Electric vehicles (EVs) are becoming increasingly popular in Illinois, but there are some important fees to consider for EV owners. One key question is whether there is a specific fee associated with owning an electric vehicle in Illinois. This fee can vary depending on the state's regulations and policies, and understanding these charges is essential for EV owners to manage their expenses effectively. The following paragraph will explore the details of any potential electric vehicle fees in Illinois and provide insights into the financial considerations for EV owners in the state.

| Characteristics | Values |

|---|---|

| Electric Vehicle Fee | No |

| Registration Fee | No |

| Annual Registration Fee | Not applicable |

| Sales Tax | 6.25% (standard rate) |

| Additional Fees | None |

| Renewable Energy Credits | Not mentioned |

| Incentives | Yes, including tax credits and rebates |

| State Policy | Encouraging the adoption of electric vehicles through incentives and no registration fees |

| Recent Changes | No recent changes reported |

What You'll Learn

- Registration Fees: Illinois charges an annual registration fee for electric vehicles, based on vehicle value

- Emission Testing: EVs in Illinois are exempt from traditional emission testing, but may require other inspections

- Road Use Taxes: Some Illinois counties and cities impose road use taxes on electric vehicles

- State Incentives: Illinois offers various incentives, including tax credits, for electric vehicle purchases

- Charging Infrastructure: The state provides grants for charging station installation, supporting EV ownership

Registration Fees: Illinois charges an annual registration fee for electric vehicles, based on vehicle value

The state of Illinois has implemented a unique fee structure for electric vehicles (EVs), which is an important consideration for EV owners in the state. One of the key aspects is the annual registration fee, which is a mandatory charge for EV owners. This fee is directly tied to the value of the vehicle, making it an essential factor for EV owners to be aware of when purchasing or registering their cars.

When it comes to calculating the registration fee, Illinois follows a straightforward approach. The annual fee is determined by a percentage of the vehicle's value, which is assessed at the time of registration. The current rate is set at 2.5% of the vehicle's value, ensuring that EV owners contribute a fair share based on their car's worth. For instance, if an EV is valued at $30,000, the registration fee would be $750 for that year. This system provides a clear and proportional fee structure, allowing EV owners to understand and budget for their registration costs.

It's worth noting that this annual registration fee is in addition to the standard registration process and is a recurring cost for EV owners in Illinois. The fee is typically due annually and must be paid to maintain legal ownership and roadworthiness of the vehicle. EV owners should be prepared for this financial obligation, especially when considering the long-term ownership of their electric vehicles.

To ensure compliance, EV owners are advised to stay informed about the registration process and any updates to the fee structure. The Illinois Department of Motor Vehicles (DMV) provides the necessary resources and guidelines for registration, including fee calculations and payment methods. By staying informed, EV owners can efficiently manage their registration fees and avoid any potential penalties or legal issues.

In summary, Illinois's approach to electric vehicle registration fees is a well-structured and value-based system. Understanding this fee structure is crucial for EV owners to ensure compliance and budget accordingly. With the annual registration fee tied to vehicle value, EV owners in Illinois can contribute to the state's infrastructure and road maintenance while enjoying the benefits of electric mobility.

Ford's Electric Future: Profits and Prospects

You may want to see also

Emission Testing: EVs in Illinois are exempt from traditional emission testing, but may require other inspections

Electric vehicles (EVs) in Illinois have a unique relationship with emission testing compared to traditional gasoline or diesel cars. While EVs are exempt from the standard emission testing requirements, they still undergo specific inspections to ensure they meet certain criteria. This is an important aspect to consider for EV owners in the state.

The exemption from traditional emission testing is a significant benefit for EV owners. These vehicles produce zero tailpipe emissions, which means they don't release harmful pollutants into the atmosphere. As a result, they don't require the same level of scrutiny as conventional vehicles during regular inspections. However, this doesn't mean that EVs are entirely free from inspection processes.

EVs in Illinois are subject to a different type of inspection, often referred to as a 'safety and emissions inspection' or 'EV-specific inspection'. This inspection focuses on the vehicle's overall safety and performance, including its electrical systems, battery health, and charging capabilities. The goal is to ensure that EVs are safe to operate and meet the necessary standards. During this inspection, technicians will check the vehicle's battery, wiring, and other critical components to identify any potential issues.

One key aspect of this inspection is the assessment of the EV's battery performance. Illinois regulations may require that the battery's health and capacity be evaluated to ensure it meets the manufacturer's specifications. This is crucial for maintaining the vehicle's efficiency and range, as well as identifying any potential safety risks associated with battery degradation. Additionally, the inspection might include a check of the EV's charging system to verify its functionality and compatibility with local charging infrastructure.

It's important for EV owners in Illinois to be aware of these inspection requirements and understand that while they are exempt from traditional emission testing, they still need to undergo these specialized checks. Staying informed about the specific regulations and requirements will help ensure that EV owners can enjoy the benefits of zero-emission driving while also maintaining their vehicles according to state standards.

Unlock EV Tax Savings: A Guide to Maximizing Your Credit

You may want to see also

Road Use Taxes: Some Illinois counties and cities impose road use taxes on electric vehicles

In Illinois, the concept of road use taxes for electric vehicles is an evolving topic, with some counties and cities implementing unique policies. These taxes are designed to generate revenue for road maintenance and infrastructure, but they also spark debates about fairness and environmental considerations. Here's an overview of this complex issue:

Understanding Road Use Taxes: Road use taxes, often in the form of a per-mile charge, are levied on vehicles based on their usage. Traditionally, these taxes have been applied to gasoline-powered vehicles, but the introduction of electric vehicles (EVs) has led to discussions about adapting these fees to the new technology. The primary goal is to ensure that the financial burden of maintaining roads is distributed fairly among all vehicle owners.

Electric Vehicle Fees in Illinois: Several Illinois counties and cities have taken the initiative to implement road use taxes specifically for electric vehicles. For instance, Cook County, which includes Chicago, introduced a per-mile charge for EVs in 2020. This fee is designed to be fairer to electric vehicle owners, as traditional gas taxes may not accurately reflect the environmental impact of different vehicle types. The revenue generated is then allocated to road maintenance and improvement projects. Other jurisdictions, such as the city of Evanston, have also considered similar measures, highlighting the growing trend of adapting road taxes for the EV market.

Environmental Considerations: Proponents of these taxes argue that they encourage the adoption of cleaner vehicles. By making road use taxes more equitable, they believe it will incentivize residents to switch to electric cars, reducing the environmental impact of transportation. This approach aligns with Illinois' commitment to combating climate change and promoting sustainable practices. However, critics argue that these taxes might discourage EV adoption, especially among lower-income households, potentially exacerbating social and economic disparities.

Challenges and Future Outlook: Implementing road use taxes for EVs presents several challenges. One significant issue is the technological complexity of tracking and charging electric vehicles accurately. Additionally, there are concerns about the potential negative impact on EV sales and the broader economy. As the debate continues, some Illinois policymakers are exploring alternative solutions, such as adjusting the gas tax to account for the lower fuel consumption of EVs or implementing a flat-rate fee for all vehicle owners, regardless of power source. The future of road use taxes in Illinois will likely involve a careful balance between generating revenue, promoting environmental sustainability, and ensuring fairness for all residents.

Battling EV Fires: Rapid Response Strategies for Safety

You may want to see also

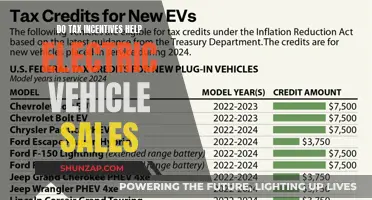

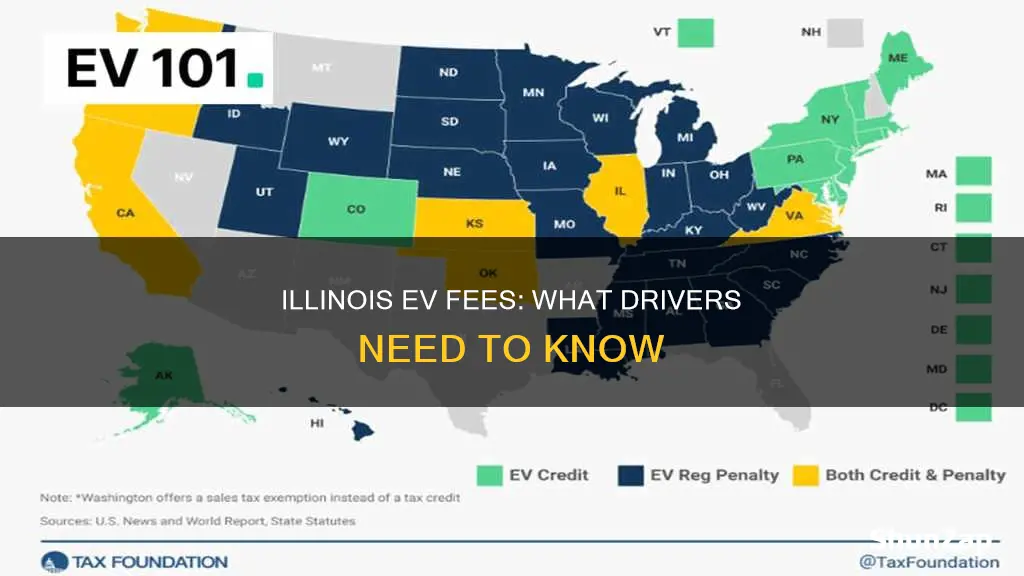

State Incentives: Illinois offers various incentives, including tax credits, for electric vehicle purchases

Illinois has implemented several incentives to encourage the adoption of electric vehicles (EVs) and promote a more sustainable transportation system. One of the primary incentives is the Electric Vehicle Property Tax Exemption, which allows EV owners to exempt the value of their vehicle from property tax assessments. This exemption can significantly reduce the annual property tax burden for EV owners, making it an attractive financial incentive. The state also offers a Tax Credit for Electric Vehicles, which provides a credit against the state income tax for individuals who purchase or lease an EV. This credit can be substantial, especially for those in higher tax brackets, and can effectively lower the overall cost of ownership.

In addition to these financial benefits, Illinois provides other incentives to make EVs more accessible and appealing to residents. The state offers a rebate program for the purchase or lease of new electric vehicles, which can further reduce the upfront cost. This rebate is typically a fixed amount and is designed to make EVs more affordable and competitive with traditional gasoline vehicles. Furthermore, Illinois has established a network of charging stations across the state, ensuring that EV owners have convenient access to charging infrastructure. This network expansion is crucial for addressing range anxiety and providing the necessary support for widespread EV adoption.

The state's incentives extend beyond the initial purchase, as Illinois also offers various benefits for EV owners throughout their ownership period. For instance, the state provides a reduced registration fee for EVs, which can result in significant savings over time. Additionally, Illinois has implemented a zero-emission vehicle (ZEV) program, which requires a certain percentage of vehicle sales to be zero-emission or low-emission vehicles. This program further incentivizes the market for EVs and promotes the transition to cleaner transportation options.

These state incentives play a vital role in making electric vehicles more affordable, accessible, and appealing to Illinois residents. By offering tax credits, property tax exemptions, rebates, and other benefits, the state is actively encouraging the shift towards sustainable transportation. As a result, EV ownership is becoming increasingly attractive, contributing to a greener and more environmentally conscious Illinois.

EV Revolution: Will Prices Drop in 5 Years?

You may want to see also

Charging Infrastructure: The state provides grants for charging station installation, supporting EV ownership

The state of Illinois has implemented a comprehensive strategy to encourage the adoption of electric vehicles (EVs) and address the critical need for charging infrastructure. Recognizing that widespread EV ownership relies heavily on convenient and accessible charging options, the state offers financial support through grants to facilitate the installation of charging stations across various locations.

These grants are designed to assist businesses, municipalities, and individuals in the process of setting up charging stations, which are essential for the seamless integration of EVs into the transportation ecosystem. By providing financial assistance, the state aims to alleviate the financial burden associated with the initial investment required for charging infrastructure, making it more accessible and affordable for EV owners and potential adopters.

The grant programs typically target specific areas, such as public parking lots, shopping centers, and residential communities, ensuring that EV owners have convenient access to charging facilities. This approach not only supports the growth of the EV market but also contributes to the development of a robust charging network, addressing range anxiety and promoting the overall convenience of electric vehicle ownership.

Furthermore, the state's initiative to provide grants for charging station installation aligns with its commitment to environmental sustainability and reducing greenhouse gas emissions. By encouraging the use of electric vehicles, Illinois is actively contributing to the global transition towards cleaner and more sustainable transportation options. This strategy not only benefits the environment but also positions Illinois as a leader in the adoption of innovative technologies, fostering a more sustainable and resilient future.

In summary, Illinois' grant programs for charging station installation play a pivotal role in supporting EV ownership and fostering a comprehensive charging infrastructure. These initiatives not only address the financial barriers to entry for EV owners but also contribute to the state's long-term sustainability goals, making electric vehicles a more attractive and viable transportation choice for residents and businesses alike.

South Carolina's EV Tax Exemption: A Green Car Owner's Guide

You may want to see also

Frequently asked questions

No, there is no specific fee for electric vehicles in Illinois. The state does not impose any additional charges or taxes solely based on the vehicle's power source.

No, the registration process for electric vehicles in Illinois is the same as for conventional gasoline or diesel cars. There are no additional fees or surcharges specifically for electric vehicle registration.

Yes, electric vehicles in Illinois are eligible for certain toll road exemptions. The Illinois State Toll Highway Authority (ISTHA) offers a toll discount program for electric vehicles, providing a reduced toll rate for EV drivers. This program aims to encourage the use of electric vehicles and promote a cleaner transportation environment.