually be found on the California Air Resources Board's website or through authorized EV dealership resources. Staying updated with the latest information ensures that individuals can make informed decisions when purchasing an electric vehicle in California.

The Future of EV Tax Credits: What You Need to Know

You may want to see also

Application Process: How do I claim the credit?

The California Electric Vehicle (EV) Tax Credit Program offers a significant incentive for residents to purchase or lease electric vehicles, promoting a cleaner and more sustainable transportation ecosystem. This credit is a valuable benefit for EV buyers, providing a financial boost to offset the often higher upfront costs of electric vehicles. To ensure you receive this credit, it's essential to understand the application process and the necessary steps to claim it.

To claim the credit, you must first ensure that your vehicle qualifies. The program is designed to support the purchase or lease of new electric vehicles, including plug-in hybrids, battery electric vehicles, and fuel cell electric vehicles. The vehicle must be new and not used, and it should be purchased or leased from a participating dealership or retailer. You can verify your vehicle's eligibility by checking the California Air Resources Board (CARB) website, which provides a list of approved models.

Once you've confirmed your vehicle's qualification, the next step is to complete the application process. This typically involves submitting a claim form, which can be found on the California Franchise Tax Board (FTB) website. The form requires detailed information about your vehicle, including its make, model, year, and vehicle identification number (VIN). You will also need to provide proof of purchase or lease, such as a sales contract or lease agreement. It is crucial to ensure that all the information provided is accurate and up-to-date to avoid any delays or issues with your claim.

After gathering the necessary documents and completing the application, you should submit it to the FTB. This can be done online through their website, by mail, or in person at one of their regional offices. The FTB provides clear instructions on their website regarding the submission process, including any specific requirements for each method. It is recommended to keep a copy of the submitted application and all supporting documents for your records.

The final step is to wait for the FTB to process your application. The agency will review your claim and, if approved, issue the tax credit. The credit amount varies depending on the vehicle's price and the state's budget availability. You will receive a notice informing you of the credit amount and the next steps, which may include a refund or a reduction in your state income tax liability. It is advisable to monitor your email and the FTB's website for updates on the status of your application.

Ford's Future: Rumors of EV Shutdown Unraveled

You may want to see also

Frequently asked questions

Yes, California offers a tax credit for electric vehicles (EVs) through the California Clean Vehicle Rebate Project (CVCRP). This program provides a rebate to reduce the purchase price of eligible EVs, making them more affordable for consumers.

The tax credit amount varies depending on the vehicle's price and battery capacity. For vehicles priced up to $50,000, the credit is 20% of the sales price, and for those priced between $50,001 and $55,000, it is 10% of the sales price.

The CVCRP is open to California residents who purchase or lease new electric vehicles. The vehicle must be new and meet specific emissions and fuel efficiency standards. Additionally, the buyer must be a California resident and have a valid California driver's license.

No, there are no income limits for the California Clean Vehicle Rebate Project. The program is designed to make electric vehicles more accessible to a wide range of California residents, regardless of their income level.