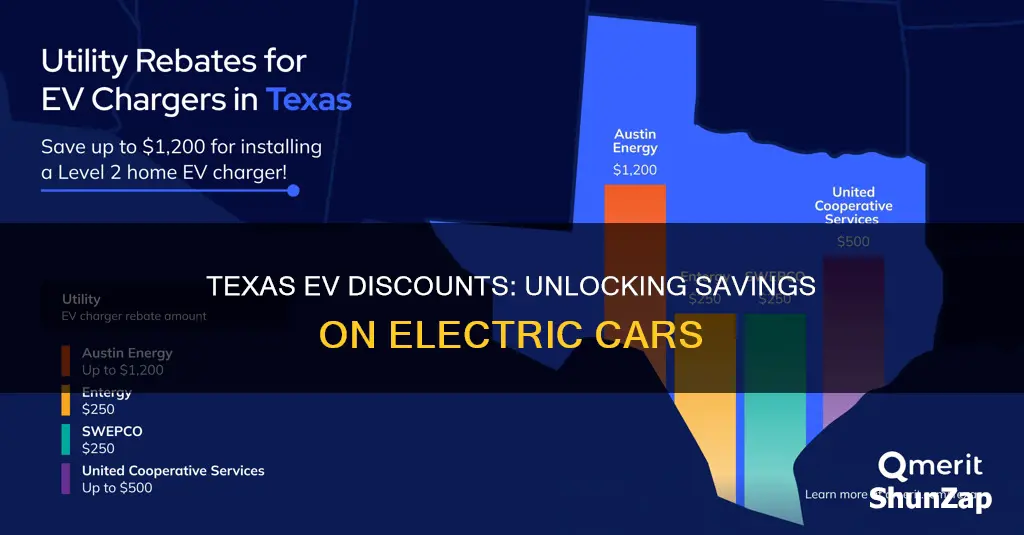

In Texas, electric vehicles (EVs) are becoming increasingly popular, and the state government has implemented various incentives to encourage their adoption. One of the key incentives is the availability of discounts and rebates for EV buyers. These discounts can significantly reduce the upfront cost of purchasing an electric vehicle, making it more affordable for residents. The Texas state government offers financial assistance through various programs, such as the Texas EV Incentive Program, which provides rebates and tax credits to eligible buyers. Additionally, some local governments and utility companies in Texas also offer their own incentives, including discounts on EV charging equipment and reduced electricity rates for EV owners. This introduction aims to explore the specific details and benefits of these discounts, helping Texans understand the potential savings they can enjoy when purchasing electric vehicles.

What You'll Learn

- Tax Rebates: Texas offers tax credits for EV purchases, reducing overall costs

- Sales Tax Exemption: EVs are exempt from sales tax in Texas, saving buyers money

- Federal Incentives: Federal tax credits and grants further lower EV prices

- Renewable Energy Credits: Texas' renewable energy policies may provide additional discounts

- Dealer Incentives: Some EV dealers offer special promotions and discounts

Tax Rebates: Texas offers tax credits for EV purchases, reducing overall costs

Texas has implemented several incentives to encourage the adoption of electric vehicles (EVs) and reduce the overall cost of ownership for residents. One of the most significant benefits is the tax rebate program, which provides financial assistance to EV buyers. This initiative aims to make electric vehicles more affordable and accessible to Texans while promoting a cleaner and more sustainable transportation environment.

When purchasing an EV, Texas residents are eligible for a tax credit that directly reduces the purchase price. This credit is typically calculated as a percentage of the vehicle's price, and it can significantly lower the upfront cost. For instance, the state may offer a tax credit of up to 50% of the EV's sales price, which can amount to a substantial savings for buyers. This rebate program is designed to make electric cars more competitive in the market and attract consumers who might otherwise be deterred by the initial investment.

The tax rebate for EV purchases is a straightforward process. After buying an eligible electric vehicle, the buyer can claim the credit by filing the appropriate tax forms. This often involves submitting a certificate of purchase and providing details of the vehicle's specifications. The tax credit is then applied to the buyer's state tax liability, effectively reducing the amount of tax owed. In some cases, if the credit exceeds the tax liability, the excess may be refunded to the purchaser, further enhancing the financial benefit.

It is important to note that the specific details and eligibility criteria for this tax rebate program can vary. Factors such as vehicle type, price, and the buyer's residency status may influence the amount of credit received. Therefore, prospective EV buyers should thoroughly research and understand the current tax rebate policies to ensure they maximize their savings. Additionally, staying informed about any changes in legislation is crucial, as tax incentives and regulations can evolve over time.

In summary, Texas's tax rebate program for EV purchases is a powerful incentive for residents to consider electric vehicles. By offering tax credits that directly reduce the cost of ownership, the state aims to accelerate the transition to sustainable transportation. This initiative not only benefits individual buyers by providing financial relief but also contributes to a broader environmental goal of reducing carbon emissions and promoting cleaner energy sources.

The Green Revolution: Should You Go Electric?

You may want to see also

Sales Tax Exemption: EVs are exempt from sales tax in Texas, saving buyers money

In Texas, electric vehicles (EVs) are eligible for a significant financial benefit through a sales tax exemption. This means that when you purchase an EV, you won't have to pay the state's 6.25% sales tax, which is typically applied to most goods and services. This tax break is a substantial advantage for EV buyers, as it directly translates to substantial savings.

The sales tax exemption for EVs in Texas is a strategic move to encourage the adoption of cleaner and more sustainable transportation options. By removing the tax burden, the state aims to make electric vehicles more affordable and attractive to consumers. This incentive is particularly beneficial for those looking to make an environmentally conscious choice without compromising their budget.

To take advantage of this exemption, buyers should ensure that they purchase their EVs from a dealership or seller that complies with the state's regulations. The process is straightforward: the seller will provide a tax exemption certificate, and the sales tax is waived at the point of sale. This exemption applies to the full purchase price, including any additional fees or charges.

For instance, if an EV costs $30,000 before tax, the savings would amount to $1,875 (6.25% of $30,000). This substantial discount can make a significant difference in the overall cost of ownership for EV buyers. Moreover, the exemption is not limited to new vehicle purchases; it also applies to used EVs, further expanding the potential savings for consumers.

This sales tax exemption is a powerful tool in Texas' efforts to promote EV adoption and reduce the environmental impact of transportation. It provides a clear financial incentive for residents to consider electric vehicles as a viable and cost-effective alternative to traditional gasoline-powered cars. As a result, more Texans can benefit from the long-term cost savings and environmental advantages of driving an electric vehicle.

The Future of EV Tax Credits: What You Need to Know

You may want to see also

Federal Incentives: Federal tax credits and grants further lower EV prices

The federal government offers a range of incentives to promote the adoption of electric vehicles (EVs) and reduce their overall cost to consumers. These incentives are designed to encourage Americans to make the switch from traditional gasoline-powered cars to more environmentally friendly alternatives. One of the most significant federal programs is the Tax Credit for Electric Vehicles. This credit provides a substantial discount on the purchase price of eligible EVs, making them more affordable for buyers. The amount of the tax credit varies depending on the vehicle's battery capacity and the manufacturer's production volume. For instance, as of 2023, the credit can be up to $7,500 for vehicles with a battery range of at least 200 miles, and it phases out for cars with higher production volumes. This incentive is a powerful tool to attract buyers and accelerate the market for EVs.

In addition to tax credits, the federal government also provides grants and other financial support for EV infrastructure and research. These grants aim to improve the charging network across the country, ensuring that EV owners have convenient access to charging stations. The Department of Energy, for example, has initiated programs like the EV Charging Program, which provides funding to states and territories to deploy EV charging stations in public and private locations. This infrastructure development is crucial for the widespread adoption of EVs, as it addresses range anxiety and makes long-distance travel more feasible.

Furthermore, federal grants have been instrumental in supporting research and development in the EV sector. These grants fund projects that focus on improving battery technology, reducing manufacturing costs, and enhancing the overall performance and efficiency of EVs. By investing in research, the government aims to make EVs more competitive against traditional vehicles in terms of price, range, and performance. This long-term strategy not only benefits consumers but also strengthens the American auto industry, fostering innovation and creating new job opportunities.

The combination of federal tax credits and grants significantly contributes to the overall discount on electric vehicles in Texas and across the nation. These incentives not only make EVs more affordable but also address the critical issues of environmental sustainability and energy independence. As a result, more consumers are likely to consider purchasing EVs, leading to a positive environmental impact and a more diverse automotive market.

In summary, federal incentives play a pivotal role in lowering the prices of electric vehicles and promoting their adoption. Tax credits provide immediate financial benefits to buyers, while grants support the development of essential infrastructure and cutting-edge technology. Together, these measures create a compelling case for consumers to embrace the EV revolution, ultimately contributing to a greener and more sustainable future.

EV Battery End-of-Life: Recycling, Disposal, and Second Life Potential

You may want to see also

Renewable Energy Credits: Texas' renewable energy policies may provide additional discounts

The state of Texas has implemented various policies and incentives to promote the adoption of renewable energy sources, and one such mechanism is the use of Renewable Energy Credits (RECs). RECs are a way to track and verify the generation and consumption of renewable energy. When a renewable energy source, such as wind, solar, or hydropower, produces electricity, it generates RECs, which can then be sold or traded. These credits are a powerful tool to encourage and reward the development of renewable energy infrastructure in Texas.

In the context of electric vehicles (EVs), RECs can play a significant role in providing additional discounts and incentives. Texas has been actively working towards reducing its carbon footprint and transitioning to a more sustainable energy model. The state's renewable energy policies often include provisions that allow for the creation of REC markets, which can offer financial benefits to EV owners and renewable energy producers.

When a renewable energy facility, such as a solar farm or wind turbine, generates electricity, it earns RECs. These credits can be sold to electricity retailers or end-users, providing a revenue stream for renewable energy producers. This market-based approach encourages the development of new renewable energy projects, as the potential for REC sales can significantly impact the overall profitability of these ventures. As a result, Texas residents who own electric vehicles and support renewable energy initiatives can indirectly benefit from these REC sales.

The connection between RECs and EV discounts in Texas is often facilitated through partnerships and agreements between renewable energy producers and EV manufacturers or dealerships. For instance, a solar panel installer might offer a discount on their systems to customers who purchase an EV, with the understanding that the solar panels will power the vehicle. In this scenario, the RECs generated by the solar panels could be a valuable asset, providing an additional incentive for both the EV owner and the renewable energy provider.

Additionally, Texas' renewable energy policies may include provisions that allow for the creation of REC-based incentives specifically for EV owners. These incentives could take the form of direct discounts on EV purchases or tax credits related to the production and sale of RECs. By linking RECs to EV ownership, Texas aims to create a comprehensive support system that encourages the adoption of both renewable energy and electric vehicles, ultimately contributing to a more sustainable future.

Ford's Electric Future: Shifting Focus or Staying Committed?

You may want to see also

Dealer Incentives: Some EV dealers offer special promotions and discounts

When it comes to electric vehicles (EVs) in Texas, one of the key factors that can influence your purchase decision is the availability of dealer incentives and discounts. Many EV dealerships in the state offer special promotions to attract customers and make electric cars more affordable. These incentives can vary widely, so it's essential to stay informed and explore the options available to you.

Dealer incentives often include cash rebates, which are direct payments to customers purchasing electric vehicles. These rebates can significantly reduce the overall cost of the car, making it more competitive against traditional gasoline-powered vehicles. For instance, some EV dealers in Texas might offer a $5,000 rebate on top of the manufacturer's incentives, providing a substantial discount for buyers. These cash rebates are a powerful tool for dealers to encourage sales and can make a significant difference in the final price you pay.

In addition to cash rebates, EV dealerships may also provide lease or financing incentives. These incentives often involve reduced interest rates or special lease terms, making it more financially attractive to purchase an electric vehicle. For example, a dealer might offer a 0% interest loan for a specific period, allowing buyers to pay off their vehicle with monthly payments that are lower than what they would typically expect. Such financing incentives can make the initial cost of ownership more manageable and encourage more people to consider going electric.

Another strategy used by EV dealers is to offer loyalty or trade-in bonuses. If you own a vehicle from a specific brand and are looking to upgrade to an electric model, the dealer might provide an additional discount or trade-in allowance. This incentive is designed to reward existing customers and encourage brand loyalty. For instance, a dealer might offer a $3,000 bonus if you trade in your old car for a new electric vehicle from the same brand, making the transition to electric ownership more appealing.

Furthermore, some EV dealerships in Texas might partner with local or state governments to offer additional incentives. These partnerships can result in further discounts or grants, making electric vehicles even more affordable. For example, a dealer might collaborate with the state government to provide a $2,000 grant for EV purchases, which can be combined with other incentives for a substantial total savings. Staying informed about these partnerships and their specific requirements is crucial for maximizing your savings.

In summary, dealer incentives play a significant role in the electric vehicle market in Texas. From cash rebates to lease and financing options, as well as loyalty bonuses and government partnerships, these incentives can make a substantial difference in the overall cost of purchasing an electric car. It is advisable to research and compare different dealerships to find the best deals and promotions available in your area.

Ford's Electric Future: A Doubtful Transition?

You may want to see also

Frequently asked questions

As of my cut-off date in January 2023, Texas does not have a state-wide incentive program for electric vehicles. However, some local governments and utility companies in Texas offer incentives, rebates, or tax credits for EV purchases. These programs vary by region and can change frequently, so it's best to check with your local authorities for the most up-to-date information.

Yes, the federal government offers a tax credit for electric vehicle purchases. As of 2022, the credit is worth up to $7,500 per vehicle, but it is subject to a price cap and income limits. The credit is designed to encourage the adoption of EVs and reduce greenhouse gas emissions. You can find more details on the IRS website or consult a tax professional for specific eligibility criteria.

You can start by contacting local EV dealerships or manufacturers directly, as they often have information about current promotions and discounts. Additionally, checking with your local electric utility company may provide insights into any partnerships or offers they have with EV manufacturers. Websites and apps dedicated to EV news and reviews can also be a valuable resource for finding local deals and staying updated on the latest incentives in Texas.