Understanding the criteria for electric vehicle (EV) credit eligibility is crucial for anyone interested in purchasing an EV. The federal government offers a tax credit for EV buyers, but not all vehicles qualify. This paragraph will explore the key factors that determine whether a vehicle is eligible for the EV tax credit, including battery size, range, and manufacturing location, as well as the importance of staying informed about the latest regulations to ensure a smooth and rewarding EV ownership experience.

What You'll Learn

Vehicle Type: Cars, trucks, motorcycles, and buses

When it comes to electric vehicle (EV) credits, the eligibility criteria can vary depending on the specific program and region. However, generally, the focus is on promoting the adoption of zero-emission vehicles, which includes cars, trucks, motorcycles, and buses. These vehicle types are crucial in the transition to a more sustainable transportation system.

Cars:

Electric cars are a prominent category in the EV credit system. Many governments and organizations worldwide offer incentives for purchasing electric cars. These vehicles are powered by electric motors and rechargeable batteries, eliminating the need for traditional internal combustion engines. The credit or rebate amount can vary based on factors such as the vehicle's battery capacity, range, and the manufacturer. For instance, in some countries, buyers may receive a fixed amount per kilowatt-hour of battery capacity, encouraging the production and purchase of more efficient electric cars.

Trucks:

While less common than cars, electric trucks are also eligible for EV credits. This includes both light-duty and heavy-duty trucks. Electric trucks offer a sustainable alternative to their diesel counterparts, reducing air pollution and noise levels. The incentives for electric trucks often target specific segments, such as delivery vehicles or commercial fleets. These credits can significantly lower the cost of ownership, making electric trucks more accessible and attractive to businesses and consumers alike.

Motorcycles:

Electric motorcycles, or e-bikes, are another category that can qualify for EV credits. These two-wheeled vehicles are gaining popularity due to their environmental benefits and cost-effectiveness. E-bikes often have smaller batteries compared to cars or trucks, but they still contribute to reducing carbon emissions. Incentive programs for electric motorcycles may include tax credits or rebates, making them an affordable and eco-friendly choice for commuters and enthusiasts.

Buses:

Electric buses play a vital role in public transportation, offering a cleaner and quieter alternative to traditional diesel buses. Many cities and transportation authorities provide EV credits to encourage the adoption of electric buses. These credits can cover a significant portion of the bus's purchase price, making it more financially viable for public transport operators. Electric buses not only reduce environmental impact but also improve energy efficiency, resulting in long-term cost savings.

In summary, cars, trucks, motorcycles, and buses all have the potential to contribute to a greener future, and governments are incentivizing their electric versions through various credit systems. Understanding the specific requirements and eligibility criteria for each vehicle type is essential for consumers and manufacturers alike to take advantage of these incentives and accelerate the transition to sustainable transportation.

Unraveling the Mystery: WH MI in Electric Vehicles

You may want to see also

Battery Capacity: Higher capacity batteries often qualify

When it comes to electric vehicles (EVs) and their eligibility for government incentives, one crucial aspect to consider is battery capacity. Higher capacity batteries are often a key factor in determining whether a vehicle qualifies for the electric vehicle credit. This credit is a financial incentive designed to encourage the adoption of electric cars and promote sustainable transportation.

The battery capacity of an EV refers to its ability to store electrical energy, which directly impacts the vehicle's range and performance. Higher capacity batteries can store more energy, allowing the vehicle to travel longer distances on a single charge. This is a significant advantage for potential EV buyers, as it addresses the common concern of range anxiety, which is the fear of running out of battery power during a journey. By offering higher capacity batteries, manufacturers can ensure that their electric vehicles are more appealing to consumers who prioritize long-range travel.

To qualify for the electric vehicle credit, vehicles must meet specific criteria set by the relevant authorities. These criteria often include a minimum battery capacity, which varies depending on the jurisdiction. For instance, in some countries, the minimum battery capacity for qualifying vehicles might be measured in kilowatt-hours (kWh). A higher kWh rating indicates a larger battery, which can store more energy and potentially provide a longer driving range. This is an essential consideration for consumers, as it directly influences the practicality and usability of the vehicle.

Manufacturers are increasingly focusing on developing and incorporating higher capacity batteries into their EV models to meet these eligibility requirements. This trend is driven by the growing demand for electric vehicles and the need to provide consumers with options that align with their preferences and practical needs. As a result, buyers can expect to find a wider range of electric vehicles with varying battery capacities, allowing them to choose the one that best suits their requirements.

In summary, battery capacity plays a vital role in determining the eligibility of electric vehicles for government incentives. Higher capacity batteries are often a prerequisite for qualifying, ensuring that the vehicle can offer a competitive range and performance. As the market for EVs continues to evolve, consumers can look forward to a diverse selection of electric cars, each with its own unique battery capacity, catering to different driving needs and preferences.

Li-ion: Powering the Future of Electric Vehicles?

You may want to see also

Range: Vehicles with longer ranges may be eligible

When it comes to electric vehicle (EV) incentives and credits, range is a critical factor that determines eligibility. The credit or incentive programs often target vehicles with longer ranges, as they provide a more significant environmental benefit by reducing the reliance on fossil fuels. This is especially true for countries and regions with less developed charging infrastructure, where longer-range EVs can offer more flexibility and peace of mind to potential buyers.

The concept of range eligibility is straightforward: vehicles with a higher electric range can cover more distance on a single charge, which means fewer trips to charging stations and a reduced carbon footprint. This is particularly appealing to consumers who are concerned about the practicality of EVs, especially for long-distance travel or those who frequently drive in areas with limited charging options. As such, governments and organizations offering these incentives often have a clear preference for vehicles that can provide a more substantial driving range.

For instance, in the United States, the Internal Revenue Service (IRS) offers a tax credit for EV purchases, and the range of the vehicle is a key consideration. The credit amount is determined by the vehicle's battery capacity and the range it can achieve on a single charge. Vehicles with a higher range, often measured in miles (or kilometers), are more likely to qualify for the maximum credit amount, which can significantly reduce the overall cost of the vehicle for the buyer.

Similarly, in the European Union, the Alternative Fuel Infrastructure Directive includes provisions for financial incentives, and range is a critical criterion. The directive aims to encourage the adoption of EVs with a focus on reducing emissions, and vehicles with longer ranges are considered more environmentally friendly. This approach ensures that the incentives are directed towards vehicles that can make a more substantial contribution to reducing greenhouse gas emissions.

It's important to note that the specific range requirements can vary depending on the region and the incentive program. Some countries might have a minimum range threshold, while others may prioritize vehicles that can achieve a certain percentage of the total driving range on electric power. Therefore, it is essential for potential EV buyers to research and understand the eligibility criteria set by their local governments or organizations offering these credits to ensure they qualify for the financial benefits.

Unraveling the GM EV Tax Credit: Current Status and Impact

You may want to see also

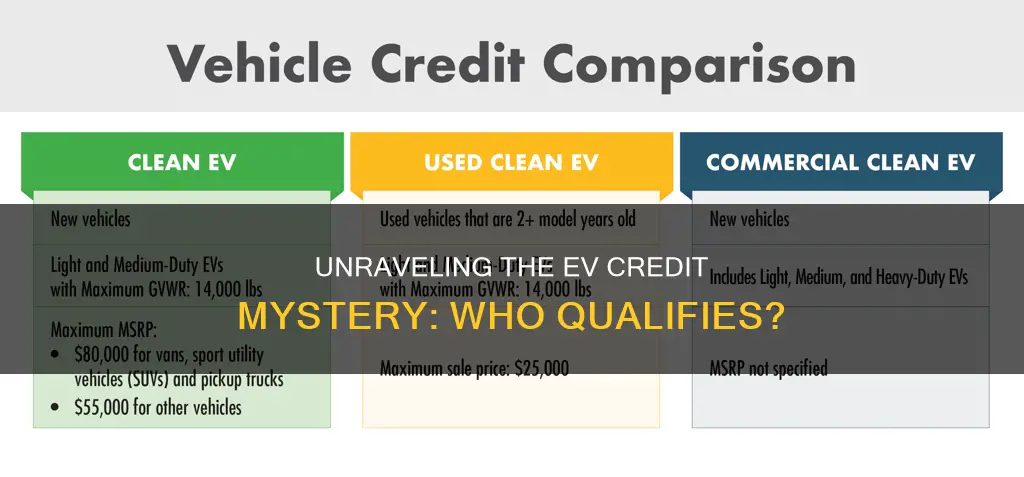

Price: Cost limits may apply to claim the credit

The electric vehicle (EV) tax credit is a financial incentive designed to encourage the purchase of electric cars and promote the adoption of cleaner transportation methods. However, it's important to understand that there are specific cost limits associated with claiming this credit. These limits are in place to ensure the program's effectiveness and fairness.

For the 2023 tax year, the credit amount is generally $7,500 per qualified electric vehicle. This credit is available to individuals and businesses, but it is subject to certain income and vehicle price thresholds. The credit amount is tied to the vehicle's sale price, and it phases out for vehicles with a manufacturer's suggested retail price (MSRP) above $80,000 for new vehicles and $85,000 for used vehicles. This means that if the EV you're interested in exceeds these price limits, the credit will decrease accordingly.

To maximize the credit, it's crucial to consider the vehicle's price carefully. For instance, if you're in the market for a luxury electric vehicle with a high MSRP, you might want to explore more affordable options to ensure you qualify for the full credit amount. Additionally, used electric vehicles may offer a more cost-effective route, as the credit is also available for used EVs, provided they meet specific criteria.

It's worth noting that the credit amount can vary depending on the vehicle's battery capacity and the manufacturer. Some states and local governments also offer additional incentives, which can further enhance the financial benefits of purchasing an electric vehicle. Therefore, it's essential to research and compare different models to find the best fit within your budget and the applicable cost limits.

In summary, when considering an electric vehicle purchase, be mindful of the price constraints to ensure you can claim the full tax credit. Understanding these cost limits will help you make an informed decision and potentially save on the overall cost of your electric vehicle.

Securing Autopilot: Preventing the Theft of Electric Vehicles

You may want to see also

Manufacturer Location: Local production can impact eligibility

Local production of electric vehicles (EVs) can significantly influence a manufacturer's eligibility for various incentives and credits, particularly when it comes to electric vehicle credits. Many governments and organizations worldwide offer financial incentives to encourage the adoption of electric vehicles, and these programs often have specific requirements regarding the production and sourcing of the vehicles.

In the context of electric vehicle credits, local production can be a critical factor. Many countries and regions have introduced policies that favor locally produced EVs to stimulate their domestic automotive industry and create jobs. For instance, the United States' Inflation Reduction Act (IRA) provides a substantial tax credit for new electric vehicles, but this credit is subject to certain conditions. One of these conditions is that the vehicle must be assembled in North America, with a significant portion of its manufacturing taking place in the United States or Canada. This requirement ensures that the economic benefits of the EV industry remain within the region.

Similarly, in the European Union, the Alternative Fuel Infrastructure Regulation (AFIR) includes a provision that encourages the production of zero-emission vehicles within the bloc. This regulation suggests that vehicles eligible for subsidies should be produced in the EU, promoting local manufacturing and reducing the environmental impact associated with long-distance transportation of vehicles.

Local production also ensures a more sustainable and resilient supply chain for EV manufacturers. By producing vehicles locally, companies can reduce the carbon footprint associated with transportation and potentially lower the overall cost of production. This is especially important for the EV industry, where the supply chain for raw materials and components is complex and often spans multiple countries.

Manufacturers should be aware that the rules and regulations regarding electric vehicle credits can vary widely, and local production requirements may change over time. Staying informed about these policies is essential for businesses to ensure they meet the necessary criteria and maximize their chances of receiving the incentives. Additionally, local production can also open up opportunities for collaboration with local suppliers and component manufacturers, fostering a more integrated and sustainable automotive ecosystem.

Electric Vehicle Fuse Safety: Fast-Blow or Slow-Blow?

You may want to see also

Frequently asked questions

The EV credit is available for a wide range of electric vehicles, including fully electric cars, trucks, and motorcycles. These vehicles must be new and originally purchased for personal, family, or household use.

The key factor is the vehicle's battery capacity and range. You can check the Environmental Protection Agency (EPA) ratings or look for the vehicle's EPA range estimate, which indicates the distance the car can travel on a full charge. Vehicles with a higher range and more efficient battery performance typically qualify for the full credit amount.

Yes, the vehicle must be purchased from a dealership or seller that participates in the EV credit program. Additionally, the vehicle should be new and not used, and it must be acquired for personal use. Some states or regions may have additional criteria, so it's essential to check local regulations.