Are corporations eligible for electric vehicle (EV) credit? This is a crucial question for businesses looking to transition to sustainable transportation options. The answer is yes, corporations can indeed qualify for various incentives and credits when purchasing electric vehicles. These financial benefits are designed to encourage businesses to adopt cleaner, more efficient transportation methods, which can have significant environmental and operational advantages. Understanding the specific criteria and eligibility requirements for these credits is essential for corporations to maximize their savings and contribute to a greener future.

What You'll Learn

- Legal Requirements: Corporations must meet specific legal criteria to qualify for EV credits

- Eligible Vehicles: Only certain electric vehicles are eligible for the credit

- Purchase vs. Lease: Corporations can claim credits for both purchasing and leasing EVs

- Tax Credit Amount: The credit amount varies based on vehicle type and price

- Compliance and Documentation: Detailed documentation and compliance with regulations are essential for claiming the credit

Legal Requirements: Corporations must meet specific legal criteria to qualify for EV credits

To be eligible for electric vehicle (EV) credits, corporations must adhere to a set of legal requirements and criteria. These requirements are designed to ensure that the financial incentives are allocated to eligible entities and promote the adoption of electric vehicles. Here are the key legal considerations for corporations seeking EV credits:

Legal Entity and Ownership: Corporations must be legally registered and incorporated as a business entity. This includes meeting the necessary registration requirements with the relevant government authorities. Additionally, the corporation should be the direct owner or lessee of the electric vehicle for which the credit is claimed. Ownership or lease agreements should be clearly documented to establish the corporation's right to the vehicle.

Compliance with Tax Laws: Tax regulations play a significant role in EV credit eligibility. Corporations must comply with tax laws and regulations related to the specific EV credit program they are applying for. This includes understanding the tax codes, filing requirements, and any restrictions or limitations imposed by the tax authorities. Staying up-to-date with tax law changes is essential to ensure ongoing compliance.

Documentation and Record-Keeping: Maintaining proper documentation is crucial. Corporations should keep detailed records of their EV purchases or leases, including invoices, contracts, and any supporting documentation. These records should clearly demonstrate the corporation's acquisition of the eligible electric vehicle. Proper record-keeping facilitates the verification process and ensures that the corporation can provide the necessary evidence to support its claim for EV credits.

Eligible Vehicle Types: Not all vehicles qualify for EV credits. Corporations must ensure that the electric vehicle they are purchasing or leasing meets the specific criteria set by the relevant authorities. This may include factors such as vehicle type, battery capacity, range, and compliance with environmental standards. Understanding the eligibility criteria for different EV models is essential to avoid disqualification.

Application and Approval Process: Corporations need to familiarize themselves with the application process for EV credits. This typically involves submitting detailed applications, including the required legal documentation, to the appropriate government or tax authorities. The application should provide evidence of the corporation's legal status, ownership of the vehicle, and compliance with all relevant regulations. Meeting the application deadlines and providing accurate information is vital to ensure a smooth approval process.

Kia K4: Electric or Not? Unveiling the Truth

You may want to see also

Eligible Vehicles: Only certain electric vehicles are eligible for the credit

The federal government's electric vehicle (EV) tax credit is a significant incentive for businesses and individuals looking to purchase electric cars. However, it's important to understand that not all electric vehicles qualify for this credit. The eligibility criteria are specific and designed to encourage the adoption of the most environmentally friendly and innovative electric vehicles.

To be eligible for the credit, the vehicle must meet certain standards set by the Internal Revenue Service (IRS). These standards primarily focus on the vehicle's battery capacity, range, and manufacturing location. The IRS has outlined specific guidelines to ensure that the credit is awarded to vehicles that provide the most significant environmental benefits.

Firstly, the vehicle's battery capacity and range are crucial factors. The IRS has set a threshold for the battery capacity and the vehicle's range, which must be met or exceeded. Vehicles with a battery capacity of at least 43 kWh and a range of at least 230 miles are generally eligible. This ensures that the credit supports the purchase of vehicles with substantial battery power and a competitive range, providing consumers with practical and efficient electric transportation options.

Secondly, the manufacturing location of the vehicle plays a vital role. The IRS requires that the vehicle be assembled in North America, including the United States and Canada. This provision aims to stimulate the domestic automotive industry and create jobs within the region. By supporting locally manufactured vehicles, the credit encourages the growth of the EV market and promotes economic development.

Additionally, the credit is designed to reward innovation. Vehicles that offer advanced technology and features are more likely to be eligible. This includes models with advanced driver-assistance systems, autonomous capabilities, or unique design elements. The IRS may also consider the vehicle's overall performance, efficiency, and any additional environmental benefits it provides.

It's essential for corporations and businesses to research and understand these eligibility criteria to ensure they take full advantage of the EV tax credit. By investing in eligible electric vehicles, companies can not only benefit from the financial incentives but also contribute to a more sustainable and environmentally conscious future. Staying informed about the latest guidelines and regulations will be crucial for businesses aiming to make informed decisions regarding their EV purchases.

Powering the Future: Unveiling the Components of Hybrid Electric Vehicles

You may want to see also

Purchase vs. Lease: Corporations can claim credits for both purchasing and leasing EVs

Corporations are indeed eligible for various incentives and credits when it comes to electric vehicle (EV) adoption, and this includes both purchase and lease options. The availability of these credits can vary depending on the country and region, but in many markets, corporations can take advantage of financial benefits to encourage the use of EVs.

When it comes to purchasing EVs, corporations can claim credits or incentives that directly reduce the upfront cost of the vehicle. These credits often provide a significant financial boost, making the purchase more affordable. For example, in some countries, corporations might be eligible for a percentage of the vehicle's price as a credit, which can be a substantial amount, especially for high-end electric cars. This approach allows companies to acquire the latest electric models without a substantial initial investment.

Leasing EVs also opens up opportunities for corporations to benefit from financial incentives. In this scenario, the corporation doesn't own the vehicle but instead enters into a lease agreement with the manufacturer or a leasing company. The lease agreement typically includes a fixed monthly payment, and corporations can claim credits based on the lease payments made. This method is particularly attractive as it provides a structured and predictable cost, allowing companies to budget accordingly. Moreover, leasing often offers the advantage of lower upfront costs compared to purchasing, making it an appealing option for corporations aiming to maximize their financial efficiency.

The key advantage of both purchase and lease options is that they provide corporations with flexibility and a range of choices to suit their specific needs. For instance, a corporation might choose to lease a fleet of EVs for a short-term project, taking advantage of the immediate tax benefits and then decide to purchase a few units for long-term use. This strategic approach ensures that companies can make the most of the available credits while also adapting to their evolving business requirements.

In summary, corporations have the opportunity to claim credits for both purchasing and leasing EVs, which can significantly impact their financial decisions. Understanding the eligibility criteria and the specific incentives offered in their respective markets is crucial for corporations to maximize their benefits. By exploring both purchase and lease options, companies can make informed choices, reduce costs, and contribute to a more sustainable future with the adoption of electric vehicles.

The Green Revolution: Unlocking the True Value of Electric Cars

You may want to see also

Tax Credit Amount: The credit amount varies based on vehicle type and price

The tax credit for electric vehicles (EVs) is a significant incentive for businesses looking to adopt cleaner transportation options. However, the credit amount varies based on several factors, primarily the type of vehicle and its price. This variation ensures that the credit system is fair and encourages the purchase of a wide range of EVs.

For electric cars, the credit amount can range from $2,500 to $7,500. This range is determined by the vehicle's battery capacity and the price of the car. Higher-capacity batteries and more expensive vehicles typically qualify for the maximum credit. For example, a car with a battery capacity of at least 40 kWh and a price tag of over $80,000 could be eligible for the full $7,500 credit. On the other hand, a lower-capacity battery and a more affordable vehicle might receive a reduced credit amount.

When it comes to light-duty trucks, the tax credit structure is similar but with slightly different thresholds. These vehicles can also qualify for a credit of up to $7,500, but the criteria for eligibility differ. The credit amount is influenced by the vehicle's battery range and price, with higher ranges and more expensive trucks often receiving the maximum credit. For instance, a light-duty truck with a battery range of over 250 miles and a price exceeding $80,000 could be eligible for the full credit.

It's important to note that the credit amount for EVs is not solely dependent on the vehicle's price. The Internal Revenue Service (IRS) has set specific guidelines to ensure that the credit system remains fair and efficient. These guidelines consider the vehicle's battery capacity, range, and other technical specifications. For instance, the credit for electric cars is based on a per-kWh credit, with a higher credit amount for vehicles with larger batteries.

Corporations interested in claiming the EV tax credit should carefully review the IRS guidelines and consult with tax professionals to ensure they meet all eligibility criteria. Understanding the variations in credit amounts based on vehicle type and price is crucial for maximizing the benefits of this incentive. By doing so, businesses can make informed decisions when purchasing electric vehicles and take advantage of the financial support provided by the government.

The Birth of US EV Tax Credits: A Historical Perspective

You may want to see also

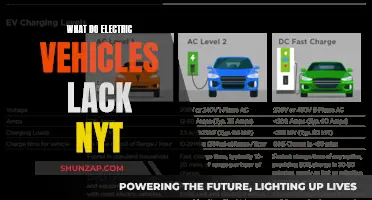

Compliance and Documentation: Detailed documentation and compliance with regulations are essential for claiming the credit

When it comes to claiming the electric vehicle (EV) credit, compliance and documentation play a pivotal role in ensuring that corporations can successfully navigate the process. This is especially crucial given the intricate nature of the regulations surrounding EV incentives. Here's a breakdown of why these aspects are indispensable:

Understanding the Regulations: Before corporations can claim any credit, they must thoroughly understand the applicable regulations. These rules can vary significantly by region and country, and they often specify the criteria for eligibility, the types of vehicles eligible for the credit, and the maximum amount that can be claimed. For instance, some regions might require a certain percentage of the vehicle's value to be attributed to the EV's battery or its production to qualify for the credit. Staying abreast of these regulations is the first step towards compliance.

Detailed Documentation: The process of claiming the EV credit requires a comprehensive set of documents. These may include purchase agreements, vehicle specifications, production or assembly certificates, and even environmental impact assessments. For instance, if a corporation is claiming the credit for a vehicle produced in-house, they will need to provide detailed documentation of the vehicle's battery components, manufacturing process, and environmental benefits. This documentation is not just for the claim but also for potential audits, so it must be accurate, complete, and well-organized.

Compliance with Tax Laws: Tax laws and regulations are complex and ever-evolving, and corporations must ensure that their EV credit claims comply with these laws. This includes understanding the tax credits available, the rules for claiming them, and any restrictions or limitations. For instance, some tax codes might require corporations to provide evidence of the vehicle's intended use, such as for business purposes, to qualify for the credit. Compliance with tax laws is crucial to avoid penalties and ensure the legitimacy of the credit claim.

Record-Keeping and Audit Trail: Maintaining detailed records is essential for corporations to provide an audit trail. This trail should demonstrate how the EV credit was calculated, the eligibility criteria met, and the compliance with all relevant regulations. Proper record-keeping also helps in quickly identifying and rectifying any discrepancies or issues that may arise during the claim process. It is a best practice to keep all relevant documents, including emails, invoices, and certificates, for a minimum of three years, as per standard tax record-keeping guidelines.

Seeking Professional Advice: Given the complexity of regulations and the potential financial implications, corporations should consider seeking professional advice. Tax consultants, legal experts, and industry professionals can provide guidance on the specific regulations applicable to the corporation and help ensure that all documentation is in order. This proactive approach can save time, money, and potential legal issues.

Choosing the Right Amp Breaker for Your Electric Vehicle

You may want to see also

Frequently asked questions

No, not all corporations are eligible. The EV credit is primarily designed to incentivize individual consumers to purchase and use electric vehicles. However, certain types of corporations may also qualify for the credit under specific conditions. These include small businesses, tax-exempt organizations, and corporations that meet the requirements for the credit as outlined in the relevant tax legislation.

Corporations can become eligible for the EV credit by meeting specific criteria, such as purchasing or leasing electric vehicles for business use. Some jurisdictions also offer additional incentives for businesses, such as tax credits or rebates, to encourage the adoption of electric vehicles. These programs often have specific guidelines and limitations, and corporations should consult tax professionals or government agencies to understand their eligibility and the application process.

Generally, the EV credit is intended for vehicles used for business purposes. Corporations may not be able to claim the credit for vehicles purchased for personal use by employees. However, there might be exceptions or variations in regulations, so it's essential to review the specific rules and consult tax experts to ensure compliance with the applicable laws and to understand any potential benefits for business-related EV purchases.