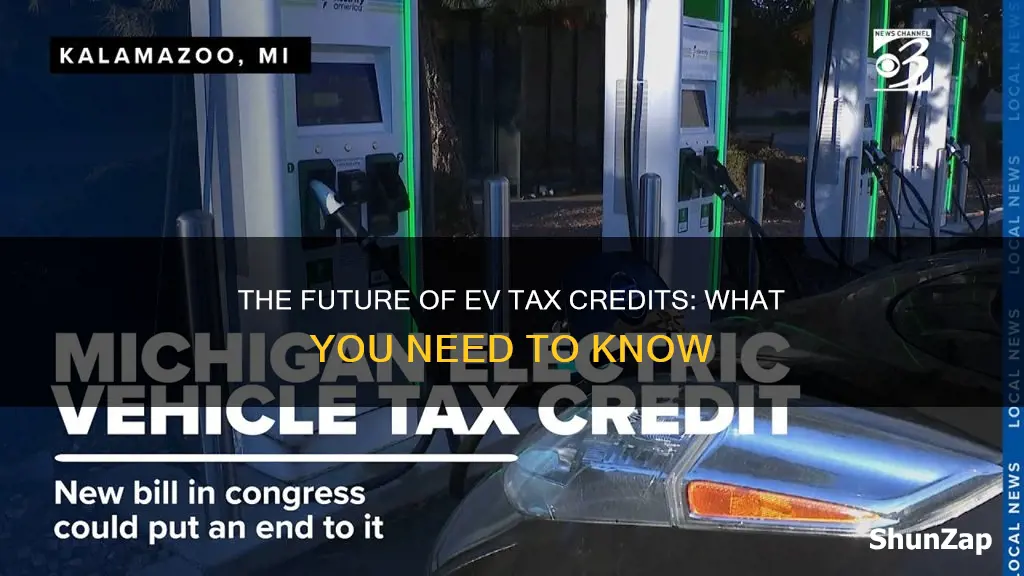

The federal electric vehicle (EV) credit, a significant incentive for EV buyers, is set to expire at the end of 2023, raising concerns among consumers and the auto industry. This credit has played a crucial role in promoting the adoption of electric cars, offering a substantial tax credit of up to $7,500 per vehicle. With the impending deadline, there is a growing need to understand the implications and potential consequences of this change, as it could significantly impact the market and the future of EV sales.

| Characteristics | Values |

|---|---|

| Program Name | Federal Tax Credit for Electric Vehicles |

| Eligibility | Available to individuals and businesses purchasing new electric vehicles (EVs) |

| Credit Amount | Up to $7,500 per vehicle (as of 2023) |

| Income Limit | The credit is phased out for individuals with modified adjusted gross income (MAGI) above $200,000 ($150,000 for single filers) |

| Vehicle Types | Includes battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) |

| Manufacturers | Applies to vehicles manufactured in the U.S. or imported from countries with a free trade agreement with the U.S. |

| Effective Dates | Initially available until December 31, 2022, but was extended to December 31, 2023, due to recent legislation |

| Phase-Out | The credit is reduced by 20% for vehicles with a base price over $80,000 ($55,000 for vehicles with more than 4 seats) |

| Recent Changes | The Inflation Reduction Act (IRA) of 2022 extended and modified the credit, introducing new rules and limitations |

| Impact | Aimed to boost EV sales, reduce greenhouse gas emissions, and support the domestic EV market |

What You'll Learn

- Legislative Changes: The federal EV tax credit may be modified or terminated by new laws

- Manufacturing Impact: Ending the credit could affect EV production and jobs

- Consumer Behavior: Reduced incentives might influence consumer choices and market trends

- Environmental Concerns: The credit's end could hinder EV adoption, impacting climate goals

- Industry Response: Auto manufacturers may adapt strategies to maintain competitiveness

Legislative Changes: The federal EV tax credit may be modified or terminated by new laws

The future of the federal electric vehicle (EV) tax credit is uncertain, as it is subject to potential legislative changes. This credit has been a significant incentive for consumers to purchase EVs, but its longevity is not guaranteed. The credit has already undergone modifications, and there are ongoing discussions about its potential termination or alteration.

Legislative actions can significantly impact the EV market and consumer behavior. New laws could either extend or reduce the credit, affecting the affordability and appeal of electric vehicles. For instance, a potential change could involve setting a specific expiration date for the credit, encouraging consumers to make purchases before the deadline. Alternatively, the government might choose to terminate the credit entirely, which could have a substantial impact on the EV industry. This decision could be influenced by various factors, including environmental policy goals, budget considerations, and the overall health of the automotive sector.

The potential termination or modification of the federal EV tax credit has sparked debates among industry experts, environmental advocates, and consumers. Proponents of the credit argue that it has been instrumental in accelerating the adoption of EVs, reducing greenhouse gas emissions, and fostering technological advancements. They believe that removing this incentive could hinder progress towards a more sustainable transportation system. On the other hand, critics argue that the credit has led to significant tax burdens and may not be the most efficient way to support the EV market. They suggest that alternative policies, such as direct subsidies or infrastructure development, could be more effective.

If the federal EV tax credit is modified or terminated, the consequences could be far-reaching. It may lead to a decrease in consumer demand for EVs, impacting the sales of electric vehicles and potentially causing a slowdown in the industry's growth. Additionally, the credit's removal could affect the financial viability of EV manufacturers, especially those heavily reliant on the tax incentive for their business models. This could result in reduced investment in EV technology and infrastructure, potentially setting back the transition to a low-carbon economy.

Staying informed about legislative developments is crucial for both consumers and industry stakeholders. As the political landscape and environmental policies evolve, the federal EV tax credit's status may change. It is essential to monitor official government communications, industry news, and expert analyses to understand the potential implications of any legislative actions. Being aware of these changes will enable individuals and businesses to make informed decisions regarding EV purchases, investments, and long-term strategies.

Honolulu Zoo: Electric Vehicle Parking Privileges and Fees

You may want to see also

Manufacturing Impact: Ending the credit could affect EV production and jobs

The potential phase-out of the federal electric vehicle (EV) credit has sparked concerns among the automotive industry, particularly regarding its impact on manufacturing and employment. This credit, which has been a significant incentive for EV purchases, is set to expire, leaving manufacturers and workers in a state of uncertainty. The implications of its end could be far-reaching, affecting not only the production of electric vehicles but also the broader supply chain and the jobs that depend on it.

One of the primary effects would be a potential decline in EV production. With the credit as a major incentive for consumers, its removal could lead to a decrease in demand for electric vehicles. This shift in consumer behavior might result in reduced sales, causing manufacturers to reconsider their production strategies. As a consequence, some companies might be forced to scale back their EV assembly lines, potentially leading to a slowdown in production and a subsequent reduction in the number of vehicles rolling off the assembly lines.

The impact on manufacturing jobs is a critical concern. The EV industry has created numerous jobs, from engineers and technicians to assembly line workers and support staff. A decrease in production could lead to layoffs or reduced hiring, affecting not only the direct employees in the EV sector but also those in supporting industries. The automotive supply chain is intricate, and a reduction in EV production might have a ripple effect, causing job losses in various sectors, including battery manufacturing, component suppliers, and even retail.

Furthermore, the ending of the credit could influence the overall investment landscape. Many companies have invested heavily in EV technology and infrastructure, relying on the credit to sustain their business models. Without this incentive, investors might reconsider their support, potentially leading to a reduction in funding for EV projects and research. This could hinder the industry's growth and innovation, affecting not only the current workforce but also future job prospects in the rapidly evolving electric vehicle market.

In summary, the potential end of the federal EV credit has the potential to significantly impact the manufacturing sector. It could lead to a decrease in production, affecting not only the direct employees in EV assembly but also the broader supply chain. The job market, investment landscape, and overall industry growth are all at risk. As such, policymakers and industry leaders must carefully consider the implications and work towards a sustainable solution to ensure the continued success and job security of the electric vehicle manufacturing sector.

Out-of-State EV Owners: Register Your Car in California

You may want to see also

Consumer Behavior: Reduced incentives might influence consumer choices and market trends

The potential phase-out of the federal electric vehicle (EV) credit could significantly impact consumer behavior and market dynamics in the automotive industry. This incentive has played a crucial role in promoting EV adoption, and its reduction or elimination might lead to a shift in consumer preferences and purchasing patterns. Here's an analysis of how reduced incentives could influence consumer choices and market trends:

Consumer Awareness and Education: Firstly, consumers might become more aware of the changing incentives and the potential impact on their purchasing power. As the federal credit is a significant factor in the overall cost of an EV, removing or reducing it could prompt buyers to re-evaluate their options. Many consumers might start researching and comparing different EV models to understand the long-term financial implications. This increased awareness could lead to a more informed buying process, where consumers consider not only the initial cost but also the total ownership expenses over the vehicle's lifetime.

Shift in Demand: Reduced incentives could result in a shift in consumer demand. With lower financial incentives, some potential EV buyers might opt for conventional gasoline or diesel vehicles, especially those who were previously attracted to EVs due to the credit. This shift could temporarily impact the market share of EV manufacturers. However, it's important to note that many consumers are already committed to the idea of going electric, and the credit has been a significant motivator. As a result, the overall market might experience a short-term dip, but the long-term trend of increasing EV adoption could still be intact.

Market Competition and Innovation: The automotive market is highly competitive, and manufacturers are constantly innovating to meet consumer demands. With the federal credit potentially ending, companies might need to re-strategize their product offerings. Some brands could focus on enhancing the features and performance of their existing EV models to remain competitive. Others might invest in research and development to introduce more affordable EV options, targeting a broader consumer base. This competitive response could drive innovation, improve EV technology, and potentially lower the overall cost of electric vehicles, making them more accessible to a wider market.

Used EV Market and Resale Value: The used EV market is an essential aspect of the overall EV ecosystem. Reduced incentives might impact the resale value of existing EVs, especially those purchased with the federal credit. As the credit disappears, buyers might be more cautious about the long-term value of their purchases. This could lead to a more conservative approach to buying used EVs, with consumers potentially seeking vehicles with higher residual value. Consequently, the used EV market might experience a period of adjustment, and sellers might need to adapt their pricing strategies to maintain competitiveness.

Government and Industry Response: The potential end of the federal EV credit is likely to prompt government bodies and industry leaders to take action. Governments may introduce new incentives or subsidies to support EV adoption, ensuring a continued market boost. Additionally, automotive manufacturers might collaborate with policymakers to propose alternative incentive structures that could benefit both consumers and the industry. Such responses could shape the future of EV incentives and influence consumer behavior in the long term.

Unleash Your Portfolio's Potential: A Guide to Electric Vehicle Stocks

You may want to see also

Environmental Concerns: The credit's end could hinder EV adoption, impacting climate goals

The potential expiration of the federal electric vehicle (EV) credit program has sparked concern among environmental advocates and industry experts, as it could significantly impede the pace of EV adoption and, consequently, the progress towards mitigating climate change. This credit system, which provides financial incentives to consumers and manufacturers, has been instrumental in driving the growth of the EV market in the United States. Its end could have far-reaching implications for the environment and the country's commitment to reducing greenhouse gas emissions.

One of the primary environmental concerns is the potential slowdown in the transition to electric mobility. EVs are widely recognized as a cleaner alternative to traditional internal combustion engine vehicles, offering a substantial reduction in carbon emissions and air pollutants. The federal credit has played a crucial role in making these vehicles more affordable and attractive to consumers. Without this incentive, the financial barrier to entry for potential EV buyers may increase, leading to a decrease in sales and a slower shift towards a more sustainable transportation system. This delay could result in higher emissions and a missed opportunity to reduce the carbon footprint of the transportation sector.

The impact of reduced EV adoption extends beyond individual vehicles. The widespread use of EVs contributes to the overall reduction of greenhouse gas emissions, which is a key goal in combating climate change. By encouraging the production and purchase of electric cars, the credit program has facilitated the development of a robust EV supply chain, including battery manufacturing and charging infrastructure. This industry growth has the potential to create a positive feedback loop, where increased production leads to more affordable prices, further stimulating demand. However, if the credit is allowed to lapse, this progress could be reversed, hindering the establishment of a robust and sustainable EV market.

Furthermore, the end of the federal credit might discourage manufacturers from investing in EV technology and research. The credit system has provided a stable and predictable environment for businesses to plan and innovate. Its absence could lead to a shift in focus away from EV development, potentially impacting the long-term sustainability of the industry. This could result in a reduction in the variety and quality of electric vehicles available to consumers, limiting their choices and the overall environmental benefits.

To address these concerns, policymakers and environmental organizations advocate for the extension and expansion of the federal EV credit program. They argue that continued support is essential to maintain momentum in the EV market and ensure that the country meets its climate goals. By providing long-term certainty and potentially increasing the credit amount, policymakers can encourage faster EV adoption, foster technological advancements, and reinforce the United States' position as a global leader in sustainable transportation.

Tesla Dominance: Exploring the Electric Vehicle Landscape Beyond the Brand

You may want to see also

Industry Response: Auto manufacturers may adapt strategies to maintain competitiveness

The potential phase-out of the federal electric vehicle (EV) credit has sparked a wave of strategic adjustments within the automotive industry. As the market shifts towards a more sustainable future, auto manufacturers are recognizing the need to adapt and innovate to stay competitive. This shift in strategy is not just about survival but also about capitalizing on the growing demand for electric mobility.

One of the primary responses from the industry is a focus on technological advancement. Auto manufacturers are investing heavily in research and development to enhance the performance and efficiency of electric vehicles. This includes improving battery technology, extending driving ranges, and reducing charging times. By addressing these critical pain points, manufacturers aim to make EVs more appealing to a broader consumer base. For instance, companies are exploring solid-state batteries, which promise higher energy density and faster charging, potentially making EVs more practical for long-distance travel and daily commutes.

Another strategy is to diversify product portfolios. Many auto manufacturers are expanding their EV offerings to cater to various consumer preferences and market segments. This involves introducing new models with different sizes, styles, and price points. For example, some companies are developing compact city cars to appeal to urban dwellers seeking affordable and efficient transportation, while others are focusing on luxury EVs to capture the high-end market. This diversification strategy ensures that manufacturers can maintain a strong presence in the EV market even if the federal credit is reduced or eliminated.

Additionally, the industry is embracing partnerships and collaborations to accelerate the transition to electric mobility. Auto manufacturers are joining forces with technology companies, energy providers, and even other carmakers to share resources, expertise, and infrastructure. These partnerships can lead to the development of standardized charging networks, improved battery recycling systems, and innovative financing models. By working together, the industry can overcome the challenges associated with the widespread adoption of EVs and create a more sustainable and resilient future.

In response to the potential end of the federal credit, auto manufacturers are also exploring new business models. This includes subscription-based services, where customers pay a monthly fee for access to an EV rather than purchasing it outright. Such models can make EVs more accessible to a wider range of consumers, especially those who may not qualify for traditional financing options. Furthermore, manufacturers are developing comprehensive after-sales services, including home charging solutions, maintenance packages, and personalized support, to ensure customer satisfaction and loyalty.

In summary, the automotive industry's response to the potential phase-out of the federal electric vehicle credit is multifaceted. By investing in technology, diversifying product lines, forming strategic alliances, and exploring innovative business models, auto manufacturers are well-positioned to navigate the changing landscape. These adaptations not only ensure their competitiveness in the market but also contribute to the broader goal of accelerating the global transition to sustainable transportation.

Boosting Electric Vehicle Range: Tips for Longer, Stress-Free Drives

You may want to see also

Frequently asked questions

Yes, the federal tax credit for electric vehicles is still in effect, but it is scheduled to decrease over time. The full credit of up to $7,500 is available for vehicles purchased and placed in service before January 1, 2023. After that date, the credit will gradually phase out, with a reduced amount available for vehicles purchased in 2023 and 2024.

The phase-out is designed to encourage the production and sale of electric vehicles in the United States. By reducing the credit, the government aims to stimulate the domestic market and promote the adoption of electric vehicles, which can help reduce greenhouse gas emissions and improve air quality.

The credit is a tax credit that buyers of electric vehicles can claim on their federal income tax return. It directly reduces the amount of tax owed, providing a financial incentive for purchasing electric vehicles. The credit is based on the vehicle's battery capacity and the manufacturer's list price.

Yes, there are certain requirements that the vehicle and the buyer must meet. The vehicle must be new, purchased from a dealership, and have a battery capacity of at least 4 kWh. Additionally, the buyer must be a U.S. citizen or resident alien and file a federal income tax return.

There have been discussions and proposals to extend or modify the federal electric vehicle credit, especially with the increasing demand for electric vehicles. However, as of my cut-off date, January 2023, no official changes or extensions have been announced. It is advisable to stay updated with the latest news and legislation regarding electric vehicle incentives.