The world of electric vehicles (EVs) is rapidly expanding, and with it comes a range of incentives and benefits for consumers. One of the most attractive incentives for EV buyers is the tax rebate, which can significantly reduce the overall cost of purchasing an electric car. However, the availability and amount of these rebates vary widely depending on location. This article aims to explore and compare the tax rebate programs for electric vehicles in different regions, helping consumers navigate the complex landscape of EV incentives and make informed decisions about their purchases.

What You'll Learn

- Geographical Distribution: Tax rebate availability varies by region and country

- Vehicle Type: Rebates may differ for electric cars, buses, and motorcycles

- Income Limits: Some programs have income-based eligibility criteria

- Government Policies: Tax incentives are influenced by government environmental goals

- Local Incentives: Cities and states offer additional rebates and grants

Geographical Distribution: Tax rebate availability varies by region and country

The availability of tax rebates for electric vehicles (EVs) is a crucial factor for potential buyers, as it can significantly reduce the upfront cost of these vehicles. However, the geographical distribution of such incentives varies widely, often influenced by government policies and economic goals. Here's an overview of how this distribution works:

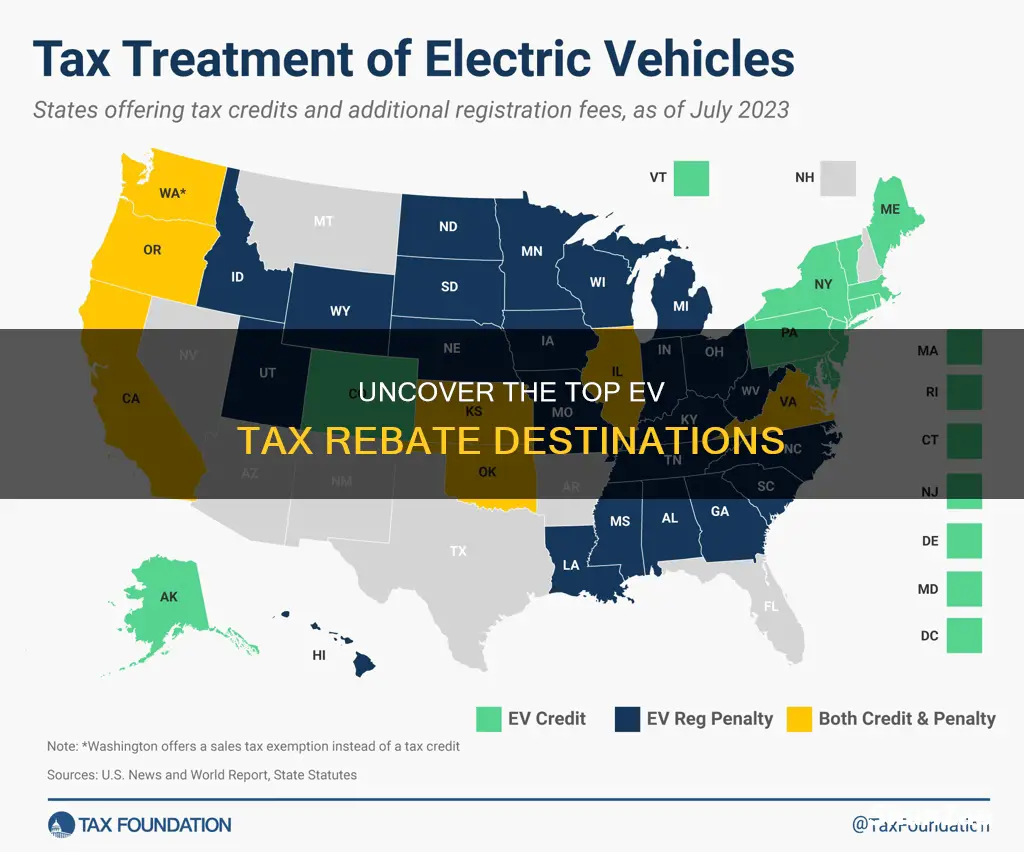

In the United States, for instance, several states offer tax credits or rebates for EV purchases. California is a prominent example, providing a rebate of up to $7,000 for new electric cars, which is one of the highest in the country. This incentive is designed to encourage the adoption of cleaner vehicles and reduce the state's carbon footprint. Other states like New York, New Jersey, and Oregon also offer varying levels of tax credits, often with specific eligibility criteria, such as residency and vehicle specifications. On the other hand, some states like Texas and Florida have no state-level tax rebates, but they may offer other incentives like reduced registration fees or toll road discounts.

In Europe, the picture is equally diverse. Norway, for instance, is renowned for its generous EV incentives, offering a combination of tax exemptions and rebates, making EVs highly affordable. This has led to a rapid increase in EV sales in the country. In contrast, countries like Italy and Spain provide limited tax credits, which are often tied to specific vehicle categories or environmental performance standards. The United Kingdom, until recently, had a relatively modest EV grant scheme, but recent changes have increased the incentive, making it more attractive to UK buyers.

Asian countries also have varying approaches. Japan, for example, provides a substantial tax reduction for EV buyers, with the amount varying based on the vehicle's price and environmental impact. South Korea offers a similar system, with additional benefits for low-emission vehicles. In contrast, India's tax rebate system is less comprehensive but has shown growth in recent years, with a focus on promoting domestic EV manufacturing.

The geographical variation in tax rebates is a significant consideration for EV buyers, as it can impact the overall cost and feasibility of purchasing an electric vehicle. Understanding these regional differences is essential for anyone looking to take advantage of available incentives and make an informed decision about their EV purchase.

Recharge and Revive: The Power of Recuperation in Electric Vehicles

You may want to see also

Vehicle Type: Rebates may differ for electric cars, buses, and motorcycles

When it comes to electric vehicle (EV) tax incentives, the specifics can vary significantly depending on the type of vehicle. Here's a breakdown of how rebates and incentives might differ for electric cars, buses, and motorcycles:

Electric Cars:

Many countries and regions offer substantial tax credits or rebates for the purchase of electric cars. For instance, in the United States, the Inflation Reduction Act provides a credit of up to $7,500 for new electric vehicles, with certain income limits applying. This credit can be significant for buyers, making electric cars more affordable. Similarly, in Norway, buyers of electric cars are exempt from the usual VAT (value-added tax), and there are also grants for purchasing electric vehicles.

Electric Buses:

The incentives for electric buses often focus on the environmental impact of public transportation. Many governments offer grants or low-interest loans to encourage the adoption of electric buses. For example, in California, the California Air Resources Board (CARB) provides the Zero-Emission Vehicle (ZEV) Funding Program, which includes grants for the purchase of electric buses. These incentives can significantly reduce the upfront cost of electric buses for public transportation fleets.

Motorcycles:

While not as prevalent as for cars and buses, there are still some incentives for electric motorcycles. In the UK, for instance, the Plug-in Car Grant also applies to motorcycles, offering a discount of up to £3,000 for the purchase of new electric motorcycles. Additionally, some regions offer exemptions from road tax or license fees for electric motorcycles, further reducing the cost of ownership.

It's important to note that the availability and specifics of these incentives can change frequently, so staying informed about the latest policies in your region is crucial. Additionally, some countries and states have different eligibility criteria and application processes for these rebates, so understanding the local regulations is essential for maximizing the benefits.

Hertz's Electric Vehicle Revolution: A Green Car Future

You may want to see also

Income Limits: Some programs have income-based eligibility criteria

When it comes to electric vehicle (EV) tax rebates, understanding the income limits and eligibility criteria is crucial to ensure you take full advantage of the available incentives. Many governments and organizations offer financial assistance to promote the adoption of electric cars, but these programs often come with specific requirements that can vary widely. Here's a detailed guide on how income limits can impact your access to EV tax rebates:

Research and Identify Income Thresholds: Start by researching the specific EV tax rebate programs in your region. Different areas may have distinct initiatives, and some might be more generous than others. Government websites, local transportation departments, and environmental agencies are excellent resources for this information. Look for details on the income thresholds set for each program. These limits are typically based on the federal poverty guidelines or similar standards, adjusted for the local cost of living. For instance, a program might offer a rebate for vehicles costing up to $50,000, with an income cap of three times the federal poverty level for that year.

Understand the Impact of Income: Income-based eligibility ensures that financial assistance goes to those who need it most. Higher-income earners may still be eligible, but they might receive a smaller rebate or none at all. This approach encourages the purchase of EVs by those who may have a higher environmental impact due to their vehicle choices. For example, a family with an annual income of $150,000 might not qualify for a rebate on a luxury electric SUV, but a lower-income household could benefit significantly from the same program.

Explore Alternative Incentives: If you don't meet the income criteria for a particular EV rebate program, don't despair. Many regions offer alternative incentives, such as direct subsidies, low-interest loans, or tax credits for EV purchases. These programs may have different income limits or no income restrictions at all. For instance, some cities provide free or discounted parking for EV owners, while others offer tax credits for the full purchase price of an electric car.

Stay Informed and Plan Ahead: Keep yourself updated on any changes to EV rebate programs and their eligibility criteria. Income limits can change over time, and new initiatives may be introduced. Planning your EV purchase with these factors in mind can help you make an informed decision and potentially save a significant amount of money. Consider consulting with a financial advisor or tax professional who can provide personalized advice based on your income and the specific EV rebate programs available in your area.

Unveiling the Mystery: Ice in Electric Vehicles

You may want to see also

Government Policies: Tax incentives are influenced by government environmental goals

Government policies play a crucial role in promoting the adoption of electric vehicles (EVs) and reducing greenhouse gas emissions. Tax incentives are a powerful tool used by governments to encourage citizens and businesses to make environmentally friendly choices. These incentives are often designed to align with broader environmental goals and can significantly impact the market for electric vehicles.

In many countries, governments have set ambitious targets to reduce carbon emissions and combat climate change. To achieve these goals, they employ various strategies, including tax rebates and subsidies for EV purchases. For instance, the United States has implemented the Tax Credit for Electric Vehicles, which provides a significant tax credit to individuals purchasing new electric cars. This credit can reach up to $7,500, making electric vehicles more affordable and attractive to consumers. Similarly, Norway offers a comprehensive tax exemption system for EVs, making it one of the top countries for EV adoption. The Norwegian government's goal is to become the world's first zero-emission country by 2050, and these tax incentives are a key part of their strategy.

The design and effectiveness of tax incentives are closely tied to a government's environmental policies and priorities. Governments often tailor these incentives to specific sectors or regions, aiming to accelerate the transition to a greener economy. For example, some countries provide tax breaks for businesses investing in EV charging infrastructure, recognizing the importance of supporting the necessary infrastructure for widespread EV adoption. Additionally, governments may offer tax credits for the purchase of electric buses or trucks, encouraging the adoption of low-emission commercial vehicles.

The impact of these policies is far-reaching. Tax incentives can influence consumer behavior, making electric vehicles more accessible and appealing to a broader market. They can also drive innovation and investment in the EV industry, fostering the development of new technologies and business models. As a result, governments can accelerate the shift towards a more sustainable transportation system, reducing reliance on fossil fuels and improving air quality.

In summary, government policies, particularly tax incentives, are instrumental in promoting electric vehicle adoption and achieving environmental goals. By providing financial benefits to consumers and businesses, governments can make EVs more affordable and attractive, while also encouraging the necessary infrastructure development. These policies are a strategic approach to creating a greener future, where electric vehicles play a significant role in reducing environmental impact.

Green Revolution: Strategies to Boost Electric Vehicle Adoption

You may want to see also

Local Incentives: Cities and states offer additional rebates and grants

Local governments across the United States are playing a crucial role in promoting the adoption of electric vehicles (EVs) by offering various incentives, including rebates and grants. These local incentives can significantly enhance the financial benefits of owning an EV, making it an even more attractive option for environmentally conscious consumers. Here's an overview of how cities and states are contributing to the EV revolution:

City-Level Rebates: Many cities have taken the initiative to provide direct financial assistance to residents purchasing electric vehicles. For instance, the city of Los Angeles offers a rebate of up to $2,000 for the purchase of new electric cars, which can be combined with federal tax credits. This incentive is particularly beneficial for low-income families, as it helps reduce the upfront cost of EVs, making them more accessible. Similarly, cities like Seattle and San Francisco have implemented their own rebate programs, often targeting specific communities to ensure a diverse and inclusive EV market. These local rebates can be a significant factor in attracting potential EV buyers, especially those who might be hesitant due to the initial investment.

State-Funded Grants: States are also contributing to the EV movement through various grant programs. For example, California's Clean Vehicle Rebate Project provides rebates of up to $2,500 for the purchase of new electric cars and $1,500 for used EVs. This state-funded initiative has been instrumental in reducing the cost barrier associated with electric vehicles. New York State offers a similar grant program, providing up to $2,000 for the purchase or lease of new electric cars, which can be a substantial savings for buyers. These grants often have specific eligibility criteria, such as residency requirements and income limits, to ensure that the funds support those who need them most.

Incentive Programs for Specific Groups: Local governments are also tailoring their incentives to target particular demographics. For instance, some cities offer rebates exclusively to low-income families or provide additional benefits for EV purchases made by seniors or students. These targeted programs ensure that the financial advantages of EVs are accessible to a diverse range of consumers. Moreover, certain states have introduced incentives for fleet operators, offering grants to encourage the adoption of electric buses and trucks, which can significantly reduce emissions in public transportation and logistics.

Local incentives play a vital role in the widespread adoption of electric vehicles by addressing the financial concerns that often deter potential buyers. These incentives not only make EVs more affordable but also contribute to a cleaner, more sustainable future. As the EV market continues to grow, it is likely that more cities and states will introduce their own unique rebate and grant programs, further driving the transition to electric mobility.

Powering Electric Vehicles: Understanding Battery Voltage and Its Impact

You may want to see also

Frequently asked questions

The availability and amount of EV tax rebates vary widely by country and even within different states or provinces. For instance, in the United States, California offers a significant rebate program for electric vehicles, providing up to $7,000 for new purchases and $2,500 for used EVs. Similarly, in the UK, the Plug-in Car Grant provides up to £3,000 for new electric cars, while some local authorities offer additional incentives.

Qualification criteria for EV tax rebates can vary. Generally, you need to be a resident in the region offering the rebate, purchase a new or used electric vehicle, and meet specific ownership and residency requirements. Some programs also consider factors like income levels, vehicle specifications, and the time of purchase. It's essential to check the eligibility criteria provided by the relevant government or local authority.

Income limits are a common factor in EV tax rebate programs. Many governments aim to ensure that financial support reaches those who need it most. For example, in some US states, the rebate amount may decrease or become ineligible for individuals with higher incomes. Similarly, in the UK, the Plug-in Car Grant has an upper income limit, and the rebate amount may be reduced for those exceeding this threshold.

Yes, many EV tax rebate programs are available for both new and used electric vehicles. Used EV rebates often have specific criteria, such as the vehicle's age, mileage, and original purchase price. For instance, some US states offer used EV rebates, but the amount may be lower than for new purchases. It's advisable to review the rebate guidelines to understand the specific requirements for used EV owners.