Navigating the complex world of electric vehicle (EV) incentives can be a daunting task, especially when it comes to understanding where to report your EV credit. This guide aims to simplify the process by providing a comprehensive overview of the various platforms and agencies where you can report your EV credit. Whether you're a new EV owner or an existing one looking to claim your credit, this resource will help you understand the reporting process, ensuring you receive the financial benefits you're entitled to.

What You'll Learn

- Federal Tax Credits: Report EV tax credits through the IRS, using Form 8936

- State Incentives: Research state-specific EV incentives and report through respective state agencies

- Local Programs: Check with local governments for EV credit reporting requirements

- Manufacturer Policies: Follow manufacturer guidelines for EV credit reporting and documentation

- Documentation: Keep records of EV purchases, invoices, and any relevant documentation for reporting

Federal Tax Credits: Report EV tax credits through the IRS, using Form 8936

If you've recently purchased an electric vehicle (EV) and are eligible for federal tax credits, it's important to know how to report these credits accurately on your tax return. The Internal Revenue Service (IRS) provides specific guidelines for claiming and reporting EV tax credits, ensuring that you can take full advantage of the financial incentives offered by the government. Here's a step-by-step guide on how to report your EV tax credits through the IRS.

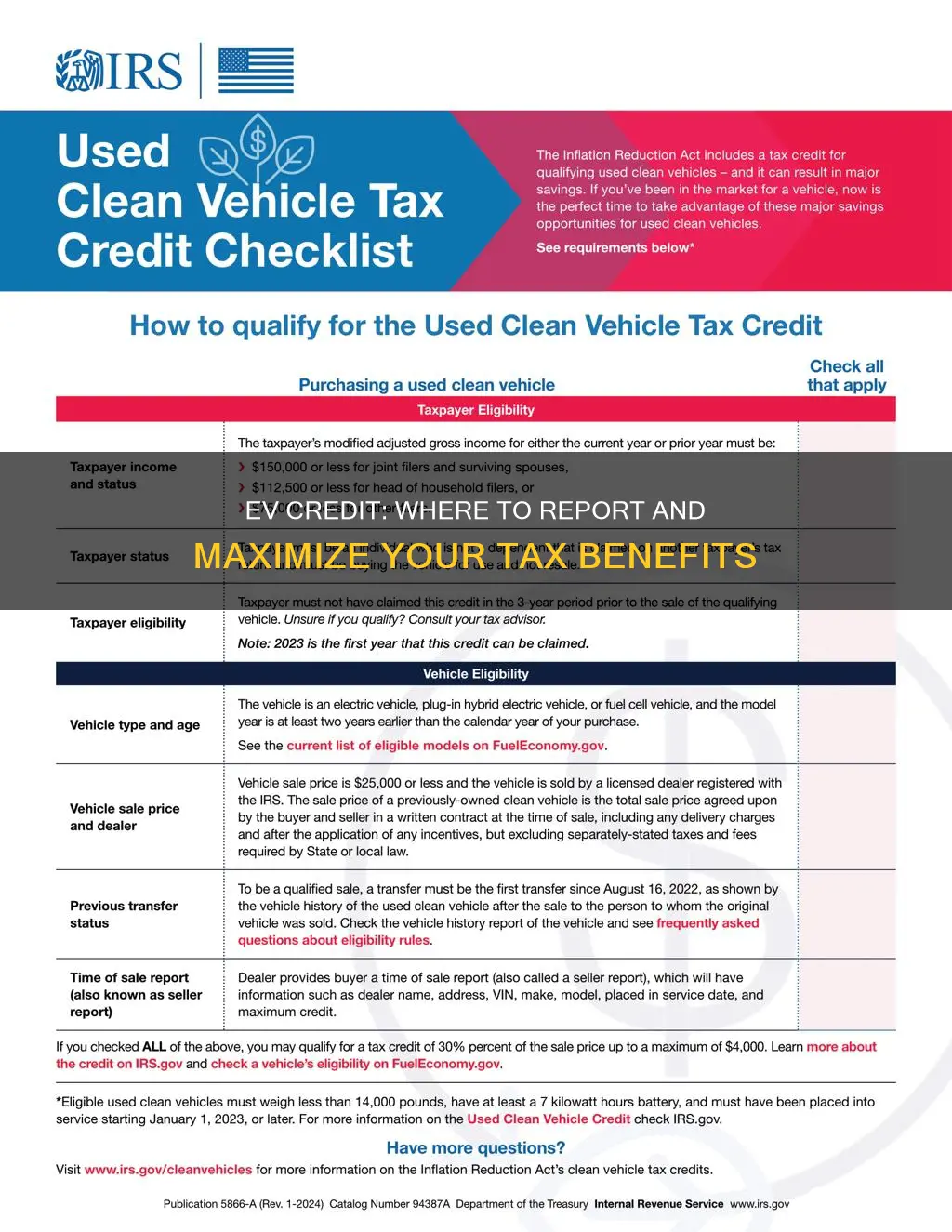

When you purchase an EV, you may be eligible for a tax credit, which can significantly reduce your tax liability or increase your refund. The IRS offers this credit to encourage the adoption of electric vehicles, promoting a more sustainable and environmentally friendly transportation system. To claim this credit, you'll need to complete and submit Form 8936, which is specifically designed for reporting plug-in electric vehicle credits. This form is an essential part of your tax return process.

To begin, gather all the necessary information related to your EV purchase. This includes the vehicle's make, model, and year, as well as the date of purchase and the vehicle's original purchase price. You will also need to provide details about the battery capacity of the EV, as this determines the credit amount. The IRS provides detailed instructions on Form 8936, guiding you through the process of calculating and reporting the credit. It's crucial to follow these instructions carefully to ensure accuracy.

Once you have all the required information, you can start filling out Form 8936. You'll need to provide details about the vehicle, including its identification number and the percentage of its battery capacity that qualifies for the credit. The form also requires you to declare whether the vehicle is used for personal or business purposes, as this affects the credit calculation. After completing the form, you must attach it to your federal tax return, ensuring that you meet the IRS's filing requirements.

It's worth noting that there are specific rules and limitations regarding EV tax credits. The IRS sets a limit on the credit amount based on the vehicle's battery capacity and other factors. Additionally, there are income limits that determine eligibility for the full credit. It is advisable to consult IRS publications or seek professional tax advice to ensure you understand these rules and can maximize your benefits. By following the proper reporting procedures, you can take advantage of the federal tax credits designed to support the transition to electric vehicles.

Revolutionizing Design: A Guide to Crafting the Future of Electric Vehicles

You may want to see also

State Incentives: Research state-specific EV incentives and report through respective state agencies

When it comes to electric vehicles (EVs), many states in the United States offer various incentives to encourage the adoption of clean energy transportation. These incentives can significantly reduce the cost of purchasing an EV and make it more affordable for consumers. To take advantage of these benefits, it's essential to research and understand the specific state incentives available to you.

Each state has its own set of programs and guidelines for EV incentives, which can include financial rebates, tax credits, or even special registration fees. For example, some states provide a fixed amount of money back to buyers of electric cars, while others offer a percentage-based credit against the purchase price. These incentives are often designed to promote the use of EVs, reduce environmental impact, and stimulate local economies.

To find out what incentives your state offers, you should start by contacting your state's department of motor vehicles (DMV) or the relevant environmental agency. These agencies typically have information on EV incentives, including eligibility criteria and application processes. They can guide you through the specific requirements for each incentive program, ensuring you understand the rules and deadlines.

Researching online is another valuable resource. Many states provide detailed information about their EV incentive programs on their official government websites. These websites often include FAQs, application forms, and guidelines, making it easier for applicants to navigate the process. Look for dedicated sections on transportation or environmental initiatives, where you can find comprehensive details about state-specific EV incentives.

Additionally, non-profit organizations and environmental advocacy groups often compile and publish information on state incentives. These resources can be particularly helpful if you prefer a centralized database or if you're looking for a comprehensive overview of all available incentives across different states. By utilizing these various sources, you can ensure that you have all the necessary information to take advantage of state-specific EV incentives and report your eligibility for these benefits.

Tesla's Dominance: Unveiling the Electric Vehicle Market Share

You may want to see also

Local Programs: Check with local governments for EV credit reporting requirements

When it comes to electric vehicle (EV) credits, the process can vary significantly depending on your location. One crucial step in navigating this is to explore local programs and initiatives. Here's a guide on how to approach this:

Research Local Government Initiatives: Start by contacting your local government offices, as they often have specific programs to promote EV adoption. Many cities and states offer incentives, rebates, or tax credits for EV purchases. These programs can vary widely, so it's essential to understand the rules and requirements. For instance, some areas might have a cap on the number of credits available, or they may prioritize certain demographics or vehicle types.

Visit City/County Websites: Local government websites are a treasure trove of information. Look for dedicated sections on transportation, environmental initiatives, or economic development. These pages often provide details on EV incentives, including application processes, eligibility criteria, and any reporting requirements. You might also find contact information for relevant departments, allowing you to reach out for clarification.

Reach Out to Local Officials: Don't hesitate to get in touch with local representatives or government agencies. They can provide direct guidance on EV credit reporting and ensure you're aware of any unique local policies. This step is especially important if you're considering a specific EV model or live in a region with a unique incentive structure.

Stay Informed and Plan Ahead: EV credit reporting can be a complex process, and requirements may change. Keep yourself updated by regularly checking local government websites and subscribing to relevant newsletters. Planning ahead is crucial, as some programs might have application deadlines or require additional documentation.

Remember, while federal guidelines provide a general framework, local programs are where the real differences lie. By engaging with your local government, you can ensure you're taking advantage of all available incentives and staying compliant with any specific reporting needs.

Beyond the Range: Uncovering EV's Hidden Limitations

You may want to see also

Manufacturer Policies: Follow manufacturer guidelines for EV credit reporting and documentation

When it comes to electric vehicle (EV) ownership, understanding the manufacturer's policies on credit reporting and documentation is crucial. Each EV manufacturer may have specific guidelines and procedures for handling financial incentives and subsidies, which can vary widely. It is essential to familiarize yourself with these policies to ensure you report your EV credit correctly and avoid any potential issues.

Many manufacturers provide detailed instructions on their websites or through dedicated customer support channels. These guidelines often include information on how to claim the credit, the required documentation, and the timeline for processing the claim. For instance, some manufacturers may require you to submit proof of purchase, vehicle registration documents, and even a valid driver's license. Others might ask for additional paperwork, such as a completed credit application form or a statement from your financial institution.

Following the manufacturer's instructions is vital because it ensures that your EV credit is reported accurately and promptly. Misreporting or missing deadlines can lead to delays in receiving the credit, which may impact your overall financial benefits. Additionally, manufacturers often have specific timelines for when they will process and approve credit claims, so being aware of these deadlines is essential to avoid any unnecessary delays.

It is recommended to keep all relevant documentation related to your EV purchase and credit claim. This includes sales receipts, purchase agreements, and any correspondence with the manufacturer or financial institutions. Organizing these documents will make the reporting process smoother and provide a record of your EV credit claim.

If you are unsure about any aspect of the reporting process, don't hesitate to contact the manufacturer's customer support team. They can provide clarification on their policies and guide you through the necessary steps. Being proactive and well-informed will help ensure a seamless experience when reporting your EV credit.

Unraveling the Mystery: Understanding Battery Voltage in Hybrid Electric Vehicles

You may want to see also

Documentation: Keep records of EV purchases, invoices, and any relevant documentation for reporting

When it comes to electric vehicle (EV) purchases and the associated tax credits, proper documentation is crucial for ensuring you receive the correct benefits and can provide proof of your investment in a greener future. Here's a comprehensive guide on why and how to keep records of your EV-related purchases and invoices:

Understanding the Importance of Documentation:

Maintaining detailed records is essential for several reasons. Firstly, it ensures that you can accurately report your EV purchase and any associated expenses when filing your taxes. This is particularly important as tax regulations often provide incentives and credits for EV buyers, and proper documentation is required to claim these benefits. Secondly, keeping records allows you to track your investment and any potential resale value, which can be valuable information for future financial planning. Lastly, having comprehensive documentation can be beneficial if you ever need to provide proof of your EV purchase, especially when dealing with insurance claims or warranty issues.

What to Document:

- Purchase Agreement: Keep a copy of the sales contract or agreement for your EV purchase. This document should include essential details such as the vehicle's make, model, year, purchase price, and any additional fees or charges.

- Invoices: Collect and retain all invoices related to the purchase. These may include sales tax invoices, registration fees, and any other costs incurred during the buying process. Ensure that the invoices are itemized and provide a clear breakdown of expenses.

- Financial Statements: Record any bank or financial institution statements related to the purchase. This can be especially important if you took out a loan or used financing options to buy your EV.

- Rebates and Incentives: If you received any government rebates, grants, or incentives for purchasing an EV, keep the corresponding documentation. This could include forms, certificates, or letters from the relevant authorities.

Tips for Organization:

- Create a dedicated folder or section in your records for EV-related documents. You can use subfolders to categorize different types of documents, making retrieval easier.

- Consider using a digital system for storage, as it allows for quick searches and easy sharing with tax professionals or financial advisors.

- If you have multiple EV purchases, ensure each record is clearly labeled with the vehicle's details and the date of purchase.

- Keep records for at least three years to cover the typical tax assessment period, but it's advisable to keep them for longer if you anticipate any future inquiries or audits.

By diligently maintaining these records, you'll be well-prepared to take advantage of any tax benefits and provide the necessary documentation when required. It also ensures that your investment in an electric vehicle is properly accounted for and can provide long-term financial advantages.

Ford's Electric Vehicle Dilemma: Profits vs. Market Demand

You may want to see also

Frequently asked questions

The EV tax credit is a federal incentive to promote the adoption of electric vehicles. You can find detailed information on the Internal Revenue Service (IRS) website. They provide guidelines and resources to help you understand the credit, including the forms and instructions for claiming it.

Yes, if you have questions or concerns about the EV tax credit, you can reach out to the IRS directly. They have a dedicated team to assist with tax-related matters, including those related to the EV credit. You can also visit your local IRS office or contact their customer service for further assistance.

Eligibility for the EV tax credit is based on certain criteria, such as the vehicle's manufacturing date, the buyer's residency, and the vehicle's final assembly location. You can check the IRS website for specific guidelines and determine if your purchase qualifies. The IRS also provides a list of eligible vehicle models, which can be a helpful resource.

While there isn't a centralized platform for reporting issues, you can contact the IRS through their official channels. You can file a tax return or amendment if you believe there's an error or discrepancy. The IRS will then review your claim and provide guidance or resolve any issues related to the EV tax credit.