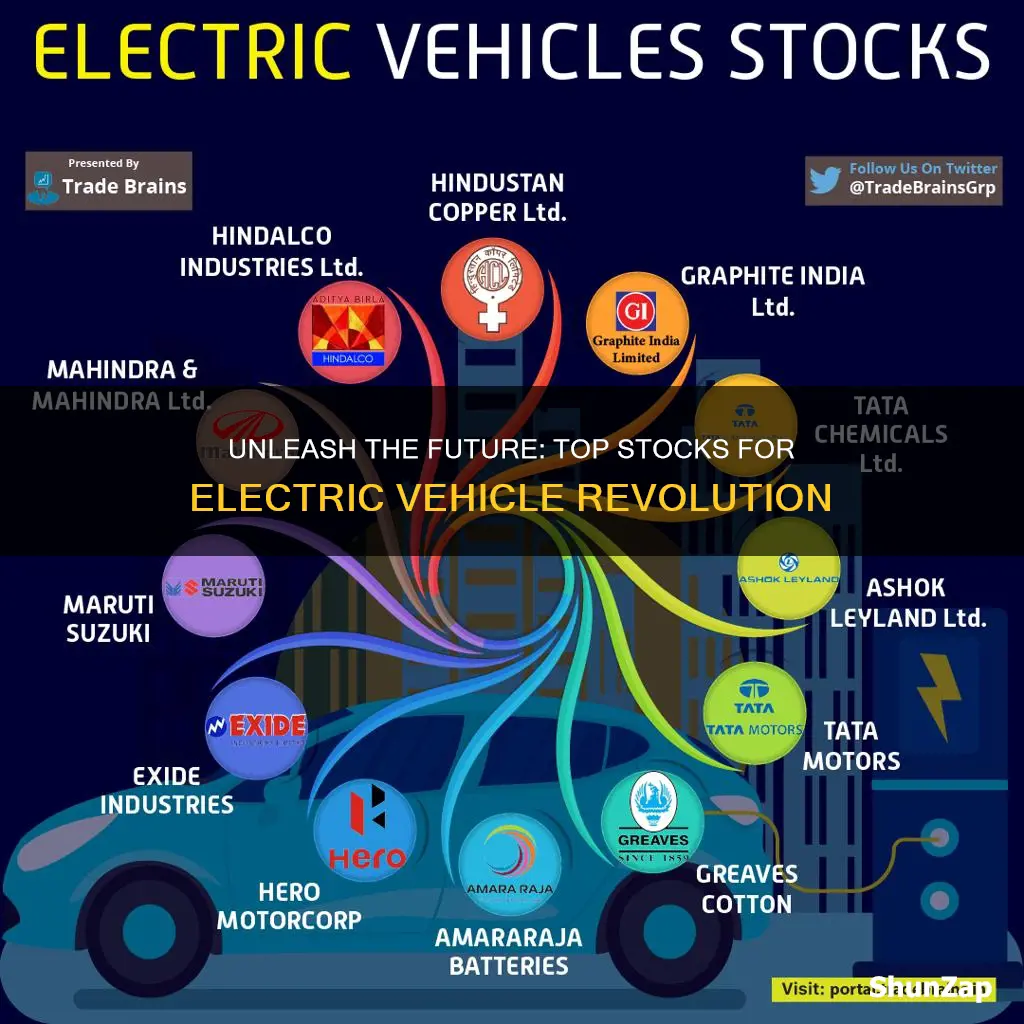

The electric vehicle (EV) market is experiencing rapid growth, and investors are keen to capitalize on this trend. With the global push towards sustainable transportation, the EV industry is poised for significant expansion. This article aims to guide investors on the best stocks to consider for this emerging sector, highlighting key players in EV manufacturing, battery technology, and charging infrastructure. Understanding the dynamics of this market is crucial for making informed investment decisions in the EV space.

What You'll Learn

- Battery Technology: Focus on companies leading in EV battery innovation

- Charging Infrastructure: Invest in firms building charging networks for electric vehicles

- Automotive Components: Explore suppliers of electric vehicle parts and systems

- Sustainable Materials: Look into companies using eco-friendly materials in EV production

- Government Policies: Study incentives and regulations impacting EV market growth

Battery Technology: Focus on companies leading in EV battery innovation

The electric vehicle (EV) market is rapidly expanding, and at the heart of this revolution is battery technology. As the demand for more efficient and sustainable transportation grows, the companies that lead in EV battery innovation will undoubtedly gain significant attention from investors. This sector is characterized by constant innovation, with companies striving to improve battery performance, energy density, and longevity. Here's an overview of some key players and the investment opportunities they present:

Innovative Battery Manufacturers:

Several companies are pushing the boundaries of battery technology, offering solutions that could shape the future of EV power. For instance, Contemporary Amperex Technology (CATL) is a prominent player in the lithium-ion battery market, known for its high-capacity, long-lasting batteries. CATL's technology has been widely adopted by major EV manufacturers, ensuring its position as a market leader. Another notable company is Panasonic, which has a strong presence in the EV battery supply chain, particularly through its partnership with Tesla. Panasonic's expertise in lithium-ion battery production and its ability to scale up production efficiently make it an attractive investment option.

Solid-State Battery Developers:

The transition from lithium-ion to solid-state batteries is a significant development in the EV industry. These batteries promise higher energy density, faster charging, and improved safety. Companies like QuantumScape and SolidEnergy Systems are at the forefront of this technology. QuantumScape, a subsidiary of Volkswagen, has developed a unique solid-state battery with a high energy density, which could potentially double the range of EVs. Investing in these companies could provide early access to this groundbreaking technology, making it a strategic move for forward-thinking investors.

Battery Recycling and Second-Life Applications:

As the EV market expands, so does the need for sustainable battery disposal and recycling solutions. Companies like Redwood Materials and Battery Resourcers are focusing on battery recycling and second-life applications. Redwood Materials, for example, aims to recover valuable materials from used EV batteries, reducing the environmental impact of the EV industry. Investing in these companies not only supports the circular economy but also ensures a steady supply of raw materials for the growing battery production.

Investment Considerations:

When investing in EV battery technology, it's crucial to assess the companies' technological capabilities, market presence, and long-term partnerships. Look for companies with a strong R&D pipeline, as this indicates their ability to stay ahead of the competition. Additionally, consider the companies' supply chain resilience and their ability to meet the increasing demand for EV batteries. The EV market is highly competitive, so investors should also evaluate the companies' strategies to gain a competitive edge.

In summary, the EV battery technology sector offers a range of investment opportunities, from established battery manufacturers to innovative startups. As the industry evolves, investors can benefit from the growth of these companies, which are pivotal in driving the transition to sustainable transportation. Staying informed about technological advancements and market trends will be essential for making well-informed investment decisions in this dynamic field.

Gartner's Hype Cycle: Navigating the EV Revolution's Peaks and Troughs

You may want to see also

Charging Infrastructure: Invest in firms building charging networks for electric vehicles

The global shift towards electric vehicles (EVs) presents a significant investment opportunity in the charging infrastructure sector. As more consumers embrace EVs, the demand for convenient and efficient charging solutions is skyrocketing. This trend is particularly evident in urban areas, where the need for accessible charging stations is at its highest. The investment landscape for charging infrastructure is ripe with potential, driven by both public and private initiatives to support the widespread adoption of electric mobility.

One of the key players in this market is the company that specializes in building and managing charging networks. These firms are instrumental in establishing a robust charging infrastructure, which is essential for the seamless integration of EVs into our daily lives. They invest in the development of fast-charging stations, which can significantly reduce the time required to recharge an EV battery, making electric vehicles more practical for long-distance travel and daily commutes. By focusing on strategic locations, such as highways, commercial areas, and residential complexes, these companies ensure that EV owners have convenient access to charging points.

Investing in charging infrastructure companies offers several advantages. Firstly, these firms benefit from the growing demand for EV charging, as they are well-positioned to capitalize on the increasing number of electric vehicles on the road. With governments and private entities setting ambitious targets for EV adoption, the need for comprehensive charging networks is undeniable. Secondly, the business model of these companies often involves partnerships with EV manufacturers, energy providers, and real estate developers, ensuring a steady revenue stream and long-term growth prospects.

When considering investment opportunities, it's crucial to look for companies with a strong track record in infrastructure development, innovative charging solutions, and a comprehensive understanding of the market dynamics. These firms should demonstrate a strategic approach to network expansion, considering factors such as location, charging speed, and user experience. Additionally, companies that can adapt to the evolving needs of the EV market, such as integrating renewable energy sources or offering smart charging solutions, will likely gain a competitive edge.

In summary, investing in charging infrastructure companies is a strategic move for those seeking to capitalize on the electric vehicle revolution. With the right combination of technological innovation, strategic partnerships, and a customer-centric approach, these firms are poised to play a pivotal role in shaping the future of sustainable transportation. As the market matures, investors can expect attractive returns, driven by the increasing demand for efficient and accessible charging solutions.

Ford's Electric Future: Shifting Focus or Staying Committed?

You may want to see also

Automotive Components: Explore suppliers of electric vehicle parts and systems

The electric vehicle (EV) market is rapidly expanding, and with it, the demand for specialized components and systems is soaring. This presents a significant opportunity for investors to capitalize on the growth of the EV industry by focusing on automotive component suppliers. These suppliers play a crucial role in providing the necessary parts and technologies to manufacturers, ensuring the production of high-quality electric vehicles.

One key area of investment is in the development and supply of electric powertrains. These include electric motors, power electronics, and battery systems. Companies like Tesla, Inc. (TSLA) have revolutionized the EV market with their innovative powertrains, and many suppliers are now focusing on providing similar cutting-edge technology. For instance, suppliers such as Contemporary Amperex Technology (CATL) and Panasonic Corporation are major players in the lithium-ion battery market, supplying some of the most advanced battery packs for EVs. Their ability to provide high-capacity, long-lasting batteries is essential for the widespread adoption of electric vehicles.

In addition to powertrains, the automotive industry requires a vast array of other components to build electric vehicles. These include advanced driver-assistance systems (ADAS), infotainment systems, and connectivity solutions. Suppliers likeZF Friedrichshafen AG and Continental AG are well-positioned to benefit from the growing demand for these systems. ZF, for example, offers a comprehensive range of ADAS solutions, including lane-keeping assist, adaptive cruise control, and automatic emergency braking, which are becoming increasingly important features in the EV market.

Another critical aspect of the EV industry is the development of charging infrastructure. Companies that supply charging stations, connectors, and related equipment are essential to the growth of the EV market. For instance, suppliers like ChargePoint Holdings, Inc. and EVgo are leading the way in providing fast-charging solutions for electric vehicles. These companies are crucial in addressing the range anxiety associated with EVs and making electric vehicles more convenient for everyday use.

When considering investments in automotive component suppliers, it is essential to research and analyze the specific strengths and market positions of each company. Factors such as technological innovation, supply chain efficiency, and customer relationships can significantly impact a company's success in the EV market. Investors should also stay informed about industry trends, regulatory changes, and the overall health of the automotive sector to make well-informed investment decisions.

Ford's Electric Future: Profits and Prospects

You may want to see also

Sustainable Materials: Look into companies using eco-friendly materials in EV production

The electric vehicle (EV) market is rapidly growing, and as the industry expands, the focus on sustainability and eco-friendly practices becomes increasingly important. One area of interest for investors is the adoption of sustainable materials in EV production, as this trend not only benefits the environment but can also drive innovation and create new investment opportunities. Here's an overview of this aspect of the EV market:

Understanding Sustainable Materials: Sustainable materials in EV production refer to the use of environmentally friendly and often recycled or biodegradable components. This includes materials like recycled plastics, plant-based textiles, and even natural fibers for interior components. The goal is to reduce the environmental impact of manufacturing EVs, which often involves a significant amount of resource-intensive processes. By utilizing sustainable materials, companies can minimize waste, lower carbon emissions, and appeal to environmentally conscious consumers.

Key Players in Sustainable EV Production: Several companies are at the forefront of incorporating sustainable materials into electric vehicle manufacturing. For instance, companies like Tesla have been praised for their efforts in using recycled materials, such as recycled aluminum and lithium-ion battery recycling. Another notable example is Rivian, which has committed to using sustainable materials throughout its production line, including plant-based foam and recycled plastics. These companies are not only driving the adoption of eco-friendly practices but also setting industry standards.

Benefits and Investment Opportunities: Investing in companies that prioritize sustainable materials offers multiple advantages. Firstly, it contributes to a greener economy, which is a global priority. Secondly, these companies often attract environmentally conscious investors, leading to potential market growth. Additionally, the use of sustainable materials can reduce production costs in the long term, as recycling and reusing materials can be more cost-effective than traditional manufacturing methods. This could result in improved profit margins for these businesses.

Research and Due Diligence: When considering investments in this sector, thorough research is essential. Investors should look into companies' sustainability reports, environmental policies, and their supply chain management. Understanding the sources of raw materials and the processes involved in recycling or upcycling them is crucial. For instance, some companies might use recycled materials from their own EV batteries, while others may partner with specialized recycling facilities. Due diligence will help investors identify companies with genuine and well-executed sustainable practices.

In summary, the EV industry's shift towards sustainable materials is an exciting development that investors can capitalize on. By supporting companies that prioritize eco-friendly production, investors can contribute to a more sustainable future while potentially benefiting from the market's growth. This approach to investing in EVs goes beyond traditional considerations of performance and technology, emphasizing the importance of environmental responsibility.

Electric Vehicles: The Dark Side of Green Transportation

You may want to see also

Government Policies: Study incentives and regulations impacting EV market growth

Government policies play a pivotal role in shaping the electric vehicle (EV) market and can significantly influence investment opportunities in this sector. When considering investments in EV-related stocks, understanding the incentives and regulations provided by governments is essential. Here's an analysis of how government policies impact the EV market growth:

Incentives for EV Adoption:

Many governments worldwide have implemented various incentives to encourage the adoption of electric vehicles. These incentives aim to reduce the upfront cost of EVs, making them more affordable for consumers. Tax credits, rebates, and cash incentives are common tools used by governments to promote EV sales. For instance, the United States offers the Internal Revenue Code Section 30D Credit, which provides a tax credit for individuals purchasing new electric vehicles. Similarly, European countries like Norway and Germany provide substantial subsidies, making EVs more competitive against traditional gasoline or diesel cars. These incentives not only benefit consumers by reducing purchase prices but also create a positive market environment for EV manufacturers and related industries.

Regulations and Standards:

Government regulations are another critical aspect that shapes the EV market. Stringent environmental regulations and emissions standards have pushed the automotive industry towards electrification. Governments set targets for reducing greenhouse gas emissions, leading to the development of stricter vehicle emission norms. These regulations often favor electric vehicles, providing a competitive edge to EV manufacturers. For example, the European Union's (EU) CO2 emissions standards mandate that car manufacturers achieve specific emission targets, with penalties for non-compliance. This has resulted in a rapid shift towards electric powertrains, benefiting companies that invest in EV technology and infrastructure.

Charging Infrastructure Development:

The growth of the EV market is closely tied to the development of charging infrastructure. Governments recognize the importance of a robust charging network to support widespread EV adoption. Many countries have introduced policies and investments to establish charging stations across urban and rural areas. These initiatives ensure that EV owners have convenient access to charging facilities, addressing range anxiety and promoting longer-term ownership. Governments may offer grants, tax benefits, or subsidies to private companies and local authorities to build and maintain charging infrastructure, creating opportunities for businesses involved in EV charging solutions.

Research and Development Support:

Government policies can also drive innovation and research in the EV space. Governments often provide grants, tax credits, and funding opportunities for companies investing in R&D related to electric vehicles. This support enables manufacturers to enhance battery technology, improve vehicle performance, and develop new EV models. Additionally, governments may establish partnerships with research institutions to foster advancements in battery recycling, charging technology, and sustainable materials. Such initiatives not only benefit the EV industry but also create a positive feedback loop, attracting more investors and accelerating market growth.

Long-term Planning and Policy Stability:

Consistency and stability in government policies are crucial for the EV market's long-term growth. Investors seek a clear and predictable regulatory environment to make informed decisions. Governments that provide long-term roadmaps and stable policies can attract domestic and international investments in the EV sector. This includes setting future emission targets, announcing subsidies, and outlining plans for phase-out of internal combustion engine vehicles. Policy stability ensures that businesses can plan their investments, manage risks, and make strategic decisions, fostering a healthy and sustainable EV market.

Unraveling the Mystery: Why Some Animals Chew on Car Wires

You may want to see also

Frequently asked questions

Investing in the EV sector can be lucrative, and here are some highly regarded stocks to consider: Tesla, Inc. (TSLA) is a well-known pioneer in the EV market, offering a range of innovative electric cars and a strong brand presence. Other notable companies include Volkswagen AG (VOW3) with its ID.3 and ID.4 models, and NIO Inc. (NIO), a Chinese EV manufacturer focusing on premium vehicles and innovative battery-swapping technology.

Research and analysis are key. Look for companies with a strong market position, innovative technology, and a clear strategy for growth. Consider factors like brand reputation, product lineup, and market share. Study the company's financial health, including revenue growth, profitability, and cash flow. Additionally, keep an eye on industry trends, government policies, and consumer demand for EVs to make informed investment decisions.

Absolutely! The EV industry is diverse, and investors can explore various sectors and themes. One theme is battery technology and supply chain, as advancements in battery performance and manufacturing are crucial for EV adoption. Companies like Contemporary Amperex Technology (CATL) and Panasonic Corporation are key players in this space. Another sector is charging infrastructure, as the development of efficient and accessible charging stations is essential for EV owners. Look into companies providing charging solutions, such as Plug Power (PLUG) and ChargePoint Holdings (CHPT).