The rise of electric vehicles (EVs) has sparked a new debate: can the financial benefits of owning an EV be limited by one's income? As the popularity of EVs grows, so does the need to understand the financial implications for different income groups. This paragraph aims to explore the relationship between income and the availability of financial incentives for electric vehicles, shedding light on potential disparities in access to these benefits.

What You'll Learn

- Electric Vehicle Affordability: Income limits may restrict access to electric vehicles

- Credit Scores and EVs: Higher credit scores can lead to better EV financing options

- Income-Based EV Loan Limits: Lenders set loan limits based on borrower income

- Electric Car Tax Benefits: Income-based eligibility for tax credits and incentives

- EV Purchase and Income: Wealthier individuals may have more options for electric vehicle purchases

Electric Vehicle Affordability: Income limits may restrict access to electric vehicles

The rising popularity of electric vehicles (EVs) has sparked a crucial discussion about accessibility and financial barriers. While the environmental benefits of EVs are well-known, the financial aspect often presents a significant challenge for potential buyers, especially those with lower incomes. Income limits can indeed play a pivotal role in determining one's ability to access and afford electric vehicles, creating a disparity in the adoption of this eco-friendly technology.

For many, the initial cost of purchasing an electric vehicle is a substantial hurdle. EVs often carry a higher price tag compared to their conventional counterparts, and this difference can be particularly daunting for individuals or families with limited financial resources. The market offers various EV models, ranging from compact city cars to luxurious SUVs, but the entry-level options might still be out of reach for those with modest incomes. As a result, income-based income limits can effectively restrict access to these vehicles, leaving certain demographics behind.

Financial institutions and government bodies have recognized this issue and have started implementing strategies to address it. Some banks and credit unions offer specialized loans and financing options tailored to EV buyers, aiming to make the purchase more affordable. These programs often include lower interest rates and flexible repayment terms, which can significantly reduce the financial burden on potential EV owners. However, not all income groups may qualify for such programs, and the eligibility criteria can still be restrictive.

Furthermore, the concept of 'electric vehicle credit' comes into play, where governments provide incentives and tax credits to promote EV adoption. While these credits can substantially reduce the overall cost, they are often limited to specific income brackets or may require a certain level of income-based eligibility. As a result, lower-income earners might not benefit fully from these incentives, making the purchase of electric vehicles even more challenging.

Addressing income-based restrictions in the EV market is essential for fostering a sustainable future. It requires a multi-faceted approach, including financial institutions offering tailored loan programs, government incentives that cater to a broader income spectrum, and manufacturers providing a wider range of affordable EV options. By doing so, we can ensure that the transition to electric vehicles is inclusive and accessible to all, regardless of their income level.

Electric Vehicles: Toll-Free or Not? Unlocking the Mystery

You may want to see also

Credit Scores and EVs: Higher credit scores can lead to better EV financing options

A higher credit score can significantly impact your ability to secure favorable financing for an electric vehicle (EV). When it comes to EV financing, lenders often view credit scores as a crucial indicator of financial health and reliability. Here's how it works:

Understanding Credit Scores: Credit scores are numerical representations of your creditworthiness, ranging from 300 to 850. A higher score indicates a more responsible credit history, suggesting that you are likely to manage debt effectively. Lenders use these scores to assess the risk associated with lending money to potential EV buyers.

Impact on EV Financing: When you have a higher credit score, you become an attractive candidate for EV financing. Here are some advantages:

- Lower Interest Rates: Lenders often offer lower interest rates to borrowers with excellent credit. This means you can secure a more affordable loan for your EV purchase, saving you money in the long run.

- Favorable Loan Terms: With a high credit score, you may be eligible for longer loan terms, allowing you to repay the loan over a more extended period. This flexibility can make EV ownership more accessible and manageable for individuals with varying financial capabilities.

- Increased Approval Probability: A strong credit score increases the likelihood of loan approval. Lenders are more inclined to approve loans for higher-credit individuals, ensuring you have access to the necessary funds to purchase your desired EV.

Benefits of a Good Credit Score: Maintaining a high credit score can have long-lasting effects on your financial journey. It not only simplifies the process of buying an EV but also opens doors to other financial opportunities. A good credit score can lead to better rates on various loans, credit cards, and even rental agreements.

In summary, a higher credit score is a powerful tool when exploring EV financing options. It empowers you to negotiate better terms, access more competitive interest rates, and increase your chances of securing the necessary funds for your electric vehicle purchase. Understanding and improving your credit score can be a valuable step towards achieving your dream of owning an EV.

Electric Vehicle: Capitalized or Not? Unlocking the Debate

You may want to see also

Income-Based EV Loan Limits: Lenders set loan limits based on borrower income

The concept of income-based loan limits for electric vehicle (EV) financing is an important aspect of the EV market, ensuring that lenders can manage risk and borrowers can access the necessary funds. When it comes to EV loans, lenders often consider the borrower's income as a critical factor in determining the loan amount they can offer. This practice is particularly relevant for high-value purchases like electric cars, where the loan amount might be substantial.

Lenders use income-based loan limits as a safety net to protect themselves from potential defaults. By assessing a borrower's income, lenders can estimate their ability to repay the loan. For EV loans, this is crucial because the cost of electric vehicles can vary significantly, and a higher loan amount may be required for more expensive models. Income verification helps lenders decide whether to approve a loan and, if so, what the maximum loan amount should be.

The process typically involves lenders requesting income documentation, such as pay stubs, tax returns, or employment verification, to assess the borrower's financial health. This information allows lenders to calculate the borrower's debt-to-income ratio, which is a key indicator of their financial stability. A lower debt-to-income ratio suggests a stronger financial position and may lead to more favorable loan terms, including higher loan limits.

Income-based loan limits can vary widely depending on the lender, the borrower's credit history, and the specific EV model being purchased. Some lenders might have standardized income thresholds for different loan amounts, while others may use a more personalized approach. For instance, a borrower with a high income and excellent credit history might qualify for a larger loan, potentially covering the entire cost of a premium electric vehicle.

It is essential for EV buyers to understand that income-based loan limits can impact their ability to purchase certain models. Borrowers with lower incomes might find it challenging to secure a loan for a high-end electric car, while those with higher incomes may have more flexibility. This aspect of EV financing highlights the importance of financial planning and research, ensuring that buyers can make informed decisions about their vehicle purchases.

Uncover the Mystery: Signs Your Car Has Electric Start

You may want to see also

Electric Car Tax Benefits: Income-based eligibility for tax credits and incentives

The purchase of an electric vehicle (EV) often comes with a range of financial incentives and tax benefits, which can significantly reduce the overall cost. One such incentive is the federal tax credit for electric cars, which is a substantial financial boost for buyers. However, it's important to note that this tax credit is not universally available; it is income-based, meaning that eligibility is tied to the taxpayer's income level.

For the 2023 tax year, the federal tax credit for electric vehicles is capped at $7,500 per vehicle. This credit is designed to encourage the adoption of electric cars and promote environmental sustainability. However, to qualify, the taxpayer's modified adjusted gross income (MAGI) must not exceed certain thresholds. For the 2023 tax year, the MAGI limit for individuals is $150,000, and for married couples filing jointly, it is $300,000. These limits are adjusted annually, so it's essential to check the latest income thresholds before purchasing an electric car.

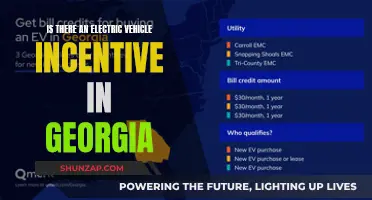

In addition to the federal tax credit, many states and local governments also offer their own incentives and tax benefits for electric vehicle buyers. These incentives can vary widely and may include additional tax credits, rebates, or even sales tax exemptions. For instance, some states provide tax credits that are not income-based, while others offer incentives that phase out at higher income levels. It is crucial to research and understand the specific eligibility criteria for these state and local programs, as they can significantly enhance the financial benefits of owning an electric car.

When considering the purchase of an electric vehicle, it is advisable to consult a tax professional or financial advisor who can provide personalized guidance based on your income and the specific incentives available in your area. They can help you navigate the complex landscape of EV tax benefits and ensure that you take full advantage of the credits and incentives you are entitled to.

In summary, while the federal tax credit for electric vehicles is a significant benefit, it is not available to everyone due to income limitations. Understanding these income-based eligibility criteria is essential for maximizing the financial advantages of owning an electric car. Additionally, exploring state and local incentives can further enhance the overall cost savings, making electric vehicles an increasingly attractive option for environmentally conscious consumers.

Unlocking Savings: California's EV Tax Credit Explained

You may want to see also

EV Purchase and Income: Wealthier individuals may have more options for electric vehicle purchases

The relationship between income and the ability to purchase electric vehicles (EVs) is an interesting aspect of the EV market. Wealthier individuals often have more financial flexibility and a wider range of options when it comes to buying EVs. This is primarily due to the fact that electric vehicles, especially high-end models, can be significantly more expensive than their conventional counterparts. As a result, having a higher income can provide several advantages in the EV purchase process.

One of the key benefits is the ability to choose from a broader selection of electric vehicles. Many luxury car manufacturers are now investing heavily in EV technology, offering a variety of high-performance, premium electric cars. These vehicles often come with advanced features, cutting-edge technology, and superior performance, which can be a significant selling point for those with higher purchasing power. Wealthier buyers can also opt for more specialized and unique EVs, such as high-end sports cars or luxury SUVs, which may not be as widely available or affordable for lower-income individuals.

Additionally, higher-income earners may have more access to financing options tailored for electric vehicles. Many financial institutions and car manufacturers offer specialized loans and financing plans for EVs, which can include lower interest rates, longer repayment terms, and even incentives for early adoption. These financing options can make the purchase more manageable for those with substantial financial resources, allowing them to acquire the latest electric models without a significant strain on their immediate cash flow.

Furthermore, wealthier individuals may be more inclined to invest in additional features and accessories for their electric vehicles. This could include premium sound systems, advanced driver-assistance packages, or even custom paint jobs and interior upgrades. These enhancements can significantly increase the overall cost of the vehicle, and having a higher income provides the financial means to accommodate these extra expenses.

In summary, income plays a crucial role in the EV market, offering wealthier individuals more choices, access to specialized financing, and the ability to customize their electric vehicle purchases. While income limitations may restrict access to certain EV models and features for lower-income buyers, higher-income earners can take advantage of the expanding EV market and its associated benefits. As the demand for electric vehicles continues to grow, understanding these income-based disparities is essential for both consumers and the automotive industry.

The Future of Transportation: Electric Vehicles Take Center Stage

You may want to see also

Frequently asked questions

No, the federal tax credit for electric vehicles is not limited by income. The full credit of up to $7,500 is available to all eligible buyers, regardless of their income level. This credit is designed to encourage the adoption of electric vehicles and reduce greenhouse gas emissions.

The EV tax credit is a non-refundable credit, meaning it can be used to offset the purchase price of the vehicle, but any remaining credit cannot be carried back or refunded. However, low-income earners can still benefit from this credit. The credit is available to individuals and businesses, and it applies to the purchase or lease of qualified electric vehicles.

While the federal EV tax credit is not income-based, some states or local governments may have their own incentives or restrictions. For example, certain states might offer additional credits or rebates, but these may have income thresholds or limitations. It's best to check with your state's department of revenue or environmental protection agency to understand any regional-specific EV incentives and their eligibility criteria.